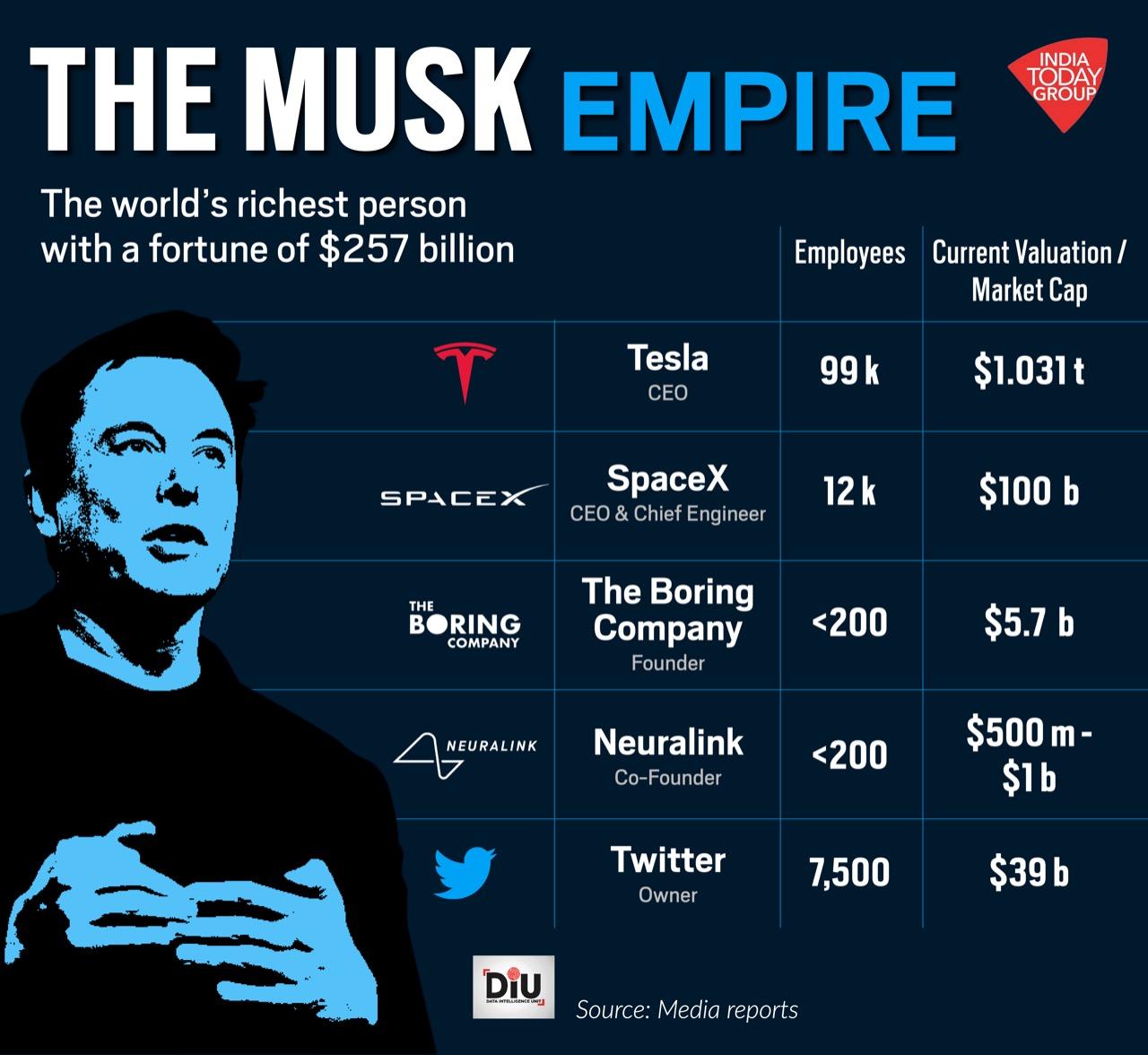

Elon Musk's Wealth: How US Power Plays Shape The Tesla Empire

Table of Contents

The Role of US Government Policies in Tesla's Growth

The US government, through various policies, has played a crucial role in fueling Tesla's expansion and, consequently, boosting Elon Musk's net worth. This support isn't merely coincidental; it reflects a broader national strategy to promote electric vehicles (EVs) and renewable energy.

Tax Incentives and Subsidies

Tesla has significantly benefited from a range of federal and state-level tax incentives designed to encourage EV adoption and investment in renewable energy technologies. These incentives have directly translated into increased profitability and accelerated growth for the company.

- Federal Tax Credits: The US government offers substantial tax credits for the purchase of electric vehicles, making Tesla cars more affordable for consumers and boosting demand.

- State-Level Incentives: Many states provide additional tax breaks, rebates, and other incentives for EV buyers and companies involved in renewable energy, further benefiting Tesla's bottom line. California, for instance, has been particularly supportive.

Data Points: While precise figures are difficult to isolate solely for Tesla, studies show that federal tax credits for EVs have added billions of dollars to the industry's value, with Tesla being a major beneficiary. Furthermore, various state-level incentives have contributed significantly to Tesla's regional success. Analyzing the impact of these incentives requires sophisticated econometric modeling but the correlation is undeniable.

Infrastructure Development and Investment

The US government's investment in charging infrastructure and renewable energy has been pivotal in supporting Tesla’s market penetration. The expansion of the charging network directly addresses one of the major concerns surrounding EV adoption: range anxiety.

- National Electric Vehicle Infrastructure (NEVI) Formula Program: This program provides funding for states to build out a nationwide network of EV chargers, directly benefiting Tesla's Supercharger network and its customers.

- Investments in Renewable Energy: Government subsidies and tax incentives for solar and wind energy production indirectly support Tesla's energy storage business (Powerwall and Powerpack), further increasing its revenue streams.

Data Points: The number of publicly accessible EV charging stations in the US has grown exponentially in recent years, largely thanks to government investments. This growth directly correlates with increased EV sales, and Tesla, being a market leader, is a prime beneficiary.

Regulatory Landscape and its Impact

Stringent US environmental regulations and emission standards have created a favorable environment for Tesla's electric vehicles, giving them a competitive edge over traditional gasoline-powered cars.

- Corporate Average Fuel Economy (CAFE) Standards: These standards require automakers to meet certain fuel efficiency targets, incentivizing the production and sale of EVs.

- State-Level Emission Regulations: Several states have implemented stricter emission standards than the federal government, further bolstering the demand for electric vehicles like those produced by Tesla.

Data Points: Tesla's market share has consistently grown in regions with stronger environmental regulations, highlighting the positive correlation between supportive regulatory environments and Tesla's success.

The Influence of US Capital Markets on Elon Musk's Wealth

Elon Musk's wealth is significantly tied to the performance of Tesla's stock on the US capital markets. Investor sentiment, market fluctuations, and funding mechanisms have all played a crucial role in shaping his net worth.

Wall Street's Perception of Tesla

Tesla's stock price is highly volatile, reflecting the fluctuating perception of the company on Wall Street. Positive investor sentiment leads to a surge in the stock price, directly increasing Musk's net worth, while negative sentiment has the opposite effect.

- Analyst Ratings and Predictions: Changes in analyst ratings and predictions regarding Tesla's future performance directly influence investor behavior and stock prices.

- Market Trends and Economic Conditions: Broader economic trends and market sentiment also influence Tesla's stock price and, in turn, Musk's net worth.

Data Points: Charts clearly demonstrate a strong correlation between Tesla's stock price and Elon Musk's net worth. Significant stock market events, such as earnings announcements and product launches, often lead to dramatic shifts in both.

Venture Capital and Private Equity Investments

Tesla’s early growth was fueled by substantial investments from US-based venture capital and private equity firms. This early funding was critical in allowing Tesla to scale its operations and develop its technology.

- Early-stage Funding Rounds: Tesla secured significant funding during its early years, providing the capital necessary to develop its technology and build its manufacturing capacity.

- Strategic Partnerships: These investors often brought not just capital but also valuable industry connections and expertise.

Data Points: Tracking the amounts invested and the valuations at each funding round illustrates the significant contribution of US venture capital to Tesla’s early success and its subsequent impact on Musk's wealth.

Mergers and Acquisitions

Tesla’s strategic acquisitions have also contributed to its growth and valuation, positively influencing Musk’s net worth. These acquisitions have expanded Tesla’s capabilities and market reach.

- SolarCity Acquisition: The acquisition of SolarCity, a solar energy company, expanded Tesla’s offerings into the renewable energy sector.

- Other Acquisitions: Numerous smaller acquisitions have provided Tesla with valuable technology and expertise.

Data Points: Analyzing the financial performance of Tesla following key acquisitions provides insights into their impact on the company's profitability and market capitalization, thereby affecting Musk’s wealth.

Geopolitical Factors and International Trade Affecting Tesla's Global Reach

Tesla's global ambitions are significantly influenced by geopolitical factors and international trade dynamics. These factors impact Tesla’s ability to compete internationally and access new markets.

US Trade Policy and International Competition

US trade policies, tariffs, and trade agreements significantly impact Tesla's global competitiveness. Tariffs and trade disputes can increase the cost of producing and selling Tesla vehicles in certain markets, impacting profitability.

- Trade Wars and Tariffs: Trade disputes between the US and other countries can impact the cost of importing and exporting Tesla vehicles and components.

- Trade Agreements: Participation in free trade agreements can reduce barriers to entry in new markets, boosting Tesla's global reach.

Data Points: Tesla's market share in different countries can be analyzed in relation to US trade policies and tariffs to assess their impact on global competitiveness.

Global Supply Chains and Resource Availability

Tesla’s manufacturing relies heavily on global supply chains, and disruptions or shortages of raw materials and components can significantly impact production and profitability.

- Battery Raw Materials: Tesla's reliance on lithium, cobalt, and other battery materials exposes it to price fluctuations and geopolitical risks associated with the sourcing of these raw materials.

- Chip Shortages: The global semiconductor shortage in recent years underscored Tesla’s vulnerability to disruptions in global supply chains.

Data Points: Tracking the price of key raw materials and Tesla's production output helps to illustrate the impact of supply chain disruptions on the company's performance.

International Relations and Market Access

Tesla's expansion into new markets is significantly influenced by international relations and diplomatic efforts. Political stability and government regulations in foreign countries play a major role.

- Government Regulations and Approvals: Navigating regulatory hurdles and obtaining necessary approvals in foreign markets can be challenging and time-consuming.

- Political Risk and Instability: Political instability or conflicts in certain regions can disrupt Tesla's operations and limit market access.

Data Points: Comparing Tesla's market penetration in different countries reveals the correlation between political stability and market access.

Conclusion: Understanding the Interplay Between Elon Musk's Wealth and the US Power Structure

In conclusion, Elon Musk's immense wealth and the success of the Tesla Empire are not solely attributable to his entrepreneurial vision but are deeply intertwined with the complex interplay of US government policies, capital markets, and geopolitical factors. US government incentives, a supportive regulatory environment, robust capital markets, and the nation's influence on global trade have all played crucial roles in shaping Tesla’s trajectory and, consequently, Elon Musk's net worth. Understanding these intricate dynamics provides crucial insights into the power plays shaping the future of the Tesla Empire and the broader US economy. To further explore the complex relationship between Elon Musk's wealth and US power structures, delve into research on US economic policy and the impact of government regulation on technological innovation. Understanding Elon Musk's wealth is key to understanding the future of electric vehicles and the global economy.

Featured Posts

-

The Unexpected Heir A Canadian Billionaire And The Berkshire Hathaway Succession

May 10, 2025

The Unexpected Heir A Canadian Billionaire And The Berkshire Hathaway Succession

May 10, 2025 -

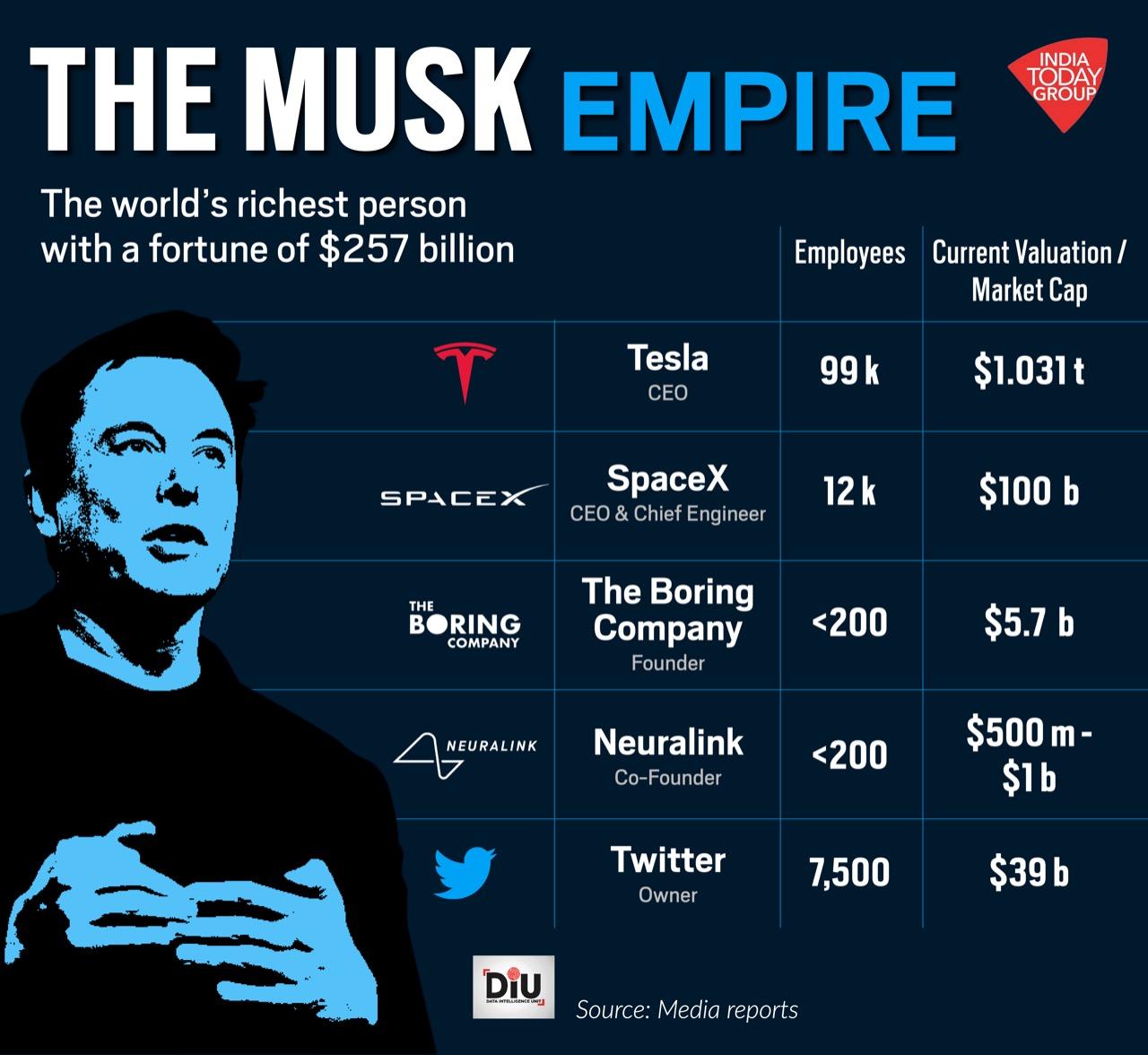

Court Dismisses Nicolas Cage In Ex Wifes Lawsuit Weston Cage Still Involved

May 10, 2025

Court Dismisses Nicolas Cage In Ex Wifes Lawsuit Weston Cage Still Involved

May 10, 2025 -

Ma Hw Tathyr Antqal Fyraty Ela Adae Alerby Alqtry

May 10, 2025

Ma Hw Tathyr Antqal Fyraty Ela Adae Alerby Alqtry

May 10, 2025 -

Ryujinx Emulator Development Ceases Following Nintendo Contact

May 10, 2025

Ryujinx Emulator Development Ceases Following Nintendo Contact

May 10, 2025 -

Is Palantir Stock A Buy Before May 5th A Wall Street Analysis

May 10, 2025

Is Palantir Stock A Buy Before May 5th A Wall Street Analysis

May 10, 2025