DAX Falls Below 24,000: Frankfurt Stock Market Losses

Table of Contents

Reasons Behind the DAX Decline

Several interconnected factors have contributed to the recent DAX decline. Understanding these underlying causes is crucial for assessing the current situation and predicting future market trends.

-

Global Economic Slowdown: The global economy is facing significant headwinds, with signs of slowing growth in major economies. Weakening consumer demand and reduced business investment are contributing to this slowdown. Indicators like falling manufacturing PMI (Purchasing Managers' Index) and declining consumer confidence indices point towards a potential recessionary environment.

-

Inflationary Pressures and Rising Interest Rates: Persistent inflation continues to be a major concern globally. Central banks, including the European Central Bank (ECB), are aggressively raising interest rates to combat inflation, but this action also dampens economic activity and increases borrowing costs for businesses and consumers. This makes investments less attractive, and negatively impacts corporate profitability, subsequently affecting stock prices.

-

Geopolitical Uncertainties: The ongoing war in Ukraine, along with the resulting energy crisis in Europe, has created significant geopolitical instability. The disruption of energy supplies and the associated price increases have placed considerable pressure on businesses and consumers across Europe, significantly impacting the DAX.

-

Specific Company Performance: The performance of individual companies listed on the DAX significantly impacts the overall index. Poor earnings reports, disappointing sales figures, or negative news surrounding major German corporations can trigger sell-offs and contribute to the overall decline. For example, recent difficulties faced by [mention a specific company and briefly explain why if applicable] may have added downward pressure.

-

Investor Sentiment and Market Volatility: Negative news and economic uncertainty often fuel investor fear and lead to increased market volatility. This can result in a sell-off, pushing the DAX index lower. Sharp price fluctuations and unpredictable market behavior add to investor anxiety and contribute to the downturn. Keywords: Economic Slowdown, Inflation, Interest Rates, Geopolitical Risk, Investor Sentiment, Market Volatility.

Impact on German Economy and Investors

The fall of the DAX below 24,000 has significant implications for both the German economy and its investors.

-

Impact on the German Economy:

- Reduced Consumer Confidence: A falling stock market can negatively impact consumer confidence, leading to decreased spending and slower economic growth.

- Impact on Corporate Investment: Businesses may postpone or reduce investments due to economic uncertainty, further hindering economic expansion.

- Potential Job Losses: Economic slowdown can result in businesses reducing their workforce to cut costs.

- Government Response and Potential Interventions: The German government might respond with fiscal stimulus packages or other policy interventions aimed at boosting the economy.

-

Impact on Investors:

- Portfolio Losses: Investors holding DAX-related assets have experienced significant portfolio losses.

- Increased Market Uncertainty: The current market volatility increases uncertainty for investors, making it challenging to predict future market movements.

- Changes in Investment Strategies: Many investors are likely to adjust their investment strategies, potentially shifting towards more conservative assets or diversifying their portfolios. Keywords: German Economy, Investor Confidence, Corporate Investment, Job Losses, Government Intervention, Portfolio Losses.

DAX Forecast and Potential Recovery

Predicting the future of the DAX is challenging, but several factors could influence its trajectory.

-

Expert Opinions and Market Predictions: While opinions vary, many analysts are closely monitoring economic indicators and geopolitical events to forecast future DAX performance. Some predict a further decline in the short term, while others anticipate a gradual recovery once the underlying issues begin to resolve.

-

Potential Catalysts for Recovery: Easing inflationary pressures, positive economic news from Germany and the Eurozone, and a resolution to geopolitical tensions could all act as catalysts for a DAX recovery. Strong corporate earnings reports from key DAX companies would also positively impact market sentiment.

-

Technical Analysis of the DAX Chart (Disclaimer): Technical analysis, while not foolproof, can offer insights into potential support and resistance levels. However, it’s crucial to remember that technical analysis is not a guaranteed predictor of future market movements. (Include a chart if available, with a clear disclaimer about the limitations of technical analysis). Keywords: DAX Forecast, Market Prediction, Economic Recovery, Technical Analysis, Market Outlook.

Alternative Investment Strategies in the Current Market

Navigating a declining market requires careful risk management and strategic adjustments to investment portfolios.

-

Diversification Strategies: Diversifying investments across different asset classes (stocks, bonds, real estate, etc.) and geographic regions helps to mitigate risk.

-

Risk Management Techniques: Techniques like stop-loss orders can limit potential losses. Additionally, it's crucial to only invest what you can afford to lose.

-

Potential Alternative Investments: Consider exploring alternative investments such as precious metals (gold, silver), government bonds, or other less volatile asset classes to balance your portfolio and mitigate risk during times of market uncertainty.

It is strongly recommended to seek professional financial advice before making any significant investment decisions. Keywords: Risk Management, Diversification, Alternative Investments, Investment Strategy, Financial Advice.

Conclusion: Navigating the DAX Decline – Looking Ahead

The DAX's fall below 24,000 is a significant event with far-reaching implications for the German economy and investors. Several factors, including global economic slowdown, inflation, geopolitical uncertainties, and investor sentiment, have contributed to this decline. While the short-term outlook remains uncertain, potential catalysts for recovery exist. It is crucial for investors to carefully assess their risk tolerance, diversify their portfolios, and actively monitor market trends. Stay updated on DAX performance, monitor the Frankfurt Stock Market closely, and make informed decisions regarding your DAX investments. Remember to seek professional financial advice for personalized guidance.

Featured Posts

-

Will Jordan Bardella Shake Up The French Presidential Race

May 24, 2025

Will Jordan Bardella Shake Up The French Presidential Race

May 24, 2025 -

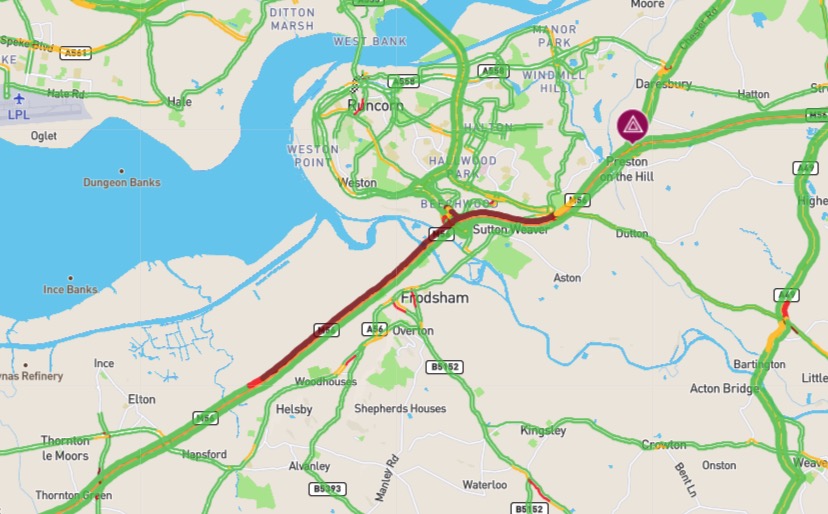

M56 Collision Cheshire Deeside Border Delays

May 24, 2025

M56 Collision Cheshire Deeside Border Delays

May 24, 2025 -

Important Information Regarding Philips 2025 Agm

May 24, 2025

Important Information Regarding Philips 2025 Agm

May 24, 2025 -

254 Apple Stock Price Target Is Now The Time To Buy Aapl

May 24, 2025

254 Apple Stock Price Target Is Now The Time To Buy Aapl

May 24, 2025 -

Understanding The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025

Understanding The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025

Latest Posts

-

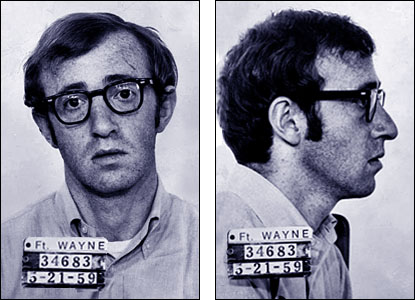

The Woody Allen Controversy Sean Penns Backing And The Public Reaction

May 24, 2025

The Woody Allen Controversy Sean Penns Backing And The Public Reaction

May 24, 2025 -

Woody Allen Sexual Abuse Allegations A Re Examination Following Sean Penns Comments

May 24, 2025

Woody Allen Sexual Abuse Allegations A Re Examination Following Sean Penns Comments

May 24, 2025 -

Sean Penns Appearance Sparks Concern What Happened To The Hollywood Star

May 24, 2025

Sean Penns Appearance Sparks Concern What Happened To The Hollywood Star

May 24, 2025 -

The Sean Penn Dylan Farrow Woody Allen Controversy A Deeper Look

May 24, 2025

The Sean Penn Dylan Farrow Woody Allen Controversy A Deeper Look

May 24, 2025 -

Sean Penns Shocking Transformation Fans React To Bombshell Claims

May 24, 2025

Sean Penns Shocking Transformation Fans React To Bombshell Claims

May 24, 2025