Effective Strategies For Utilizing Proxy Statements (Form DEF 14A)

Table of Contents

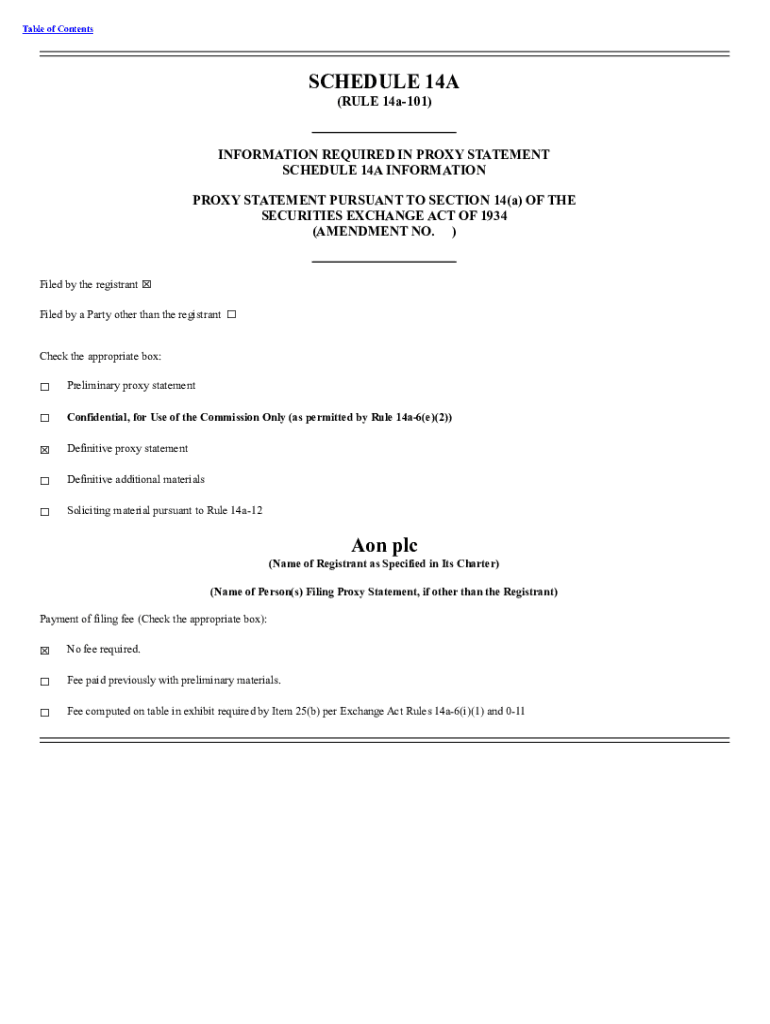

A proxy statement, also known as Form DEF 14A, is a document that companies are required by the Securities and Exchange Commission (SEC) to file before their annual meetings and other significant shareholder votes. It outlines important matters up for vote, providing shareholders with the information they need to make informed decisions on issues such as executive compensation, director elections, and shareholder proposals. Understanding and effectively using proxy statements offers significant benefits, including improved investment decisions, enhanced shareholder engagement, and a better grasp of corporate governance practices. This article will focus on providing you with effective strategies to utilize proxy statements for maximum benefit.

Understanding the Components of a Proxy Statement (Form DEF 14A)

The proxy statement is a multifaceted document offering valuable insights into a company's operations and governance. Carefully dissecting its various sections is crucial for any stakeholder. Let's explore the key components:

-

Executive Compensation: This section details the compensation packages of top executives, including salaries, bonuses, stock options, and other benefits. Analyzing CEO pay relative to company performance and industry peers is crucial for assessing executive accountability and potential conflicts of interest. For investors, this section helps determine whether executive compensation aligns with shareholder value creation. Proxy advisory firms use this data to inform their voting recommendations, while corporate governance experts scrutinize it for potential governance weaknesses.

-

Director Nominations: This section profiles the individuals nominated to serve on the company's board of directors. Investors, proxy advisory firms, and governance experts should carefully examine the nominees' backgrounds, experience, and independence to assess their suitability for overseeing the company.

-

Shareholder Proposals: This section presents resolutions submitted by shareholders. Understanding the proposals and their potential impact on the company is crucial for informed voting. Investors need to evaluate the merits of each proposal against their investment thesis, while activists use this section to gauge support for their own proposals.

-

Mergers and Acquisitions: If a company is involved in a merger or acquisition, the proxy statement will detail the terms of the transaction, including the rationale, valuation, and potential risks. This is critical information for shareholders to decide whether to approve or oppose the transaction.

-

Other Important Information: The proxy statement may also contain other crucial information, such as risk factors, the company's financial performance, and details about upcoming shareholder meetings. Thorough review can help identify potential red flags or critical information that might impact investment decisions or shareholder voting.

Analyzing Proxy Statements for Effective Investment Decisions

Proxy statements are invaluable tools for assessing a company's performance, governance, and overall risk profile. By carefully analyzing the information provided, investors can make more informed decisions.

-

Evaluating Management Performance and Strategies: Examine the proxy statement's narrative and financial data to understand management's strategies, successes, and challenges. Identify key performance indicators (KPIs) discussed to track progress towards stated goals.

-

Assessing Corporate Governance Practices and Risk Factors: A thorough review helps identify potential weaknesses in the company's governance structure. Assess the independence and expertise of the board of directors, paying attention to the presence of independent directors and their committee assignments. Evaluate the company's risk management practices and the adequacy of its disclosures.

-

Identifying Potential Conflicts of Interest: Scrutinize the compensation and related-party transactions sections to uncover potential conflicts of interest among board members and management. Look for any instances where personal interests might outweigh the interests of shareholders.

-

Sustainability and ESG Initiatives: Analyze the company’s sustainability and ESG (environmental, social, and governance) initiatives highlighted in the proxy statement. This information provides insight into the company's long-term vision and commitment to responsible business practices.

Leveraging Proxy Statements for Shareholder Activism

Proxy statements play a central role in shareholder activism, empowering shareholders to engage with company management and advocate for change.

-

Identifying Opportunities for Engagement: Review the proxy statement to identify areas where management’s performance falls short of expectations or where significant improvements could be made. This provides opportunities for dialogue and potential shareholder resolutions.

-

Formulating Effective Shareholder Resolutions: Shareholder activism often involves submitting proposals to be voted on at the annual meeting. The proxy statement provides crucial information to frame effective shareholder resolutions addressing specific concerns.

-

Understanding Rules and Regulations: Familiarize yourself with the SEC regulations governing shareholder proposals to ensure compliance.

-

Coordinating with Other Shareholders: Building alliances with other shareholders can significantly amplify the impact of shareholder activism. The proxy statement can facilitate identifying potential allies based on shared concerns.

Utilizing Technology to Enhance Proxy Statement Analysis

Technology significantly streamlines the process of analyzing proxy statements.

-

Proxy Voting Platforms: These platforms simplify the process of reviewing and voting on proposals, saving time and increasing efficiency.

-

Data Analytics and AI: Data analytics and AI-powered tools can be used to identify trends and patterns in corporate governance practices across various companies. This enables comparative analysis and identification of best practices or potential red flags.

-

Online Databases of SEC Filings: Accessing online databases provides easy access to a vast amount of SEC filings, enabling comparative analysis across multiple companies and over time.

Mastering Proxy Statements for Informed Decisions

Effectively utilizing proxy statements (Form DEF 14A) is crucial for making informed investment decisions and engaging in meaningful shareholder activism. By understanding the components of a proxy statement, analyzing it for key performance indicators and potential risks, and leveraging technology to enhance the analysis process, you can significantly improve your understanding of corporate governance and contribute to positive change. By mastering the effective use of proxy statements, you can become a more informed and engaged investor. Start analyzing your next Form DEF 14A today!

Featured Posts

-

Delinquent Student Loans The Governments Aggressive Pursuit And Your Rights

May 17, 2025

Delinquent Student Loans The Governments Aggressive Pursuit And Your Rights

May 17, 2025 -

La Lakers News Highlights And Analysis From Vavel United States

May 17, 2025

La Lakers News Highlights And Analysis From Vavel United States

May 17, 2025 -

The 10 Most Memorable Sherlock Holmes Quotes

May 17, 2025

The 10 Most Memorable Sherlock Holmes Quotes

May 17, 2025 -

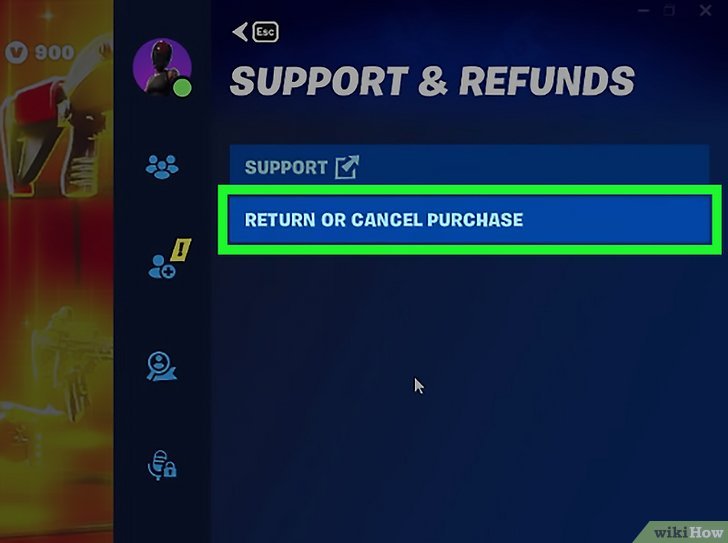

Recent Fortnite Refunds Indicate Shift In Cosmetic Policy

May 17, 2025

Recent Fortnite Refunds Indicate Shift In Cosmetic Policy

May 17, 2025 -

Celebrity Misbehavior Analyzing Red Carpet Rule Violations

May 17, 2025

Celebrity Misbehavior Analyzing Red Carpet Rule Violations

May 17, 2025