Economists Forecast Bank Of Canada Rate Cuts Due To Tariff-Related Job Losses

Table of Contents

The Impact of Tariffs on Canadian Employment

Tariffs, often a tool in international trade disputes, have had a demonstrably negative impact on Canadian employment. The current trade tensions have resulted in a decline in employment across several key sectors of the Canadian economy, creating a ripple effect throughout the nation.

-

Specific Sectors Heavily Impacted: The manufacturing and agricultural sectors have been particularly hard hit. The automotive industry, a significant employer in Ontario and other provinces, has experienced significant slowdowns due to increased import costs resulting from tariffs. Similarly, Canadian farmers, already facing challenges, have seen reduced export opportunities and lower prices for their goods due to retaliatory tariffs imposed by trading partners.

-

Statistics on Job Losses: According to Statistics Canada (cite specific report and data here), employment in the manufacturing sector declined by X% in the last quarter, with Y number of jobs lost. Similarly, the agricultural sector saw a Z% decline, resulting in the loss of A number of jobs. These numbers are alarming and underscore the severity of the situation.

-

Reduced Consumer Spending: The job losses are further exacerbating the economic downturn. Reduced consumer spending, a direct consequence of widespread job losses, creates a vicious cycle, hindering economic growth and further impacting business profitability.

-

Ripple Effect: The impact extends beyond the directly affected sectors. Job losses in manufacturing, for example, affect related industries like transportation and logistics, leading to further job losses and economic contraction.

Case Studies of Tariff-Affected Industries

1. The Automotive Sector: The Canadian automotive industry, a cornerstone of the manufacturing sector, has seen production cuts and plant closures due to increased costs associated with imported parts. This has resulted in thousands of job losses and a significant decrease in economic activity. (Cite specific data and sources here).

2. The Agricultural Sector: Canadian farmers exporting to certain markets have faced significant challenges due to retaliatory tariffs, leading to reduced profits and job losses in related industries such as food processing and distribution. (Cite specific data and sources here).

Bank of Canada's Response and Potential Rate Cuts

The Bank of Canada, responsible for maintaining price stability and full employment, is likely to respond to the economic downturn with interest rate cuts.

-

Bank of Canada's Mandate: The Bank’s dual mandate necessitates a response to the current economic slowdown characterized by high unemployment and potential inflationary pressures.

-

Stimulating Economic Activity: Lower interest rates are a common monetary policy tool to stimulate economic activity. Reduced borrowing costs encourage businesses to invest and expand, leading to job creation and increased consumer spending.

-

Current Inflation Rate and Rate Cuts: While inflation remains relatively low (cite current inflation rate data and source here), the significant job losses and potential for further economic contraction outweigh the inflationary risks, making interest rate cuts a likely response.

-

Previous Responses: The Bank of Canada has a history of implementing rate cuts during periods of economic downturn. (Cite examples of past rate cuts in response to economic downturns).

Analysis of the Bank of Canada's Recent Statements

Recent statements from the Bank of Canada Governor (cite specific statements and press releases here) have hinted at a willingness to adjust monetary policy to address the current economic challenges. While not explicitly committing to rate cuts, the tone suggests that such a measure is under serious consideration given the severity of the job losses linked to tariffs.

Alternative Economic Solutions and Mitigation Strategies

While interest rate cuts are a significant monetary policy response, other economic solutions and mitigation strategies are necessary to effectively address the issue.

-

Government Intervention: The government could implement targeted fiscal policy measures such as job creation programs, retraining initiatives for displaced workers, and investment incentives to stimulate growth in affected sectors.

-

Renegotiating Trade Deals: Negotiating new trade deals or renegotiating existing ones to reduce or eliminate the impact of tariffs is crucial for long-term economic stability.

-

Effectiveness of Previous Interventions: Analyzing the effectiveness of past government interventions in similar situations can inform the development of more effective strategies. (Cite examples of previous government interventions and their outcomes).

-

Long-Term Consequences: Failure to address the issue promptly and effectively could lead to long-term economic consequences, including slower growth, higher unemployment, and reduced international competitiveness.

Conclusion

The significant job losses resulting from tariffs are placing considerable pressure on the Canadian economy. Economists predict that the Bank of Canada will respond with interest rate cuts to stimulate economic activity and mitigate the effects of the downturn. However, interest rate cuts alone are insufficient. The Canadian government must also implement complementary fiscal policies and actively work towards resolving trade disputes to reduce the impact of tariffs on the Canadian job market. Staying informed about the evolving economic situation and the Bank of Canada's monetary policy decisions regarding interest rate cuts is crucial for individuals and businesses alike. Monitor reputable financial news sources for updates on the impact of tariffs on the Canadian economy and the potential for further Bank of Canada interest rate cuts. Understanding these factors is critical for making informed financial decisions in the current challenging economic climate.

Featured Posts

-

Ufc 315 Muhammad Vs Della Maddalena Complete Results And Highlights

May 12, 2025

Ufc 315 Muhammad Vs Della Maddalena Complete Results And Highlights

May 12, 2025 -

Visite Exceptionnelle Sylvester Stallone A L Atelier D Une Artiste

May 12, 2025

Visite Exceptionnelle Sylvester Stallone A L Atelier D Une Artiste

May 12, 2025 -

Farrah Abraham A Case Study Of The Teen Mom Phenomenons Impact

May 12, 2025

Farrah Abraham A Case Study Of The Teen Mom Phenomenons Impact

May 12, 2025 -

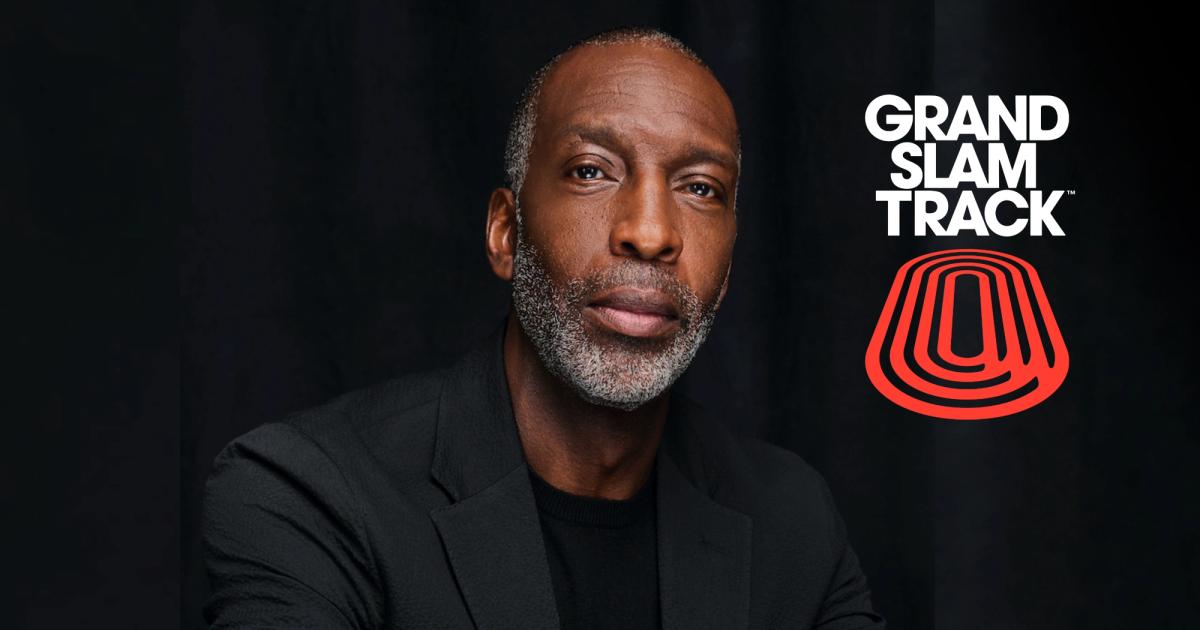

New Athletic Wear Cooyahs Grand Slam Track Collection Debuts

May 12, 2025

New Athletic Wear Cooyahs Grand Slam Track Collection Debuts

May 12, 2025 -

Uruguay Envia Inusual Regalo A China Para Impulsar Exportaciones Ganaderas

May 12, 2025

Uruguay Envia Inusual Regalo A China Para Impulsar Exportaciones Ganaderas

May 12, 2025