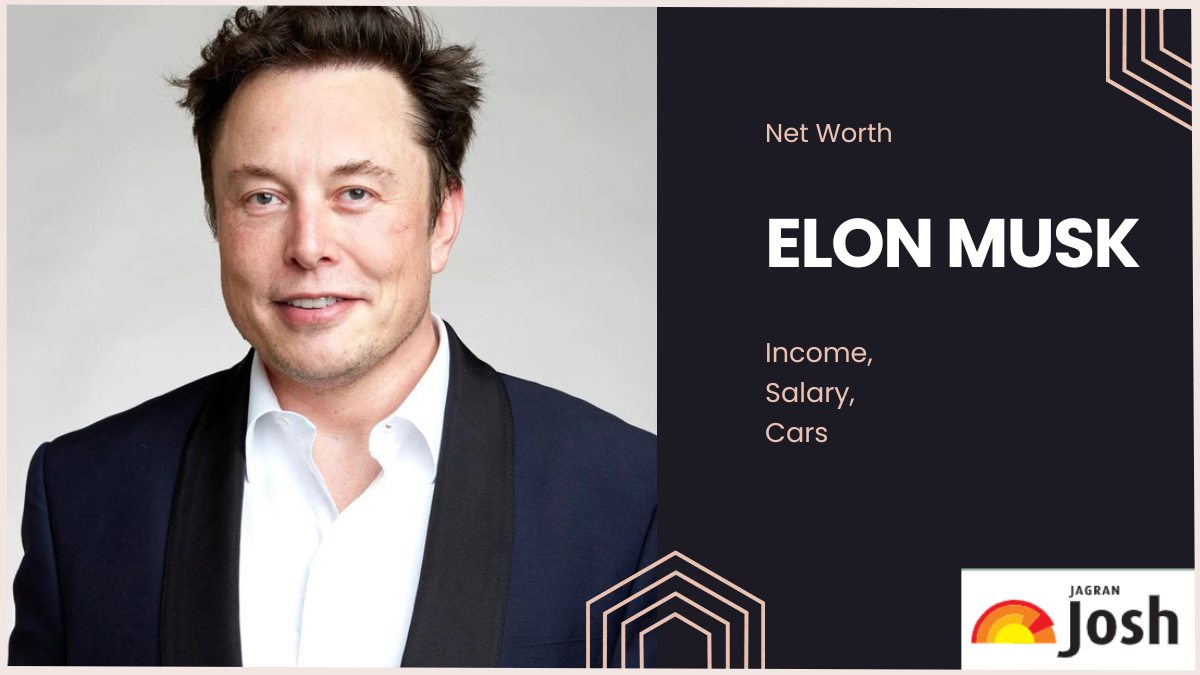

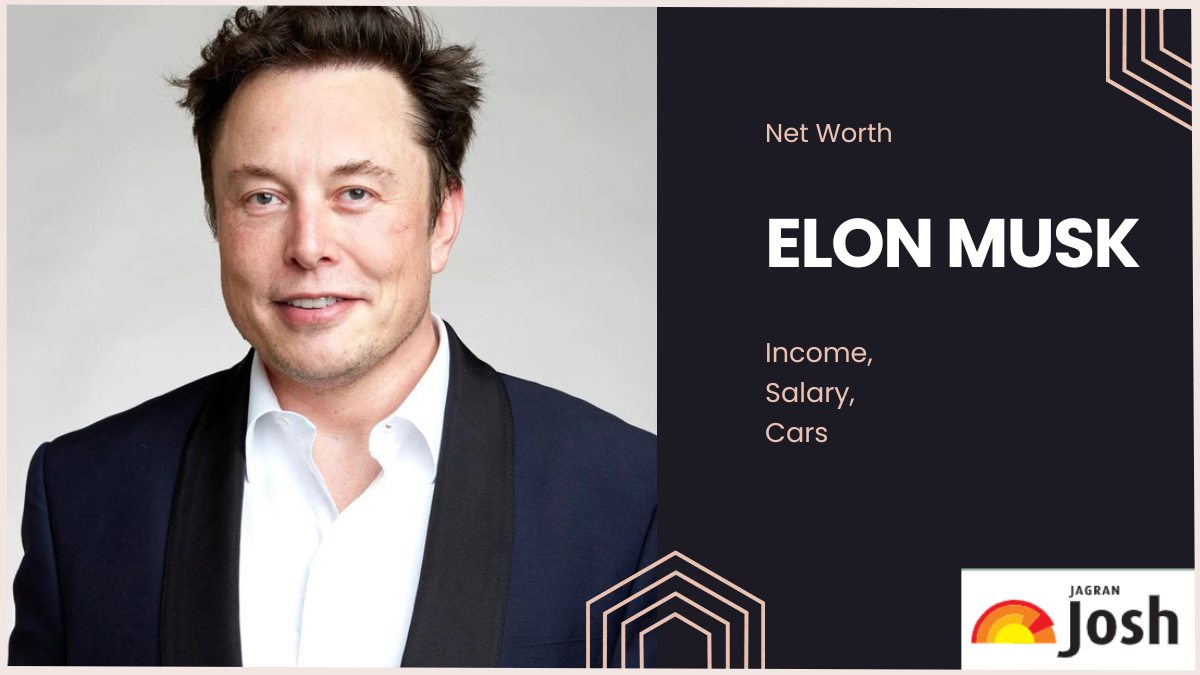

Elon Musk's Net Worth Falls Below $300 Billion: Tesla, Tariffs, And Market Shifts

Table of Contents

Tesla Stock Performance and its Impact on Elon Musk's Net Worth

The Correlation between Tesla Stock and Musk's Wealth

Elon Musk's wealth is inextricably linked to Tesla's stock price. He owns a significant portion of Tesla's shares, making him highly vulnerable to market volatility. Any fluctuation in Tesla's stock price directly translates into a substantial change in his net worth.

- Between [Start Date] and [End Date], Tesla's stock price dropped by [Percentage]%, resulting in a corresponding decrease of approximately [Dollar Amount] in Elon Musk's net worth.

- Investor sentiment plays a crucial role. Positive news and strong earnings reports generally boost the stock price, while negative news or disappointing performance leads to declines.

- Tesla's stock has historically shown significant volatility, experiencing both periods of rapid growth and sharp corrections. This inherent risk contributes to the fluctuating nature of Musk's wealth.

Factors Affecting Tesla's Stock Price

Several factors contribute to Tesla's stock price fluctuations, impacting Musk's net worth significantly.

- Intense Competition: The electric vehicle (EV) market is becoming increasingly competitive, with established automakers and new entrants vying for market share. Rivals like [Competitor 1], [Competitor 2], and [Competitor 3] are posing a challenge to Tesla's dominance.

- Production Challenges: Tesla has faced various production challenges, including supply chain disruptions and difficulties scaling production to meet growing demand. These operational hurdles can impact profitability and investor confidence.

- Negative News and Controversies: Negative news stories, controversies surrounding Tesla's products or Elon Musk's public statements can significantly impact investor sentiment and lead to stock price declines.

The Role of Tariffs and Global Economic Uncertainty

Impact of Tariffs on Tesla's International Sales

Tariffs imposed on Tesla vehicles in certain markets significantly affect the company's profitability and, consequently, its stock price.

- Regions like [Region 1] and [Region 2] have imposed tariffs, increasing the price of Tesla vehicles and reducing their competitiveness in those markets.

- These tariffs directly impact Tesla's revenue and profit margins, leading to reduced earnings and potentially affecting investor confidence.

Broader Economic Factors Influencing Musk's Net Worth

Macroeconomic factors play a significant role in shaping market conditions and influencing the value of high-growth tech stocks like Tesla.

- High inflation rates, rising interest rates, and fears of a recession can lead to a sell-off in the stock market, impacting even the most successful companies.

- These economic headwinds often lead to decreased investor confidence, prompting investors to move their funds into safer, more conservative assets. This flight to safety can dramatically impact Tesla's stock price and, therefore, Musk's net worth.

Other Contributing Factors to the Decline

Musk's Other Ventures and Their Impact

While SpaceX and other Musk-led ventures have potential, their current financial contributions to offsetting Tesla-related losses are limited.

- SpaceX is a rapidly growing company, but it's not yet generating significant profits to cushion the impact of Tesla's stock price volatility on Musk's overall net worth.

- Other ventures, while potentially promising, are not currently large enough to significantly influence Musk's overall financial picture.

Market Sentiment Towards Elon Musk Himself

Public perception and controversies surrounding Elon Musk can negatively impact investor confidence in Tesla and, consequently, his net worth.

- Recent controversies and public statements made by Elon Musk have sometimes led to negative media coverage, impacting investor sentiment and potentially influencing the stock price.

- Negative media coverage can create uncertainty and risk aversion among investors, leading to a decline in stock prices.

Conclusion

The decline in Elon Musk's net worth is a multifaceted issue stemming from a combination of factors. Tesla's stock performance, driven by competition, production challenges, and negative news, plays a significant role. Global economic uncertainty, including the impact of tariffs and macroeconomic factors, further exacerbates the situation. Additionally, controversies surrounding Elon Musk himself have contributed to the market's negative perception. Understanding these factors provides valuable insight into the complex interplay between individual wealth, corporate performance, and global economic conditions. Stay informed on the latest developments regarding Elon Musk's net worth and Tesla's performance by regularly checking reputable financial news sources. Understanding the factors influencing Elon Musk's net worth provides insight into the dynamics of the global economy and the volatile nature of high-growth tech stocks.

Featured Posts

-

Fur Rondys Condensed Race The Endurance Of Mushers And Their Teams

May 09, 2025

Fur Rondys Condensed Race The Endurance Of Mushers And Their Teams

May 09, 2025 -

Woman Claims To Be Madeleine Mc Cann Dna Test Results Revealed

May 09, 2025

Woman Claims To Be Madeleine Mc Cann Dna Test Results Revealed

May 09, 2025 -

Nyt Strands Hints And Answers Saturday April 12 Game 405

May 09, 2025

Nyt Strands Hints And Answers Saturday April 12 Game 405

May 09, 2025 -

Newark Airport System Failure Controllers Prior Safety Concerns Ignored

May 09, 2025

Newark Airport System Failure Controllers Prior Safety Concerns Ignored

May 09, 2025 -

Bayern Munich Vs Inter Milan Match Preview And Prediction

May 09, 2025

Bayern Munich Vs Inter Milan Match Preview And Prediction

May 09, 2025