Deutsche Bank Loses Key Figure In Distressed Sales To Morgan Stanley

Table of Contents

The Key Figure's Impact on Deutsche Bank's Distressed Sales Team

The departure of a Senior Managing Director from Deutsche Bank's distressed sales division represents a considerable loss for the institution. This individual, a highly respected figure within the distressed asset sales community, was instrumental in Deutsche Bank's success in this specialized area of investment banking. Their expertise in navigating complex distressed debt transactions and building strong client relationships was invaluable.

- Quantifiable Success: This executive was responsible for over $3 billion in distressed asset sales over the past three years, consistently exceeding targets and contributing significantly to Deutsche Bank's revenue.

- Loss of Client Relationships: Their departure could lead to the erosion of key client relationships, built over years of trust and successful collaborations. These clients may follow the executive to Morgan Stanley, taking their lucrative distressed debt portfolios with them.

- Impact on Market Share: This loss of expertise and client connections could significantly impact Deutsche Bank's market share in the competitive distressed sales market. The bank may find itself struggling to maintain its current standing without this key figure's contribution.

- Impact on Distressed Debt Trading: The overall distressed debt trading capabilities of Deutsche Bank may be weakened, requiring significant restructuring and retraining of remaining team members.

Assessing the Long-Term Implications for Deutsche Bank

The long-term implications for Deutsche Bank are multifaceted and potentially significant. This loss could impact the bank’s competitive advantage in the distressed sales sector, forcing a strategic response.

- Competitive Standing: Deutsche Bank's competitive standing in the distressed sales market will undoubtedly be challenged in the short term. The bank will need to work diligently to compensate for the loss of expertise and market connections.

- Mitigation Strategies: To mitigate the impact, Deutsche Bank may need to implement a range of strategies. This could include an aggressive recruitment drive to find a suitable replacement, internal restructuring of the distressed sales team to redistribute responsibilities, and a renewed focus on client relationship management.

- Reputation and Talent Retention: This departure raises concerns about Deutsche Bank's ability to attract and retain top talent. The bank may need to review its compensation packages and overall employee value proposition to prevent further attrition.

- Future Performance: The long-term impact on Deutsche Bank's profitability and market share in distressed asset trading remains uncertain, but the potential for a negative effect is significant. A swift and effective response will be crucial to minimize the damage.

Morgan Stanley's Strategic Gain and Competitive Advantage

Morgan Stanley’s acquisition of this experienced distressed sales expert is a strategic coup, significantly bolstering their position within the competitive landscape.

- Strategic Importance: This hire is strategically vital for Morgan Stanley, offering immediate access to a seasoned professional with a proven track record and established network of clients.

- Strengthened Market Position: The addition of this executive strengthens Morgan Stanley's position in the distressed debt market, giving them a competitive edge against other investment banks.

- Increased Transaction Volume: Morgan Stanley can expect increased transaction volume and improved revenue generation due to the executive’s expertise and existing client relationships.

- Competitive Landscape Impact: This move could significantly shift the competitive dynamics in the distressed sales sector, potentially leading to further consolidation or shifts in market share among the major players.

The Broader Context of the Distressed Debt Market

The move also needs to be viewed within the broader context of the current distressed debt market.

- Market Conditions and Demand: The current economic climate, characterized by volatility and uncertainty, has increased the demand for experienced professionals who can navigate the complexities of distressed debt investments and sales.

- Growing Importance of Distressed Sales: Distressed sales strategies are becoming increasingly important as businesses grapple with financial difficulties, creating significant investment opportunities for those with the necessary skills.

- Recent Industry Trends: Recent industry trends highlight the intense competition within the distressed debt market. Large-scale mergers and acquisitions, along with significant distressed asset sales, demonstrate the sector's dynamism and growth potential.

Conclusion

The departure of a key figure from Deutsche Bank's distressed sales team to Morgan Stanley represents a significant event with far-reaching implications. This move underscores the intense competition for top talent in the lucrative distressed debt market and highlights the importance of strong leadership and expertise in navigating challenging economic conditions. The long-term effects on both banks and the broader distressed sales market remain to be seen, but this personnel shift has certainly shaken up the industry.

Call to Action: Stay informed on the evolving landscape of distressed sales and the impact of key personnel moves. Follow [Your Website/Publication] for the latest updates on Deutsche Bank, Morgan Stanley, and other significant players in the distressed debt market. Learn more about the complexities of distressed asset sales and their impact on the financial industry.

Featured Posts

-

High Stock Market Valuations A Bof A Perspective For Investors

May 30, 2025

High Stock Market Valuations A Bof A Perspective For Investors

May 30, 2025 -

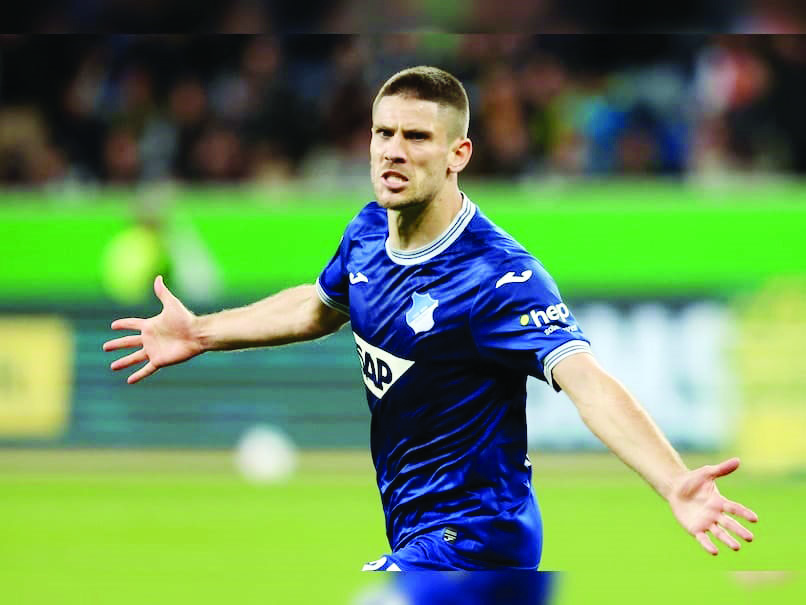

Hoffenheims Kramaric Secures Draw With Late Penalty Against Augsburg

May 30, 2025

Hoffenheims Kramaric Secures Draw With Late Penalty Against Augsburg

May 30, 2025 -

Measles Outbreak Concerns Virginia Announces Second Case Of 2025

May 30, 2025

Measles Outbreak Concerns Virginia Announces Second Case Of 2025

May 30, 2025 -

Negociations Retraites Le Rn Explore Une Collaboration Avec La Gauche

May 30, 2025

Negociations Retraites Le Rn Explore Une Collaboration Avec La Gauche

May 30, 2025 -

Roland Garros 2024 Ruud And Tsitsipas Early Losses Swiateks Continued Success

May 30, 2025

Roland Garros 2024 Ruud And Tsitsipas Early Losses Swiateks Continued Success

May 30, 2025