Elon Musk's SpaceX Investment: A $43 Billion Increase Over Tesla Stake

Table of Contents

SpaceX Valuation Soars: A $43 Billion Jump

SpaceX's recent valuation increase is nothing short of phenomenal. Fueled by successful launches, burgeoning Starlink subscriptions, and significant private market transactions, the company's worth has skyrocketed. This substantial jump reflects investor confidence in SpaceX's innovative technology and ambitious long-term goals.

- Specific numbers: Reports indicate SpaceX's valuation has increased by approximately $43 billion, bringing its total valuation to well over $100 billion. This represents a massive jump from previous valuations.

- Comparison to previous valuations: Prior to this surge, SpaceX's valuation was already substantial, but this recent increase signifies exponential growth and market recognition of its potential.

- Key investors and their roles: While the specifics of private investor involvement aren't always publicly disclosed, the participation of large venture capital firms and institutional investors plays a key role in boosting SpaceX's valuation.

- Official statements/news articles: Several reputable financial news sources have reported on this significant valuation increase, confirming the substantial growth of the Elon Musk SpaceX investment.

Comparing SpaceX Investment to Tesla Stake

A direct comparison between Musk's SpaceX stake and his Tesla holdings reveals a fascinating shift in his portfolio. While precise figures regarding his ownership percentages in both companies aren’t always publicly released, it's clear that his SpaceX stake is rapidly approaching, or may even surpass, the value of his Tesla holdings.

- Percentage breakdown: While exact figures are not publicly available, it's estimated that Musk's SpaceX stake represents a significant, and potentially growing, portion of his overall net worth. Conversely, although Tesla remains a hugely successful company, the relative proportion of his wealth tied to Tesla might be decreasing.

- Historical context: Musk's investment in both companies has spanned years, with both showing phenomenal growth. However, the recent acceleration of SpaceX's valuation signifies a noteworthy change in the dynamics of his investment portfolio.

- Risk and reward: While both Tesla and SpaceX are high-growth companies with inherent risks, SpaceX's focus on space exploration arguably presents a higher risk-reward profile compared to Tesla's established position in the electric vehicle market.

- Market performance: Both Tesla and SpaceX stocks (where applicable) have exhibited significant volatility, but SpaceX's valuation increase signals a growing confidence in its long-term prospects.

Implications for the Future of SpaceX and Musk's Portfolio

This substantial valuation increase holds profound implications for SpaceX's future endeavors and Musk's overall investment strategy. The influx of capital strengthens SpaceX's ability to pursue its ambitious goals.

- SpaceX's ambitious projects: The Starship development program, aiming for Mars colonization, and the expansion of Starlink, the satellite internet constellation, are poised to benefit significantly from this increased valuation.

- Potential for future funding rounds and IPO: While SpaceX has largely relied on private funding, this valuation increase may pave the way for future funding rounds or even an eventual Initial Public Offering (IPO), though there are currently no official plans in place.

- Impact on Musk's net worth: The increase directly and substantially boosts Musk's net worth, solidifying his position as one of the world's wealthiest individuals.

- Potential competition and market challenges: Despite SpaceX's current success, the competitive landscape is dynamic, with other companies actively pursuing space exploration and satellite internet services.

The Role of Starlink in SpaceX's Growth

Starlink's contribution to SpaceX's valuation increase cannot be overstated. The rapid expansion of its global satellite internet network is a major driver of its success.

- Market analysis: The satellite internet industry is experiencing significant growth, and Starlink is a major player, capturing a considerable market share.

- Starlink's subscriber growth and revenue projections: The increasing number of Starlink subscribers and the associated revenue streams significantly contribute to SpaceX's overall profitability and valuation.

- Global reach impact: Starlink's global reach provides a substantial revenue stream, far exceeding that of any other single provider.

- Comparison to competitors: Compared to established and emerging satellite internet providers, Starlink's technological advancements and coverage have provided a significant competitive advantage.

The Broader Impact on the Space Exploration Industry

SpaceX's success is not just about a single company; it's reshaping the entire space exploration landscape.

- Increased competition and innovation: SpaceX's achievements are inspiring competition and innovation within the private space sector, encouraging other companies to pursue ambitious projects.

- Cost reduction: SpaceX has been instrumental in lowering the cost of space travel, making it more accessible to both private and public entities.

- Future collaborations and partnerships: SpaceX's success fosters potential for collaborations and partnerships with other space agencies and private companies.

- Impact on government space programs: SpaceX's achievements are prompting government space programs to reassess their strategies and explore new partnerships.

Conclusion

The dramatic increase in Elon Musk's SpaceX investment, exceeding his Tesla stake by $43 billion, marks a pivotal moment for both the company and the space exploration industry as a whole. This significant valuation surge underscores SpaceX's remarkable growth and the potential of its ambitious projects like Starlink and Starship. The impact of Elon Musk's SpaceX investment extends far beyond his personal wealth; it's reshaping the future of space travel and communication.

Call to Action: Stay informed about the latest developments in Elon Musk's SpaceX investment and the future of space exploration by subscribing to our newsletter and following us on social media. Learn more about the evolving landscape of Elon Musk SpaceX Investment and the continued advancements in space technology.

Featured Posts

-

Brekelmans Wil India Aan Zijn Zijde Houden Een Analyse Van De Strategie

May 09, 2025

Brekelmans Wil India Aan Zijn Zijde Houden Een Analyse Van De Strategie

May 09, 2025 -

Whats App Spyware Case Metas Financial Hit And Ongoing Legal Battles

May 09, 2025

Whats App Spyware Case Metas Financial Hit And Ongoing Legal Battles

May 09, 2025 -

9 Maya Makron I Tusk Podpishut Vazhnoe Oboronnoe Soglashenie

May 09, 2025

9 Maya Makron I Tusk Podpishut Vazhnoe Oboronnoe Soglashenie

May 09, 2025 -

Bilateral Trade Agreement India And Us To Hold Key Discussions

May 09, 2025

Bilateral Trade Agreement India And Us To Hold Key Discussions

May 09, 2025 -

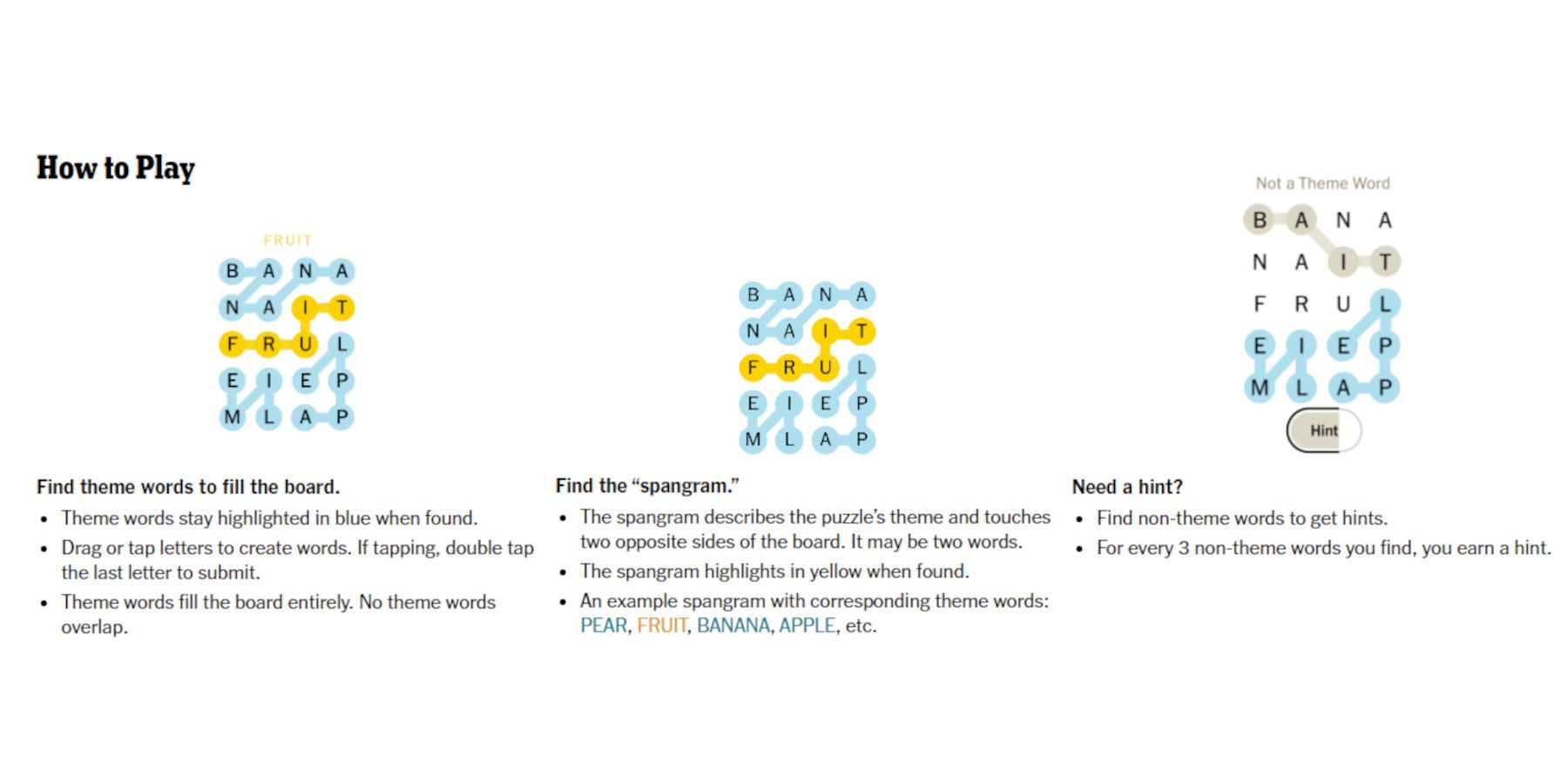

Nyt Strands Game 374 Complete Hints And Answers For March 12

May 09, 2025

Nyt Strands Game 374 Complete Hints And Answers For March 12

May 09, 2025