D-Wave Quantum (QBTS) Stock: Understanding The 2025 Decline

Table of Contents

Market Volatility and the Quantum Computing Sector

The technology sector is inherently volatile, and emerging fields like quantum computing are particularly susceptible to dramatic swings. The speculative nature of investments in such early-stage technologies makes them highly sensitive to broader market conditions. A hypothetical 2025 decline in QBTS stock could be attributed to several macroeconomic factors.

- Impact of macroeconomic factors on QBTS stock price: A general economic downturn, increased interest rates, or a shift in investor risk appetite could negatively impact even promising companies like D-Wave. Investors might move capital from riskier assets to safer havens, leading to a sell-off in QBTS stock.

- Comparison to other quantum computing stocks' performance: Analyzing the performance of other quantum computing companies during the same period can provide valuable context. A sector-wide decline would suggest broader market forces at play, whereas a QBTS-specific drop might point to company-specific issues.

- Analysis of investor sentiment towards the sector: Investor sentiment, often driven by news, technological breakthroughs, or regulatory changes, plays a significant role in stock valuations. Negative news or a lack of substantial progress in the quantum computing field could dampen investor enthusiasm, leading to a price drop.

D-Wave's Technological Advancements (or Lack Thereof)

D-Wave's technological progress, or the perceived lack thereof, is another key factor to consider. Investor confidence is heavily reliant on a company's ability to deliver on its promises and maintain a competitive edge.

- Comparison of D-Wave's technology with competitors: The quantum computing landscape is becoming increasingly competitive. Breakthroughs by rivals could shift investor attention and resources away from D-Wave, impacting its stock price. A comparative analysis of D-Wave's technology against competitors like IBM, Google, and Rigetti is essential.

- Analysis of any new product launches or delays: Successful product launches often boost investor confidence, while delays or setbacks can have the opposite effect. Analyzing D-Wave's product development cycle and any potential delays in delivering new quantum computing solutions is crucial.

- Discussion of R&D investments and their return: Investors look for a return on investment in research and development. If D-Wave's R&D spending isn't translating into tangible results or market share gains, it could negatively influence investor perception and the QBTS stock price.

Competitive Landscape and Emerging Players

The quantum computing market is experiencing rapid growth, with numerous companies entering the fray. This increased competition can significantly impact individual companies' market share and investor confidence.

- Overview of key competitors and their market share: Understanding the competitive landscape is vital. Analyzing the market share of D-Wave and its competitors provides context for its performance. The emergence of new players with potentially disruptive technologies could pose a significant threat.

- Assessment of the competitive advantages and disadvantages of D-Wave: D-Wave's unique approach to quantum computing, using adiabatic quantum computation, has both advantages and disadvantages compared to other approaches. Evaluating these aspects is essential for understanding its competitive position.

- Analysis of technological breakthroughs by competitors: Significant breakthroughs by competitors could render D-Wave's technology less attractive, leading to a decline in investor interest and potentially affecting the QBTS stock price.

Financial Performance and Investor Expectations

D-Wave's financial performance directly impacts investor confidence. Analyzing its financial reports helps determine whether the company is meeting or exceeding expectations.

- Revenue growth or decline: Consistent revenue growth is a positive sign, while a decline can raise concerns about the company's long-term viability.

- Profitability and margins: Profitability is a crucial indicator of financial health. Analyzing profit margins helps understand the company's efficiency and its ability to generate profits from its operations.

- Debt levels and financial stability: High debt levels can create financial instability and increase risk, potentially affecting investor confidence.

- Comparison of actual performance to investor expectations: Investors form expectations based on various factors, including previous performance and market forecasts. If D-Wave's actual performance falls short of expectations, it can lead to a sell-off.

Conclusion: Navigating the Future of D-Wave Quantum (QBTS) Stock

The hypothetical 2025 decline in QBTS stock likely resulted from a confluence of factors: market volatility, technological challenges, increasing competition, and perhaps a shortfall in meeting investor expectations. The quantum computing sector is still in its nascent stages, characterized by both immense potential and significant risk.

While D-Wave Quantum holds a prominent position in the field, understanding the inherent risks and carefully considering the company's performance relative to its competitors and the broader market is crucial before investing. Conduct thorough due diligence before investing in D-Wave Quantum (QBTS) stock, and stay informed about the developments in the quantum computing market to make informed investment decisions regarding QBTS and similar stocks.

Featured Posts

-

Efimeries Iatron Stin Patra Savvatokyriako 10 And 11 Maioy

May 20, 2025

Efimeries Iatron Stin Patra Savvatokyriako 10 And 11 Maioy

May 20, 2025 -

Plongez Au C Ur De L Integrale Agatha Christie

May 20, 2025

Plongez Au C Ur De L Integrale Agatha Christie

May 20, 2025 -

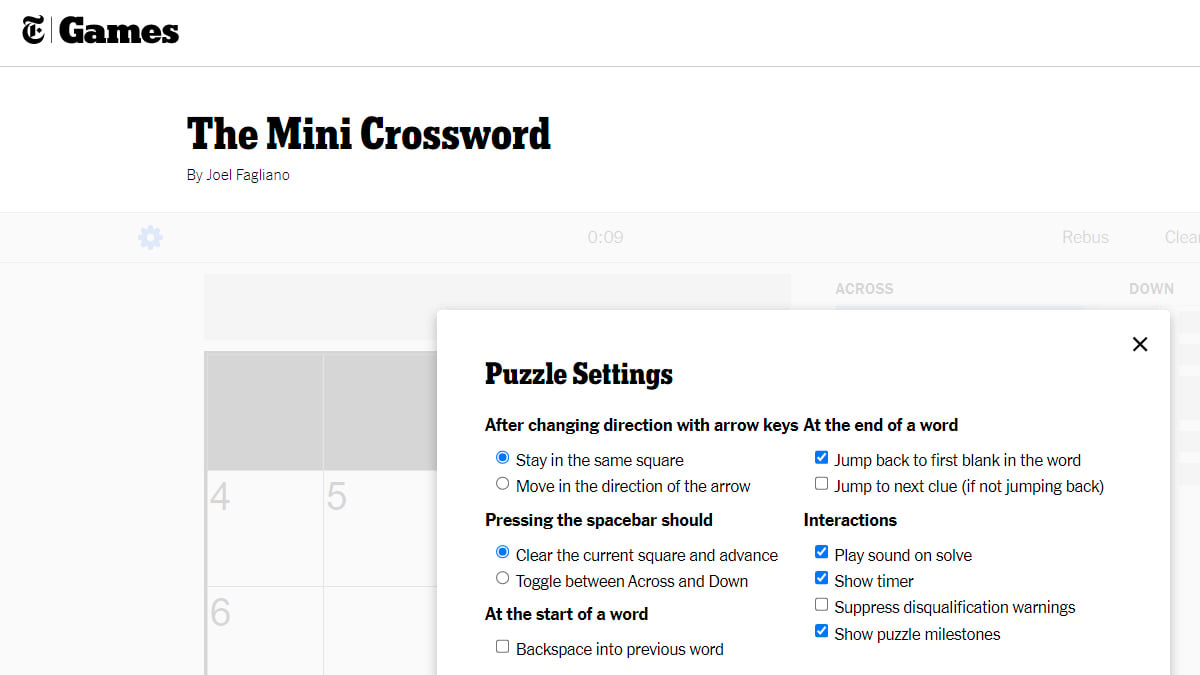

Todays Nyt Mini Crossword Answers March 15

May 20, 2025

Todays Nyt Mini Crossword Answers March 15

May 20, 2025 -

Quantum Computing Stock Investment A Deep Dive Into D Wave Qbts

May 20, 2025

Quantum Computing Stock Investment A Deep Dive Into D Wave Qbts

May 20, 2025 -

Eurovision Song Contest 2025 Artist Lineup Revealed

May 20, 2025

Eurovision Song Contest 2025 Artist Lineup Revealed

May 20, 2025

Latest Posts

-

O Baggelis Giakoymakis Kai I Friki Toy Sxolikoy Ekfovismoy

May 20, 2025

O Baggelis Giakoymakis Kai I Friki Toy Sxolikoy Ekfovismoy

May 20, 2025 -

Giakoymakis Mls Ena Oneiro Poy Mporei Na Ginei Pragmatikotita

May 20, 2025

Giakoymakis Mls Ena Oneiro Poy Mporei Na Ginei Pragmatikotita

May 20, 2025 -

Baggelis Giakoymakis To Bullying Oi Vasanismoi Kai To Tragiko Telos

May 20, 2025

Baggelis Giakoymakis To Bullying Oi Vasanismoi Kai To Tragiko Telos

May 20, 2025 -

T Ha Epistrepsei O Giakoymakis Sto Mls Analyontas Tis Pithanotites

May 20, 2025

T Ha Epistrepsei O Giakoymakis Sto Mls Analyontas Tis Pithanotites

May 20, 2025 -

I Ypothesi Giakoymaki Bullying Vasanismoi Kai Thanatos Enos 20xronoy

May 20, 2025

I Ypothesi Giakoymaki Bullying Vasanismoi Kai Thanatos Enos 20xronoy

May 20, 2025