Dutch Central Bank To Investigate ABN Amro Bonus Practices

Table of Contents

Reasons Behind the DNB Investigation of ABN Amro Bonus Practices

The DNB's investigation into ABN Amro's bonus scheme stems from several converging factors. Public criticism regarding potentially excessive bonuses paid to executives has played a significant role. Concerns have been raised about whether these bonus structures are properly aligned with effective risk management strategies. There are also suspicions of potential breaches of regulatory guidelines concerning executive compensation within the Dutch banking sector. Finally, pressure from shareholders and consumer advocacy groups advocating for greater transparency and fairness in banking practices has added to the mounting pressure on the DNB to act.

- Increased scrutiny of bank executive pay globally: The 2008 financial crisis highlighted the potential dangers of excessive risk-taking fueled by lucrative bonus schemes, leading to increased global scrutiny of executive compensation in the financial sector.

- Potential links between high bonuses and risky lending practices: Concerns remain that high bonuses can incentivize excessive risk-taking, potentially leading to risky lending practices and ultimately harming the stability of the financial system. The DNB is likely investigating whether ABN Amro's bonus system contributed to such behavior.

- Need to ensure responsible corporate governance and ethical conduct: The investigation underscores the DNB's commitment to promoting responsible corporate governance and ethical conduct within the Dutch banking system. Fair and transparent compensation schemes are viewed as crucial elements of this commitment.

Scope and Methodology of the DNB's Investigation into ABN Amro's Bonus Scheme

The DNB's investigation into ABN Amro's bonus scheme is likely comprehensive, encompassing various aspects of the bank's compensation structure. The investigation will likely scrutinize the methodologies used to calculate bonuses, the performance metrics employed to determine bonus payouts, and the overall transparency of the bonus system. A key area of focus will be the proportion of bonuses paid relative to overall profits and whether this aligns with responsible banking practices. The potential for conflicts of interest within the bonus structure will also be carefully examined.

- Review of internal ABN Amro documents: The DNB will undoubtedly review internal ABN Amro documents related to bonus calculations, performance evaluations, and compensation policies.

- Interviews with key ABN Amro personnel: Interviews with key individuals involved in designing, implementing, and administering the bonus scheme will be conducted to gain insights into the decision-making processes.

- Analysis of compensation data across multiple years: The DNB will analyze compensation data over several years to identify trends and patterns in bonus payouts.

- Comparison with bonus schemes at other Dutch banks: The DNB might compare ABN Amro's bonus scheme with those of other Dutch banks to assess whether ABN Amro's practices deviate significantly from industry norms.

Potential Implications for ABN Amro and the Wider Banking Sector

If the DNB's investigation reveals irregularities in ABN Amro's bonus practices, the consequences could be significant. ABN Amro could face substantial financial penalties, considerable reputational damage, and be forced to implement significant changes to its bonus structures. Increased regulatory oversight of the bank's activities is also a strong possibility. The implications extend beyond ABN Amro; the investigation could trigger a domino effect across the Dutch banking sector.

- Increased pressure on other Dutch banks to review their own bonus practices: The investigation will likely prompt other Dutch banks to conduct internal reviews of their own bonus schemes to ensure compliance with regulatory guidelines and best practices.

- Potential for tighter regulation of executive compensation in the Netherlands: The DNB's findings could lead to tighter regulation of executive compensation in the Netherlands, with stricter guidelines and greater transparency requirements.

- Impact on investor confidence in the Dutch banking sector: Negative findings could negatively impact investor confidence in the Dutch banking sector as a whole.

- Increased public awareness of the issue of executive pay in the financial industry: The investigation will undoubtedly raise public awareness of the broader issue of executive pay in the financial industry and the importance of responsible compensation practices.

Conclusion

The Dutch Central Bank's investigation into ABN Amro bonus practices underscores the ongoing debate surrounding executive compensation and its crucial impact on responsible banking. The outcome of this investigation will not only significantly affect ABN Amro but could also reshape regulatory practices and corporate governance throughout the Dutch banking sector. Understanding the nuances of this investigation – and the potential implications for ABN Amro's bonus schemes – is crucial for anyone involved in or following the Dutch financial market. Stay informed about further developments in this case, as the findings could significantly reshape the landscape of executive compensation in the Netherlands.

Featured Posts

-

College Town Economies Navigating The Challenges Of Declining Enrollment

May 21, 2025

College Town Economies Navigating The Challenges Of Declining Enrollment

May 21, 2025 -

Saskatchewan Political Fallout Redneck Comments And The Federal Leader

May 21, 2025

Saskatchewan Political Fallout Redneck Comments And The Federal Leader

May 21, 2025 -

Maybank Drives 545 Million Investment In Economic Zone

May 21, 2025

Maybank Drives 545 Million Investment In Economic Zone

May 21, 2025 -

Cassidy Hutchinson To Publish Memoir Detailing Jan 6th Experience

May 21, 2025

Cassidy Hutchinson To Publish Memoir Detailing Jan 6th Experience

May 21, 2025 -

India Makes History 19 Paddlers At Wtt Star Contender Chennai

May 21, 2025

India Makes History 19 Paddlers At Wtt Star Contender Chennai

May 21, 2025

Latest Posts

-

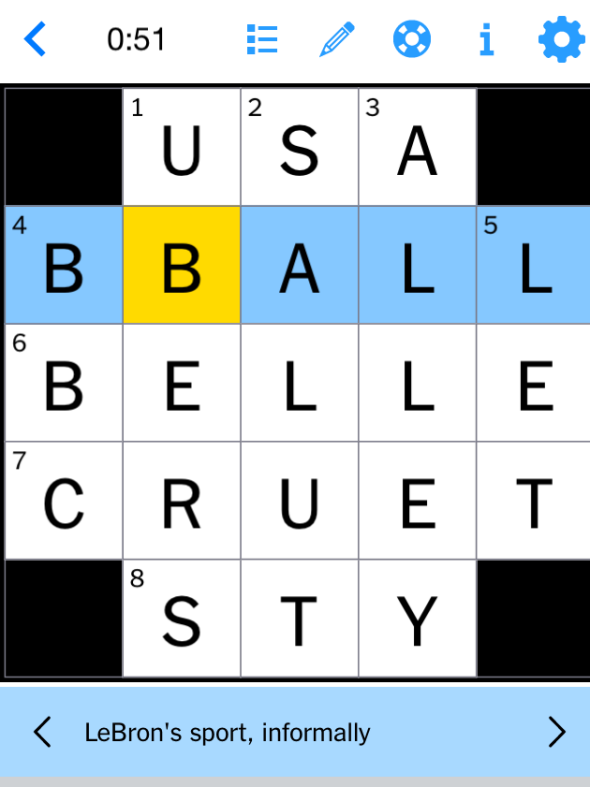

Nyt Mini Crossword Puzzle Hints April 26 2025

May 21, 2025

Nyt Mini Crossword Puzzle Hints April 26 2025

May 21, 2025 -

Bucharest Tiriac Open Cobollis Maiden Atp Victory

May 21, 2025

Bucharest Tiriac Open Cobollis Maiden Atp Victory

May 21, 2025 -

Nyt Mini Crossword Solutions April 26 2025

May 21, 2025

Nyt Mini Crossword Solutions April 26 2025

May 21, 2025 -

Flavio Cobolli Wins Bucharest Tiriac Open

May 21, 2025

Flavio Cobolli Wins Bucharest Tiriac Open

May 21, 2025 -

April 20 2025 Nyt Mini Crossword Complete Answers And Hints

May 21, 2025

April 20 2025 Nyt Mini Crossword Complete Answers And Hints

May 21, 2025