Dutch Investor's $65 Billion Investment: A Turning Point For US Money Management?

Table of Contents

The Scale of the Investment and its Implications

The sheer size of the $65 billion investment is staggering. To put this into perspective, it represents a significant percentage of the total assets under management in the US money management sector (the exact percentage would require further market analysis). This scale alone suggests the potential for significant consolidation within the industry.

-

Market share analysis: While precise market share figures require detailed financial data, a $65 billion investment could easily give InvestCorp a substantial position within several key segments of the US money management market, potentially impacting existing players.

-

Potential for consolidation: We might see mergers and acquisitions as InvestCorp seeks to strategically integrate its investment, leading to a reduction in the number of major players and a reshaping of the market structure.

-

Impact on competition and innovation: The entry of such a significant investor will likely increase competition, pushing existing firms to innovate and enhance their services to remain competitive. This could lead to better products, improved technology, and potentially lower fees for consumers.

InvestCorp's motives are likely multifaceted, including diversification of its portfolio, strategic acquisitions of existing firms, and a long-term bet on the growth of the US economy and its financial sector.

Potential Benefits for the US Economy

This massive investment holds the potential for significant economic benefits for the US.

-

Job creation and economic stimulus: InvestCorp's investment will likely lead to job creation, both directly within its acquired companies and indirectly through the ripple effects across related industries. This injection of capital can stimulate economic growth.

-

Technological advancements and innovation in the financial sector: The investment could fuel technological advancements within the US money management industry, potentially leading to more efficient and sophisticated financial services.

-

Increased access to capital for US businesses: A larger pool of investment capital can facilitate greater access to funding for US businesses, promoting growth and entrepreneurship.

Improved financial services and infrastructure resulting from this investment will benefit consumers, businesses, and the overall US economy.

Potential Risks and Challenges

While the potential benefits are considerable, the investment also presents certain risks and challenges.

-

Regulatory hurdles and compliance issues: Navigating US regulatory requirements will be crucial for InvestCorp. Compliance issues and potential legal challenges could complicate the investment process.

-

Potential for market volatility and risk: Such large-scale investments always carry inherent market risks. Economic downturns or unforeseen events could negatively impact the return on investment.

-

Concerns about foreign influence on US financial markets: Some may express concerns about the influence of a foreign investor on US financial markets. However, this concern needs to be weighed against the potential economic benefits.

Careful risk management and robust regulatory oversight are crucial to mitigate these potential downsides.

Comparison with Previous Large Investments in US Money Management

To understand the significance of InvestCorp's investment, it's helpful to compare it with previous large-scale investments in the US money management sector. [Here, you would insert specific examples of past significant investments, their outcomes, and comparative analyses. For instance, you might discuss investments by other sovereign wealth funds or large private equity firms in the US market]. This historical context will help evaluate the potential impact of the $65 billion investment.

Future Outlook and Predictions

The long-term impact of InvestCorp's $65 billion investment remains to be seen, but several key predictions can be made:

-

Potential changes in market dynamics and competition: We can expect intensified competition among money management firms, leading to innovation and potentially lower fees for clients.

-

Predictions regarding industry consolidation and growth: Further industry consolidation is likely, with larger firms emerging as dominant players. Overall sector growth is predicted, though the pace will depend on macroeconomic factors.

-

Impact on investors, businesses, and consumers: The investment’s impact will be felt across the board – benefiting some businesses and investors while potentially posing challenges to others. Consumers could see improved services and potentially lower costs.

Continued foreign investment in the US financial industry is likely, driven by the country's economic strength and the potential for high returns.

Conclusion

The Dutch investor's $65 billion investment represents a pivotal moment for the US money management industry. Its immense scale has the potential to reshape the sector’s competitive dynamics, spur innovation, and stimulate economic growth. However, careful consideration of the associated risks and regulatory complexities is crucial. The long-term effects of this substantial injection of capital will undoubtedly be felt for years to come, reshaping the landscape of US financial markets. We encourage you to share your thoughts and opinions on the impact of this substantial Dutch investment and its implications for the future of US money management after this $65 billion injection. This significant event warrants continued observation and analysis to fully understand its lasting consequences.

Featured Posts

-

Stock Market Valuation Concerns Bof A Explains Why Investors Shouldnt Worry

May 28, 2025

Stock Market Valuation Concerns Bof A Explains Why Investors Shouldnt Worry

May 28, 2025 -

Pacers Vs Bulls Game Time Tv Schedule And Streaming Options March 10th

May 28, 2025

Pacers Vs Bulls Game Time Tv Schedule And Streaming Options March 10th

May 28, 2025 -

Avrupa Da Transfer Heyecani Ingiliz Takimi Bueyuek Oyuncuyu Transfer Etmek Uezere

May 28, 2025

Avrupa Da Transfer Heyecani Ingiliz Takimi Bueyuek Oyuncuyu Transfer Etmek Uezere

May 28, 2025 -

Hugh Jackmans Stance In The Justin Baldoni Lawsuit A Show Of Solidarity

May 28, 2025

Hugh Jackmans Stance In The Justin Baldoni Lawsuit A Show Of Solidarity

May 28, 2025 -

Arizona Diamondbacks Defeat San Francisco Giants Jordan Hicks Takes The Loss

May 28, 2025

Arizona Diamondbacks Defeat San Francisco Giants Jordan Hicks Takes The Loss

May 28, 2025

Latest Posts

-

Klimatolerans Noevenyfajtak Valasztasa Az Alfoeldi Termesztesben

May 31, 2025

Klimatolerans Noevenyfajtak Valasztasa Az Alfoeldi Termesztesben

May 31, 2025 -

Bert Natters Concentratiekamproman Een Indrukwekkend Vermoeiend Portret Van De Nazidagen

May 31, 2025

Bert Natters Concentratiekamproman Een Indrukwekkend Vermoeiend Portret Van De Nazidagen

May 31, 2025 -

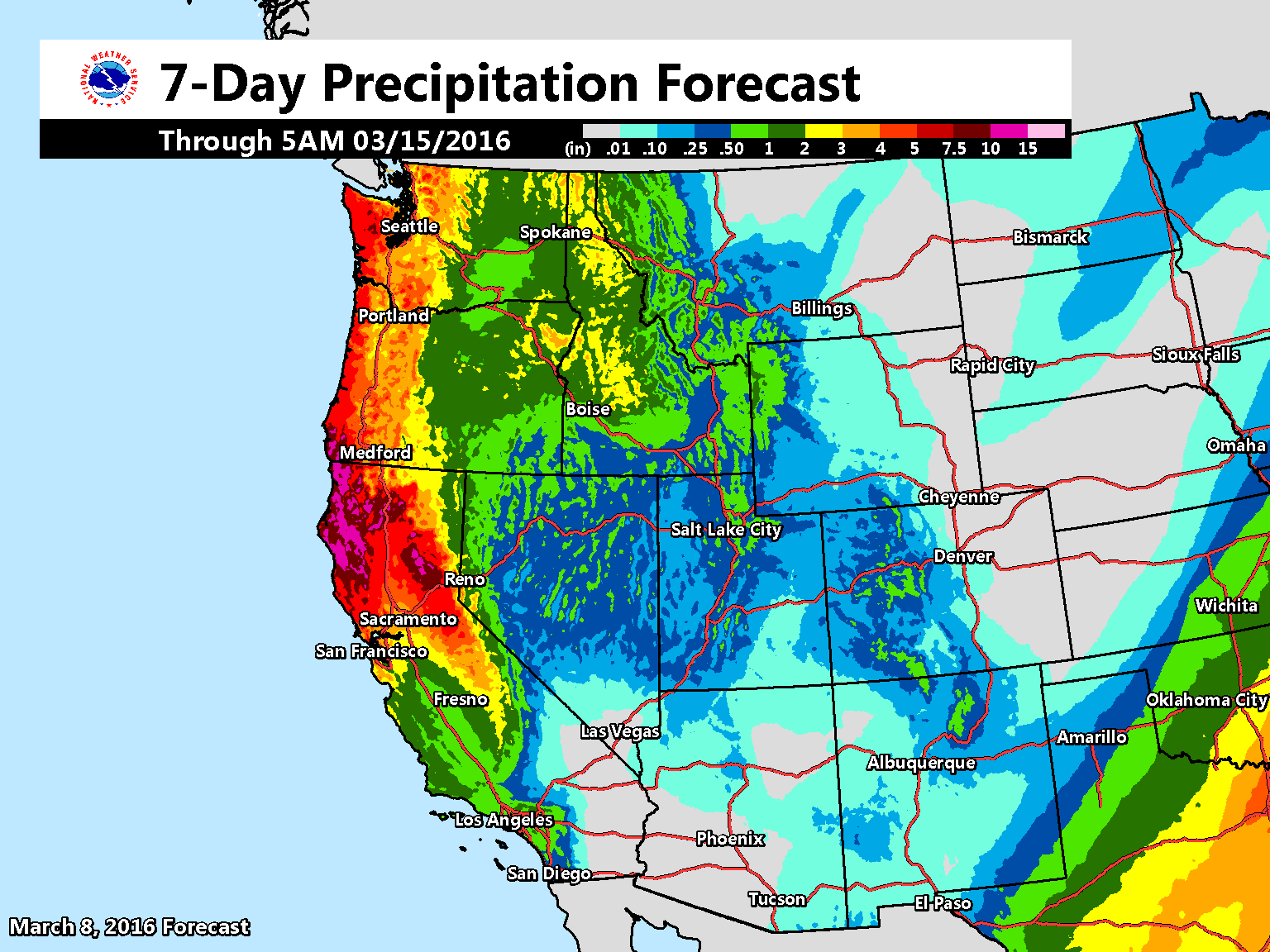

April Outlook Update Recent Developments And Forecasts

May 31, 2025

April Outlook Update Recent Developments And Forecasts

May 31, 2025 -

Seattle Weather Extended Weekend Rain Forecast

May 31, 2025

Seattle Weather Extended Weekend Rain Forecast

May 31, 2025 -

A Talajnedvesseg Es A Homerseklet Optimalizalasa Az Alfoeldi Noevenytermesztesben

May 31, 2025

A Talajnedvesseg Es A Homerseklet Optimalizalasa Az Alfoeldi Noevenytermesztesben

May 31, 2025