Dangote And NNPC: The Impact On Petrol Prices In Nigeria

Table of Contents

The Current State of Petrol Prices in Nigeria and the NNPC's Role

Nigeria's current petrol pricing mechanism is a complex interplay of global crude oil prices, foreign exchange rates, and government subsidies managed primarily by the NNPC. The NNPC, historically, has been the major importer and distributor of refined petroleum products, shouldering the burden of substantial fuel subsidies to keep prices artificially low. This has placed a significant strain on the government's budget and created inefficiencies in the market. Global crude oil price increases directly translate into higher petrol costs for Nigeria, as the nation heavily relies on imported refined products. Fluctuations in the value of the Naira further exacerbate this issue, leading to unpredictable petrol price hikes.

- High dependence on imported refined petroleum products: Nigeria lacks sufficient domestic refining capacity, making it vulnerable to international market volatility.

- Fluctuations in foreign exchange rates impacting petrol costs: The Naira's volatility against the dollar significantly impacts the cost of importing refined petroleum products.

- Government subsidies and their economic implications: Fuel subsidies, while intended to alleviate the burden on consumers, put a strain on government finances and can lead to inefficiencies.

- NNPC's role as the major importer and distributor: The NNPC's dominant role has historically limited competition and transparency in the petrol market.

The Potential Impact of the Dangote Refinery on Petrol Prices

The Dangote Refinery, boasting a projected refining capacity of 650,000 barrels per day, represents a monumental shift in Nigeria's energy landscape. Its completion promises a significant reduction in Nigeria's dependence on imported refined petroleum products. This increased domestic refining capacity is expected to lower import costs and stabilize petrol prices, potentially leading to more competitive pricing at the pump. By reducing the reliance on foreign exchange for petrol imports, the refinery can contribute to macroeconomic stability. The potential for price competition, as other players enter the market, could further benefit consumers.

- Increased domestic refining capacity leading to lower import costs: Local refining will significantly reduce Nigeria's reliance on costly imports.

- Potential for price competition leading to lower consumer prices: Increased competition among refineries could drive down prices for consumers.

- Reduced reliance on foreign exchange for petrol imports: This will lessen the impact of foreign exchange fluctuations on petrol prices.

- Potential impact on the NNPC's role in petrol distribution: The NNPC's role may shift towards regulation and oversight, rather than solely importation and distribution.

Challenges and Uncertainties

Despite the immense potential, integrating the Dangote Refinery into the existing market presents various challenges. Logistical hurdles in efficient distribution across the country need to be addressed. Furthermore, a clear and effective regulatory framework is crucial to ensure fair competition and prevent market manipulation. Maintaining the refinery's operational efficiency and addressing potential unforeseen circumstances, such as global market disruptions or political instability, are paramount.

- Potential logistical challenges in distribution: Ensuring efficient and widespread distribution of refined products across Nigeria is crucial.

- Regulatory framework and its effectiveness: A robust regulatory environment is needed to ensure fair competition and prevent market distortions.

- Maintaining refinery operational efficiency: Sustained high performance of the refinery is essential for realizing its full potential.

- Impact of potential political and economic instability: Political and economic uncertainty could affect the refinery's operations and market stability.

NNPC's Adaptation and Future Role

With the emergence of the Dangote Refinery and other potential private sector players, the NNPC must adapt its role. A potential shift towards focusing on infrastructure development, exploration, and upstream activities is likely. Collaboration with private sector entities, including the Dangote Refinery, could prove mutually beneficial. This could involve joint ventures or strategic partnerships to optimize the entire energy value chain.

- Shifting focus towards infrastructure development and exploration: NNPC may concentrate on upstream activities, such as exploration and production.

- Potential partnerships and collaborations with private sector players: Collaborations could enhance efficiency and market competitiveness.

- Redefining its role in the downstream petroleum sector: The NNPC's role in the downstream sector might become more regulatory and oversight-focused.

Conclusion

The Dangote Refinery’s impact on Nigeria's petrol prices holds immense potential. Reduced import dependency, price stabilization, and increased competition are all highly anticipated outcomes. However, challenges related to integration, regulation, and unforeseen circumstances must be proactively addressed. The NNPC's strategic adaptation to this new market dynamic will be crucial for a smooth transition and the overall efficiency of Nigeria's energy sector. Understanding the interplay between the Dangote Refinery and the NNPC is key to comprehending the future of fuel costs in Nigeria.

Call to Action: Stay informed about the latest developments regarding the Dangote Refinery and its impact on Nigeria's petrol prices. Continue to follow discussions surrounding the role of the NNPC and its strategic adjustments to the changing market dynamics. Understanding the intricacies of the Dangote Refinery and NNPC's interplay is vital to understanding the future of fuel costs in Nigeria.

Featured Posts

-

Nyt Spelling Bee Strands April 12 2025 Complete Guide

May 10, 2025

Nyt Spelling Bee Strands April 12 2025 Complete Guide

May 10, 2025 -

Ivan Barbashevs Ot Goal Wins Game 4 For Vegas Golden Knights

May 10, 2025

Ivan Barbashevs Ot Goal Wins Game 4 For Vegas Golden Knights

May 10, 2025 -

King Zvinuvachuye Maska Ta Trampa V Zradi Detali Zayavi Pismennika

May 10, 2025

King Zvinuvachuye Maska Ta Trampa V Zradi Detali Zayavi Pismennika

May 10, 2025 -

Palantir Pltr Stock Buy Or Sell Before May 5th Expert Analysis

May 10, 2025

Palantir Pltr Stock Buy Or Sell Before May 5th Expert Analysis

May 10, 2025 -

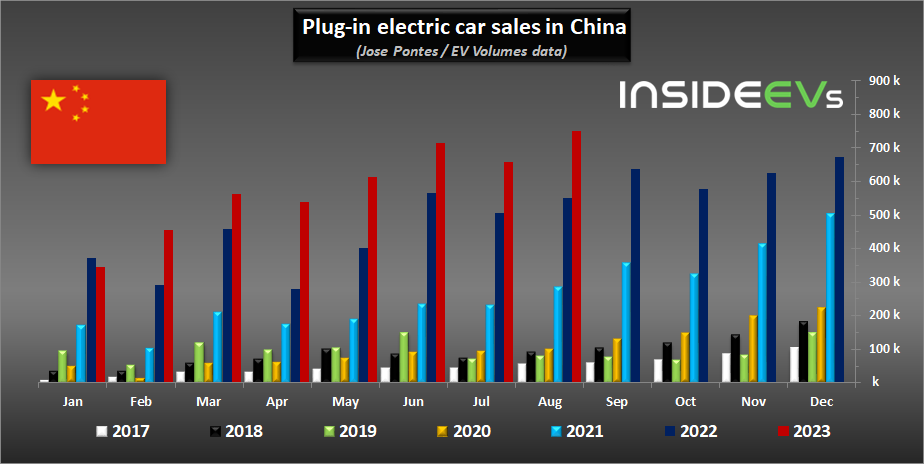

Luxury Car Sales In China A Look At The Challenges Faced By Bmw Porsche And Others

May 10, 2025

Luxury Car Sales In China A Look At The Challenges Faced By Bmw Porsche And Others

May 10, 2025