Economic Slowdown In Japan's First Quarter: A Pre-Tariff Assessment

Table of Contents

Impact of Weakening Domestic Demand

The significant contraction in Japan's Q1 GDP is largely attributable to a weakening in domestic demand. This internal pressure manifested in two key areas: reduced consumer spending and a decline in business investment.

Reduced Consumer Spending

- Decreased Consumer Confidence: Surveys conducted during the final quarter of 2023 revealed a notable dip in consumer confidence, reflecting anxieties about rising prices and the overall economic outlook. This uncertainty directly translated into reduced spending.

- Rising Prices (Inflation): Persistent inflation, although relatively moderate compared to some other economies, eroded purchasing power, forcing consumers to tighten their belts and postpone non-essential purchases.

- Impact of Previous Economic Policies: While intended to stimulate growth, some previous economic policies may have inadvertently dampened consumer confidence or failed to achieve their intended objectives. A reassessment of these policies is warranted.

Data Point: Consumer spending fell by 1.2% (quarter-on-quarter) in Q1 2024, compared to a 0.8% increase in Q4 2023, according to the Cabinet Office's preliminary report. This significant drop highlights the severity of the reduced consumer spending.

Decline in Business Investment

- Reduced Capital Expenditure: Businesses, facing uncertainty regarding both domestic and global economic prospects, significantly curtailed their capital expenditure plans. This hesitancy stemmed from a lack of confidence in future profitability.

- Reasons for Hesitation: Factors contributing to this hesitation include global economic uncertainty, geopolitical instability, and lingering supply chain disruptions.

Data Point: Business investment declined by 2.1% (quarter-on-quarter) in Q1 2024, a sharp contrast to the 1.5% growth observed in the previous quarter. This significant reduction further underscores the weakness of the domestic economy.

The interconnectedness between reduced consumer spending and the decline in business investment created a negative feedback loop, significantly impacting overall economic growth.

The Role of External Factors

Beyond internal pressures, several external factors contributed to Japan's economic slowdown. These included the global economic climate and the volatility of the Japanese Yen.

Global Economic Slowdown

- Supply Chain Disruptions: Ongoing supply chain disruptions, although easing somewhat, continued to impact production and trade, increasing costs and hindering economic activity.

- Inflation in Other Major Economies: High inflation in major global economies dampened global demand, negatively affecting Japanese exports reliant on these markets.

- Reduced Global Demand: Overall weakness in global economic growth reduced demand for Japanese goods and services, putting pressure on export-oriented industries.

Data Point: The IMF's World Economic Outlook (April 2024) projected a slower than anticipated global growth rate, directly impacting Japan's export-dependent economy.

Impact of the Yen's Fluctuation

- Effect on Exports and Imports: Fluctuations in the Yen's value against other major currencies significantly impacted both exports and imports. A strengthening Yen made Japanese exports more expensive in foreign markets, while cheaper imports reduced domestic production.

- Currency Volatility: The Yen's volatility itself created uncertainty in the market, discouraging investment and trade.

Data Point: The Yen appreciated against the US dollar by approximately 5% during the first quarter of 2024, impacting export competitiveness.

Pre-Tariff Considerations and Future Outlook

The economic slowdown in Japan's first quarter presents a complex picture, further complicated by the looming prospect of new tariffs.

Potential Impact of Future Tariffs

- Impact on Various Sectors: Proposed tariffs could significantly affect various sectors, including automotive manufacturing, electronics, and agriculture. Both positive and negative consequences are possible depending on the specific tariffs imposed and retaliatory measures from other nations.

- Exacerbation or Alleviation?: Tariffs could potentially exacerbate the slowdown by raising prices and reducing competitiveness, but in some sectors, they might offer a degree of protection against foreign competition.

Government Policy Responses

- Existing Economic Policies: The Japanese government has implemented various economic stimulus packages in recent years, including monetary easing and fiscal spending. The effectiveness of these measures in addressing the current slowdown needs evaluation.

- Potential Future Responses: Further policy interventions are likely, potentially focusing on measures to boost consumer confidence, support business investment, and address the impact of external factors.

Predictions for the Following Quarters

- Potential Scenarios: Predicting future economic performance is inherently uncertain, yet several scenarios are plausible, ranging from a continued mild contraction to a gradual recovery. The impact of upcoming tariffs will be a crucial determining factor.

- Uncertainty: Geopolitical risks, global economic instability, and the unpredictable nature of consumer behavior all introduce considerable uncertainty into any economic forecast.

Analyzing Japan's Economic Slowdown: Conclusion

The economic slowdown in Japan's first quarter is a multifaceted issue stemming from a combination of weakening domestic demand and unfavorable external factors. This pre-tariff assessment highlights the significance of understanding these underlying causes before the added complexities of potential new tariffs are introduced. Key takeaways include the interconnectedness of reduced consumer spending and business investment, the impact of global economic headwinds, and the role of currency fluctuations. Staying informed about further developments regarding the economic slowdown in Japan and the government's policy responses is crucial. Further analysis, including the impact of the tariffs, will be essential for accurate future economic projections. Continue to follow reputable economic news sources and government reports for updates on this evolving situation.

Featured Posts

-

The Knicks And Landry Shamet A Roster Spot Decision

May 17, 2025

The Knicks And Landry Shamet A Roster Spot Decision

May 17, 2025 -

Simplified Surface Microsofts Product Line Reduction

May 17, 2025

Simplified Surface Microsofts Product Line Reduction

May 17, 2025 -

Knicks Star Requests Reduced Minutes Thibodeaus Response

May 17, 2025

Knicks Star Requests Reduced Minutes Thibodeaus Response

May 17, 2025 -

May 16 Oil Market Report Prices Trends And Forecasts

May 17, 2025

May 16 Oil Market Report Prices Trends And Forecasts

May 17, 2025 -

Reese Joins Wnba Pay Equity Debate Potential Strike On The Horizon

May 17, 2025

Reese Joins Wnba Pay Equity Debate Potential Strike On The Horizon

May 17, 2025

Latest Posts

-

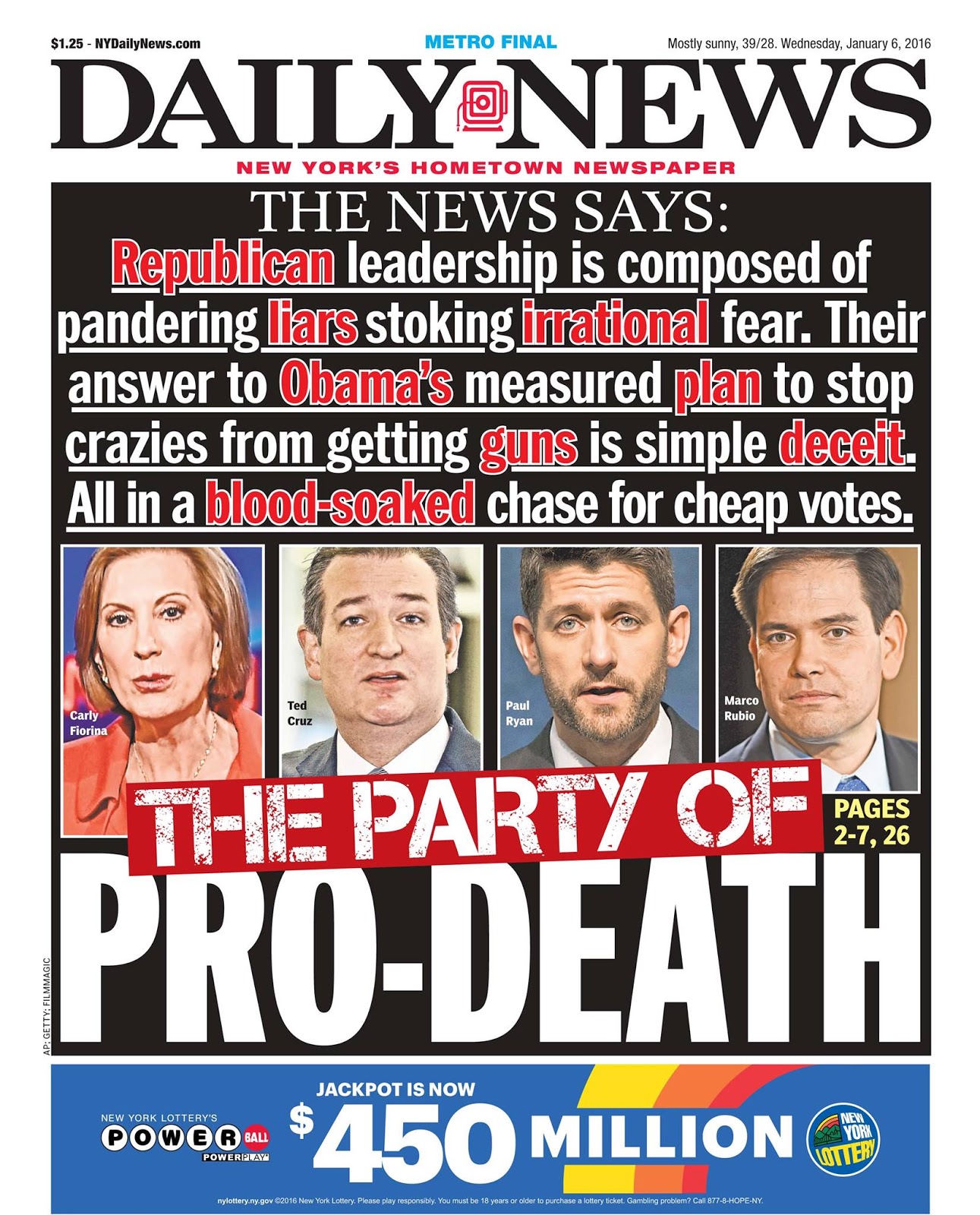

New York Daily News Back Pages May 2025 Archives

May 17, 2025

New York Daily News Back Pages May 2025 Archives

May 17, 2025 -

Knicks Win Over Pistons Nba Referees Admit To Crucial Missed Foul

May 17, 2025

Knicks Win Over Pistons Nba Referees Admit To Crucial Missed Foul

May 17, 2025 -

Nba Officials Acknowledge Missed Call In Knicks Pistons Game

May 17, 2025

Nba Officials Acknowledge Missed Call In Knicks Pistons Game

May 17, 2025 -

Nba Refs Admit Missed Crucial Foul Call In Knicks Win Over Pistons

May 17, 2025

Nba Refs Admit Missed Crucial Foul Call In Knicks Win Over Pistons

May 17, 2025 -

Knicks Brunson Podcast Criticized By Nba Veteran Perkins

May 17, 2025

Knicks Brunson Podcast Criticized By Nba Veteran Perkins

May 17, 2025