Democratizing Stock Investment: The JazzCash-KTrade Partnership

Table of Contents

Enhanced Accessibility: Breaking Down Barriers to Entry

The JazzCash-KTrade partnership significantly lowers the barriers to entry for potential investors. This is achieved through two primary methods: a simplified onboarding process and significantly reduced minimum investment requirements.

Simplified Onboarding Process

Traditional stock brokerage accounts often involve cumbersome paperwork, lengthy processes, and multiple in-person visits. This partnership streamlines the entire process.

- Mobile Registration: Open an account entirely through your mobile phone, eliminating the need for physical visits.

- Digital KYC: Utilize a quick and easy digital Know Your Customer (KYC) process, minimizing documentation requirements.

- User-Friendly Interfaces: Intuitive apps and websites guide users through each step, ensuring a smooth and hassle-free experience.

Statistics show that account opening time has been reduced by up to 80% compared to traditional methods, making stock investment a realistic option for busy individuals.

Lower Minimum Investment Requirements

One of the most significant barriers to entry is the often substantial minimum investment required by traditional brokerage firms. This partnership drastically lowers this barrier, making stock market participation possible even for individuals with limited capital.

- Lower Thresholds: The minimum investment amount is significantly lower than traditional brokerage firms, allowing for smaller, more manageable investments.

- Regular Small Investments: The platform encourages small, regular investments, allowing individuals to gradually build their portfolios over time.

For example, an individual with only 5,000 PKR in disposable income can now participate in the stock market, something previously unimaginable. This accessibility fosters a culture of long-term investment and wealth building.

Leveraging Technology for Seamless Trading

The partnership utilizes cutting-edge technology to provide a seamless and convenient trading experience. This is especially important in a country where mobile phones are the primary means of accessing information and services.

Mobile-First Approach

The partnership prioritizes a mobile-first approach, leveraging JazzCash's vast mobile network to provide a user-friendly mobile trading platform accessible to almost everyone.

- Real-time Market Data: Access up-to-the-minute stock market information directly from your mobile device.

- Order Placement: Buy and sell stocks directly through the app, eliminating the need for desktop computers or physical brokers.

- Portfolio Tracking: Monitor your investments and track your portfolio's performance in real time.

- Direct Fund Transfers: Easily transfer funds between your JazzCash account and your KTrade trading account.

This mobile-first approach enhances accessibility, particularly in areas with limited internet access, by using USSD codes and other features alongside the app.

Secure and Reliable Transactions

Security and reliability are paramount. The platform incorporates robust security measures to protect investors' funds and data.

- Encryption: All transactions are encrypted using industry-standard security protocols.

- Fraud Prevention Measures: Advanced fraud detection systems are in place to protect against unauthorized access and fraudulent activities.

- Regulatory Compliance: The platform adheres to all relevant regulatory requirements to ensure the safety and security of investor funds.

- 24/7 Customer Support: Dedicated customer support channels are available to address any queries and resolve any issues promptly.

Financial Inclusion and Economic Empowerment

The implications of this partnership extend far beyond individual investors; it's a significant step towards greater financial inclusion and economic empowerment in Pakistan.

Expanding the Investor Base

By lowering barriers to entry, the partnership is poised to significantly increase the number of active investors in Pakistan.

- Increased Capital Formation: A larger investor base translates to increased capital formation, fueling economic growth and development.

- Economic Growth Catalyst: Increased participation in the stock market can stimulate economic activity and create new opportunities.

Projections suggest a potential increase of millions of new investors within the next few years, significantly broadening the country's economic participation.

Promoting Financial Literacy

Alongside increased access, the partnership is committed to improving financial literacy among the Pakistani population.

- Educational Initiatives: JazzCash and KTrade are actively developing educational resources and initiatives to help users understand investing concepts and make informed decisions.

- Long-Term Economic Benefits: Increased financial literacy empowers individuals to make better financial decisions, leading to long-term economic benefits.

Conclusion

The JazzCash-KTrade partnership represents a significant leap forward in democratizing stock investment in Pakistan. By simplifying the onboarding process, lowering minimum investment requirements, leveraging technology for seamless trading, and prioritizing security, this collaboration is making the stock market accessible to a wider population than ever before. This increased access is fostering financial inclusion, empowering individuals, and contributing to broader economic growth. Ready to access stock investment opportunities and begin your investment journey? Visit the JazzCash or KTrade website today to learn more and embrace democratized stock investing.

Featured Posts

-

Dijon Et La Cite De La Gastronomie Intervention Municipale Face Aux Problemes D Epicure

May 09, 2025

Dijon Et La Cite De La Gastronomie Intervention Municipale Face Aux Problemes D Epicure

May 09, 2025 -

Analysis Of Indias Improved Global Power Ranking Overtaking Uk France And Russia

May 09, 2025

Analysis Of Indias Improved Global Power Ranking Overtaking Uk France And Russia

May 09, 2025 -

Elizabeth City Weekend Shooting Arrest Made Investigation Continues

May 09, 2025

Elizabeth City Weekend Shooting Arrest Made Investigation Continues

May 09, 2025 -

Leon Draisaitl Injury Update Oilers Star Expected Back For Playoffs

May 09, 2025

Leon Draisaitl Injury Update Oilers Star Expected Back For Playoffs

May 09, 2025 -

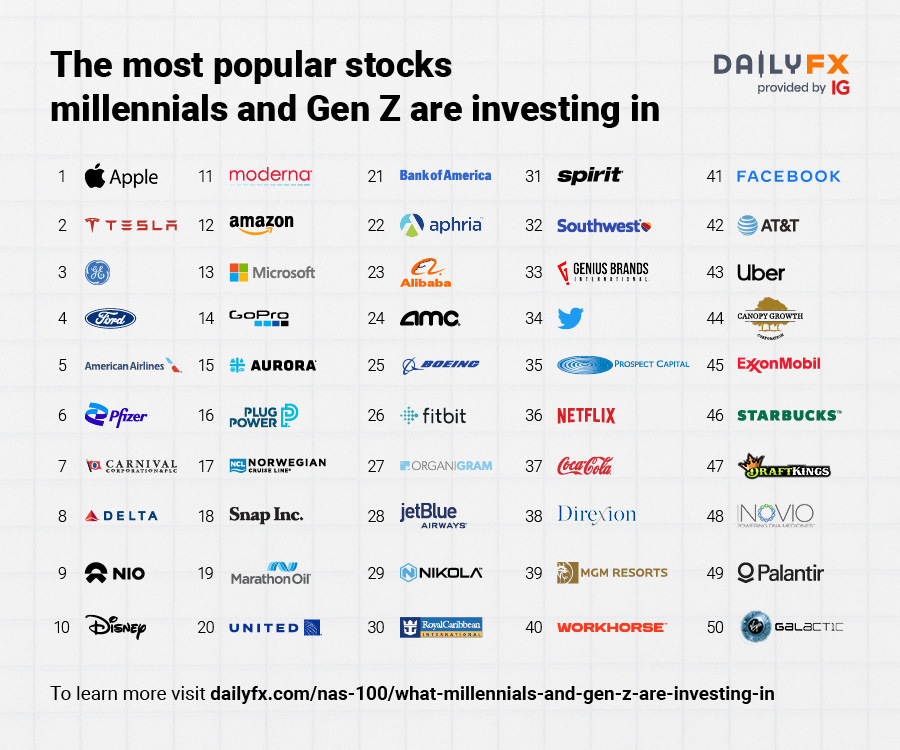

Palantir Stock Prediction 2025 Should You Invest Now

May 09, 2025

Palantir Stock Prediction 2025 Should You Invest Now

May 09, 2025