Details Emerge: House GOP's Trump Tax Plan Unveiled

Table of Contents

Key Tax Rate Changes in the House GOP Trump Tax Plan

The House GOP's Trump tax plan proposes substantial alterations to both individual and corporate income tax rates. Understanding these changes is crucial for assessing the plan's overall impact.

Individual Income Tax Rates

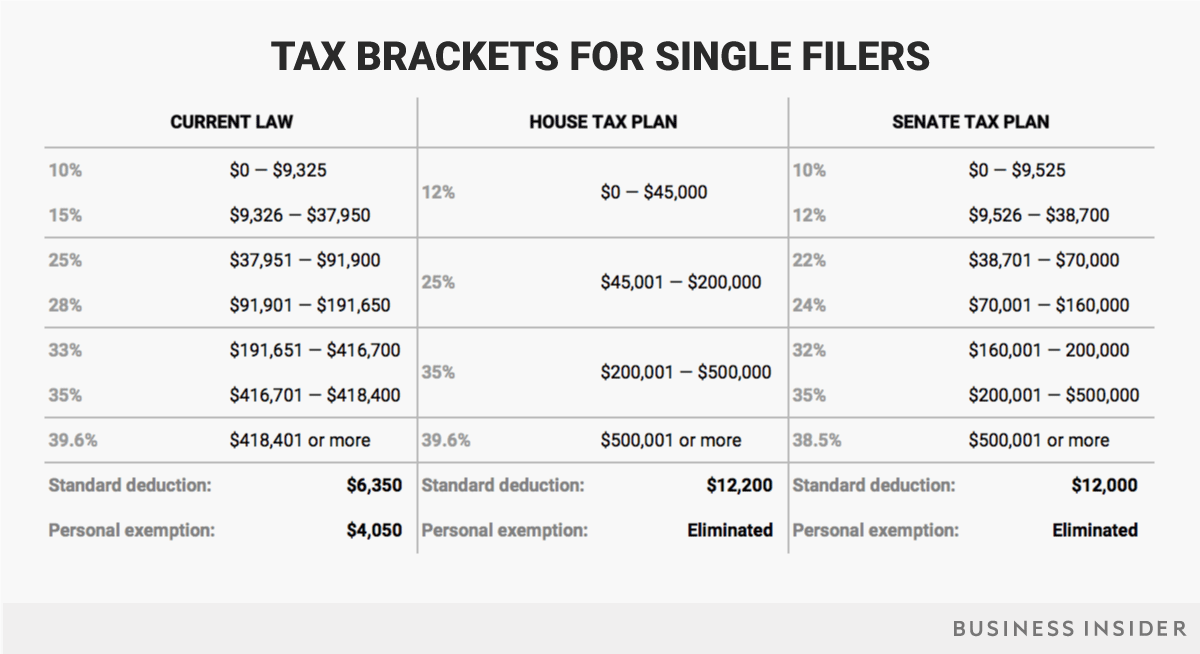

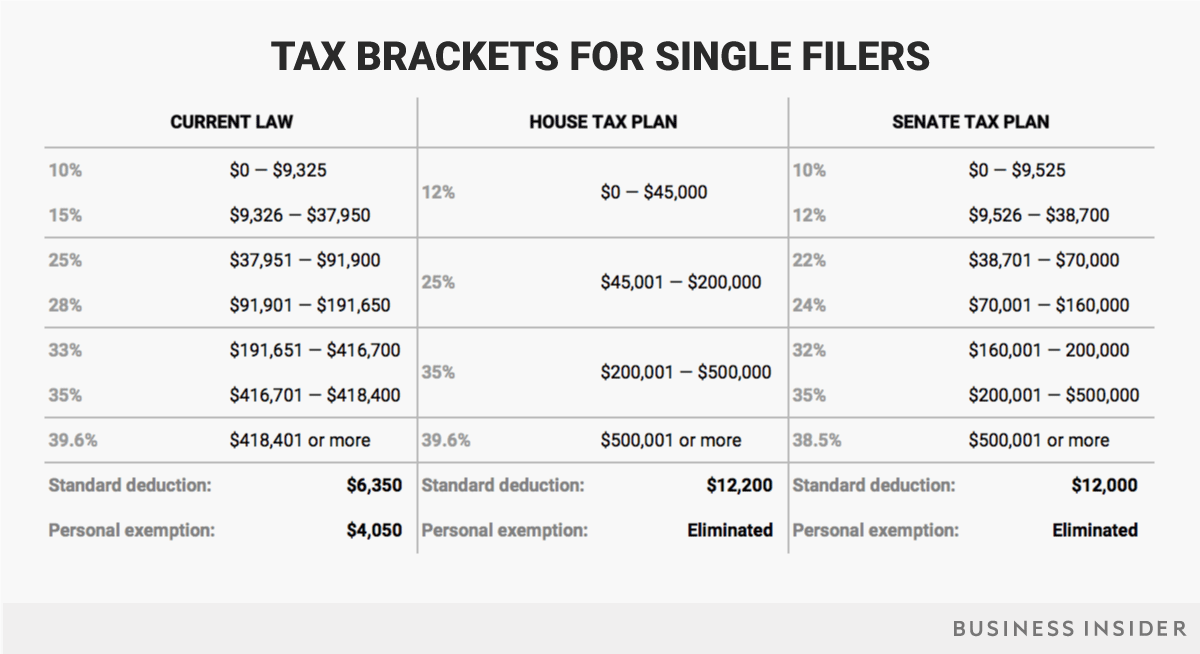

The proposed individual income tax rates represent a significant shift from the current system. While specific numbers may vary depending on the final version of the legislation, the plan generally aims to simplify the tax brackets and potentially lower rates for some income levels.

- Current Rates: The current system features several tax brackets, with rates ranging from 10% to 37%.

- Proposed Changes: The House GOP plan may consolidate these brackets, potentially resulting in fewer brackets with adjusted rate percentages. For example, there might be a reduction in the highest bracket's rate, while lower brackets might experience minimal changes or slight reductions.

- Impact on Income Groups: The impact varies. High-income earners could see substantial tax savings depending on the final rate structure. Middle-class families might experience modest reductions, while lower-income individuals could see minimal changes or even slight increases, depending on the specifics of the plan and any proposed adjustments to deductions and credits. This necessitates careful analysis of individual circumstances under the new structure. Related keywords: individual tax rates, tax brackets, tax cuts, income tax reform.

Corporate Tax Rates

The plan also proposes changes to corporate tax rates, aiming to enhance business competitiveness and stimulate investment.

- Current Corporate Tax Rate: Currently, the US corporate tax rate is relatively high compared to many other developed nations.

- Proposed Changes: The House GOP plan likely proposes a reduction in the corporate tax rate, mirroring similar tax cuts enacted during the Trump administration. This lower rate aims to incentivize businesses to expand, invest, and create jobs.

- Impact on Economic Competitiveness: A lower corporate tax rate could make the US more attractive for foreign investment and encourage domestic businesses to expand. However, potential downsides include reduced government revenue and concerns regarding the distribution of benefits to businesses of different sizes. Related keywords: corporate tax rate, business tax cuts, tax incentives, economic growth.

Changes to Itemized Deductions and Standard Deduction

Significant alterations to itemized deductions and the standard deduction are central to the House GOP's Trump tax plan. These changes aim to simplify the tax code and potentially impact a large portion of taxpayers.

- Itemized Deductions: The plan might limit or eliminate certain itemized deductions, such as those for state and local taxes (SALT), mortgage interest, or charitable contributions.

- Standard Deduction: The standard deduction could be increased, potentially offsetting some of the losses incurred from the limitations on itemized deductions.

- Impact on Taxpayers: Taxpayers who currently itemize might find it more beneficial to switch to the standard deduction if the standard deduction significantly increases. Conversely, those who rely heavily on itemized deductions could see a substantial increase in their tax liability. Related keywords: itemized deductions, standard deduction, tax simplification, tax reform.

Impact on Specific Demographics Under the House GOP Trump Tax Plan

The proposed tax changes will differentially affect various demographic groups, leading to varied impacts on household budgets and financial well-being.

Families and Children

The plan's effect on families is a key area of discussion.

- Child Tax Credit: Modifications to the Child Tax Credit (CTC), such as altering the amount or eligibility requirements, are anticipated. These adjustments could significantly impact family budgets and child-rearing costs.

- Other Family-Related Deductions: Other deductions or credits benefiting families could be revised or eliminated. The net effect on family finances depends on the interplay of all changes. Related keywords: child tax credit, family tax relief, family budget.

Small Businesses and Self-Employed Individuals

The plan intends to influence small businesses and the self-employed, a significant portion of the US economy.

- Tax Breaks for Small Businesses: The plan might offer specific tax breaks aimed at incentivizing small business growth and job creation. These could include deductions, credits, or simplified tax filing procedures.

- Challenges for the Self-Employed: The plan might simultaneously create challenges for the self-employed, potentially impacting their ability to deduct certain expenses or claim specific credits. This necessitates a careful evaluation of individual circumstances. Related keywords: small business tax relief, self-employment tax, entrepreneurship.

High-Income Earners vs. Low-Income Earners

Analyzing the distributional effects of the plan is crucial for understanding its overall impact.

- High-Income Earners: High-income earners might benefit most from lower individual and corporate tax rates.

- Low-Income Earners: Low-income earners could experience minimal changes, or even slight increases, depending on the specific changes to deductions and credits. This could exacerbate existing income inequality. Addressing these concerns through targeted assistance programs might be necessary to mitigate potential negative impacts. Related keywords: income inequality, tax fairness, progressive taxation.

Political Implications and Future of the House GOP Trump Tax Plan

The House GOP Trump Tax Plan faces a complex political landscape.

- Political Support and Opposition: The plan is likely to encounter varying degrees of support and opposition from different political factions. Bipartisan agreement will be essential for its passage.

- Chances of Passing Congress: The plan's success depends on navigating the legislative process, which involves various stages of review, debate, and amendments. Overcoming potential hurdles and securing sufficient votes in both the House and Senate is a significant challenge.

- Long-Term Economic Consequences: The long-term economic effects are uncertain and subject to debate. Economists and policymakers will offer various analyses forecasting the potential impacts on economic growth, job creation, and national debt. Related keywords: political implications, legislative process, economic forecast.

Conclusion:

The House GOP's Trump tax plan presents a significant restructuring of the US tax code. While proponents anticipate economic stimulation, critics raise concerns about income inequality and national debt. The specifics of individual tax rates, corporate tax rates, and modifications to deductions will considerably affect various population segments. Understanding the details of the House GOP Trump Tax Plan is critical for individuals and businesses to plan effectively. Further analysis and discussion are necessary to thoroughly assess this ambitious legislative proposal's long-term effects. Stay informed on the latest developments regarding this impactful Trump tax plan and its potential effects.

Featured Posts

-

Rf Atakovala Ukrainu Bolee 200 Raket I Bespilotnikov

May 16, 2025

Rf Atakovala Ukrainu Bolee 200 Raket I Bespilotnikov

May 16, 2025 -

Nhl Prediction Avalanche Vs Maple Leafs March 19th Matchup Analysis

May 16, 2025

Nhl Prediction Avalanche Vs Maple Leafs March 19th Matchup Analysis

May 16, 2025 -

Padres Vs Cubs Predicting The Outcome And A Potential Cubs Victory

May 16, 2025

Padres Vs Cubs Predicting The Outcome And A Potential Cubs Victory

May 16, 2025 -

Jalen Brunson Knicks Fans Bold Petition To Replace Lady Liberty

May 16, 2025

Jalen Brunson Knicks Fans Bold Petition To Replace Lady Liberty

May 16, 2025 -

Examining Joe Bidens Rebuttals Fact Checking The Claims

May 16, 2025

Examining Joe Bidens Rebuttals Fact Checking The Claims

May 16, 2025