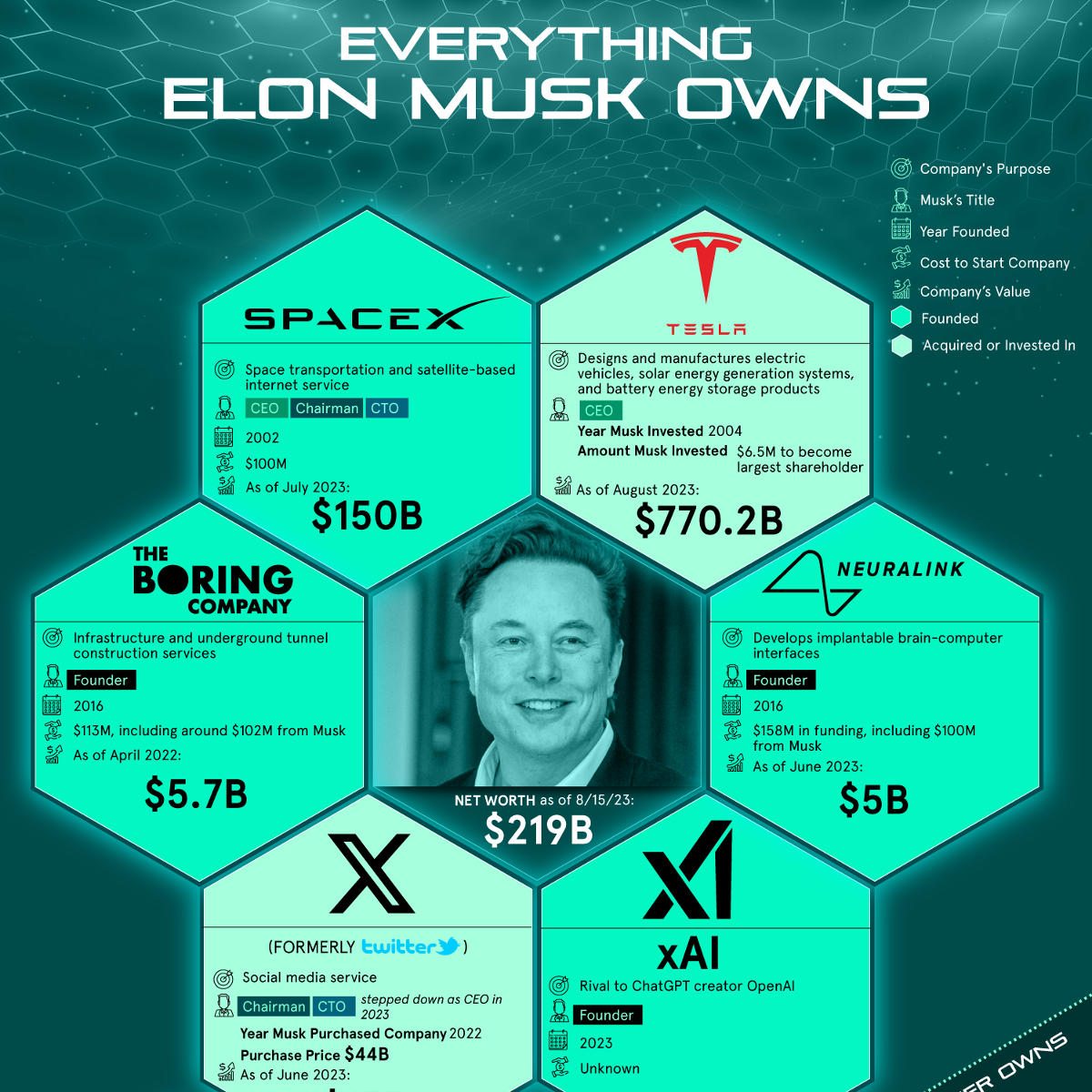

Elon Musk's Net Worth Dips: Analysis Of Tesla's Challenges And Market Impact

Table of Contents

Tesla's Production and Delivery Challenges

Tesla's recent struggles are significantly tied to its production capabilities and delivery timelines. Several factors have conspired to create a perfect storm impacting the company's output and, consequently, its stock price.

Production Bottlenecks

- Supply Chain Disruptions: The global supply chain continues to be a major hurdle. Shortages of crucial components, from semiconductor chips to raw materials, have repeatedly hampered Tesla's production lines, leading to delays and increased manufacturing costs.

- Factory Production Issues: While Tesla boasts impressive Gigafactories, achieving optimal efficiency hasn't always been seamless. Reports of production line bottlenecks and logistical challenges within the factories themselves have contributed to lower-than-expected output.

- Impact on Delivery Timelines: The combined effect of these production challenges has resulted in extended delivery timelines for new Tesla vehicles, potentially impacting customer satisfaction and sales figures. This delay directly impacts revenue projections and investor confidence. Increased wait times for deliveries further affect the perception of Tesla's market dominance. Keywords: Tesla production, supply chain disruptions, manufacturing bottlenecks, delivery delays, vehicle production, Gigafactory.

Increased Competition

The EV market is no longer Tesla's exclusive domain. Established automakers like Ford and General Motors, along with ambitious startups like Rivian, are aggressively entering the space, posing a significant threat to Tesla's market share.

- Aggressive Market Strategies: Competitors are launching a wider array of competitive EV models, often at more accessible price points. They are also investing heavily in marketing and expanding their charging infrastructure, directly challenging Tesla's perceived advantages.

- Impact on Tesla's Sales: The intensified competition is putting downward pressure on Tesla's sales figures and market dominance, directly impacting its overall valuation and consequently, Elon Musk’s net worth. The automotive industry is becoming increasingly crowded, forcing Tesla to adapt its strategies to maintain its competitive edge. Keywords: Electric vehicle competition, EV market share, Tesla competitors, market rivalry, automotive industry, Ford, GM, Rivian.

Market Sentiment and Investor Confidence

The dip in Elon Musk's net worth is intrinsically linked to the fluctuating market sentiment surrounding Tesla and the broader tech sector.

Impact of Stock Market Volatility

- Recent Market Downturns: Broader economic uncertainty, including recent market downturns and increased interest rates, has negatively impacted investor sentiment towards growth stocks, including Tesla. This general market volatility directly translates into fluctuations in Tesla's stock price.

- Interest Rate Hikes: Rising interest rates make borrowing more expensive for companies, potentially affecting Tesla's expansion plans and impacting future profitability, influencing investor decisions. Keywords: Tesla stock price, market volatility, investor sentiment, stock market fluctuations, tech stock performance, interest rate hikes.

Elon Musk's Public Statements and Actions

Elon Musk's public persona and actions have also played a role in shaping investor confidence in Tesla.

- Controversial Tweets and Actions: Musk's controversial tweets and actions, such as the Twitter acquisition, have generated considerable market volatility. These events can cause sudden shifts in investor sentiment, leading to immediate impacts on Tesla's stock price.

- Impact on Brand Reputation: The perception of risk associated with Elon Musk's leadership and his often unpredictable behavior has influenced investor confidence and risk assessment concerning Tesla. Keywords: Elon Musk Twitter, public image, investor confidence, brand reputation, market impact, Tesla leadership.

Economic Headwinds and Inflationary Pressures

Macroeconomic factors are also exerting pressure on Tesla and its valuation.

Rising Costs and Margins

- Inflationary Pressures: Inflationary pressures are increasing the cost of raw materials, energy, and logistics, squeezing Tesla's profit margins. These increased costs directly affect profitability and investor perception of the company's long-term financial health.

- Impact on Profitability: The rising costs, coupled with increased competition, are putting pressure on Tesla's profitability and ability to maintain its high growth trajectory. Keywords: Inflation impact, rising costs, profit margins, Tesla profitability, economic downturn, raw materials, logistics.

Consumer Spending and Demand

Economic uncertainty might also be affecting consumer demand for EVs.

- Decreased Consumer Spending: In times of economic uncertainty, consumers might postpone large purchases like new vehicles, impacting Tesla's sales figures. Rising interest rates also impact the affordability of purchasing high-value assets like Tesla vehicles.

- Impact on EV Demand: While the long-term demand for EVs remains strong, short-term economic headwinds could dampen consumer appetite for Tesla's premium-priced vehicles. Keywords: Consumer spending, economic uncertainty, EV demand, sales figures, market analysis, affordability.

Conclusion

The recent dip in Elon Musk's net worth is a multifaceted issue reflecting Tesla's operational challenges, intensified market competition, broader economic headwinds, and the impact of Elon Musk's public image. Production bottlenecks, supply chain disruptions, increased competition, market volatility, and inflationary pressures all contribute to the current situation. Understanding these interwoven factors is crucial for grasping the complex dynamics shaping Tesla's trajectory and the valuation of its CEO. Stay tuned for future updates on Elon Musk's Net Worth and the evolving challenges facing Tesla in the dynamic electric vehicle market.

Featured Posts

-

Unprovoked Hate Crime The Devastating Impact On One Family

May 09, 2025

Unprovoked Hate Crime The Devastating Impact On One Family

May 09, 2025 -

Emmerdale Star Amy Walsh Speaks Out On Wynne Evans Strictly Controversy

May 09, 2025

Emmerdale Star Amy Walsh Speaks Out On Wynne Evans Strictly Controversy

May 09, 2025 -

Woman Kills Man In Unprovoked Racist Stabbing Attack

May 09, 2025

Woman Kills Man In Unprovoked Racist Stabbing Attack

May 09, 2025 -

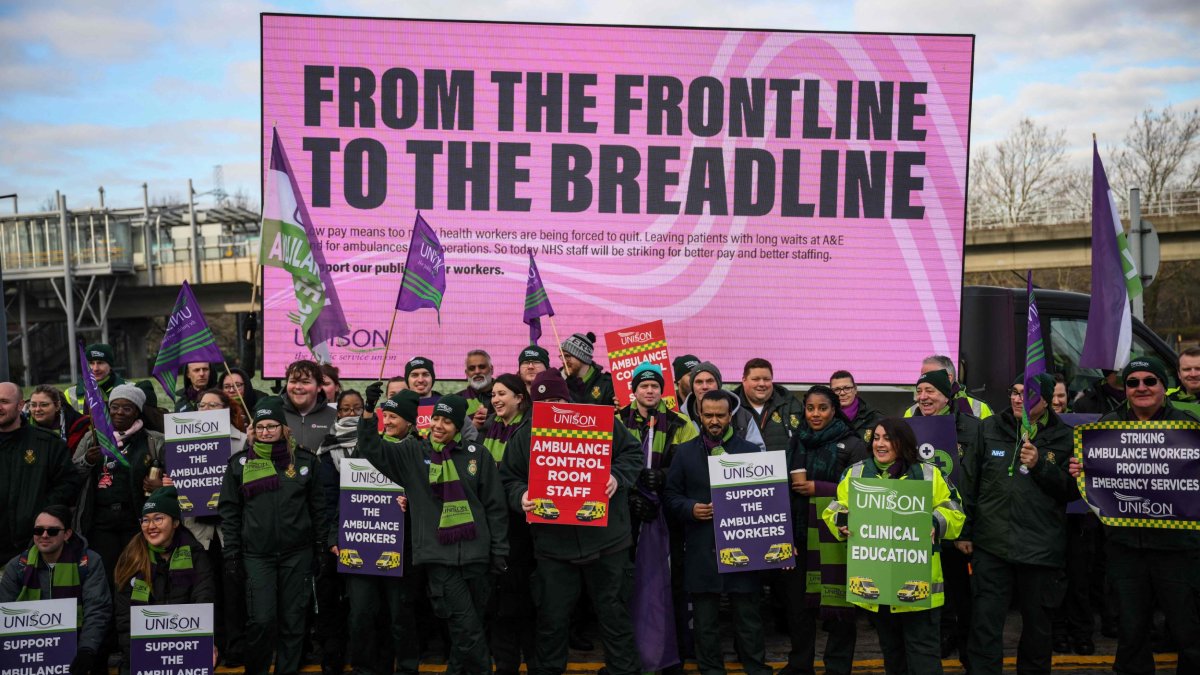

Planned Elizabeth Line Strikes Impact On February And March Services

May 09, 2025

Planned Elizabeth Line Strikes Impact On February And March Services

May 09, 2025 -

Frances Nuclear Shield A Shared European Approach

May 09, 2025

Frances Nuclear Shield A Shared European Approach

May 09, 2025