Debunking The GOP Tax Plan: A Deep Dive Into Its Deficit Implications

Table of Contents

Projected Revenue Losses Under the GOP Tax Plan

Independent analyses from organizations like the Congressional Budget Office (CBO) and the Tax Policy Center consistently projected significant revenue shortfalls resulting from the GOP tax cuts. These projections paint a stark picture of the plan's fiscal impact.

-

Corporate Tax Rate Cuts: The reduction of the corporate tax rate from 35% to 21% significantly decreased government revenue. While proponents argued this would stimulate investment and growth, the actual revenue gains fell far short of predictions.

-

Individual Income Tax Cuts: Reductions in individual income tax rates, particularly for higher earners, also contributed substantially to revenue losses. These cuts disproportionately benefited wealthier individuals, further exacerbating income inequality and reducing the tax base.

-

Standard Deduction Increases & Other Provisions: The expansion of the standard deduction and other provisions further reduced the taxable income for many individuals and families, contributing to the overall revenue shortfall.

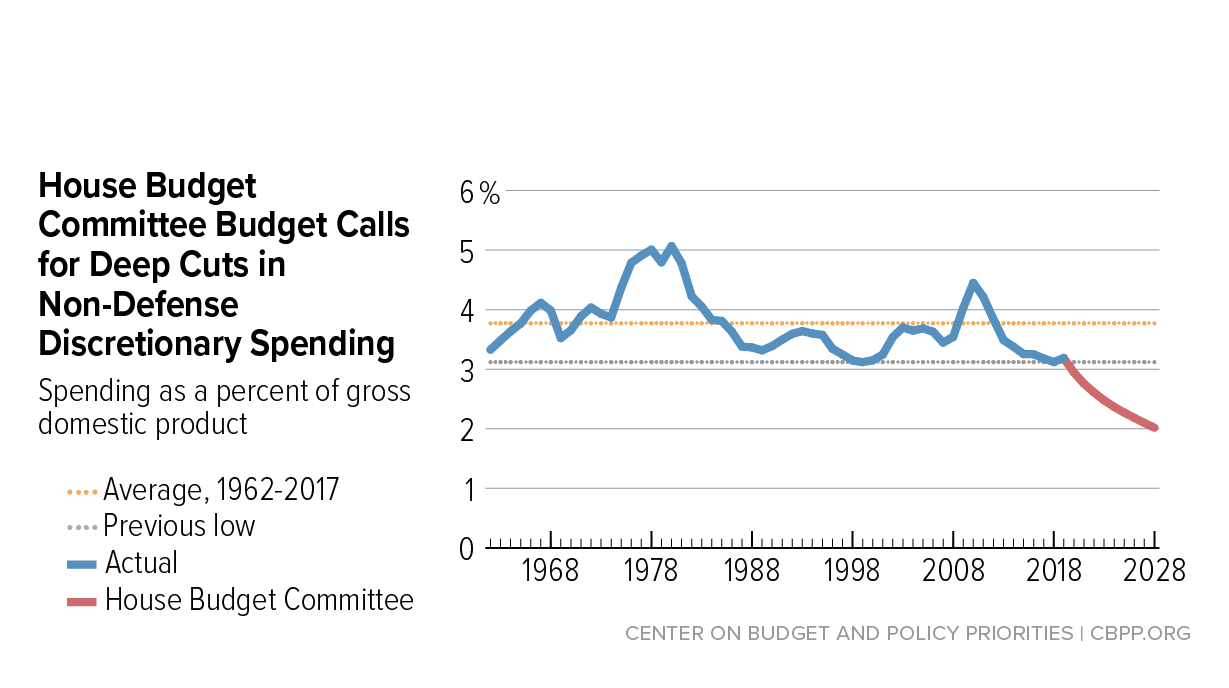

The following chart (insert chart here illustrating projected revenue loss over time) visually represents the projected revenue loss over the decade following the implementation of the GOP tax plan. This data clearly demonstrates the significant impact of the tax cuts on government revenue. Keywords: GOP Tax Cuts, Revenue Projections, Tax Revenue Loss, Fiscal Impact

The Role of Dynamic Scoring in the GOP Tax Plan Debate

The justification for the GOP tax cuts often relied heavily on "dynamic scoring," a method of economic forecasting that considers the potential impact of tax changes on economic growth. This contrasts with "static scoring," which assumes no change in economic behavior.

-

Dynamic Scoring vs. Static Scoring: Dynamic scoring argues that tax cuts stimulate economic activity, leading to increased tax revenue that offsets the initial loss. Static scoring, however, assumes that tax cuts simply reduce government revenue without stimulating sufficient economic growth to compensate.

-

Criticisms of Dynamic Scoring: The use of dynamic scoring in the GOP tax plan debate was highly controversial. Critics argued that the models used overestimated the positive impact of tax cuts on economic growth and underestimated the potential for increased deficits. Empirical evidence from subsequent years largely supported these criticisms.

-

Evidence Countering Growth Claims: Independent analyses showed that the projected economic growth spurred by the tax cuts did not materialize to the extent predicted by dynamic scoring models. This meant the revenue losses were far greater than initially anticipated, directly contributing to the increase in the national debt. Keywords: Dynamic Scoring, Static Scoring, Economic Growth Projections, Tax Plan Revenue Estimates

Increased National Debt and Long-Term Deficit Concerns

The GOP tax plan's projected revenue shortfalls significantly increased the national debt and exacerbated long-term deficit concerns. The implications of this are far-reaching and potentially devastating for the nation's fiscal health.

-

Projected Debt Increases: The CBO's projections showed a substantial increase in the national debt over the subsequent decade due to the tax cuts. This increase burdened future generations with the responsibility of paying off this debt.

-

Consequences of High National Debt: A larger national debt can lead to several negative consequences:

- Higher interest rates on government borrowing.

- Reduced government spending in critical areas like infrastructure, education, and healthcare.

- Increased risk of economic instability.

-

Impact on Social Programs: The increased national debt has forced difficult choices regarding the funding of social programs, potentially leading to cuts in vital services affecting millions of Americans. Keywords: National Debt, Budget Deficit, Government Spending, Fiscal Sustainability, Long-Term Economic Impact

Alternative Analyses and Expert Opinions on the GOP Tax Plan's Deficit Implications

Numerous economists, think tanks, and other credible sources have provided alternative analyses of the GOP tax plan's fiscal projections, often reaching drastically different conclusions than the administration's rosy predictions.

-

Diverse Perspectives: These analyses highlight the significant uncertainty surrounding the long-term fiscal impact of the plan and underscore the importance of considering a wide range of viewpoints.

-

Comparing Models and Projections: Different models and projections used to assess the plan's impact often yielded vastly different results, emphasizing the sensitivity of the analysis to the underlying assumptions. This underscores the importance of critical analysis when evaluating economic forecasts. Keywords: Economic Analysis, Expert Opinion, Think Tank Analysis, Fiscal Policy, Tax Reform

Conclusion: Understanding the Real Costs of the GOP Tax Plan

This analysis demonstrates the significant potential for increased national debt stemming from the GOP tax plan. The projections used to justify the tax cuts often relied on overly optimistic assumptions about economic growth, ignoring potential negative consequences. Ignoring the projected GOP Tax Plan deficit implications has long-term consequences for the nation’s fiscal stability and the ability of the government to invest in critical programs and infrastructure. Understanding the GOP tax plan's deficit implications is crucial for informed civic engagement. Continue your research and become an active voice in shaping our nation's fiscal future. Let’s advocate for responsible fiscal management and demand transparency in government spending and taxation policies.

Featured Posts

-

Nyt Mini Crossword April 26 2025 Helpful Hints

May 20, 2025

Nyt Mini Crossword April 26 2025 Helpful Hints

May 20, 2025 -

Ginger Zee Slams Critic Over Aging Comments

May 20, 2025

Ginger Zee Slams Critic Over Aging Comments

May 20, 2025 -

Hugo Boss Perfume Deals Amazon Spring Sale 2025 Save Up To 60

May 20, 2025

Hugo Boss Perfume Deals Amazon Spring Sale 2025 Save Up To 60

May 20, 2025 -

Hercule Poirot Su Play Station 5 Prezzo Basso Meno Di 10 E Su Amazon

May 20, 2025

Hercule Poirot Su Play Station 5 Prezzo Basso Meno Di 10 E Su Amazon

May 20, 2025 -

Biarritz Celebre Le 8 Mars Evenements Et Discussions Sur Parcours De Femmes

May 20, 2025

Biarritz Celebre Le 8 Mars Evenements Et Discussions Sur Parcours De Femmes

May 20, 2025

Latest Posts

-

D Wave Quantum Qbts Stock Plunge Thursdays Market Analysis

May 20, 2025

D Wave Quantum Qbts Stock Plunge Thursdays Market Analysis

May 20, 2025 -

Analyzing The Increase In D Wave Quantum Qbts Stock Value On Friday

May 20, 2025

Analyzing The Increase In D Wave Quantum Qbts Stock Value On Friday

May 20, 2025 -

Analyzing The Sharp Increase In D Wave Quantum Qbts Stock This Week

May 20, 2025

Analyzing The Sharp Increase In D Wave Quantum Qbts Stock This Week

May 20, 2025 -

Why Did D Wave Quantum Qbts Stock Price Rise On Monday

May 20, 2025

Why Did D Wave Quantum Qbts Stock Price Rise On Monday

May 20, 2025 -

D Wave Quantum Inc Qbts Stock Drop On Thursday Explained

May 20, 2025

D Wave Quantum Inc Qbts Stock Drop On Thursday Explained

May 20, 2025