Decline In Taiwanese Investment In US Bond ETFs

Table of Contents

Rising Interest Rates and Their Impact on US Bond ETF Attractiveness

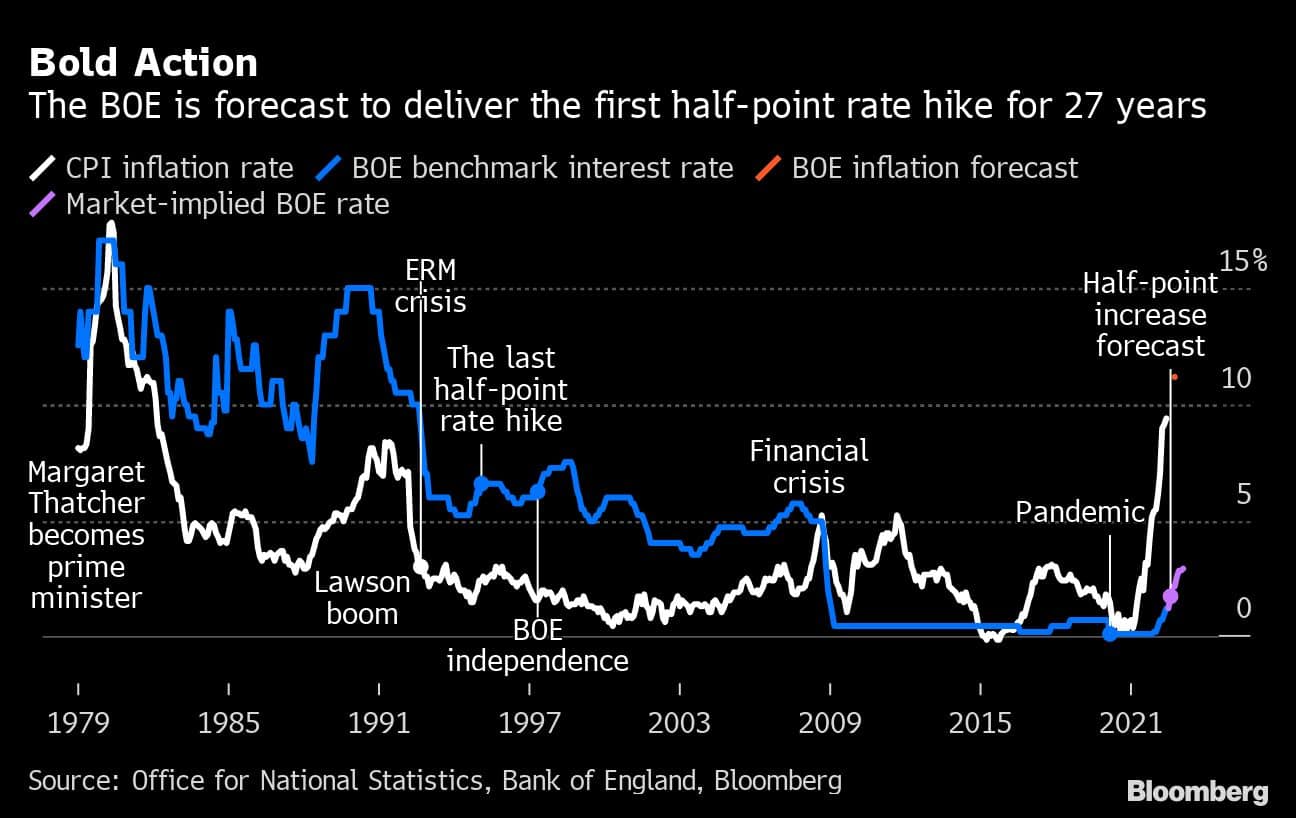

The inverse relationship between interest rates and bond prices is a fundamental principle of finance. As US interest rates rise, the yields on newly issued bonds increase, making existing bonds, and consequently US bond ETFs, less attractive. This is because the fixed income generated by older bonds becomes less competitive compared to newer, higher-yielding options.

The Federal Reserve's series of interest rate hikes throughout 2022 and 2023 directly impacted the returns of US bond ETFs. This, in turn, discouraged Taiwanese investors who are sensitive to fluctuations in their portfolio's value. The correlation between the rate hikes and the decline in Taiwanese investment in US bond ETFs is clearly visible in recent market data.

- Increased attractiveness of higher-yielding alternatives within Taiwan: Rising domestic interest rates in Taiwan offered more competitive returns, reducing the incentive to invest in US bond ETFs.

- Reduced capital appreciation potential of US Bond ETFs: Higher interest rates lead to lower bond prices, diminishing the potential for capital gains.

- Impact on overall portfolio returns for Taiwanese investors: The lower returns from US bond ETFs negatively affected the overall performance of many Taiwanese investment portfolios, leading to portfolio rebalancing.

Geopolitical Uncertainty and its Influence on Investment Decisions

Geopolitical factors, particularly the evolving US-China relationship, significantly influence investor sentiment. Tensions between these two global powers create uncertainty and risk aversion, potentially prompting Taiwanese investors to diversify away from US assets. Concerns about potential trade wars, sanctions, or other disruptive events can lead to capital flight from the US market.

Specific events, such as escalating trade disputes or heightened military activity in the region, can exacerbate this uncertainty and further dampen investor confidence in US assets, including US bond ETFs.

- Increased risk perception associated with US investments: Geopolitical instability raises the perceived risk associated with holding US assets, making Taiwanese investors seek safer havens.

- Shift towards more geographically diversified portfolios: Investors are increasingly seeking diversification across various regions and asset classes to mitigate geopolitical risks.

- Potential for capital flight from the US market: Uncertainty can trigger a sudden outflow of capital from the US, impacting the value of US bond ETFs and discouraging further investment.

Attractiveness of Alternative Investment Options for Taiwanese Investors

The Taiwanese investment landscape has seen the emergence and growth of compelling alternatives to US bond ETFs. The domestic bond market in Taiwan has expanded, offering competitive yields and reducing the need for foreign investment. Furthermore, investors are increasingly looking towards Asian markets for diversification and growth opportunities.

Currency fluctuations and regulatory changes also play a role. The relative strength of the Taiwanese dollar against the US dollar, as well as any changes in tax regulations or investment restrictions, can influence the attractiveness of US bond ETFs compared to domestic or other international options.

- Growth of the Taiwanese domestic bond market: The expansion of the domestic market offers Taiwanese investors more choice and potentially higher yields closer to home.

- Increased investment in Asian markets: The rise of other Asian economies provides attractive investment opportunities for Taiwanese investors seeking regional diversification.

- Diversification into other asset classes (e.g., real estate, equities): Investors are actively exploring diverse investment vehicles to reduce overall portfolio risk and enhance returns.

Analysis of Investment Data and Trends

Analyzing data on Taiwanese investment in US bond ETFs over the past few years reveals a clear downward trend. Charts and graphs showing net investment flows would illustrate this decline visually. Data from reputable sources like the Taiwan Stock Exchange, the Financial Supervisory Commission, and major financial news outlets should be referenced to support the analysis.

- Quantitative analysis of investment flows: Examining the net inflow and outflow of funds into US bond ETFs held by Taiwanese investors provides quantitative evidence of the decline.

- Comparison with investment trends in other regions: Comparing Taiwanese investment trends with those of other Asian investors provides valuable context and identifies potential broader market forces at play.

- Identification of key turning points in investment patterns: Pinpointing specific dates or events that coincide with significant shifts in investment flows provides valuable insights into the underlying causes.

Understanding and Navigating the Shift in Taiwanese Investment in US Bond ETFs

The decline in Taiwanese investment in US bond ETFs is a multifaceted phenomenon driven by a confluence of factors including rising US interest rates, geopolitical uncertainty, and the growing attractiveness of alternative investment options. Understanding these trends is crucial for both Taiwanese and US investors to adapt their strategies effectively.

Future trends will likely depend on the evolution of US interest rate policy, the resolution of geopolitical tensions, and the continued growth of alternative investment opportunities. Careful analysis and diversification will be key to navigating this evolving market environment.

Call to Action: Conduct thorough research and consider consulting a qualified financial advisor before making any investment decisions related to Taiwanese investment in US Bond ETFs or US Bond ETF investments from Taiwan. Explore alternative investment strategies suitable for managing risk in this evolving market landscape. Understanding the factors influencing "Taiwanese Investment in US Bond ETFs" is crucial for making informed investment choices.

Featured Posts

-

Dwp Breaks Silence On Universal Credit Six Month Rule

May 08, 2025

Dwp Breaks Silence On Universal Credit Six Month Rule

May 08, 2025 -

Dwp Universal Credit Refunds How To Claim Historical Payments

May 08, 2025

Dwp Universal Credit Refunds How To Claim Historical Payments

May 08, 2025 -

A Half Point Rate Cut The Bank Of Englands Path Forward

May 08, 2025

A Half Point Rate Cut The Bank Of Englands Path Forward

May 08, 2025 -

Dwp Benefit Stoppage Four Word Letters To Uk Households

May 08, 2025

Dwp Benefit Stoppage Four Word Letters To Uk Households

May 08, 2025 -

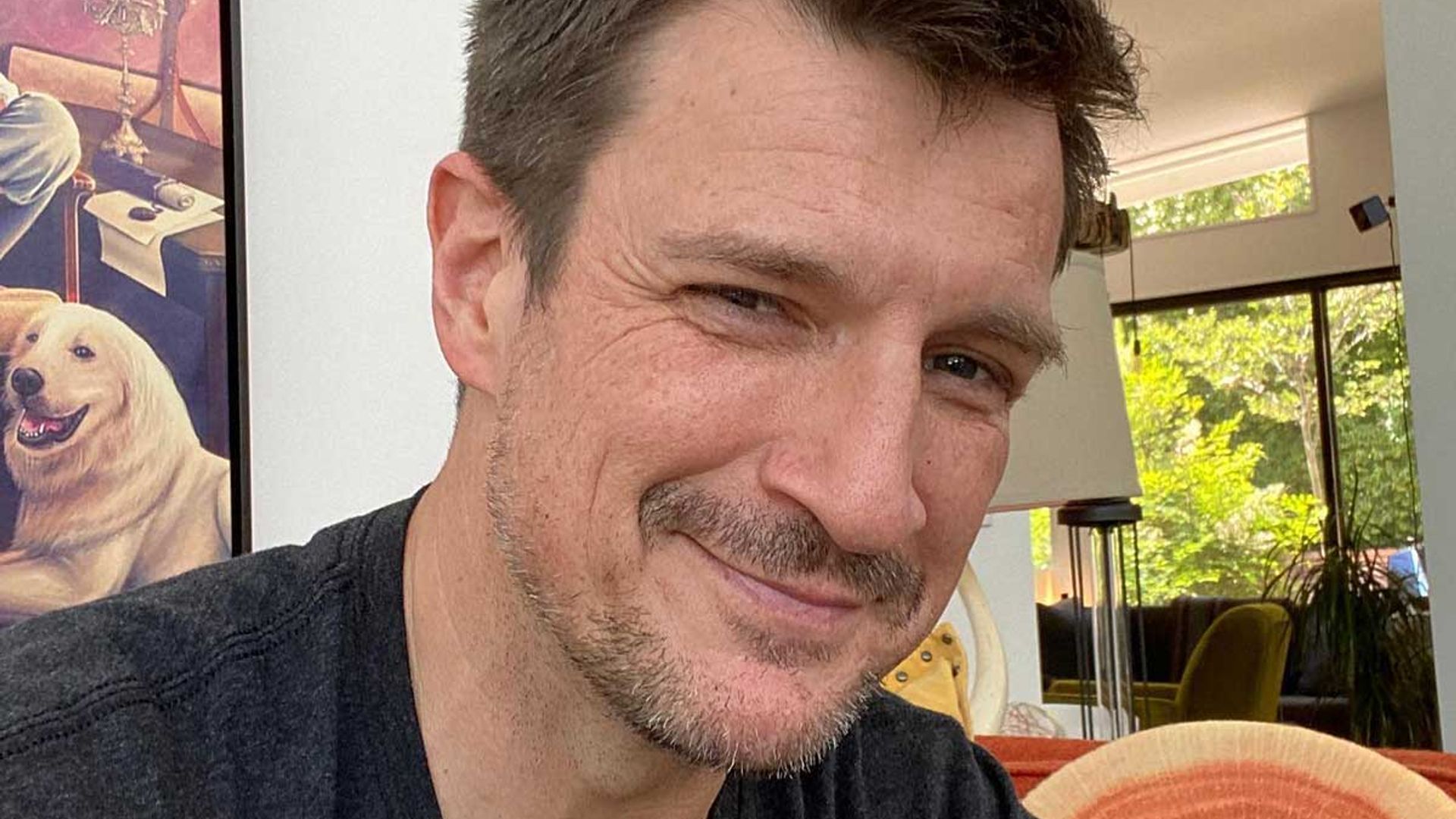

From Wwii To The Rookie Nathan Fillions Career Highlight

May 08, 2025

From Wwii To The Rookie Nathan Fillions Career Highlight

May 08, 2025