D-Wave Quantum (QBTS): Stock Price Volatility And Valuation Debate

Table of Contents

Understanding D-Wave's Business Model and Technological Advantages

D-Wave Quantum, trading under the ticker QBTS, is a leading player in the quantum computing market, albeit with a unique approach. Its business model and technological advantages are crucial for understanding the company's potential and the associated risks.

D-Wave's Quantum Annealing Approach:

D-Wave utilizes quantum annealing, a specialized type of quantum computing designed to solve specific optimization problems. Unlike gate-based quantum computing, which aims for universal quantum computation, quantum annealing excels at finding the global minimum of a complex energy landscape.

- Applications: D-Wave's technology finds applications in various fields, including:

- Logistics and supply chain optimization

- Financial modeling and risk management

- Materials science and drug discovery

- Artificial intelligence and machine learning

- Advantages: Quantum annealing offers a faster solution for specific problem types compared to classical computing methods. Its specialized architecture allows for the construction of larger quantum processors than some gate-based systems currently available.

- Disadvantages: Quantum annealing is not a universal quantum computing method. It's best suited for specific optimization problems and may not be applicable to all quantum algorithms. Comparison with gate-based approaches remains a subject of ongoing research and debate.

- Partnerships: D-Wave collaborates with major companies and research institutions, furthering its technological development and market reach. These partnerships help validate the technology and drive adoption.

Revenue Streams and Growth Prospects:

Currently, D-Wave's revenue streams primarily come from hardware sales and cloud-based access to its quantum computers. Future growth potential hinges on several factors:

- Software Development: Creating user-friendly software and tools to simplify the use of quantum annealing will expand accessibility and drive adoption.

- Cloud Services: Expanding its cloud computing platform to offer broader access to its quantum processors and related software is key for scaling revenue.

- Hardware Sales: Continued development and sales of more powerful quantum annealing processors are essential for sustained growth.

- Market Projections: The quantum computing market is projected to experience significant growth in the coming years. D-Wave's potential market share depends on its ability to innovate, secure partnerships, and address the limitations of its technology.

Factors Contributing to QBTS Stock Price Volatility

The QBTS stock price exhibits significant volatility, influenced by several interconnected factors.

Market Sentiment and Speculation:

Investor sentiment and speculation play a major role in the fluctuations of QBTS's stock price.

- News and Advancements: Any news regarding technological breakthroughs, new partnerships, or successful applications significantly impacts market sentiment.

- Market Trends: Overall market conditions (bull or bear markets) directly affect the valuation of high-growth, speculative stocks like QBTS.

- Competitor Activities: Developments and announcements from competing quantum computing companies influence investor perception of D-Wave's relative position.

Technological Risks and Development Challenges:

Quantum computing is a nascent technology with inherent risks:

- Scaling Challenges: Building larger and more powerful quantum computers is a significant technological hurdle.

- Error Correction: Addressing the issue of errors in quantum computations is crucial for practical applications.

- Competition: The quantum computing field is highly competitive, with several companies pursuing different approaches.

Financial Performance and Investor Expectations:

D-Wave's financial performance directly impacts investor confidence and the stock price.

- Financial Metrics: Revenue, losses, and cash flow are key indicators scrutinized by investors. Currently, D-Wave is operating at a loss, which contributes to volatility.

- Analyst Ratings: Analyst ratings and target prices significantly influence investor decisions and overall market sentiment.

Valuation Debate: Assessing the Intrinsic Value of D-Wave Quantum

Valuing D-Wave Quantum presents unique challenges due to its stage of development and the speculative nature of the quantum computing market.

Traditional Valuation Methods and Their Limitations:

Traditional valuation methods like discounted cash flow (DCF) analysis and comparable company analysis face significant limitations when applied to QBTS.

- Pre-Revenue/Early-Revenue Stage: Predicting future cash flows for a company still in its early stages of revenue generation is highly uncertain.

- Lack of Comparables: Finding truly comparable companies in the quantum computing sector is difficult, making traditional comparable company analysis unreliable.

Alternative Valuation Approaches:

Alternative valuation methods better suited for high-growth, early-stage companies include:

- Venture Capital Valuation: This approach considers factors like future potential, market size, and risk tolerance.

- Discounted Cash Flow with High Uncertainty Assumptions: A DCF analysis can be adapted to incorporate high uncertainty by using a wider range of discount rates and growth projections.

- Precedent Transactions: Analyzing comparable transactions in the tech sector, although imperfect, can offer some insights into valuation.

The Role of Future Technological Advancements:

Future breakthroughs in quantum computing will significantly impact D-Wave's valuation.

- Increased Computational Power: Significant advancements in qubit count and coherence time would dramatically enhance the capabilities of D-Wave's technology, potentially leading to higher valuations.

- Wider Applications: Expanding the range of problems solvable by quantum annealing will attract more customers and increase the overall market potential.

Conclusion: Investing Wisely in D-Wave Quantum (QBTS): A Balanced Perspective

Investing in D-Wave Quantum (QBTS) requires a balanced perspective. While the long-term growth potential of the quantum computing sector is considerable, the volatility of QBTS's stock price and the challenges in its valuation necessitate careful consideration. The company's reliance on a niche quantum computing approach (quantum annealing), its pre-profit status, and the competitive landscape contribute to significant risk. Thorough due diligence is crucial before investing in QBTS or any quantum computing stock. Conduct extensive research, analyze the latest financial reports, and seek professional financial advice to make informed investment decisions. Further research and analysis regarding D-Wave Quantum's technology and market position are vital for any potential investor.

Featured Posts

-

Bp Ceo Targets Valuation Doubling Remains Committed To Current Stock Exchange Listing According To Ft

May 21, 2025

Bp Ceo Targets Valuation Doubling Remains Committed To Current Stock Exchange Listing According To Ft

May 21, 2025 -

Le Festival Le Bouillon Engagement Et Spectacles A Clisson

May 21, 2025

Le Festival Le Bouillon Engagement Et Spectacles A Clisson

May 21, 2025 -

The Development And Deployment Of Chinas Space Supercomputer

May 21, 2025

The Development And Deployment Of Chinas Space Supercomputer

May 21, 2025 -

Peppa Pigs Family Grows The Gender Reveal

May 21, 2025

Peppa Pigs Family Grows The Gender Reveal

May 21, 2025 -

Whats Sydney Sweeney Doing After Echo Valley And The Housemaid New Film Role Revealed

May 21, 2025

Whats Sydney Sweeney Doing After Echo Valley And The Housemaid New Film Role Revealed

May 21, 2025

Latest Posts

-

The Economic Impact Of Susquehanna Valley Storm Damage

May 22, 2025

The Economic Impact Of Susquehanna Valley Storm Damage

May 22, 2025 -

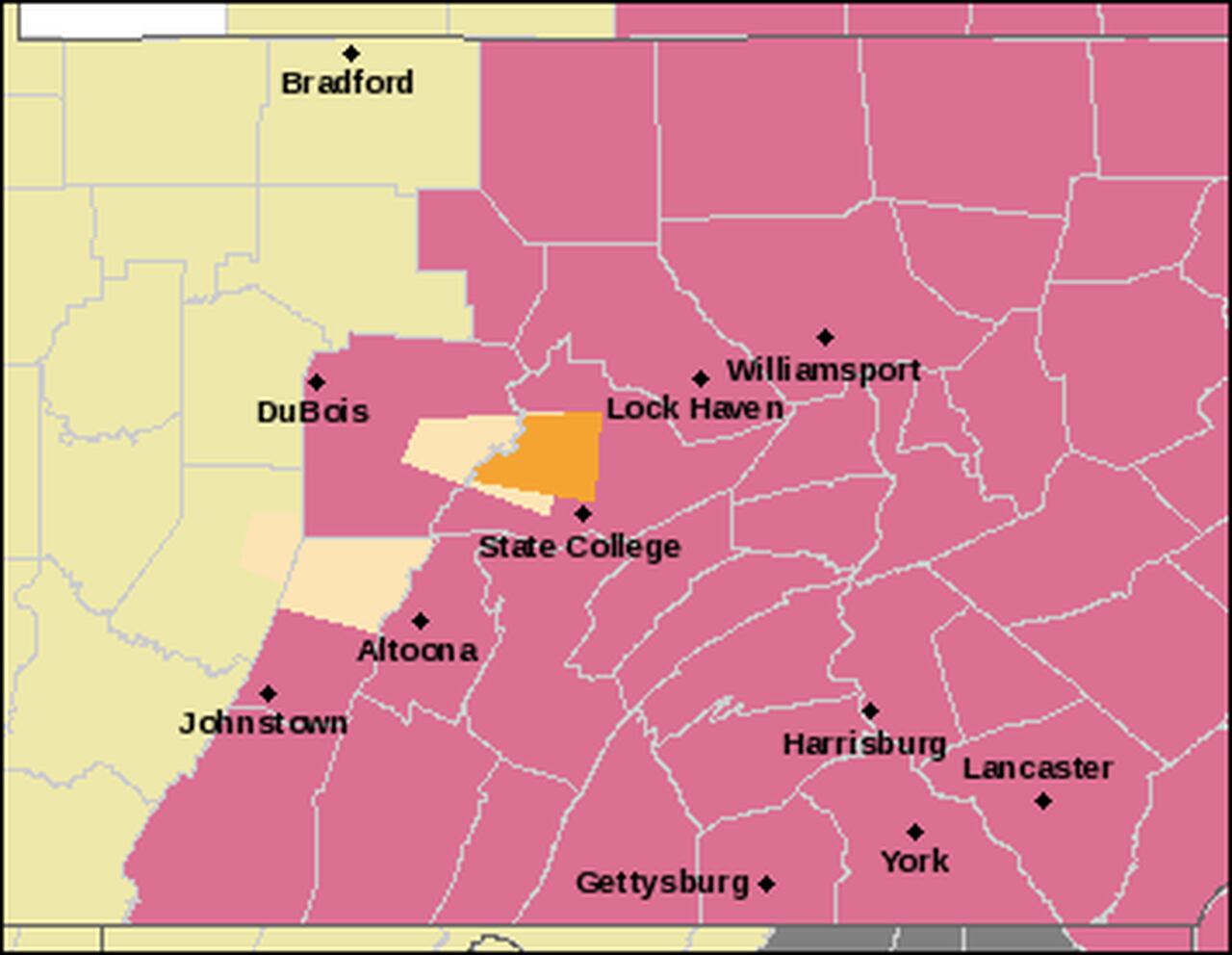

Thunderstorm Watch In Effect South Central Pennsylvania

May 22, 2025

Thunderstorm Watch In Effect South Central Pennsylvania

May 22, 2025 -

Shooting In Lancaster County Pa Police Investigate

May 22, 2025

Shooting In Lancaster County Pa Police Investigate

May 22, 2025 -

Susquehanna Valley Storm Damage Prevention Preparedness And Response

May 22, 2025

Susquehanna Valley Storm Damage Prevention Preparedness And Response

May 22, 2025 -

South Central Pennsylvania Under Severe Thunderstorm Watch

May 22, 2025

South Central Pennsylvania Under Severe Thunderstorm Watch

May 22, 2025