DAX Rally: Can It Withstand A Resurgent Wall Street?

Table of Contents

The DAX's Recent Performance and Driving Factors

The DAX index has seen significant gains recently, outperforming many other major global indices. This impressive DAX performance is fueled by a confluence of positive factors:

- Stronger-than-expected German economic data: Recent economic reports have painted a more optimistic picture of the German economy, defying initial recessionary fears. This positive economic outlook has boosted investor confidence in German companies.

- Positive corporate earnings reports: Many DAX-listed companies have reported better-than-anticipated earnings, further strengthening the index's upward trajectory. Strong corporate performance directly translates to higher stock prices.

- Easing energy crisis concerns: While the energy crisis continues to pose challenges, recent measures and a milder-than-expected winter have eased some of the immediate pressures on German businesses and consumers, fostering a more positive investment environment. Reduced energy price volatility benefits the DAX significantly.

- Positive investor sentiment towards European markets: A broader shift in investor sentiment towards European markets, driven partly by the relative strength of the Euro and a perceived undervaluation of European assets compared to US counterparts, has contributed to the DAX rally.

(Insert chart/graph visualizing the DAX index performance over the relevant period. Clearly label the chart: "DAX Index Performance - [Date Range]" )

Wall Street's Resurgence and its Implications for the DAX

The US stock market, particularly the S&P 500 and the Dow Jones, has also experienced a notable resurgence. This Wall Street comeback is driven by:

- Stronger-than-expected US economic data: Resilient US economic indicators, including lower-than-anticipated inflation figures, have bolstered investor confidence.

- Federal Reserve monetary policy shifts: While interest rates remain elevated, the pace of interest rate hikes has slowed, signaling a potential pivot towards a less aggressive monetary policy stance. This shift is interpreted as positive for the stock market.

- Increased investor confidence: A combination of economic data and perceived progress in combating inflation has led to a surge in investor confidence, fueling capital inflows into the US stock market.

This Wall Street resurgence presents a potential headwind for the DAX rally. A strong US market could lead to:

- Capital flight: Investors might shift their focus and capital from European markets, including the DAX, towards the perceived higher returns offered by the US stock market.

- Investor preference shifts: The allure of a resurgent Wall Street could overshadow the gains witnessed in the DAX, leading investors to reallocate their portfolios.

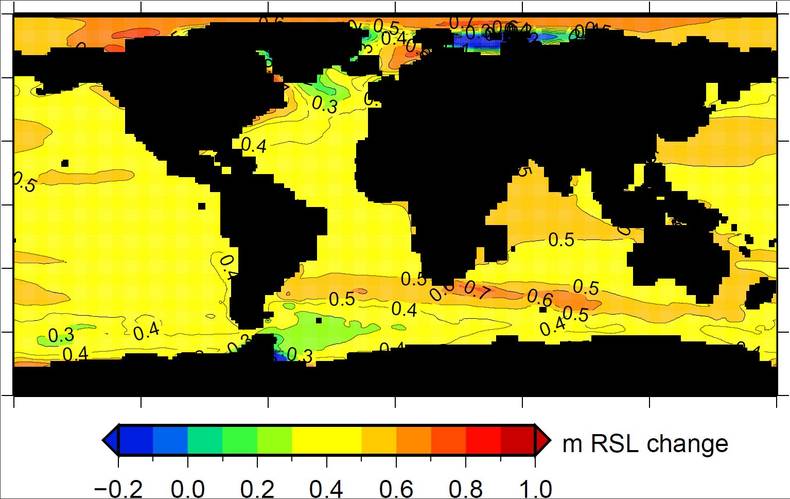

Analyzing the Correlation Between DAX and Wall Street

Historically, the DAX and US indices like the S&P 500 have shown a degree of correlation, though it's not always perfect. Analyzing the DAX correlation with Wall Street is crucial to understanding the current rally's sustainability.

Whether the current correlation is typical or unusual requires a deeper historical analysis considering various economic cycles and geopolitical events. Potential decoupling scenarios include:

- DAX outperformance: The DAX could outperform Wall Street if the European economy significantly outpaces US growth or if European companies demonstrate superior profitability.

- DAX underperformance: If the US economy continues to outperform, or if global investors favor US assets due to factors like regulatory certainty or perceived political stability, the DAX might underperform.

(Insert chart/graph showing historical correlation between DAX and a major US index, e.g., S&P 500. Clearly label the chart: "DAX vs. S&P 500 Correlation - [Date Range]")

Geopolitical Risks and their Impact

Geopolitical risks significantly impact both the DAX and Wall Street. The ongoing war in Ukraine, US-China relations, and other global uncertainties create volatility and influence investor sentiment. These factors can impact both markets differently, sometimes leading to decoupling. For instance, increased energy prices stemming from the war in Ukraine disproportionately impact the European economy and the DAX, while trade tensions between the US and China impact both markets but might have different repercussions depending on the specific industry sectors. Economic uncertainty stemming from these geopolitical risks creates a challenging environment for both indices.

Conclusion: The Future of the DAX Rally

The sustainability of the DAX rally remains uncertain. While strong German economic data, positive corporate earnings, and easing energy concerns have driven the recent gains, the resurgent Wall Street presents a significant challenge. The historical correlation between the DAX and US indices, coupled with the influence of geopolitical risks, introduces further complexities. A balanced perspective acknowledges both the strengths of the current DAX performance and the potential for capital flight and investor preference shifts towards a strengthening US market.

Stay tuned for further updates on the DAX rally and its ability to withstand pressure from a strengthening Wall Street. Continue to monitor the key indicators – DAX performance, US economic data, and global market dynamics – to make informed investment decisions. Understanding the interplay between the DAX rally and the broader global market is critical for navigating the current investment landscape.

Featured Posts

-

Best New R And B Songs This Week Leon Thomas And Flo Lead The Pack

May 25, 2025

Best New R And B Songs This Week Leon Thomas And Flo Lead The Pack

May 25, 2025 -

Schekotat Nervy Intervyu S Fedorom Lavrovym O Pavle I I Zhanre Trillera

May 25, 2025

Schekotat Nervy Intervyu S Fedorom Lavrovym O Pavle I I Zhanre Trillera

May 25, 2025 -

How To Interpret The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist

May 25, 2025

How To Interpret The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist

May 25, 2025 -

Porsche Dan Seni Rupa Indonesia Classic Art Week 2025

May 25, 2025

Porsche Dan Seni Rupa Indonesia Classic Art Week 2025

May 25, 2025 -

Post Record High Frankfurt Stock Market Opening And Dax Performance

May 25, 2025

Post Record High Frankfurt Stock Market Opening And Dax Performance

May 25, 2025

Latest Posts

-

Ilya Ilich I Ego Gryozy Lyubvi Istoriya Iz Gazety Trud

May 25, 2025

Ilya Ilich I Ego Gryozy Lyubvi Istoriya Iz Gazety Trud

May 25, 2025 -

Sterke Aex Prestaties Markt Reageert Positief Op Trump Uitstel

May 25, 2025

Sterke Aex Prestaties Markt Reageert Positief Op Trump Uitstel

May 25, 2025 -

Aex Index Over 4 Decline Sends Market To 12 Month Low

May 25, 2025

Aex Index Over 4 Decline Sends Market To 12 Month Low

May 25, 2025 -

Aex Rally Na Trump Besluit Positief Nieuws Voor Alle Fondsen

May 25, 2025

Aex Rally Na Trump Besluit Positief Nieuws Voor Alle Fondsen

May 25, 2025 -

Beurzenherstel Na Trump Uitstel Aex Stijging Over De Bord

May 25, 2025

Beurzenherstel Na Trump Uitstel Aex Stijging Over De Bord

May 25, 2025