Deutsche Bank Bolsters Defense Finance Expertise With New Deals Team

Table of Contents

Deutsche Bank is significantly expanding its footprint in the lucrative defense finance sector. The bank's newly formed deals team represents a strategic move to capitalize on the growing global defense spending and the complex financial needs of the defense industry. This dedicated team will focus on providing specialized financial services to companies involved in military equipment, technology, and related services. This expansion positions Deutsche Bank as a key player in this increasingly important market segment, offering comprehensive solutions for military finance and government contracts.

<h2>Strategic Rationale Behind Deutsche Bank's Expansion into Defense Finance</h2>

Deutsche Bank's investment in a dedicated defense finance deals team is a strategic response to several key market factors. The decision reflects a forward-looking approach to capitalizing on a sector poised for significant growth and offering substantial untapped potential.

-

Increased Global Defense Spending: Global defense budgets are experiencing a period of sustained growth, driven by geopolitical instability and technological advancements. This presents a compelling investment opportunity for financial institutions with the specialized knowledge to navigate the unique aspects of this market. The increasing demand for sophisticated military equipment and technology translates directly into greater financial activity within the defense industry.

-

Untapped Market Potential: While the defense sector requires substantial financial support, relatively few banks possess the deep understanding of its specific regulations, contracting processes, and risk profiles. This creates a significant opportunity for a specialized team to provide superior service and build strong, lasting relationships with defense contractors.

-

Competitive Advantage: By establishing a dedicated defense finance deals team, Deutsche Bank is positioning itself as a leader in this niche market. This specialized focus allows the bank to offer tailored solutions and develop a deeper understanding of client needs than more generalized financial institutions can provide. This focused approach leads to a competitive edge in securing and maintaining clients in the defense industry.

-

Synergies with Existing Banking Services: The new deals team leverages and complements Deutsche Bank’s existing expertise in investment banking, mergers and acquisitions (M&A), and debt financing. This integrated approach enables the bank to offer a comprehensive suite of financial solutions specifically designed for the defense sector, enhancing the overall value proposition for clients.

<h2>The Composition and Expertise of the New Deals Team</h2>

Deutsche Bank's new defense finance deals team comprises a select group of highly experienced professionals with proven track records in the defense industry and related financial markets.

-

Team Size and Structure: The team consists of [Insert Number] experienced professionals, including senior bankers, analysts, and support staff. The team is structured to efficiently handle a diverse range of transactions and advisory engagements.

-

Key Personnel and Backgrounds: The team members possess extensive experience in defense finance, mergers and acquisitions (M&A), government contracting, and military finance. Their backgrounds include [mention specific relevant experience, e.g., previous roles in defense contracting firms, government agencies, or other financial institutions specializing in defense].

-

Specific Areas of Expertise: The team possesses specific expertise in various aspects of defense finance, including M&A advisory, debt financing, equity financing, project finance, and financial restructuring for companies involved in military technology, aerospace, and defense systems.

-

Industry Connections and Network: The team boasts an extensive network of contacts within the defense industry, government agencies, and related sectors. These relationships facilitate seamless transaction execution and provide invaluable insights into market trends and opportunities.

<h2>Services Offered by Deutsche Bank's Defense Finance Deals Team</h2>

The new team offers a comprehensive suite of financial services specifically tailored to meet the unique needs of companies operating within the defense industry.

-

Mergers and Acquisitions (M&A) Advisory: The team advises on mergers, acquisitions, divestitures, and other strategic transactions within the defense sector, navigating the complexities of regulatory approvals and security clearances.

-

Debt and Equity Financing Solutions: Deutsche Bank provides customized debt and equity financing solutions for defense contractors, including syndicated loans, private placements, and capital market transactions. This encompasses both traditional financing and innovative solutions for government contracts.

-

Financial Restructuring and Advisory Services: The team offers expert guidance on financial restructuring and turnaround strategies for defense companies facing financial challenges, helping them to navigate complex situations and maintain operational stability.

-

Support for Government Contract Bidding and Financing: The team provides comprehensive support to defense contractors throughout the government contracting process, including bid preparation, financing arrangements, and compliance with regulatory requirements.

-

Risk Management Solutions: The team offers tailored risk management solutions for the defense sector, mitigating the unique financial and operational risks associated with government contracts and defense-related projects.

<h3>Impact on the Defense Industry and Global Finance</h3>

Deutsche Bank's initiative will have a significant impact on both the defense industry and the broader landscape of global finance.

-

Increased Competition: The entry of a dedicated defense finance team from a major financial institution like Deutsche Bank will increase competition within the sector, potentially leading to more favorable terms and conditions for defense companies seeking financial support.

-

Enhanced Innovation and Efficiency: Improved access to specialized financial services will foster innovation and efficiency within the defense industry. Better access to capital allows for quicker development of new technologies and more efficient operations.

-

Shaping the Future of Defense Finance: Deutsche Bank’s dedicated focus and expertise will play a key role in shaping the future of defense finance, driving innovation, and improving the overall financial health of the defense sector.

<h2>Conclusion</h2>

Deutsche Bank's new deals team dedicated to defense finance represents a bold strategic move to tap into a high-growth market. This expansion showcases Deutsche Bank's commitment to providing specialized financial services to a sector with unique needs and complexities. The team's expertise in M&A, financing, and risk management will significantly benefit defense companies, contributing to industry growth and innovation. Their understanding of military finance and government contracts is a clear competitive advantage.

Call to Action: Learn more about how Deutsche Bank's defense finance expertise and dedicated deals team can support your organization's financial goals. Contact our team today to discuss your defense finance needs and explore the opportunities available within this dynamic sector. Let Deutsche Bank help you navigate the complexities of defense finance and achieve your strategic objectives.

Featured Posts

-

Sensex At 1400 Points Nifty At 23800 5 Key Factors Driving The Indian Market

May 10, 2025

Sensex At 1400 Points Nifty At 23800 5 Key Factors Driving The Indian Market

May 10, 2025 -

Elizabeth Hurley Baring It All Her Most Unforgettable Cleavage Moments

May 10, 2025

Elizabeth Hurley Baring It All Her Most Unforgettable Cleavage Moments

May 10, 2025 -

High Potential Examining 11 Years Of Psych Spiritual Development

May 10, 2025

High Potential Examining 11 Years Of Psych Spiritual Development

May 10, 2025 -

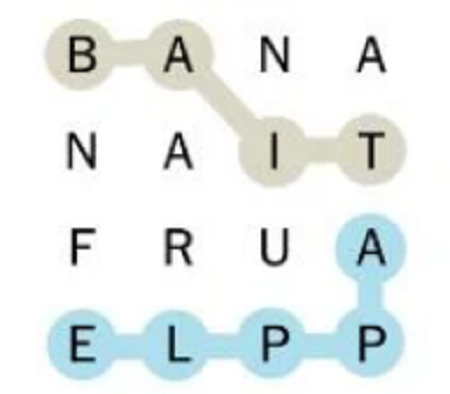

Strands Nyt Crossword Game 349 Solutions February 15th

May 10, 2025

Strands Nyt Crossword Game 349 Solutions February 15th

May 10, 2025 -

Where To Invest Mapping The Countrys Top Emerging Business Locations

May 10, 2025

Where To Invest Mapping The Countrys Top Emerging Business Locations

May 10, 2025