Economic Fallout: Analyzing The Student Loan Debt Crisis

Table of Contents

The Root Causes of the Mounting Student Loan Debt Crisis

The current student loan debt crisis is a multifaceted problem stemming from a confluence of factors, each contributing to its explosive growth.

Rising Tuition Costs and Inflation

College tuition fees have skyrocketed over the past few decades, far outpacing the rate of inflation. Between 1980 and 2020, tuition costs at public four-year colleges increased by over 1000%, significantly exceeding the inflation rate during the same period. This dramatic increase is attributable to several factors:

- Decreased State Funding: Many states have drastically reduced their funding for public universities, forcing institutions to raise tuition to compensate for lost revenue.

- For-Profit College Practices: Aggressive marketing tactics and questionable educational practices employed by for-profit colleges have contributed significantly to rising student loan debt. These institutions often target vulnerable populations with promises of lucrative careers, frequently resulting in high debt and low employment outcomes.

- Administrative Bloat: Increased administrative costs in universities, sometimes disproportionate to educational investments, also contribute to higher tuition fees.

Limited Financial Aid and Grant Opportunities

The availability of grants and scholarships hasn't kept pace with the surging cost of education, leaving many students with no option but to rely heavily on loans.

- Insufficient Funding: The limited pool of financial aid and grants means many students are forced into taking out larger loans to cover their education costs.

- FAFSA Complexity: The Free Application for Federal Student Aid (FAFSA) process can be complex and daunting, deterring some eligible students from applying. This complexity can also exacerbate the existing disparities in access to financial aid.

- Socioeconomic Disparities: Students from low-income backgrounds often face significant barriers in accessing financial aid, perpetuating cycles of debt.

Aggressive Lending Practices

Lenders have played a role in fueling the crisis through aggressive marketing and, in some cases, predatory lending practices.

- Lack of Financial Literacy: Many students lack the necessary financial literacy to understand the long-term implications of taking out student loans.

- Loan Type Complexity: The complexities of different loan types – subsidized vs. unsubsidized, federal vs. private – often leave students confused and unprepared for the financial burden they are undertaking. Private loans, in particular, can carry high interest rates and less favorable repayment terms.

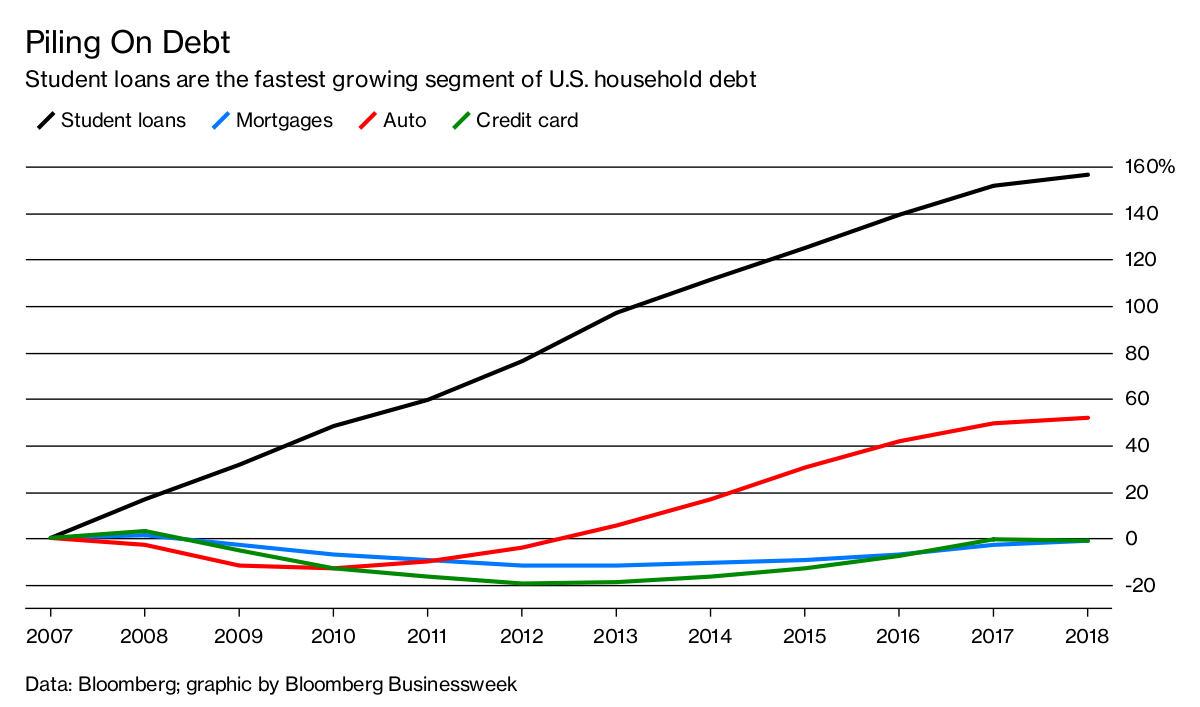

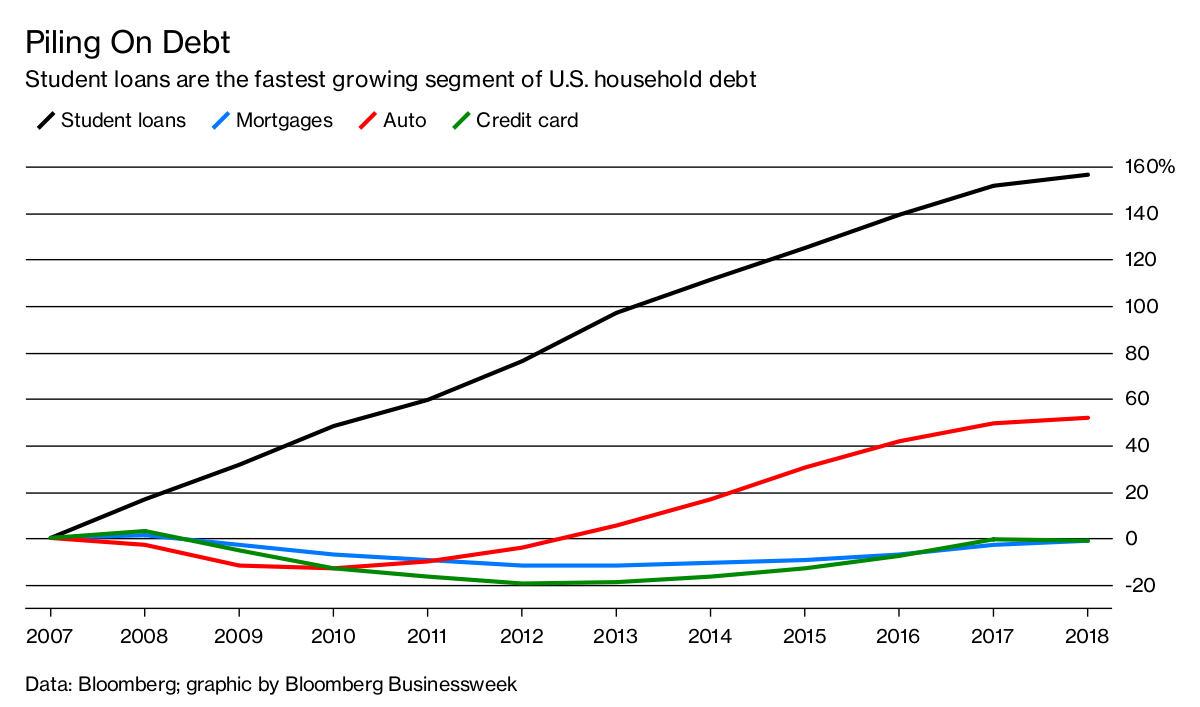

The Economic Consequences of the Student Loan Debt Crisis

The student loan debt crisis casts a long shadow, with far-reaching consequences for individuals and the broader economy.

Impact on Personal Finances

Student loan debt significantly hinders an individual's ability to achieve financial stability.

- Delayed Homeownership: High monthly loan payments make it difficult for borrowers to save for a down payment on a house, delaying or preventing homeownership.

- Retirement Savings Challenges: The burden of student loan repayment often leaves little room for saving for retirement, jeopardizing financial security in later life.

- Family Formation Difficulties: Starting a family can be significantly more challenging for those burdened with significant student loan debt.

- High Default Rates: The high default rate on student loans has devastating consequences, impacting credit scores and limiting future borrowing opportunities.

Ripple Effects on the Broader Economy

The crisis's effects extend beyond individual borrowers, creating ripple effects throughout the economy.

- Reduced Consumer Spending: High student loan payments constrain consumer spending, hindering economic growth.

- Labor Market Impacts: The weight of student loan debt can delay career advancement as borrowers prioritize repayment over pursuing higher education or career changes.

- National Debt Burden: The increasing need for government intervention and loan forgiveness programs adds to the national debt.

The Burden on the Federal Budget

The federal government shoulders a significant financial burden due to student loan programs and defaults. The cost of loan forgiveness programs and the increasing amount of defaulted loans place a considerable strain on the federal budget.

Potential Solutions and Policy Recommendations to Address Student Loan Debt

Addressing this crisis requires a multi-pronged approach focusing on prevention and remediation.

Tuition Reform and Increased Funding for Education

Controlling rising tuition costs and increasing funding for grants and scholarships are crucial.

- Government Intervention: Increased government regulation and accountability for colleges and universities could help control tuition increases.

- Income-Based Tuition: Exploring models like income-based tuition could make higher education more accessible.

- Free College Tuition: Debates surrounding free college tuition highlight the need for innovative funding models and discussions about the role of government in higher education.

Loan Forgiveness Programs and Refinancing Options

Existing loan forgiveness programs require careful evaluation and potential improvements.

- Targeted Forgiveness: Implementing targeted loan forgiveness measures based on income or profession could provide relief to those most in need.

- Streamlined Refinancing: Simplifying loan refinancing processes could help borrowers secure lower interest rates and more manageable repayment plans.

Improved Financial Literacy and Counseling Initiatives

Investing in financial literacy programs is paramount.

- Increased Access to Counseling: Improving access to comprehensive financial counseling services can help students make informed borrowing decisions.

- Transparent Loan Agreements: Requiring clearer and more understandable loan agreements would help prevent borrowers from being misled about loan terms and repayment options.

Conclusion: Addressing the Economic Fallout of the Student Loan Debt Crisis

The student loan debt crisis is a complex issue with profound economic consequences. The root causes – rising tuition costs, limited financial aid, and aggressive lending practices – have created a situation where millions of Americans struggle under the weight of debt. This burden not only impacts personal finances but also ripples through the broader economy, hindering consumer spending and overall growth. Addressing this crisis requires a concerted effort focusing on tuition reform, increased financial aid, improved financial literacy, and responsible lending practices. Understanding the complexities of the student loan debt crisis is crucial for creating effective solutions. Let’s work together to alleviate the economic fallout caused by this pervasive issue and build a more sustainable and equitable future for higher education. We must advocate for policy changes that prioritize affordability and accessibility in higher education, thus reducing the burden of student loan debt and ensuring a stronger economic future for all.

Featured Posts

-

Nba 2 K25 Playoffs Updated Player Ratings Reflect Real World Performance

May 28, 2025

Nba 2 K25 Playoffs Updated Player Ratings Reflect Real World Performance

May 28, 2025 -

Cristiano Ronaldo Nun Al Nassr Daki Gelecegi 2 Yillik Soezlesmenin Detaylari

May 28, 2025

Cristiano Ronaldo Nun Al Nassr Daki Gelecegi 2 Yillik Soezlesmenin Detaylari

May 28, 2025 -

Pandemic Fraud Lab Owners Guilty Plea On False Covid Tests

May 28, 2025

Pandemic Fraud Lab Owners Guilty Plea On False Covid Tests

May 28, 2025 -

Padres Face Rockies At Coors Field A Potential Blowout

May 28, 2025

Padres Face Rockies At Coors Field A Potential Blowout

May 28, 2025 -

Rodrygo To Arsenal Gunners Prepare Offer To Real Madrid

May 28, 2025

Rodrygo To Arsenal Gunners Prepare Offer To Real Madrid

May 28, 2025

Latest Posts

-

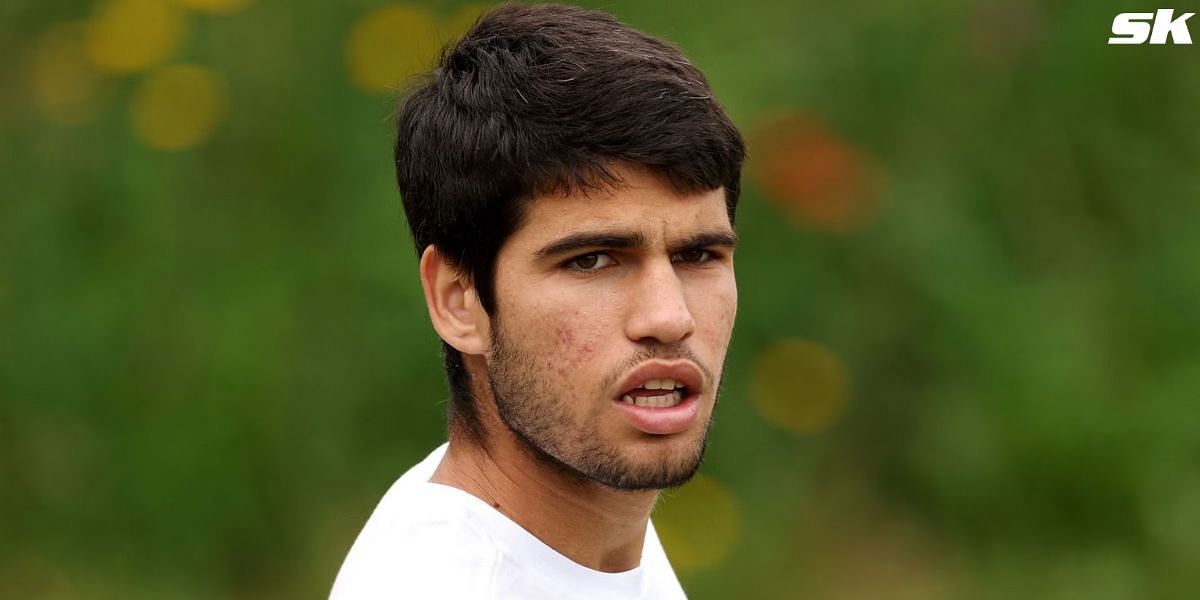

Monte Carlo Alcaraz Secures Championship Win Following Musettis Injury

May 30, 2025

Monte Carlo Alcaraz Secures Championship Win Following Musettis Injury

May 30, 2025 -

Alcarazs Monte Carlo Victory Musetti Forced To Retire

May 30, 2025

Alcarazs Monte Carlo Victory Musetti Forced To Retire

May 30, 2025 -

Monte Carlo Masters Alcaraz Wins As Musetti Withdraws

May 30, 2025

Monte Carlo Masters Alcaraz Wins As Musetti Withdraws

May 30, 2025 -

Rolex Monte Carlo Masters 2025 Alcaraz And Musetti Set For Final Showdown

May 30, 2025

Rolex Monte Carlo Masters 2025 Alcaraz And Musetti Set For Final Showdown

May 30, 2025 -

Alcarazs Monte Carlo Masters Win Overcoming Musettis Injury

May 30, 2025

Alcarazs Monte Carlo Masters Win Overcoming Musettis Injury

May 30, 2025