DAX Surge: Will A Wall Street Rebound Dampen German Market Gains?

Table of Contents

The Recent DAX Surge: Underlying Factors

The recent impressive performance of the DAX, a key indicator of the German economy, is fueled by several interconnected factors. Understanding these underlying drivers is crucial for assessing its future trajectory.

Strong German Economic Indicators

Germany's robust economic fundamentals have significantly contributed to the DAX surge. Several key indicators paint a positive picture:

- Positive GDP Growth: Germany has consistently shown positive GDP growth in recent quarters, exceeding expectations in some periods. For example, [cite source with specific data]. This robust growth reflects strong domestic demand and export performance.

- Robust Industrial Production: The industrial sector, a cornerstone of the German economy, has demonstrated resilience, with industrial production figures [cite source with specific data] exceeding forecasts. This is largely due to increased demand for German manufactured goods both domestically and internationally.

- Low Unemployment Rates: Germany’s unemployment rate remains historically low [cite source with specific data], indicating a strong labor market and high consumer spending power. This fuels further economic growth and strengthens investor confidence.

- Consumer Confidence Data: Consumer confidence surveys consistently show a positive outlook among German consumers [cite source with specific data]. This translates into increased consumer spending, further bolstering the economy.

These positive economic indicators significantly influence investor sentiment and drive investment in the German market, contributing directly to the DAX's rise.

Global Market Sentiment and Investor Confidence

The DAX surge isn't solely a result of domestic factors. Global market sentiment and investor confidence play a significant role.

- Positive Investor Sentiment towards European Markets: A general positive shift in investor sentiment towards European markets has boosted investment in the DAX. This is partly due to the relative stability of the Eurozone compared to other regions.

- Reduced Geopolitical Risks (Examples): While geopolitical risks always exist, a period of relative calm, for instance, [cite specific example, e.g., easing tensions in a particular region], has positively impacted investor confidence.

- Strong Corporate Earnings Reports from German Companies: Many leading DAX companies have reported strong corporate earnings, exceeding analysts' expectations. These positive results further bolster investor confidence and drive up stock prices.

The confluence of these global factors, alongside positive domestic indicators, has created a fertile ground for the DAX's impressive performance.

Specific DAX Company Performances Driving the Surge

Several DAX companies have been key drivers of the recent surge. Their individual success stories contribute significantly to the overall index performance.

- [Company A]: [Company A]’s stock price has risen significantly due to [reason, e.g., strong sales growth in a key market, successful product launch]. [Link to relevant news article or financial report].

- [Company B]: [Company B] benefited from [reason, e.g., a successful merger and acquisition, expansion into new markets]. [Link to relevant news article or financial report].

- [Company C]: [Company C]'s strong performance is attributable to [reason, e.g., innovative technological advancements, cost-cutting measures]. [Link to relevant news article or financial report].

These examples illustrate how strong individual company performances within the DAX contribute to the index's overall upward trajectory.

The Potential Wall Street Rebound: Implications for the DAX

While the DAX has experienced a notable surge, a potential Wall Street rebound could significantly influence its future performance.

Correlation between Wall Street and the DAX

The US and German stock markets exhibit a degree of correlation, though not perfect. Historically, positive movements in Wall Street often lead to positive movements in the DAX, and vice versa. This correlation is driven by several factors:

- Global Economic Trends: Global economic events, such as changes in interest rates or commodity prices, impact both markets simultaneously.

- Investor Sentiment: Positive investor sentiment in one market often spills over to the other, reflecting a global outlook on economic prospects.

Understanding this historical relationship is crucial for anticipating the impact of a Wall Street rebound on the DAX.

Factors Driving a Potential Wall Street Rebound

A Wall Street rebound could be driven by several factors:

- Positive Economic News: Positive economic data from the US, such as lower-than-expected inflation figures or stronger-than-expected job growth, could trigger a rebound.

- Easing Inflation Concerns: If inflation shows signs of cooling down, investor confidence might increase, leading to a stock market rally.

- Changes in Monetary Policy: A shift in the US Federal Reserve's monetary policy, such as a pause or reversal in interest rate hikes, could also stimulate a rebound.

These factors, if realized, would likely have a significant impact on global markets, including the DAX.

Potential Scenarios: DAX Performance in the Face of a Wall Street Rebound

Several scenarios are possible depending on the strength and duration of a Wall Street rebound:

- DAX Continues to Rise: A moderate Wall Street rebound might not significantly impact the DAX, allowing its upward trend to continue. This scenario is most likely if the German economy remains strong and investor sentiment towards Europe remains positive.

- DAX Growth Slows: A more substantial Wall Street rebound could lead to a slowdown in DAX growth, as investors might shift their focus to the US market. This scenario is more likely if a strong Wall Street rebound is accompanied by weaker German economic data.

- DAX Experiences a Correction: A very strong and rapid Wall Street rebound, particularly if fueled by a significant shift in global investor sentiment, could trigger a correction in the DAX, leading to a temporary decline. This scenario is less likely but warrants consideration.

Conclusion: DAX Surge: Navigating Uncertainty

The DAX's recent surge is a result of strong German economic indicators, positive global market sentiment, and stellar performances by several key DAX companies. However, the potential for a Wall Street rebound introduces an element of uncertainty. While a moderate rebound might not significantly affect the DAX's positive trajectory, a strong rebound could potentially lead to a slowdown in growth or even a correction. Therefore, carefully monitoring both the DAX index and related economic indicators, along with Wall Street's performance, is crucial for informed investment decisions. Stay informed on the latest developments in the DAX and Wall Street to make informed investment decisions. Monitor the DAX index and related economic indicators to navigate the potential market fluctuations. Understanding the interplay between the DAX and Wall Street is vital for successful investing in today's dynamic global market.

Featured Posts

-

Planning Your Memorial Day Trip Smart Tips For Booking Flights In 2025

May 25, 2025

Planning Your Memorial Day Trip Smart Tips For Booking Flights In 2025

May 25, 2025 -

Sterke Aex Prestaties Markt Reageert Positief Op Trump Uitstel

May 25, 2025

Sterke Aex Prestaties Markt Reageert Positief Op Trump Uitstel

May 25, 2025 -

Test Na Znanie Filmov S Olegom Basilashvili

May 25, 2025

Test Na Znanie Filmov S Olegom Basilashvili

May 25, 2025 -

A Successful Escape To The Country Tips For A Smooth Transition

May 25, 2025

A Successful Escape To The Country Tips For A Smooth Transition

May 25, 2025 -

Amundi Msci World Catholic Principles Ucits Etf Acc A Guide To Net Asset Value Nav

May 25, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc A Guide To Net Asset Value Nav

May 25, 2025

Latest Posts

-

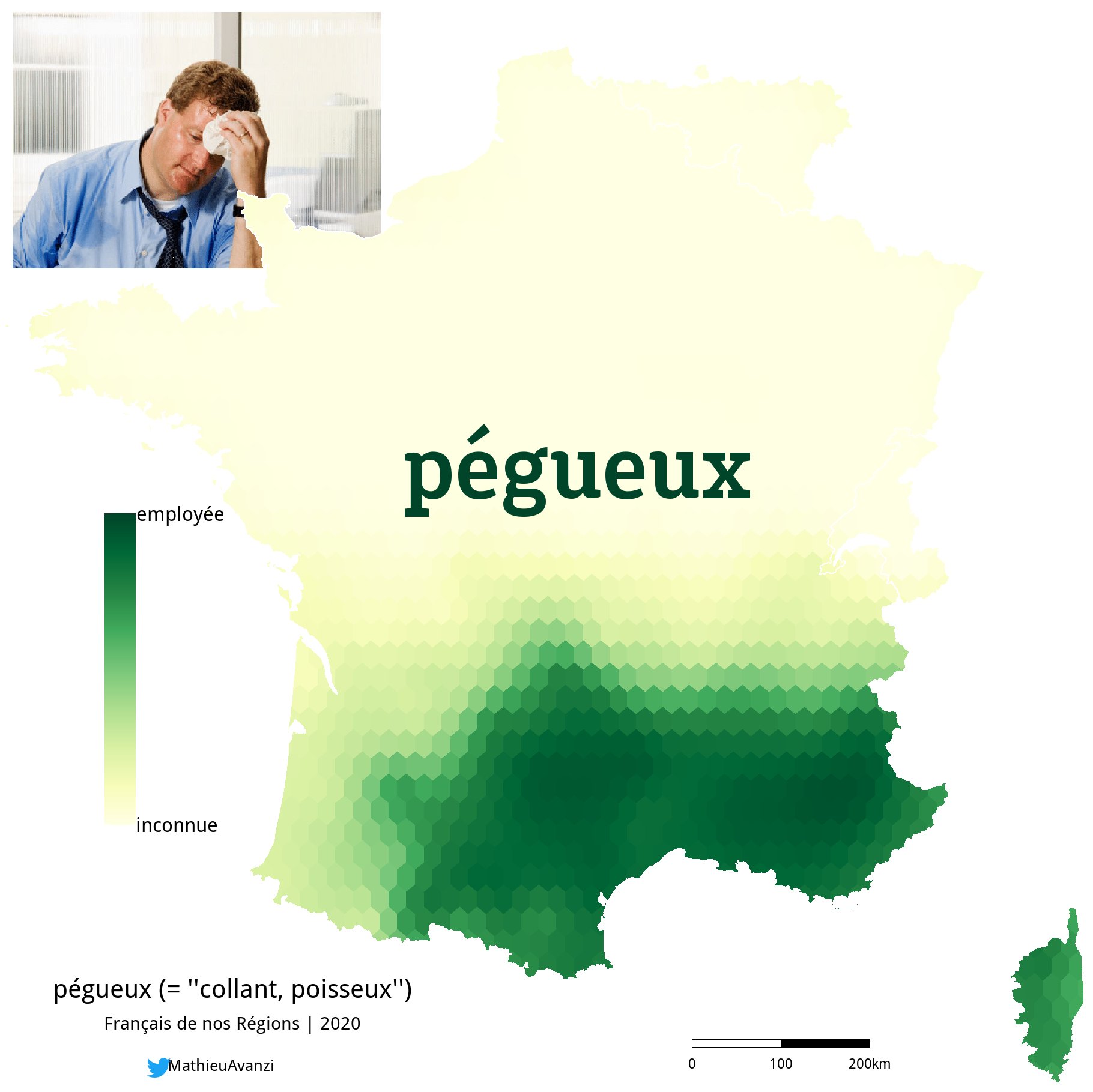

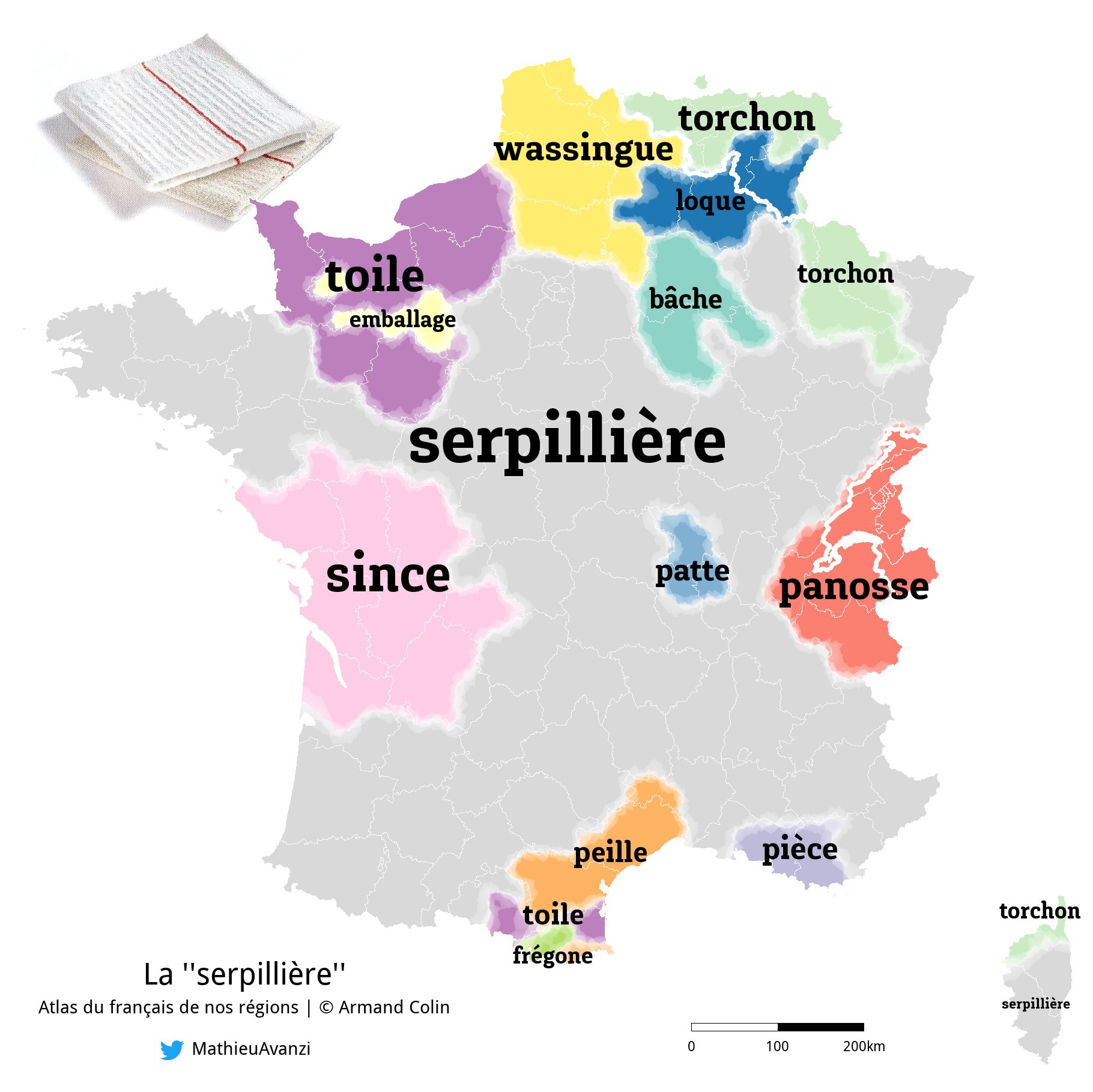

Le Francais Selon Mathieu Avanzi Bien Plus Qu Une Matiere Scolaire

May 25, 2025

Le Francais Selon Mathieu Avanzi Bien Plus Qu Une Matiere Scolaire

May 25, 2025 -

L Impact De Mathieu Avanzi Sur La Perception Du Francais

May 25, 2025

L Impact De Mathieu Avanzi Sur La Perception Du Francais

May 25, 2025 -

Bangladeshs Strategic European Partnerships Growth And Collaboration

May 25, 2025

Bangladeshs Strategic European Partnerships Growth And Collaboration

May 25, 2025 -

Mathieu Avanzi Et L Evolution De La Langue Francaise

May 25, 2025

Mathieu Avanzi Et L Evolution De La Langue Francaise

May 25, 2025 -

Best Of Bangladesh In Europe Fostering Collaboration And Growth In Its Second Edition

May 25, 2025

Best Of Bangladesh In Europe Fostering Collaboration And Growth In Its Second Edition

May 25, 2025