De Minimis Tariffs On Chinese Goods: The G-7's Ongoing Dialogue And Potential Impacts

Table of Contents

Understanding De Minimis Tariffs and their Application to Chinese Goods

Defining De Minimis Value

De minimis value, in international trade, refers to the threshold below which imported goods are exempt from customs duties. This threshold varies considerably across G-7 nations, leading to inconsistencies and complexities in global trade.

- Differences in thresholds across countries: The US, for example, may have a higher de minimis threshold than France, meaning that lower-value goods from China might be subject to tariffs in France but not in the US. This creates an uneven playing field for businesses.

- Impact on small businesses: Small businesses relying on importing low-value goods from China are particularly vulnerable to changes in de minimis thresholds. Higher thresholds can benefit them, while lower ones can significantly increase their import costs.

- Examples of goods affected: Many everyday consumer goods, including clothing, electronics accessories, small household items, and certain types of toys, fall into the category of low-value goods potentially impacted by de minimis tariff adjustments. These are often items sold through e-commerce platforms, adding another layer of complexity.

- Keywords: De minimis threshold, import duty, customs duty, low-value goods, tariff exemption

The Significance of Chinese Goods

China is a dominant player in the global supply chain for low-value goods. The sheer volume of these imports significantly impacts global trade and economic relationships.

- Statistics on Chinese imports: A substantial percentage of low-value goods imported globally originate from China. Precise figures vary depending on the reporting agency and year, but the volume is undeniable.

- Sectors most affected: Consumer electronics, clothing and textiles, and various types of manufactured goods are heavily reliant on imports from China, making them particularly sensitive to changes in de minimis tariffs.

- Economic dependencies: Many countries have significant economic dependencies on Chinese imports, affecting both businesses and consumers. Changes in import policies can create ripple effects throughout entire supply chains.

- Keywords: Chinese imports, global supply chains, trade imbalances, e-commerce, import volume

The G-7 Dialogue: Current State and Key Players

Recent Discussions and Agreements

The G7 nations have engaged in ongoing discussions regarding the harmonization of de minimis tariffs, aiming to create a more consistent and predictable international trade environment. However, reaching a consensus proves challenging due to varying national interests.

- Summary of key arguments: Discussions often center around balancing the needs of small businesses and consumers with concerns about protecting domestic industries from unfair competition and the overall impact on global economic stability.

- Positions of individual member states: Each G7 nation brings its own economic priorities and political considerations to the table. This leads to varied perspectives on the optimal de minimis threshold and the speed at which changes should be implemented.

- Potential compromises: Finding a compromise requires navigating complex trade-offs between free trade principles and the need to address concerns about potential market disruptions and unfair trade practices.

- Keywords: G7 summit, trade negotiations, tariff harmonization, international trade policy, trade liberalization

Political and Economic Considerations

The political landscape plays a crucial role in shaping the G7's approach to de minimis tariffs on Chinese goods.

- Impact on domestic industries: Adjusting de minimis thresholds can significantly impact domestic industries competing with imported goods. Higher thresholds can lead to increased competition, while lower thresholds offer more protection.

- Concerns about unfair competition: Some argue that low de minimis thresholds are necessary to address concerns about unfair trade practices, such as dumping and subsidies, originating from China.

- Potential retaliatory measures: Changes in de minimis tariffs could spark retaliatory measures from other countries, potentially escalating into trade disputes.

- Keywords: Trade wars, protectionism, free trade agreements, geopolitical implications, trade disputes

Potential Impacts of Revised De Minimis Tariffs

Economic Impacts on Businesses

Changes to de minimis tariffs can significantly impact businesses involved in importing and exporting goods.

- Increased costs for importers: Lowering de minimis thresholds will directly increase import costs for businesses, potentially reducing profitability and impacting competitiveness.

- Potential shifts in sourcing strategies: Businesses might shift sourcing strategies away from China to countries with more favorable tariff regimes, potentially disrupting established supply chains.

- Impact on consumer prices: Increased import costs can translate to higher prices for consumers, affecting affordability and purchasing power.

- Keywords: supply chain disruption, business costs, consumer spending, price inflation, import costs

Broader Geopolitical Implications

Adjusting de minimis tariffs has far-reaching geopolitical consequences.

- Impact on bilateral relationships: Changes to tariff policies can strain bilateral relationships between countries, especially between the G7 nations and China.

- Potential for escalation of trade disputes: Unilateral actions on de minimis tariffs can escalate into broader trade disputes, creating uncertainty and instability in the global trading system.

- Implications for global trade governance: The ongoing debate highlights the challenges in coordinating global trade policies and the need for strengthened international cooperation.

- Keywords: international trade relations, global economic stability, WTO rules, trade agreements, global trade governance

Conclusion

The ongoing G7 dialogue on de minimis tariffs on Chinese goods carries significant weight in shaping global trade. Understanding the complexities of these tariffs, their application to Chinese imports, and the potential economic and political consequences is essential for businesses and policymakers alike. The potential impact on businesses, ranging from increased costs to supply chain disruptions, underscores the need for careful consideration of any changes. Keeping abreast of the latest developments in the G7's discussion on de minimis tariffs on Chinese goods is crucial for navigating this dynamic and influential aspect of the international trade environment. Stay informed and adapt your strategies accordingly to minimize potential risks and capitalize on emerging opportunities. Monitoring changes in de minimis import thresholds and their impact on Chinese goods is vital for businesses to maintain competitiveness in the global market.

Featured Posts

-

Alartfae Alqyasy Ldks Dwr Atfaq Washntn Wbkyn Aljmrky

May 24, 2025

Alartfae Alqyasy Ldks Dwr Atfaq Washntn Wbkyn Aljmrky

May 24, 2025 -

M56 Traffic Delays Cheshire And Deeside Affected By Accident

May 24, 2025

M56 Traffic Delays Cheshire And Deeside Affected By Accident

May 24, 2025 -

Bitcoins Record High Positive Us Regulatory Outlook Drives Price Increase

May 24, 2025

Bitcoins Record High Positive Us Regulatory Outlook Drives Price Increase

May 24, 2025 -

Model Night Out Fallout Annie Kilners Posts Fuel Poisoning Claims Against Kyle Walker

May 24, 2025

Model Night Out Fallout Annie Kilners Posts Fuel Poisoning Claims Against Kyle Walker

May 24, 2025 -

Escape To The Country Finding Your Perfect Rural Home

May 24, 2025

Escape To The Country Finding Your Perfect Rural Home

May 24, 2025

Latest Posts

-

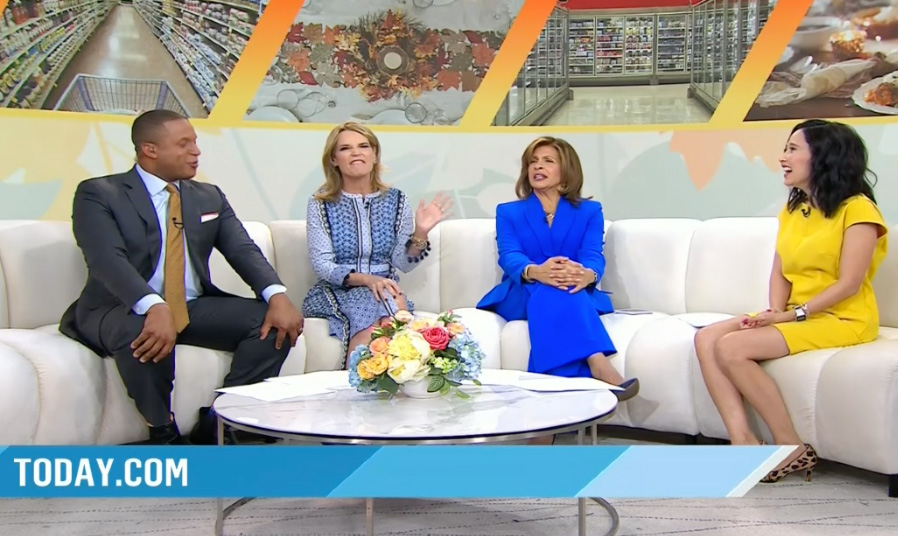

Sheinelle Jones Health Update Nbcs Today Show Addresses Her Absence

May 24, 2025

Sheinelle Jones Health Update Nbcs Today Show Addresses Her Absence

May 24, 2025 -

Todays Cast Talks Sheinelle Jones Addresses Daily Absence

May 24, 2025

Todays Cast Talks Sheinelle Jones Addresses Daily Absence

May 24, 2025 -

Who Replaced Savannah Guthrie On The Today Show This Week

May 24, 2025

Who Replaced Savannah Guthrie On The Today Show This Week

May 24, 2025 -

Today Show Shake Up Savannah Guthries Temporary Co Host

May 24, 2025

Today Show Shake Up Savannah Guthries Temporary Co Host

May 24, 2025 -

Savannah Guthries Replacement Co Host A Mid Week Change

May 24, 2025

Savannah Guthries Replacement Co Host A Mid Week Change

May 24, 2025