Easing Regulations For Bond Forwards: A Boon For Indian Insurers?

Table of Contents

Increased Investment Opportunities and Enhanced Portfolio Diversification

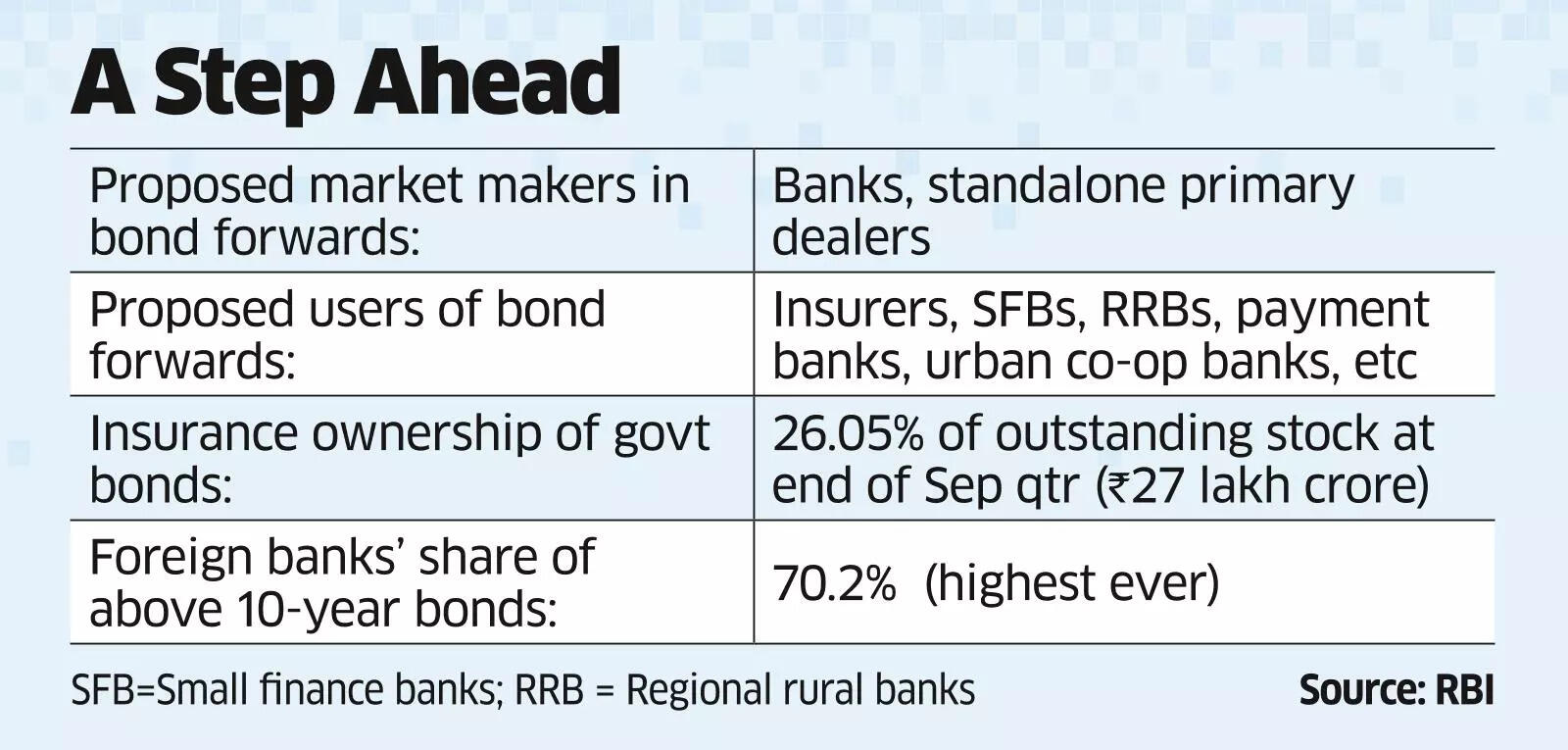

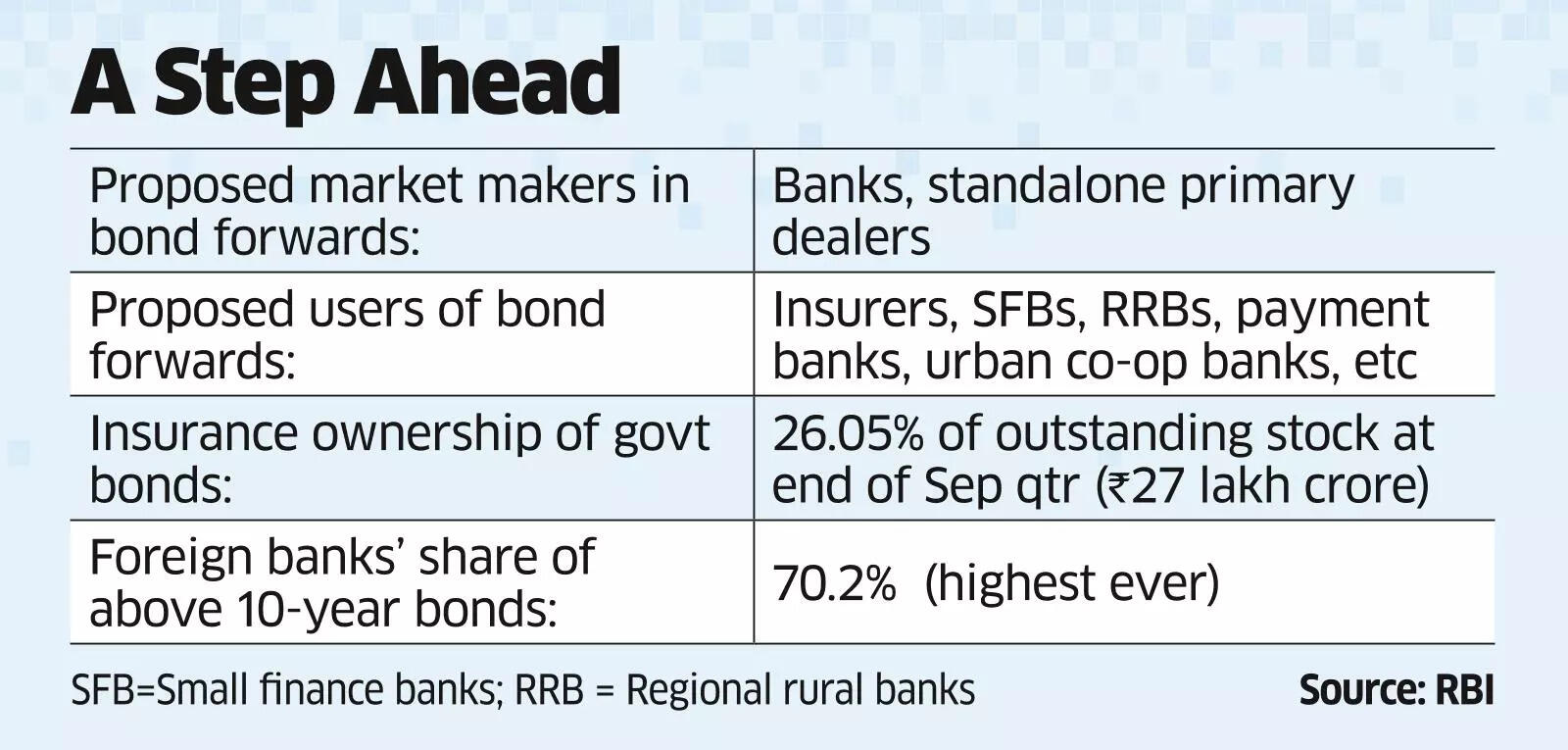

Relaxing regulations surrounding bond forwards will unlock a wealth of new investment avenues for Indian insurers. Currently, limited access to these instruments restricts portfolio diversification and potentially limits returns. Easing these restrictions will allow insurers to participate more actively in the bond market, leading to significant advantages.

- Access to a wider range of fixed-income instruments: Bond forwards offer exposure to a broader spectrum of fixed-income securities beyond those traditionally accessible, allowing for more nuanced portfolio construction.

- Opportunities for hedging interest rate risk more effectively: Insurers can utilize bond forwards to strategically hedge against interest rate fluctuations, mitigating the impact of rising rates on their investment portfolios and liabilities.

- Improved portfolio returns through strategic bond forward trading: Sophisticated trading strategies employing bond forwards can potentially enhance overall portfolio returns by capitalizing on market inefficiencies and exploiting arbitrage opportunities.

- Enhanced ability to manage liability mismatches: Bond forwards can play a crucial role in managing the mismatch between an insurer's assets and liabilities, improving the overall stability of their balance sheet. This is particularly critical given the long-term nature of insurance liabilities.

Improved Risk Management Capabilities

Improved access to the bond forward market significantly bolsters the risk management capabilities of Indian insurers. Currently, limitations on using these instruments restrict their ability to effectively manage various risks, particularly interest rate risk and credit risk.

- Effective hedging of interest rate risk: Bond forwards provide a powerful tool for hedging against interest rate risk, reducing the volatility of investment returns and protecting the insurer's financial position.

- Mitigation of credit risk through strategic use of bond forwards: While not a complete solution, strategic use of bond forwards can help mitigate credit risk by allowing insurers to adjust their exposure to specific issuers or sectors.

- Improved asset-liability management (ALM): By facilitating better matching of assets and liabilities, bond forwards contribute significantly to improved ALM practices, strengthening the insurer's long-term financial stability.

- Enhanced ability to meet regulatory capital requirements: Improved risk management resulting from greater access to bond forwards can lead to more efficient capital allocation, potentially allowing insurers to meet regulatory requirements with less capital.

Boosting Competitiveness in the Global Insurance Market

Easing regulations for bond forwards places Indian insurers on a more level playing field with their global counterparts. Many international insurers routinely utilize bond forwards as a core component of their investment and risk management strategies. This regulatory reform will:

- Attract foreign investment in the Indian insurance sector: Access to sophisticated financial instruments like bond forwards will attract foreign investment, bringing in both capital and expertise.

- Increased participation in global reinsurance markets: Enhanced risk management capabilities through bond forwards will allow Indian reinsurers to compete more effectively in international markets.

- Enhanced ability to offer innovative insurance products: Access to more robust risk management tools facilitates the development and offering of innovative insurance products tailored to specific market needs.

- Improved global competitiveness and market share: Overall, the combination of factors above leads to increased global competitiveness and potential expansion of market share for Indian insurers.

Potential Challenges and Mitigation Strategies

While easing regulations offers significant benefits, it also presents potential challenges. Increased market volatility and the potential for market manipulation are key concerns that must be carefully addressed.

- Need for robust risk management frameworks: Insurers must implement robust internal risk management frameworks to ensure responsible use of bond forwards and prevent excessive risk-taking.

- Importance of regulatory oversight and monitoring: Strong regulatory oversight and ongoing monitoring are crucial to prevent market manipulation and ensure fair market practices.

- Potential for market manipulation and strategies to prevent it: Regulations must be designed to deter market manipulation and ensure transparency and fair trading practices within the bond forward market.

- Investor education and awareness programs: Comprehensive investor education programs are needed to ensure that investors understand the risks and benefits associated with bond forwards.

Conclusion: Easing Regulations for Bond Forwards: Unlocking Growth for Indian Insurers

Easing regulations for bond forwards holds immense potential for the Indian insurance sector. The benefits – increased investment opportunities, enhanced risk management, and improved global competitiveness – are significant. While potential challenges exist, robust risk management frameworks, effective regulatory oversight, and investor education can mitigate these concerns. Further research and open dialogue with policymakers are crucial to ensure the responsible implementation of this vital regulatory reform. The future of the Indian insurance sector may well depend on proactively addressing the opportunities presented by easing regulations for bond forwards and embracing the potential for growth and innovation that it unlocks.

Featured Posts

-

Nyt Strands Hints And Answers For Thursday April 10 Game 403

May 09, 2025

Nyt Strands Hints And Answers For Thursday April 10 Game 403

May 09, 2025 -

Nyt Strands Today April 1 2025 Clues Hints And Solutions

May 09, 2025

Nyt Strands Today April 1 2025 Clues Hints And Solutions

May 09, 2025 -

Revised Disney Profit Forecast Parks And Streaming Remain Key Drivers

May 09, 2025

Revised Disney Profit Forecast Parks And Streaming Remain Key Drivers

May 09, 2025 -

2025 Nhl Trade Deadline Impact On Playoff Races And Predictions

May 09, 2025

2025 Nhl Trade Deadline Impact On Playoff Races And Predictions

May 09, 2025 -

Four New Openings In Anchorage Candle Studio Alaska Airlines Lounge Korean Bbq And Eye Tooth Restaurant

May 09, 2025

Four New Openings In Anchorage Candle Studio Alaska Airlines Lounge Korean Bbq And Eye Tooth Restaurant

May 09, 2025