Disaster Betting: The Los Angeles Wildfires As A Case Study

Table of Contents

The Mechanics of Disaster Betting

Disaster betting operates on the principle of predicting the severity of natural disasters. Instead of betting on sporting events or financial markets, individuals wager on outcomes related to events like wildfires, hurricanes, or earthquakes. These bets can take various forms, focusing on quantifiable aspects of the disaster.

- Types of Bets: For wildfires, bets might revolve around the total acreage burned (over/under a certain number), the estimated cost of damages, the number of structures destroyed, or even the number of evacuations.

- Data Analysis and Predictive Modeling: The foundation of disaster betting rests on sophisticated data analysis. Betting platforms and individuals utilize various data sources, including:

- Historical weather patterns and wildfire data.

- Real-time satellite imagery and remote sensing data.

- Predictive models incorporating factors like wind speed, humidity, and fuel availability.

- Limitations: While sophisticated, these predictive models have inherent limitations. Unpredictable weather patterns, unexpected shifts in fire behavior, and the inherent complexities of natural systems make precise predictions challenging. This uncertainty is a key element of the risk involved in disaster betting.

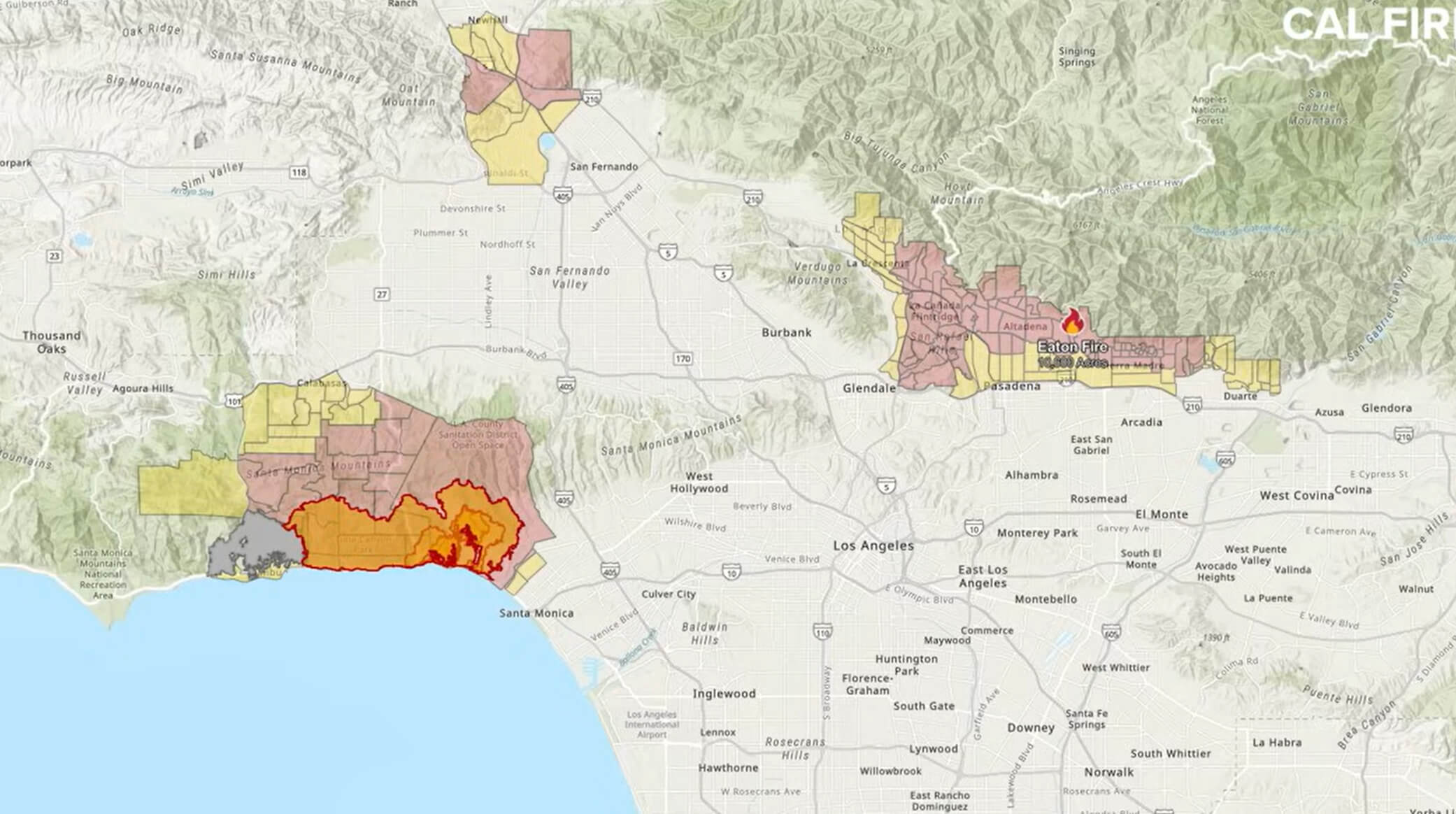

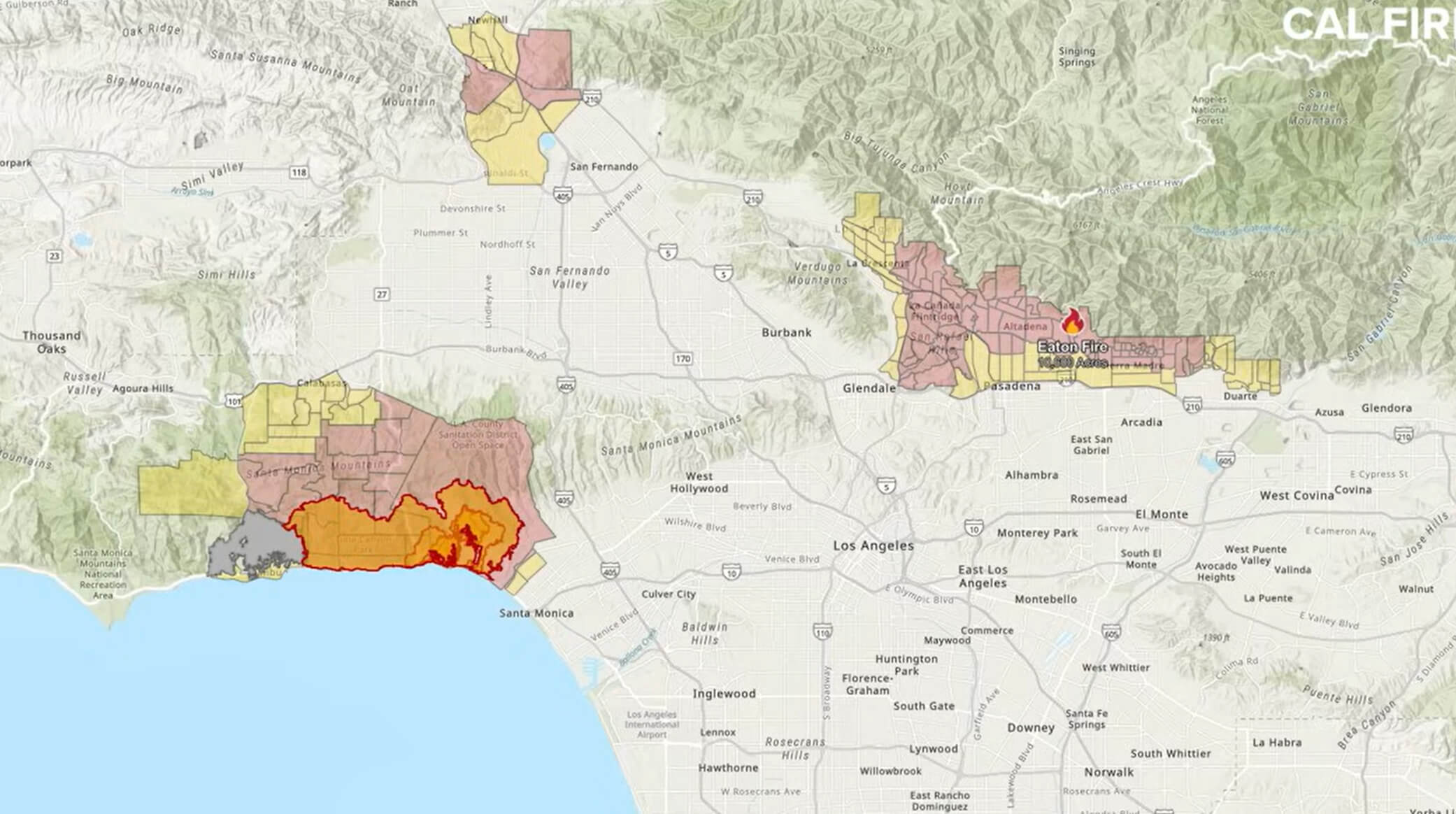

The Los Angeles Wildfires: A Case Study

Los Angeles has a history of devastating wildfires. The Woolsey Fire (2018), for example, burned nearly 100,000 acres, destroyed hundreds of homes, and caused billions of dollars in damage. Similarly, the Getty Fire (2019), though smaller in scale, caused significant property destruction and evacuations. These events highlight the vulnerability of the region and the potential for significant financial losses.

- Impact on Betting Markets: While specific betting odds for these specific wildfires are difficult to obtain publicly due to the sensitive and potentially exploitative nature of such markets, the principle remains. The scale of these disasters, and the subsequent property damage and economic disruption, would have likely influenced any active disaster betting markets.

- Accuracy of Predictions: Hypothetically, predictions of the acreage burned, cost of damage, or the number of evacuations could have been compared to the actual outcomes to assess the accuracy of predictive models used in these hypothetical disaster betting scenarios. The discrepancies would highlight the inherent uncertainty and risk involved.

Ethical and Legal Considerations of Disaster Betting

The ethical implications of disaster betting are profound. Profiting from the suffering and destruction caused by natural disasters raises serious moral questions. Is it acceptable to financially benefit from events that cause widespread devastation and human loss? This practice raises concerns about exploiting vulnerable populations and insensitive financial gain.

- Ethical Arguments: Many argue that disaster betting is morally reprehensible, akin to gambling on human suffering. The potential for secondary victimization, the trivialization of human loss, and the creation of an insensitive market are major criticisms.

- Legal Landscape: The legal status of disaster betting is largely unregulated. While laws against fraud and market manipulation would likely apply, specific legislation targeting disaster betting is largely absent. This regulatory vacuum raises concerns about potential abuses and the need for clear legal frameworks.

The Future of Disaster Betting and Risk Management

The future of disaster betting remains uncertain. While technological advancements in data analysis and predictive modeling could lead to more sophisticated betting markets, the ethical considerations and potential for abuse remain significant hurdles.

- Technological Advancements: Improvements in remote sensing, weather forecasting, and AI-based predictive models could refine the accuracy of disaster predictions, potentially making disaster betting more attractive – but also more ethically problematic.

- Risk Management and Insurance: The insurance industry plays a crucial role in managing disaster risk. The potential interplay between disaster betting markets and insurance payouts needs careful consideration. The intersection of private speculation and public risk management is a complex issue needing thorough examination.

- Responsible Investment: Instead of focusing on speculative profits, resources should be directed towards responsible investment in disaster preparedness, mitigation, and relief efforts.

Conclusion

Disaster betting, as illustrated by the case of the Los Angeles wildfires, presents a complex and ethically challenging landscape. While the mechanics of predicting natural disasters for financial gain may seem straightforward, the profound ethical implications and the potential for exploitation cannot be ignored. We must critically examine the moral considerations and the need for strong regulations to prevent the trivialization of human suffering. The focus should shift away from speculative disaster betting towards robust disaster prediction, risk assessment, and responsible investment in mitigation and relief strategies. Further research into improving disaster prediction and focusing on proactive risk management is crucial to build more resilient communities and avoid the pitfalls of ethically dubious markets involving disaster betting.

Featured Posts

-

Report Jennifer Lawrence And Cooke Maroney Have A Second Child

May 20, 2025

Report Jennifer Lawrence And Cooke Maroney Have A Second Child

May 20, 2025 -

Marche Africain Des Solutions Spatiales Mass Abidjan Ouvre Ses Portes A L Innovation Spatiale

May 20, 2025

Marche Africain Des Solutions Spatiales Mass Abidjan Ouvre Ses Portes A L Innovation Spatiale

May 20, 2025 -

Biarritz Le Bo Cafe Renait Sous La Houlette De Nouveaux Gerants

May 20, 2025

Biarritz Le Bo Cafe Renait Sous La Houlette De Nouveaux Gerants

May 20, 2025 -

Madrid Open Sabalenka Rallies Past Mertens To Maintain Top Spot

May 20, 2025

Madrid Open Sabalenka Rallies Past Mertens To Maintain Top Spot

May 20, 2025 -

Smrt Andelke Milivojevic Tadic Poslednji Pozdrav Voljenih

May 20, 2025

Smrt Andelke Milivojevic Tadic Poslednji Pozdrav Voljenih

May 20, 2025

Latest Posts

-

Four Star Admirals Bribery Case Exposes Systemic Problems Within The Navy

May 20, 2025

Four Star Admirals Bribery Case Exposes Systemic Problems Within The Navy

May 20, 2025 -

High Ranking Admirals Corruption Trial Verdict And Implications

May 20, 2025

High Ranking Admirals Corruption Trial Verdict And Implications

May 20, 2025 -

Bribery Prosecution Of Four Star Admiral Uncovering Deep Rooted Navy Cultural Issues

May 20, 2025

Bribery Prosecution Of Four Star Admiral Uncovering Deep Rooted Navy Cultural Issues

May 20, 2025 -

Us Four Star Admiral Found Guilty On Corruption Charges

May 20, 2025

Us Four Star Admiral Found Guilty On Corruption Charges

May 20, 2025 -

Four Star Admiral Convicted Unprecedented Corruption Case

May 20, 2025

Four Star Admiral Convicted Unprecedented Corruption Case

May 20, 2025