Elon Musk, Jeff Bezos, Mark Zuckerberg: Billions Lost Since January 20, 2017

Table of Contents

Elon Musk's Net Worth Fluctuations

Elon Musk, the visionary behind Tesla and SpaceX, has seen his net worth experience some of the most dramatic swings among the three. His wealth is heavily tied to Tesla's stock performance, making him acutely sensitive to market volatility.

Tesla Stock Performance and its Impact

Tesla's stock price has been a major determinant of Musk's net worth since January 20, 2017.

- 2017-2019: Steady growth in Tesla's stock propelled Musk's net worth significantly higher. However, periods of production challenges and market uncertainty led to temporary dips.

- 2020-2021: A meteoric rise in Tesla's stock price saw Musk's net worth skyrocket, briefly making him the world's richest person. This was fueled by increased demand for electric vehicles and successful production ramp-ups.

- 2022-Present: A significant correction in Tesla's stock price, partly driven by macroeconomic factors and Musk's controversial tweets, has led to a substantial decrease in his net worth. Specific examples include the impact of his Twitter acquisition.

Reliable sources like Bloomberg and Forbes provide detailed historical data on Tesla's stock performance and its direct correlation to Musk's fluctuating wealth. These sources showcase the considerable risk associated with wealth heavily reliant on a single company's stock.

SpaceX and Other Ventures

While Tesla is the primary driver of Musk's wealth, SpaceX and other ventures also contribute.

- SpaceX Successes: SpaceX's contracts with NASA and private companies have generated significant revenue and contributed positively to Musk's overall net worth.

- The Boring Company and Neuralink: While these ventures are still in their early stages, their potential success could significantly impact Musk's future wealth. However, their current contribution remains relatively minor compared to Tesla.

- Investment Portfolio: Musk's diverse investment portfolio, though less publicized, adds another layer of complexity to the analysis of his total net worth.

Jeff Bezos's Net Worth Shift

Jeff Bezos, the founder of Amazon, has also experienced considerable fluctuations in his net worth since January 20, 2017. However, his wealth is less directly tied to the daily volatility of a single stock compared to Musk.

Amazon's Stock Performance and Diversification

Amazon's stock performance has been a cornerstone of Bezos's wealth.

- Consistent Growth (with fluctuations): Amazon's continued growth across various sectors (e-commerce, cloud computing, advertising) has largely contributed to a positive trajectory for Bezos's net worth despite market downturns.

- AWS Dominance: Amazon Web Services (AWS) has proven to be a remarkably profitable and stable segment, providing a buffer against fluctuations in other areas of the business.

- Diversification Benefits: Bezos's investments in Blue Origin, The Washington Post, and other ventures have provided diversification, mitigating some of the risk associated with relying solely on Amazon's stock performance.

Divorce and Philanthropy

Significant life events have also impacted Bezos's net worth.

- Divorce Settlement: Bezos's high-profile divorce resulted in a substantial transfer of wealth, reducing his net worth considerably.

- Philanthropic Endeavors: Bezos's increasing philanthropic activities, through the Bezos Earth Fund and other initiatives, represent significant charitable donations, further affecting his overall net worth.

Mark Zuckerberg's Financial Trajectory

Mark Zuckerberg, the CEO of Meta (formerly Facebook), has seen his wealth undergo a significant transformation since January 20, 2017.

Facebook (Meta) Stock and the Metaverse

Meta's stock performance has been a major factor in Zuckerberg's financial picture.

- Initial Growth and Subsequent Decline: While Meta's stock enjoyed substantial growth initially, recent years have seen a decline, largely attributed to increased competition, privacy concerns, and the significant investment in the metaverse.

- Metaverse Investment: The ambitious metaverse project, while potentially transformative in the long term, has faced criticism and skepticism, impacting investor confidence and the company's stock price.

- Advertising Revenue Fluctuations: Changes in the digital advertising landscape, including increased regulatory scrutiny, have affected Meta's revenue streams and consequently its stock value.

Regulatory Scrutiny and Public Perception

Public and regulatory scrutiny has played a considerable role in shaping Meta's, and consequently Zuckerberg's, financial trajectory.

- Antitrust Investigations: Facing antitrust investigations in various jurisdictions, Meta has experienced legal and financial challenges, impacting investor sentiment.

- Data Privacy Concerns: Concerns regarding data privacy and user data handling have led to regulatory actions and negative public perception, impacting the company's value and, therefore, Zuckerberg's net worth.

- Content Moderation Challenges: Balancing free speech with the need for content moderation has proven to be a significant challenge, leading to criticism and impacting public perception of the company.

Conclusion: Understanding Billionaire Wealth Volatility – The Case of Musk, Bezos, and Zuckerberg

The case studies of Elon Musk, Jeff Bezos, and Mark Zuckerberg highlight the extreme volatility of billionaire wealth, particularly in the tech industry. Their net worth fluctuations since January 20, 2017, demonstrate the complex interplay of market forces, company performance, personal decisions, and regulatory environments. While significant losses have been experienced, the overall trajectories of these individuals' wealth showcase the resilience and adaptability needed to navigate the unpredictable landscape of high-stakes business. Learn more about the fluctuating fortunes of Elon Musk, Jeff Bezos, and Mark Zuckerberg and stay updated on the ever-changing landscape of billionaire net worths.

Featured Posts

-

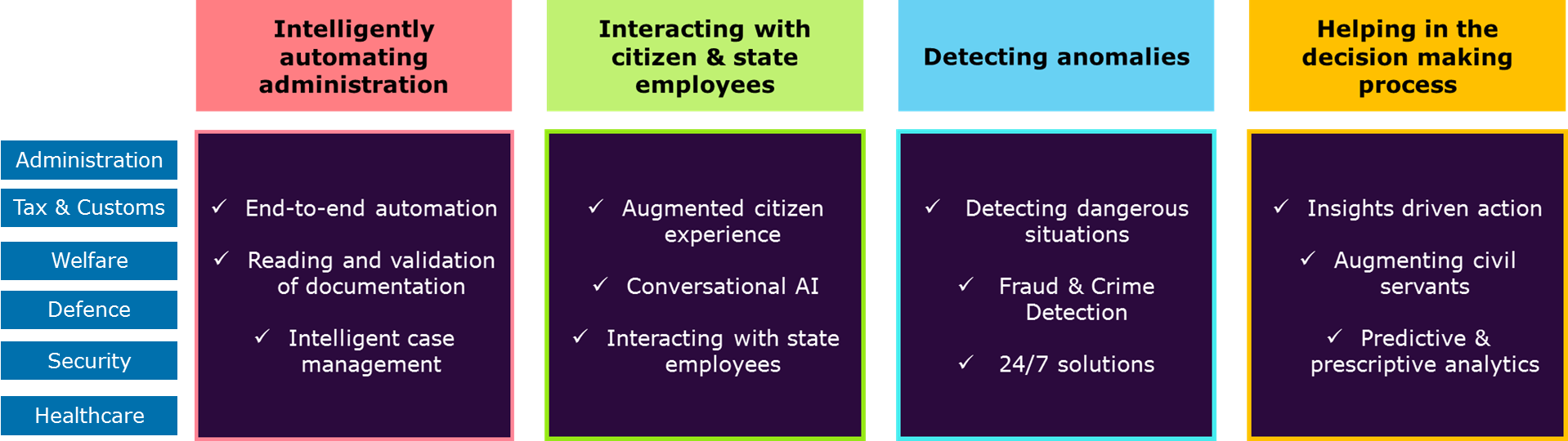

Public Sector Ai Revolution Understanding Palantirs Nato Deal

May 10, 2025

Public Sector Ai Revolution Understanding Palantirs Nato Deal

May 10, 2025 -

5 Tips For Securing A Private Credit Job In Todays Market

May 10, 2025

5 Tips For Securing A Private Credit Job In Todays Market

May 10, 2025 -

Military Strength On Display Putins Victory Day Parade In Moscow

May 10, 2025

Military Strength On Display Putins Victory Day Parade In Moscow

May 10, 2025 -

Vegas Claims Playoff Berth After Narrow Loss To Oilers 3 2

May 10, 2025

Vegas Claims Playoff Berth After Narrow Loss To Oilers 3 2

May 10, 2025 -

Family Demands Justice Following Racist Murder Of Loved One

May 10, 2025

Family Demands Justice Following Racist Murder Of Loved One

May 10, 2025