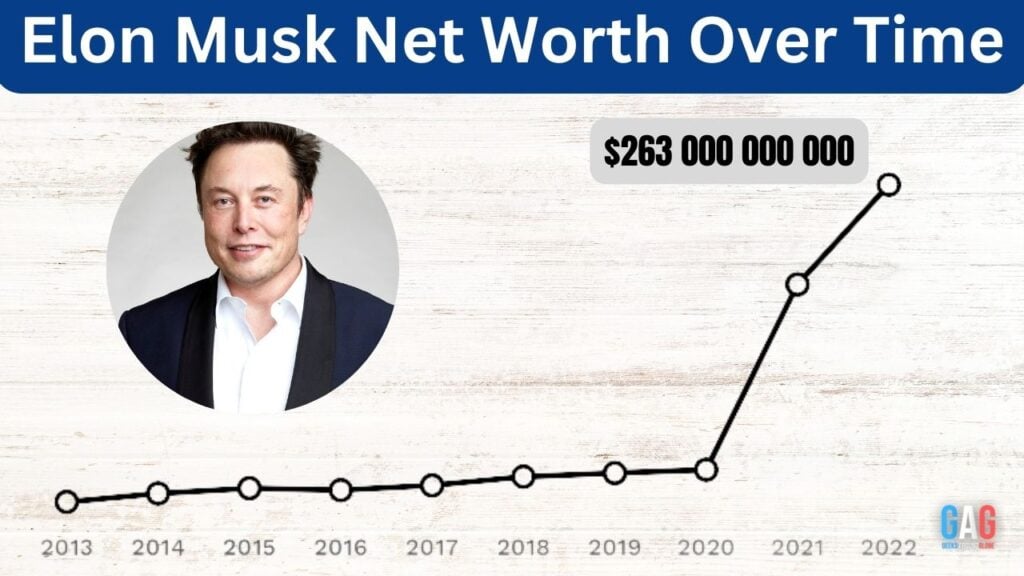

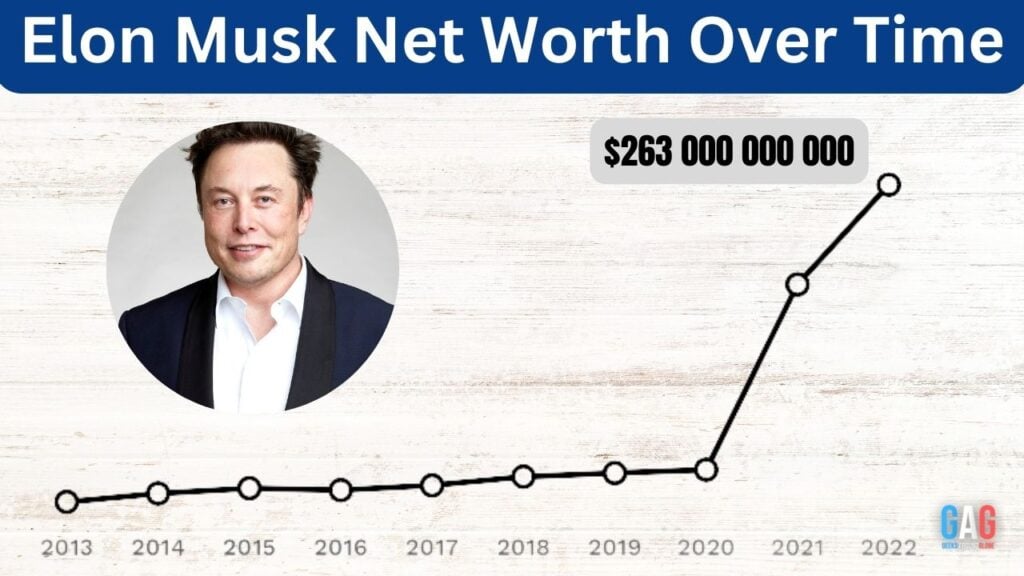

Elon Musk Net Worth Dips Below $300 Billion: Impact Of Tesla Stock And Market Conditions

Table of Contents

Tesla Stock Performance: A Major Factor in Elon Musk's Net Worth

Tesla's stock price is inextricably linked to Elon Musk's net worth. Any substantial change in Tesla's valuation directly translates into a corresponding change in his overall wealth. Recent market headwinds have significantly impacted Tesla's share price, resulting in a considerable decrease in Musk's net worth.

-

Market Volatility and Tesla Stock: The unpredictable nature of the stock market plays a pivotal role. Periods of uncertainty and economic downturn frequently trigger investors to sell off shares, including those of high-growth companies like Tesla. This "risk-off" sentiment directly impacts Tesla's stock price and, consequently, Musk's net worth.

-

Intense Competition in the EV Market: The burgeoning electric vehicle (EV) market is becoming increasingly competitive. New entrants and established automakers are aggressively launching their own EVs, challenging Tesla's dominance and putting pressure on its market share and profitability. This competitive landscape impacts investor confidence and, subsequently, Tesla's stock valuation.

-

Elon Musk's Public Image and Social Media Influence: Musk's frequent and often controversial pronouncements on social media can significantly impact investor sentiment. Negative news or unpredictable statements can trigger immediate sell-offs, leading to a rapid decline in Tesla's stock price and Musk's net worth. Managing his public persona effectively is crucial for maintaining investor confidence.

-

Production Bottlenecks and Supply Chain Disruptions: Difficulties in meeting production targets and navigating persistent global supply chain disruptions can also negatively affect Tesla's performance and, subsequently, its stock price. These operational challenges can erode investor confidence and contribute to a decline in Tesla's valuation.

Broader Market Conditions and Economic Factors Affecting Elon Musk's Wealth

The decrease in Elon Musk's net worth isn't solely attributable to Tesla's performance; broader economic factors play a significant role.

-

Interest Rate Hikes and Their Impact: Rising interest rates globally impact investor sentiment and risk appetite. Higher rates make borrowing more expensive, potentially slowing economic growth and reducing demand for riskier assets like Tesla stock. This dampens investor enthusiasm for growth stocks, impacting Tesla's valuation.

-

Inflationary Pressures and Recessionary Fears: Concerns about persistent inflation and the potential for a global recession often prompt investors to seek safer investments. This flight to safety leads to a sell-off of growth stocks, including Tesla, further impacting Musk's net worth.

-

Geopolitical Instability and Market Uncertainty: Global geopolitical events and uncertainties, such as the ongoing conflict in Ukraine, can create market instability and affect investor confidence worldwide. These uncertainties contribute to market volatility and influence investment decisions, affecting Tesla's stock performance.

The Impact on Musk's Business Ventures and Future Strategies

The dip in Elon Musk's net worth doesn't automatically translate to immediate problems for his businesses. However, it could influence his future investment strategies and overall business decisions.

-

Funding for SpaceX and Other Ambitious Projects: Musk's personal wealth is vital for funding his ambitious projects, particularly SpaceX's expansion into space exploration. A reduced net worth might necessitate adjustments in his investment approach and funding strategies for these ventures.

-

Increased Reliance on Debt Financing: A lower net worth could necessitate an increased reliance on debt financing for future projects, potentially increasing financial risk for his companies. This shift in funding mechanisms could affect his strategic decision-making.

-

Indirect Impact on Investor Confidence in Musk's Vision: While not directly impacting the operational performance of his companies, a drop in net worth could subtly affect investor confidence in his overall vision and strategic direction. Maintaining investor confidence remains crucial for the success of his ventures.

Conclusion:

The recent decline in Elon Musk's net worth below $300 billion is a multifaceted issue resulting from a confluence of factors including Tesla's stock performance and broader macroeconomic conditions. Fluctuations in Tesla's share price, heightened competition in the EV sector, macroeconomic anxieties, and global geopolitical uncertainties all contributed to this decline. While this drop doesn't necessarily signal imminent trouble for his companies, it highlights the volatility inherent in extreme wealth tied to market performance. To stay informed about the future trajectory of Elon Musk's net worth and its relationship to Tesla stock, continue monitoring market trends and his business activities. Understanding the dynamics of Elon Musk's net worth and its connection to Tesla stock is crucial for comprehending the complexities of the modern financial landscape.

Featured Posts

-

Accident Mortel A Dijon Chute D Un Ouvrier Du 4e Etage

May 09, 2025

Accident Mortel A Dijon Chute D Un Ouvrier Du 4e Etage

May 09, 2025 -

Harry Styles Snl Impression His Honest Reaction

May 09, 2025

Harry Styles Snl Impression His Honest Reaction

May 09, 2025 -

Aeroport Permi Otmena I Zaderzhka Reysov Iz Za Snegopada

May 09, 2025

Aeroport Permi Otmena I Zaderzhka Reysov Iz Za Snegopada

May 09, 2025 -

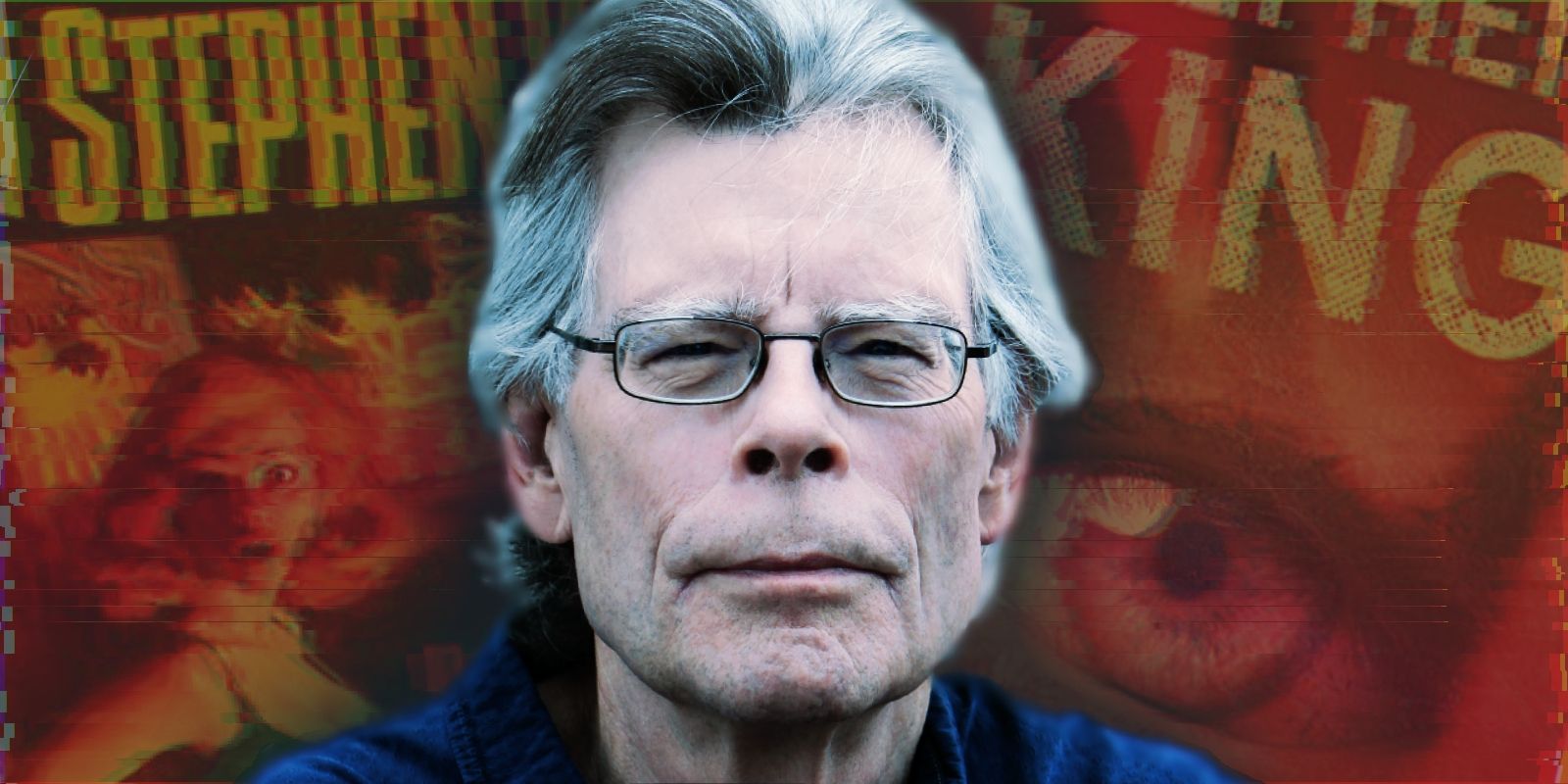

Stephen Kings 2024 Movie Lineup The Monkey And Whats Next

May 09, 2025

Stephen Kings 2024 Movie Lineup The Monkey And Whats Next

May 09, 2025 -

Dwry Abtal Awrwba Barys San Jyrman Ela Aetab Altarykh

May 09, 2025

Dwry Abtal Awrwba Barys San Jyrman Ela Aetab Altarykh

May 09, 2025