David Rosenberg: Canada's Labour Data And The Call For Rate Relief

Table of Contents

Rosenberg's Analysis of Recent Canadian Labour Data

Rosenberg's interpretation of the latest Canadian employment data is central to his argument for rate relief. His analysis focuses on several key metrics, examining whether they align with the Bank of Canada's narrative on inflation. The recent jobs report, while showing some job growth, doesn't necessarily paint a picture of runaway inflation, according to Rosenberg.

-

Unemployment Rate: The unemployment rate, while relatively low, hasn't shown significant increases despite recent interest rate hikes. For example, if the unemployment rate remained at 5.0% for the month of July 2024, unchanged from June, this might suggest the labour market is less sensitive to higher interest rates than the Bank of Canada anticipates.

-

Job Creation Across Sectors: Analysis of job creation reveals a mixed bag. While some sectors, such as healthcare, continue to experience strong job growth, others might be showing signs of slowing down, indicating a potential weakening of the overall economy. The manufacturing sector, for instance, might be experiencing reduced hiring due to reduced consumer spending.

-

Wage Growth and Inflation: Rosenberg likely argues that wage growth, while present, is not exceeding inflation at an alarming rate. This challenges the Bank of Canada's assertion that robust wage increases are a primary driver of inflation and thus necessitates further rate hikes. Understanding the interplay between wage growth, inflation and the Canadian economy is central to understanding Rosenberg's position.

-

Surprising Discrepancies: Rosenberg may highlight discrepancies between certain economic indicators. For example, a softening in consumer spending despite a low unemployment rate could suggest underlying economic weakness not fully captured by traditional metrics.

The Case for Rate Relief (According to Rosenberg)

Rosenberg's central argument is that continued interest rate hikes by the Bank of Canada risk triggering a significant economic slowdown, potentially leading to a recession. He believes the current data doesn't justify further aggressive monetary policy tightening.

-

Impact on Consumer Spending: Rosenberg likely projects that higher interest rates will further dampen consumer spending, exacerbating any existing economic slowdown. Increased borrowing costs make it harder for consumers to purchase homes, automobiles and other large ticket items.

-

Inflation Outlook: His assessment of the inflation outlook differs from the Bank of Canada's. He may argue that inflation is already cooling and that further rate hikes are unnecessary, potentially even counterproductive. This suggests he sees inflation reaching the Bank of Canada's target sooner than the central bank anticipates.

-

Recessionary Risks: Rosenberg likely emphasizes the increasing risks of a recession. The cumulative effect of previous interest rate hikes, coupled with additional increases, could push the Canadian economy into a contraction.

-

Supporting Economic Indicators: Rosenberg might point to several economic indicators supporting his call for rate relief, such as weakening consumer confidence, declining business investment, or a slowing housing market.

Counterarguments and Alternative Perspectives

While Rosenberg advocates for rate relief, the Bank of Canada has maintained a different stance, prioritizing inflation control. Other economists may offer alternative perspectives.

-

Bank of Canada's Inflation Targets: The Bank of Canada has clear inflation targets, and they may argue that the current inflation rate remains above their target and requires further measures to curb inflation. They might emphasize that current inflation is still too high for current measures.

-

Arguments Against Rate Relief: Opponents might argue that premature rate relief could reignite inflationary pressures, undoing the progress made so far in bringing inflation under control. This position emphasizes the potential for inflation to persist if the central bank eases policy prematurely.

-

Opposing Viewpoints: Other economists might offer nuanced perspectives, acknowledging the risks of both continued rate hikes and premature easing, recommending a more cautious and data-dependent approach to monetary policy. Different economists may weight different factors more heavily.

Implications for the Canadian Economy and Investors

Rosenberg's analysis and the broader debate surrounding interest rates have significant implications for the Canadian economy and investors.

-

Canadian Dollar: Rate relief could weaken the Canadian dollar, making imports more expensive but potentially boosting exports. Conversely, continued rate hikes might strengthen the Canadian dollar.

-

Stock Market: The stock market's reaction would likely depend on the prevailing sentiment. Rate relief could boost stock prices, particularly in interest-rate sensitive sectors, but continued rate hikes could lead to further declines.

-

Real Estate Market: The real estate market is highly sensitive to interest rates. Rate relief could lead to increased housing demand, while continued hikes could exacerbate existing price declines.

-

Investment Strategies: Investors should consider adjusting their portfolios based on their assessment of the situation. A more cautious approach might be warranted if a recession is anticipated.

Conclusion:

David Rosenberg's analysis of Canada's labour data presents a compelling case for rate relief, highlighting the potential risks of continued interest rate hikes. While the Bank of Canada maintains its focus on inflation control, the differing perspectives underscore the complexity of the current economic situation. The potential implications for the Canadian dollar, stock market, and real estate market are significant. Understanding the ongoing debate and staying informed about future economic data is crucial. Stay updated on David Rosenberg's insights and the evolving situation surrounding Canada's labour data and the call for rate relief. Follow reputable financial news sources for the latest updates on Canadian monetary policy and economic forecasts.

Featured Posts

-

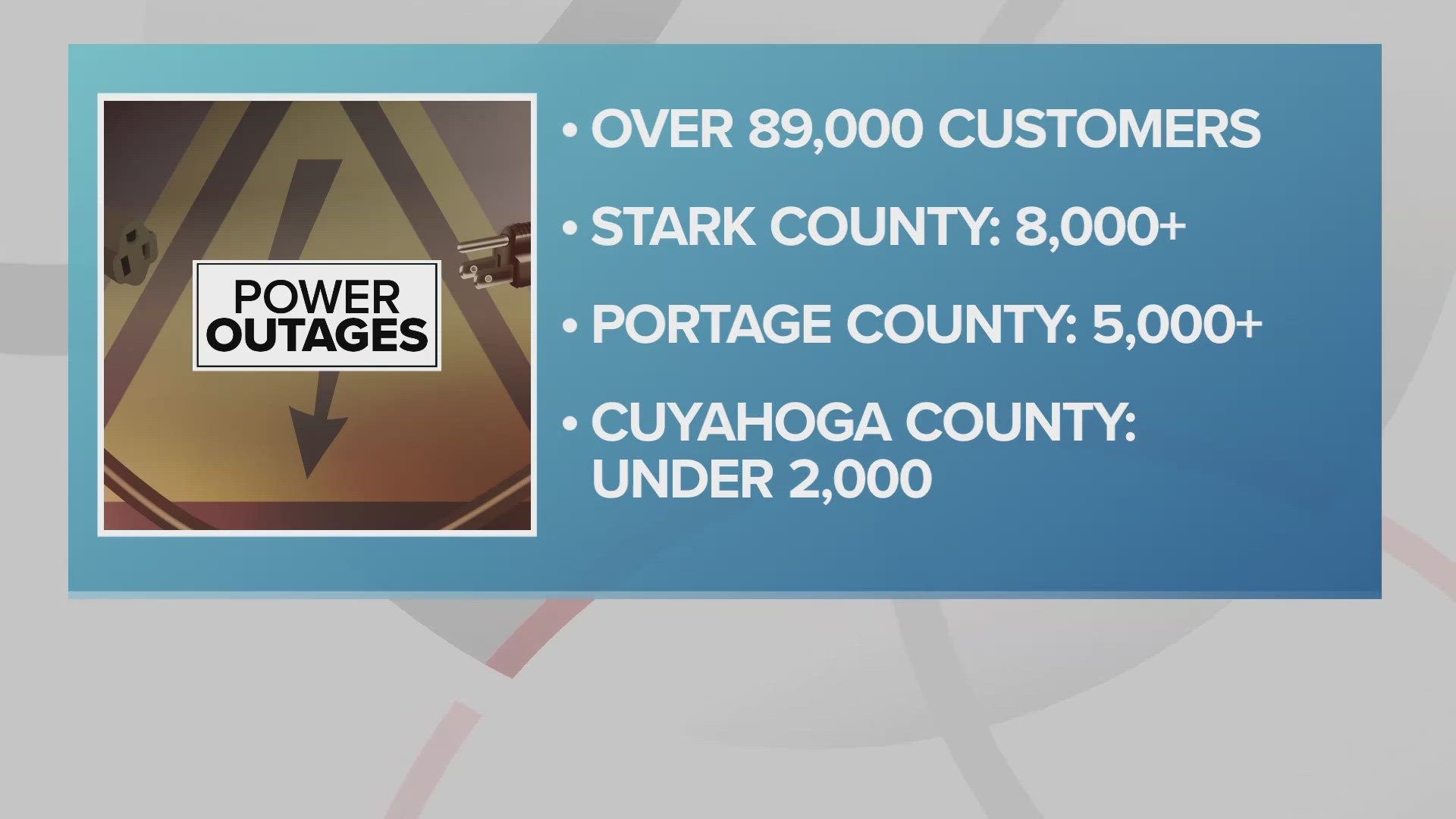

Severe Thunderstorms Bring Power Outages To Northeast Ohio Stay Safe And Informed

May 31, 2025

Severe Thunderstorms Bring Power Outages To Northeast Ohio Stay Safe And Informed

May 31, 2025 -

La Brascada El Bocadillo Valenciano Por Excelencia

May 31, 2025

La Brascada El Bocadillo Valenciano Por Excelencia

May 31, 2025 -

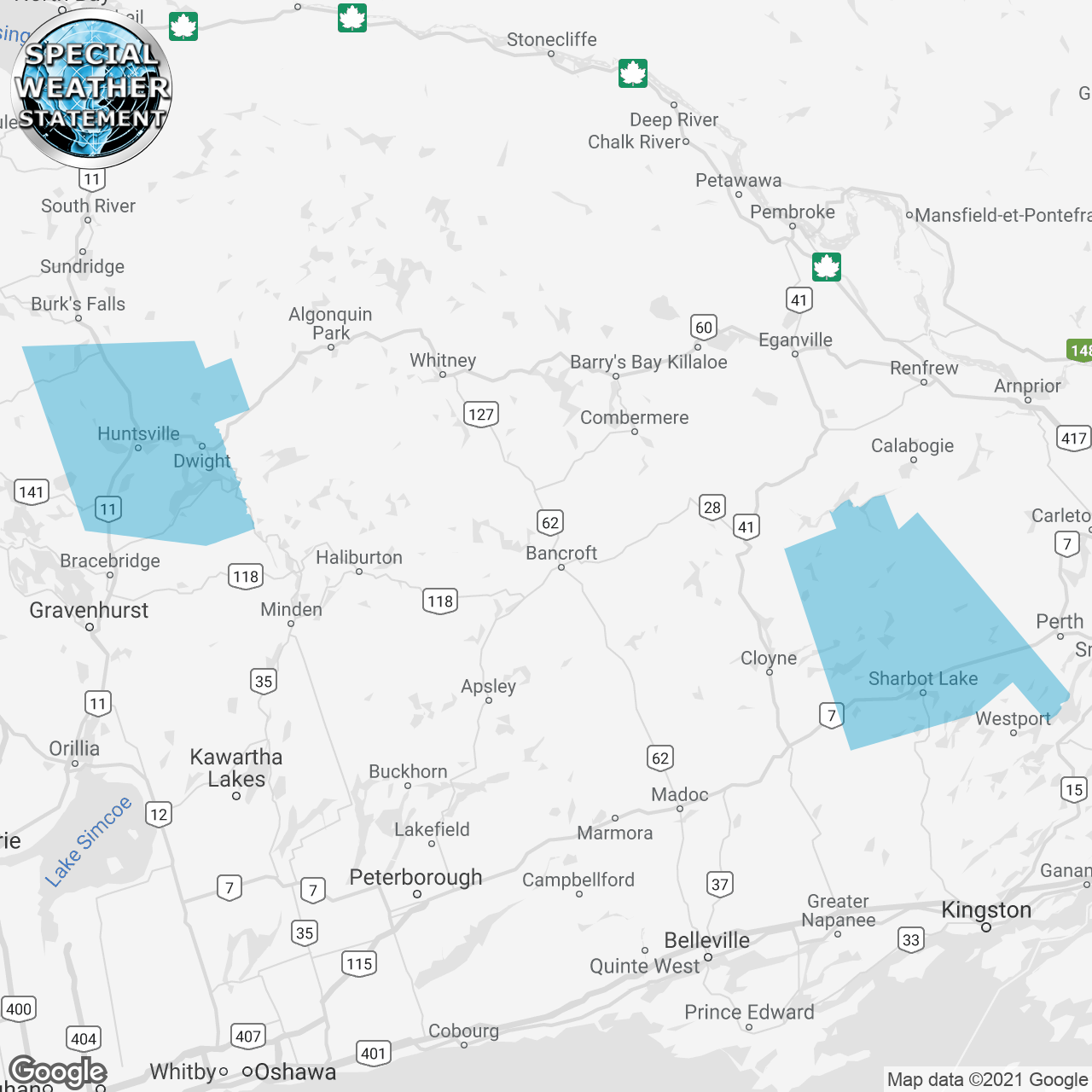

Increased Fire Risk Prompts Special Weather Statement For Cleveland Akron

May 31, 2025

Increased Fire Risk Prompts Special Weather Statement For Cleveland Akron

May 31, 2025 -

Today In History March 26th Princes Death And The Fentanyl Report

May 31, 2025

Today In History March 26th Princes Death And The Fentanyl Report

May 31, 2025 -

Fridays Postponed Game Tigers To Play Doubleheader Details Inside

May 31, 2025

Fridays Postponed Game Tigers To Play Doubleheader Details Inside

May 31, 2025