Dow Futures And Bitcoin: Stock Market Analysis Following Tax Bill Vote

Table of Contents

Impact of the Tax Bill Vote on Dow Futures

Short-Term Market Volatility

The immediate market reaction to the tax bill vote was a period of heightened volatility in Dow Futures contracts. The uncertainty surrounding the specific tax implications for corporations created a nervous atmosphere among investors.

- Initial Price Fluctuations: Dow Futures experienced significant price swings in the hours and days following the vote, with sharp increases and decreases reflecting the rapidly shifting investor sentiment. Trading volumes surged as traders reacted to the news.

- News Headlines: Major financial news outlets reported widespread uncertainty and concern, with headlines such as "Dow Futures Plunge on Tax Bill Uncertainty" and "Investors Await Clarity on Corporate Tax Implications."

- Contributing Factors: Beyond the general uncertainty, specific concerns about the impact on corporate tax rates, deductions, and international tax regulations contributed to the volatility. The potential for increased corporate profits versus inflationary pressures fuelled the market's fluctuating response.

Long-Term Implications for Dow Futures

The long-term effects of the tax bill on Dow Futures remain to be seen, but several potential scenarios exist.

- Potential Scenarios:

- Positive Impacts: Lower corporate tax rates could boost corporate earnings, leading to increased investment and higher stock prices. This positive sentiment could translate to sustained growth in Dow Futures.

- Negative Impacts: Conversely, inflationary pressures resulting from the tax bill could erode consumer spending and negatively affect corporate profits, potentially leading to decreased Dow Futures values.

- Neutral Impacts: The actual outcome might be a blend of positive and negative effects, resulting in relatively muted long-term impacts on Dow Futures.

- Economic Indicators: Key economic indicators like GDP growth, inflation rates, and consumer confidence will be closely monitored to assess the long-term impact of the tax bill on the overall economy and, consequently, on Dow Futures.

- Sectoral Impact: Different sectors within the Dow Jones Industrial Average are expected to experience varying degrees of impact. Sectors heavily reliant on government contracts or sensitive to inflation might react differently than those less affected by the tax changes.

Bitcoin's Reaction to the Tax Bill Vote and Dow Futures Movement

Correlation (or Lack Thereof) between Bitcoin and Dow Futures

Historically, the correlation between Bitcoin and traditional stock markets like those represented by Dow Futures has been debated.

- Weak Correlation: While some studies suggest a weak correlation, particularly during periods of extreme market uncertainty, Bitcoin often acts independently of traditional markets.

- Divergence: Numerous instances demonstrate divergence between Bitcoin's price movements and Dow Futures. This is often attributed to Bitcoin's unique characteristics as a decentralized digital asset, less influenced by traditional macroeconomic factors.

- Safe-Haven Status: Some investors view Bitcoin as a safe haven asset, potentially leading to increased demand during periods of market instability, even if Dow Futures are declining. This contributes to its independent behavior.

- Independent Market Drivers: Bitcoin's price is influenced by factors like regulatory news, technological advancements, and overall market sentiment within the cryptocurrency space – all independent of traditional market drivers affecting Dow Futures.

Bitcoin Price Volatility Post-Vote

Following the tax bill vote, Bitcoin's price demonstrated significant volatility, though not necessarily directly mirroring the movements of Dow Futures.

- Price Fluctuations: Bitcoin's price experienced both sharp increases and decreases, showing independent market dynamics. The degree of volatility varied compared to that observed in Dow Futures.

- Comparative Volatility: While both Bitcoin and Dow Futures experienced volatility, the nature of their price swings differed, highlighting the distinct market forces at play.

- Influencing Factors: Bitcoin's price fluctuations were likely influenced by factors such as uncertainty surrounding cryptocurrency regulation, evolving investor sentiment within the crypto community, and technological developments within the Bitcoin ecosystem.

Tax Implications for Bitcoin Investors

The new tax laws have significant implications for Bitcoin investors, impacting both capital gains and overall tax liability.

- Capital Gains Taxes: Profits from selling Bitcoin are subject to capital gains taxes, the rates of which vary depending on the holding period and income bracket.

- Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies remains complex, leading to uncertainty around tax reporting and compliance.

- Institutional vs. Retail Investors: The tax implications differ for institutional and retail investors, with institutional investors facing more complex reporting requirements.

- Resources: Investors should consult tax professionals and refer to official IRS guidelines (or equivalent for their region) for accurate and up-to-date information on tax implications related to Bitcoin holdings.

Conclusion

The tax bill vote created a period of heightened volatility in both Dow Futures and Bitcoin, demonstrating the market's sensitivity to significant legislative events. While a direct correlation between the two asset classes isn't consistently observed, both were affected by the overall uncertainty. Dow Futures reacted primarily to the direct impact on corporate earnings and the economic outlook, while Bitcoin’s response was driven by a combination of factors, including broader market sentiment and regulatory uncertainty within the cryptocurrency space. Understanding the independent and sometimes interconnected market dynamics affecting both Dow Futures and Bitcoin is crucial for investors.

Call to Action: Stay informed about the evolving market dynamics impacting Dow Futures and Bitcoin. Continue monitoring economic indicators, legislative developments, and cryptocurrency-specific news for a comprehensive understanding of future market trends. Further analysis of Dow Futures and Bitcoin price movements is crucial for investors to make informed decisions.

Featured Posts

-

Sadie Sink And Mia Farrow Fellow Tony Nominees Connect

May 24, 2025

Sadie Sink And Mia Farrow Fellow Tony Nominees Connect

May 24, 2025 -

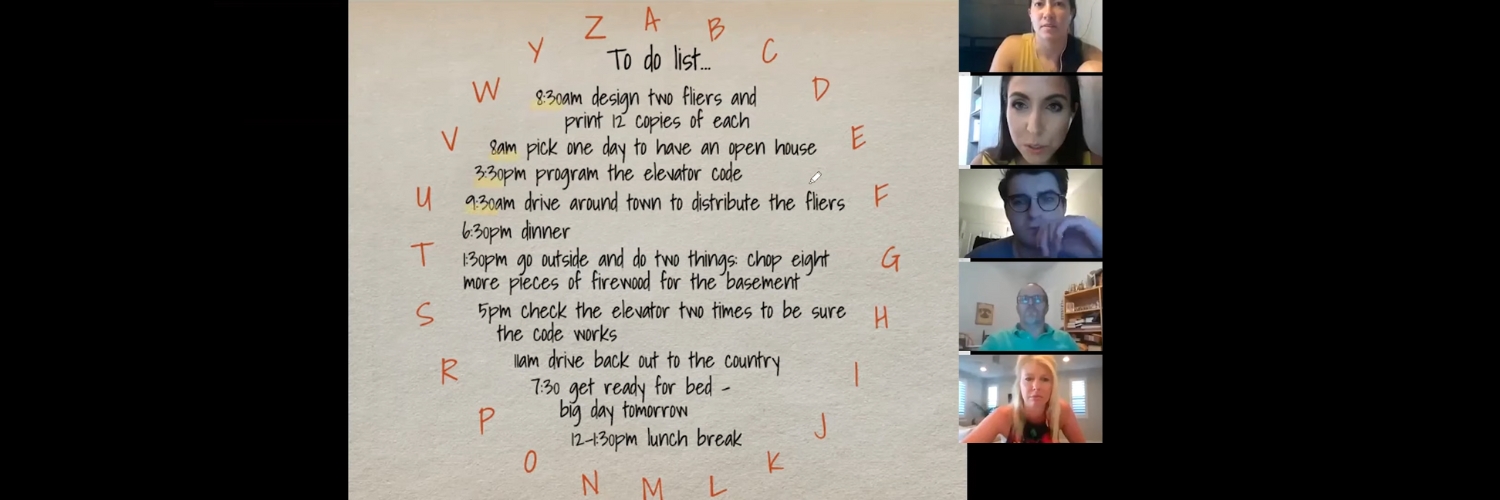

Planning Your Country Escape Homes Activities And Considerations

May 24, 2025

Planning Your Country Escape Homes Activities And Considerations

May 24, 2025 -

Dylan Dreyer Faces Unexpected Hardship Today Show Reaction

May 24, 2025

Dylan Dreyer Faces Unexpected Hardship Today Show Reaction

May 24, 2025 -

Best Of Bangladesh 2024 Focusing On European Collaboration

May 24, 2025

Best Of Bangladesh 2024 Focusing On European Collaboration

May 24, 2025 -

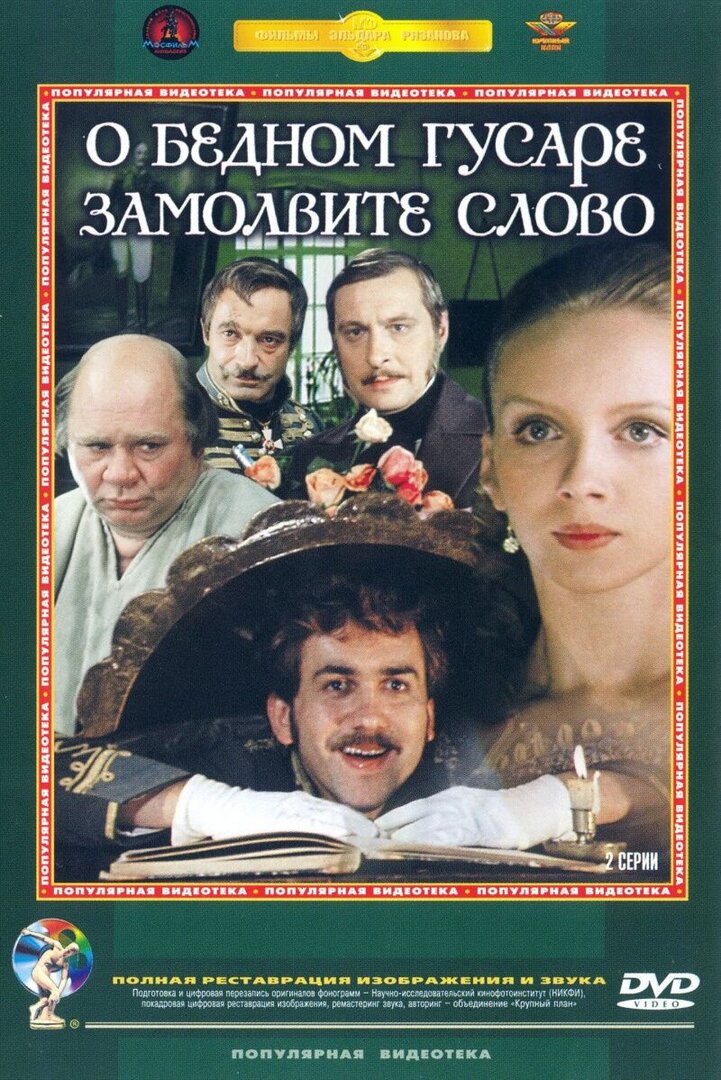

Raschet Vozrasta Geroev Filma O Bednom Gusare Zamolvite Slovo

May 24, 2025

Raschet Vozrasta Geroev Filma O Bednom Gusare Zamolvite Slovo

May 24, 2025

Latest Posts

-

Todays Cast Talks Sheinelle Jones Addresses Daily Absence

May 24, 2025

Todays Cast Talks Sheinelle Jones Addresses Daily Absence

May 24, 2025 -

Who Replaced Savannah Guthrie On The Today Show This Week

May 24, 2025

Who Replaced Savannah Guthrie On The Today Show This Week

May 24, 2025 -

Today Show Shake Up Savannah Guthries Temporary Co Host

May 24, 2025

Today Show Shake Up Savannah Guthries Temporary Co Host

May 24, 2025 -

Savannah Guthries Replacement Co Host A Mid Week Change

May 24, 2025

Savannah Guthries Replacement Co Host A Mid Week Change

May 24, 2025 -

Al Roker Under Fire After Revealing Off The Record Today Show Conversation

May 24, 2025

Al Roker Under Fire After Revealing Off The Record Today Show Conversation

May 24, 2025