Effective Succession Planning For Multi-Generational Wealth

Table of Contents

Understanding Your Family's Wealth and Goals

Before embarking on the creation of a robust succession plan, it's vital to fully comprehend the scope of your family's assets and the aspirations you hold for future generations. This requires a thorough assessment of your current financial standing and a clear articulation of your family's values and long-term objectives.

Assessing Your Assets

A comprehensive inventory of all your assets is the cornerstone of effective wealth transfer planning. This includes a detailed list of everything your family owns, allowing for a realistic appraisal of your net worth and a better understanding of what needs to be preserved and distributed. This process should be meticulous and include:

- Real Estate: Residential properties, commercial buildings, land holdings. Consider their current market value, potential appreciation, and associated tax implications.

- Investments: Stocks, bonds, mutual funds, ETFs, private equity, and other investment vehicles. Analyze their performance, risk profiles, and potential future returns.

- Private Businesses: Family-owned businesses represent a significant portion of wealth for many families. Their valuation and future sustainability are crucial considerations in succession planning.

- Intellectual Property: Patents, trademarks, copyrights, and other intellectual assets need to be accounted for and protected.

- Art Collections: Valuable art pieces, antiques, and collectibles require specialized appraisal and insurance considerations.

- Other Assets: This might include bank accounts, retirement accounts, life insurance policies, and other financial instruments.

Defining Family Values and Goals

Your family's values and long-term goals should be the guiding principles of your succession plan. These values will shape how you manage and distribute your wealth, ensuring that your legacy aligns with your family's core beliefs. Consider:

- Philanthropic Goals: Do you wish to establish a family foundation or support specific charities?

- Business Continuity: If you own a business, how will you ensure its continued success and transfer of ownership?

- Preserving Family Unity: How can you mitigate potential conflicts among family members regarding wealth distribution?

- Educational Support for Future Generations: Will you establish educational funds for your children and grandchildren?

Identifying and Engaging Key Stakeholders

Open communication and the active involvement of all relevant family members are crucial for a successful succession plan. This process is not solely the responsibility of one individual; it requires the collective input and understanding of everyone who will be affected. Effective engagement strategies include:

- Family Meetings: Regular meetings provide a platform for open dialogue and the collaborative creation of the plan.

- Individual Discussions: Private conversations allow for addressing individual concerns and perspectives.

- Professional Advisors’ Input: Solicit the expertise of legal, financial, and tax professionals to guide the process.

Developing a Comprehensive Succession Plan

With a clear understanding of your family's wealth and goals, you can start developing a comprehensive succession plan. This requires careful consideration of legal, tax, and financial implications to ensure the long-term preservation and responsible distribution of your assets.

Legal and Tax Considerations

Wealth transfer comes with significant legal and tax implications. Understanding these complexities is critical to minimize tax liabilities and avoid potential legal disputes. Essential aspects to consider include:

- Estate Taxes: Understanding estate tax laws is essential to minimize the tax burden on your heirs.

- Gift Taxes: Gifting assets during your lifetime can reduce estate taxes, but it's essential to adhere to gift tax regulations.

- Inheritance Laws: Familiarity with inheritance laws in your jurisdiction is crucial for ensuring the legal and equitable distribution of your assets.

- Trusts: Establishing trusts (living trusts, irrevocable trusts) can provide significant tax advantages and protect assets for future generations.

- Wills: A well-drafted will ensures your wishes regarding the distribution of your assets are legally binding.

- Power of Attorney: Designating power of attorney ensures your financial and legal affairs are managed effectively in case of incapacitation.

Investment and Asset Management Strategies

Preserving and growing your family's wealth across generations necessitates a strategic approach to investment and asset management. This requires professional guidance to ensure a diversified portfolio that balances risk and return. Key strategies include:

- Diversification of Assets: Spreading investments across different asset classes minimizes risk and maximizes returns.

- Risk Tolerance Assessment: Understanding your family's risk tolerance informs investment decisions suitable for each generation.

- Professional Financial Advisors: Engaging experienced financial advisors is crucial for creating and managing a tailored investment portfolio.

- Investment Portfolios Tailored to Different Generations: Younger generations may tolerate higher risk, while older generations may prefer more conservative investments.

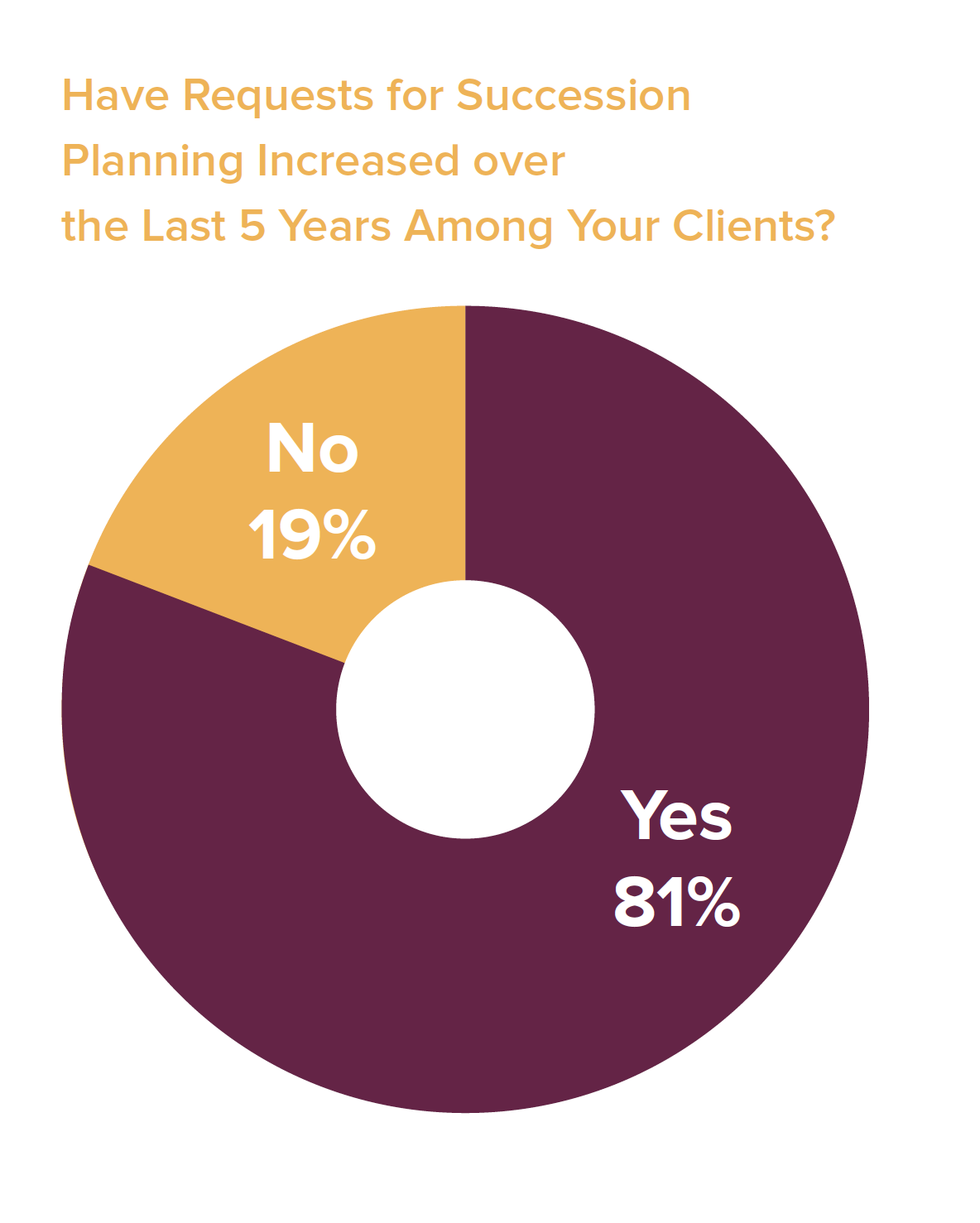

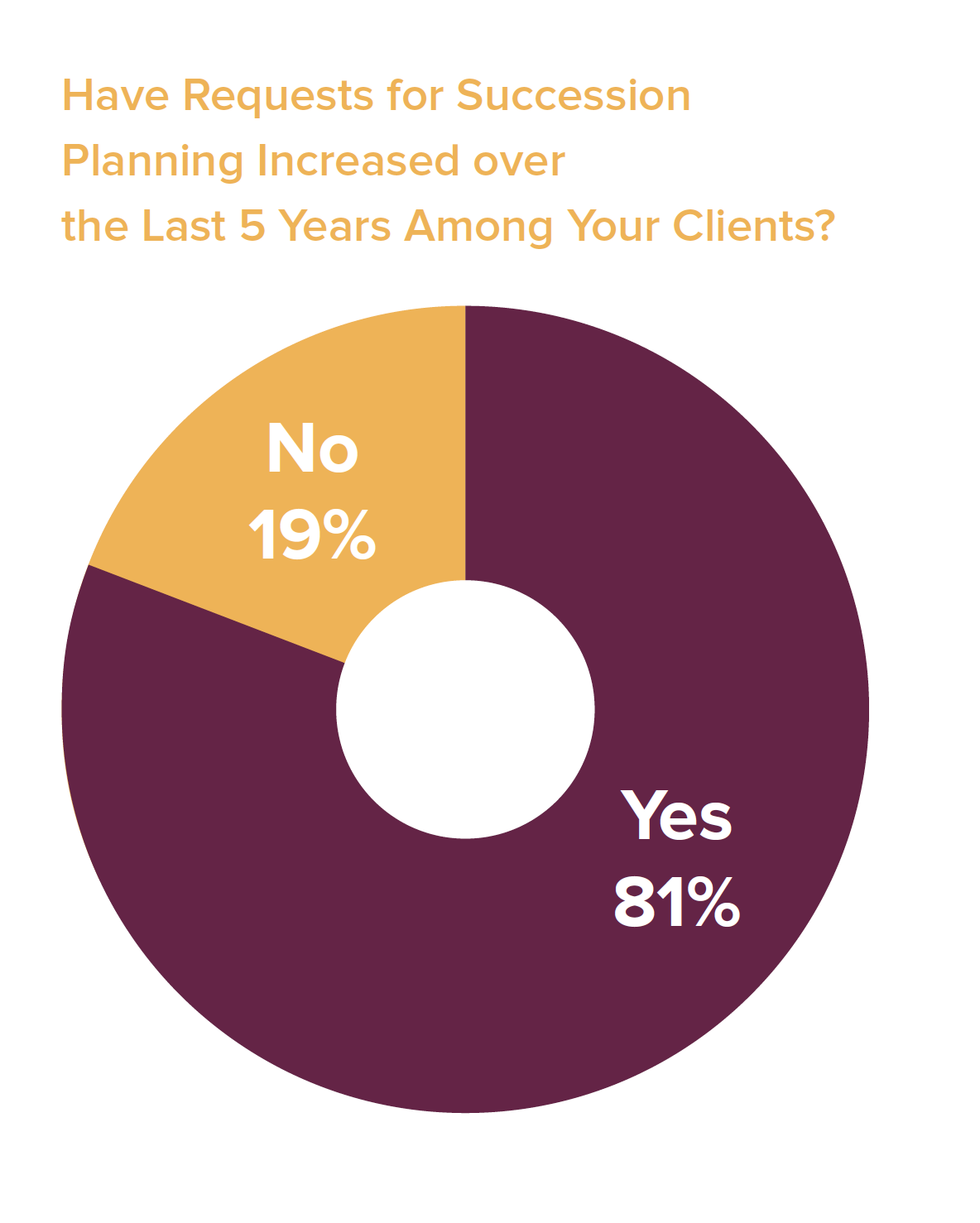

Business Succession Planning (if applicable)

For families owning businesses, a clear succession plan is crucial for ensuring business continuity and transferring ownership smoothly. Key considerations include:

- Succession Plans for Family Businesses: Developing a structured plan for transitioning ownership and management to future generations.

- Buy-Sell Agreements: These legally binding agreements govern the transfer of ownership within the family.

- Management Training Programs: Providing training and mentorship to prepare the next generation for leadership roles.

- Mentoring: Guiding the next generation in the nuances of running the family business.

Implementing and Monitoring Your Plan

Once your succession plan is developed, its implementation and ongoing monitoring are paramount. This ensures the plan adapts to changing circumstances and remains effective in achieving your family's long-term objectives.

Regular Review and Updates

A static plan is ineffective. Regular reviews are critical to accommodate changes in family dynamics, economic conditions, and legal frameworks.

- Annual Reviews: Conducting annual reviews allows for timely adjustments to the plan.

- Adjustments for Life Events: Major life events, such as marriages, births, deaths, and divorces, necessitate plan updates.

- Changes in Tax Laws: Staying abreast of changes in tax legislation is vital for optimizing tax efficiency.

- Economic Shifts: Economic fluctuations require adjustments to investment strategies and risk management.

Communication and Transparency

Open and honest communication throughout the process is essential for maintaining family unity and preventing potential conflicts.

- Family Meetings: Regular family meetings foster dialogue and transparency.

- Newsletters: Periodic newsletters can keep family members informed about the plan's progress.

- Regular Updates from Advisors: Providing regular updates from professional advisors ensures everyone is informed.

- Conflict Resolution Mechanisms: Establishing mechanisms for resolving potential disputes is crucial.

Professional Advice

Seeking advice from experienced professionals is paramount throughout the succession planning process.

- Estate Planning Attorneys: Ensure legal compliance and optimize tax efficiency.

- Financial Advisors: Develop and manage investment portfolios aligned with your family's goals.

- Tax Accountants: Minimize tax liabilities and ensure compliance with tax regulations.

- Family Therapists (for conflict resolution): Facilitate communication and address potential family conflicts.

Conclusion

Effective succession planning for multi-generational wealth is not a one-time event but an ongoing process that requires proactive planning, open communication, and professional guidance. By comprehensively assessing your assets, defining your family's values and goals, and developing a well-structured plan that considers all legal, tax, and financial implications, you can ensure the long-term preservation of your family's wealth and legacy. A robust plan fosters family unity, protects assets, and provides financial security for future generations. Don't leave your family's future to chance. Contact us today to discuss effective multi-generational wealth succession planning and secure your family's legacy.

Featured Posts

-

Fastest Ever Man Completes Trans Australia Foot Race

May 22, 2025

Fastest Ever Man Completes Trans Australia Foot Race

May 22, 2025 -

Selena Gomezs Wake Up Call To Taylor Swift The Blake Lively Claim

May 22, 2025

Selena Gomezs Wake Up Call To Taylor Swift The Blake Lively Claim

May 22, 2025 -

The Untold Story Vybz Kartel On Prison Family And His Musical Future

May 22, 2025

The Untold Story Vybz Kartel On Prison Family And His Musical Future

May 22, 2025 -

Bp Ceos Plan Double Valuation Remain On London Stock Exchange

May 22, 2025

Bp Ceos Plan Double Valuation Remain On London Stock Exchange

May 22, 2025 -

Vidmova Ukrayini U Vstupi Do Nato Naslidki Dlya Bezpeki Ukrayini Ta Yevropi

May 22, 2025

Vidmova Ukrayini U Vstupi Do Nato Naslidki Dlya Bezpeki Ukrayini Ta Yevropi

May 22, 2025

Latest Posts

-

Did Taylor Swifts Legal Troubles Damage Her Bond With Blake Lively

May 22, 2025

Did Taylor Swifts Legal Troubles Damage Her Bond With Blake Lively

May 22, 2025 -

The Strain On Taylor Swift And Blake Livelys Friendship A Legal Battles Aftermath

May 22, 2025

The Strain On Taylor Swift And Blake Livelys Friendship A Legal Battles Aftermath

May 22, 2025 -

Blake Lively Justin Baldoni And Taylor Swift An Exclusive Report On The Ongoing Legal Dispute

May 22, 2025

Blake Lively Justin Baldoni And Taylor Swift An Exclusive Report On The Ongoing Legal Dispute

May 22, 2025 -

Taylor Swift And Blake Lively A Friendship On The Rocks Due To Legal Issues

May 22, 2025

Taylor Swift And Blake Lively A Friendship On The Rocks Due To Legal Issues

May 22, 2025 -

Exclusive How Taylor Swift Is Navigating The Blake Lively And Justin Baldoni Legal Battle

May 22, 2025

Exclusive How Taylor Swift Is Navigating The Blake Lively And Justin Baldoni Legal Battle

May 22, 2025