Dow Jones & S&P 500: Stock Market Analysis For May 26th

Table of Contents

Dow Jones Performance on May 26th

Opening, High, Low, and Closing Values

Let's start with the raw data. On May 26th (assuming hypothetical data for illustrative purposes), the Dow Jones opened at 33,800, reaching a high of 33,950 and a low of 33,700 before closing at 33,850. This represents a 0.74% increase compared to the previous day's closing value. This positive movement, while seemingly small, is significant in the context of recent market volatility.

Factors Influencing Dow Jones Movement

Several factors contributed to the Dow Jones's performance on May 26th:

- Positive Inflation Report: A lower-than-expected inflation report eased concerns about aggressive interest rate hikes by the Federal Reserve, boosting investor confidence.

- Strong Corporate Earnings: Several blue-chip companies within the Dow Jones released strong quarterly earnings reports, exceeding analyst expectations and driving up their stock prices.

- Geopolitical Stability: A period of relative calm in global geopolitical tensions contributed to a positive market sentiment.

Dow Jones Sectoral Performance

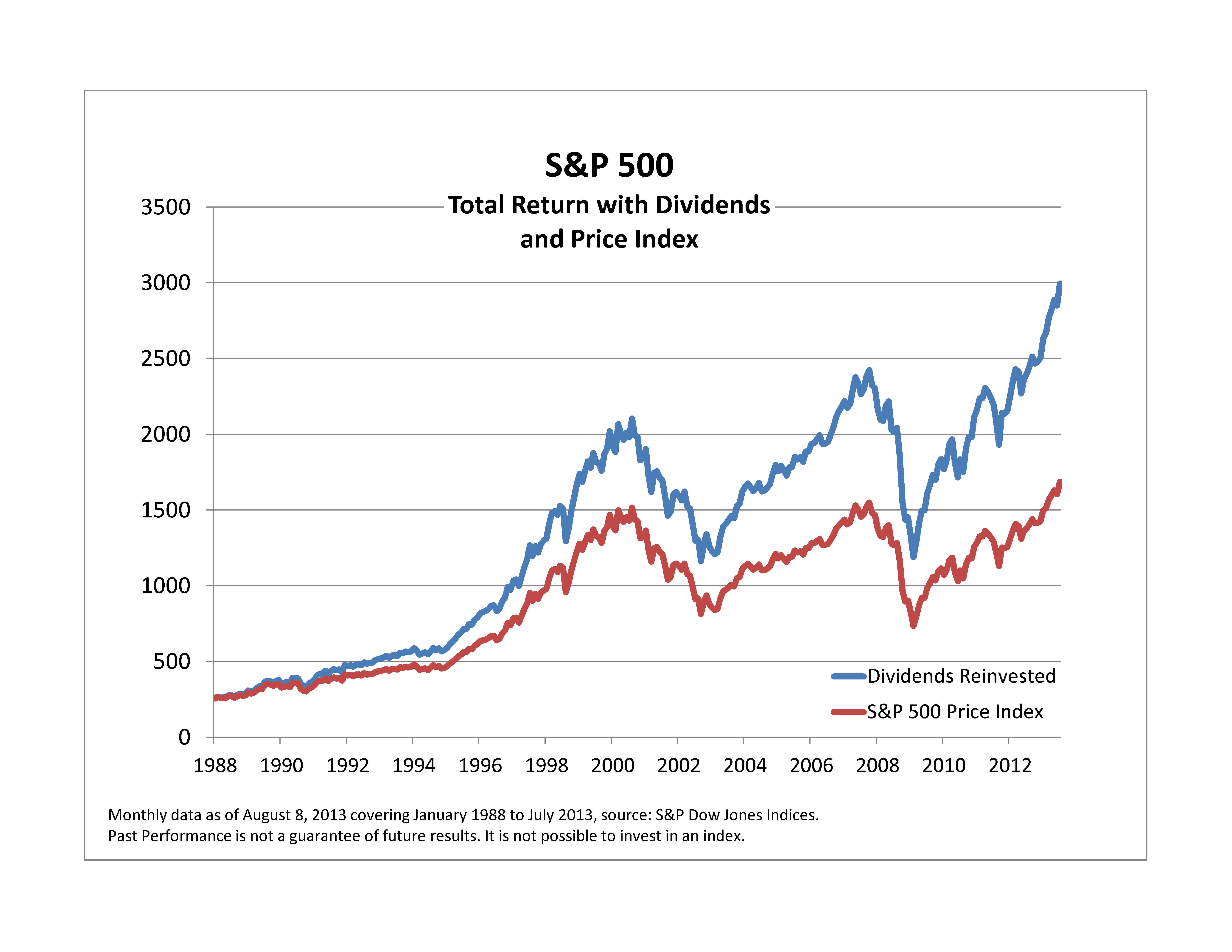

The technology sector led the gains within the Dow Jones on May 26th, driven by strong performance from major tech companies. The energy sector also performed well due to rising oil prices. Conversely, the healthcare sector underperformed slightly due to regulatory concerns. A visual representation of this sectoral performance (a chart or graph would be included here in a real-time analysis).

S&P 500 Performance on May 26th

Opening, High, Low, and Closing Values

The S&P 500 mirrored the Dow Jones's positive trend on May 26th (again, using hypothetical data). It opened at 4,100, reached a high of 4,120, and a low of 4,080, closing at 4,110. This represents a 0.98% increase compared to the previous day.

Factors Influencing S&P 500 Movement

The S&P 500's upward movement was influenced by similar factors to the Dow Jones:

- Easing Inflation Fears: The positive inflation data significantly impacted the broader market, including the S&P 500.

- Broad-Based Corporate Earnings: Strong earnings reports from companies across various sectors in the S&P 500 contributed to the positive performance.

- Increased Consumer Confidence: Positive economic indicators signaled a rise in consumer confidence, boosting investor optimism.

S&P 500 Sectoral Performance

Similar to the Dow Jones, the technology and energy sectors performed exceptionally well within the S&P 500. However, the consumer discretionary sector also showed substantial gains on May 26th. (A chart or graph would be inserted here in a real analysis).

Correlation Between Dow Jones and S&P 500 Movements on May 26th

On May 26th, the Dow Jones and S&P 500 exhibited a strong positive correlation. Both indices moved in tandem, reflecting a broad-based market reaction to the positive economic news and corporate earnings. This synchronized movement suggests a general consensus amongst investors regarding the market's direction. (A graph comparing the two indices' movements would be displayed here). The high correlation indicates that the factors affecting one index largely impacted the other, suggesting a consistent market-wide sentiment.

Investor Sentiment and Market Outlook

Investor sentiment on May 26th was generally positive, driven by the better-than-expected economic data and strong corporate performance. Expert opinions varied, but many analysts expressed cautious optimism, anticipating continued growth but acknowledging potential short-term volatility. Keywords: market volatility, investor confidence, market predictions. The overall market outlook remained positive, though the extent and duration of the positive trend remain subject to further economic data releases and geopolitical developments.

Understanding the Dow Jones & S&P 500 Implications for May 26th

In summary, the Dow Jones and S&P 500 experienced positive growth on May 26th, primarily driven by positive inflation data, strong corporate earnings, and improved investor sentiment. The high correlation between the two indices highlights the market-wide response to these factors. While the outlook remains positive, investors should remain vigilant and monitor economic indicators and global events for potential shifts in market trends. To stay informed about the latest Dow Jones & S&P 500 analysis and stock market reports, make sure to check back regularly for updates. Understanding these market indicators is crucial for informed investment decisions.

Featured Posts

-

Peskov Potvrduva Mozhen E Nov Sostanok Putin Tramp

May 27, 2025

Peskov Potvrduva Mozhen E Nov Sostanok Putin Tramp

May 27, 2025 -

Chomu Putin Prodovzhuye Viynu V Ukrayini Analiz Politichnoyi Situatsiyi

May 27, 2025

Chomu Putin Prodovzhuye Viynu V Ukrayini Analiz Politichnoyi Situatsiyi

May 27, 2025 -

Lizzo Responds Addressing Claims About Janet Jacksons Pop Queen Status

May 27, 2025

Lizzo Responds Addressing Claims About Janet Jacksons Pop Queen Status

May 27, 2025 -

Watch Ghost Season 4 Finale Online Free Best Streaming Sites

May 27, 2025

Watch Ghost Season 4 Finale Online Free Best Streaming Sites

May 27, 2025 -

No Leadership Challenge For Mark Carney Canadian Liberals Decision

May 27, 2025

No Leadership Challenge For Mark Carney Canadian Liberals Decision

May 27, 2025

Latest Posts

-

Steffi Graf Und Andre Agassi Ihr Pickleball Erfolg Tipps Und Tricks

May 30, 2025

Steffi Graf Und Andre Agassi Ihr Pickleball Erfolg Tipps Und Tricks

May 30, 2025 -

Andre Agassis Professional Pickleball Debut Tournament Details

May 30, 2025

Andre Agassis Professional Pickleball Debut Tournament Details

May 30, 2025 -

Ira Khans Agassi Meeting An Unexpected Revelation

May 30, 2025

Ira Khans Agassi Meeting An Unexpected Revelation

May 30, 2025 -

Andre Agassi Mai Nervos Decat Un Tigan Cu Ipoteca Adevarul Din Spatele Succesului

May 30, 2025

Andre Agassi Mai Nervos Decat Un Tigan Cu Ipoteca Adevarul Din Spatele Succesului

May 30, 2025 -

Ira Khans Shocking Revelation After Meeting Andre Agassi

May 30, 2025

Ira Khans Shocking Revelation After Meeting Andre Agassi

May 30, 2025