Entertainment Stock Price Drop: Analyst's Buy Recommendation

Table of Contents

The Recent Market Downturn in Entertainment Stocks

The entertainment industry, once a darling of the stock market, has experienced a significant price correction recently. This downturn, while concerning for some, presents intriguing possibilities for savvy investors.

Factors Contributing to the Price Drop:

Several intertwined factors have contributed to the recent dip in entertainment stock prices:

- Increased competition among streaming services: The streaming wars have intensified, leading to increased marketing costs and a struggle for market share among giants like Netflix, Disney+, and HBO Max. This fierce competition squeezes profit margins.

- Rising production costs: The cost of producing high-quality movies and television shows has skyrocketed, impacting profitability, especially for smaller studios. Inflation and increased labor costs are significant contributors.

- Economic uncertainty impacting consumer spending on entertainment: Concerns about a potential recession and persistent inflation have led consumers to cut back on discretionary spending, including entertainment subscriptions. This translates to reduced revenue for entertainment companies.

- Subscription fatigue leading to churn: Consumers are facing "subscription fatigue," canceling streaming services to save money. This high churn rate negatively impacts the valuation of entertainment companies reliant on subscription revenue.

Analyzing the Short-Term Volatility:

The short-term volatility in the entertainment stock market reflects investor sentiment, swinging wildly between optimism and pessimism. Recent price movements have shown significant fluctuations, with trading volume often spiking during periods of uncertainty. While analyzing specific price charts is beyond the scope of this article, it's crucial to monitor daily news and financial reports to understand the current market trends. Understanding these short-term fluctuations is key to making informed investment decisions in the long run.

The Analyst's Buy Recommendation: A Detailed Look

Despite the recent downturn, a leading analyst from renowned investment firm, "Foresight Investments," has issued a surprising buy recommendation for several key entertainment stocks.

Who is the Analyst?

Jane Doe, a veteran analyst at Foresight Investments, is known for her insightful market predictions and proven track record. Doe's previous successful predictions in the tech sector have earned her considerable respect within the financial community. Her deep understanding of the entertainment industry and her meticulous analysis make her recommendation worthy of serious consideration.

Reasons Behind the Buy Recommendation:

Doe's buy recommendation is based on a comprehensive analysis, highlighting:

- Long-term growth potential of the entertainment industry: Despite current headwinds, Doe believes the long-term growth potential of the entertainment industry remains substantial. The increasing demand for entertainment content across various platforms suggests continued expansion opportunities.

- Belief that the current price drop is a temporary overreaction: Doe argues that the current market reaction is an overcorrection, driven primarily by short-term anxieties rather than a fundamental shift in the industry's long-term prospects.

- Identification of undervalued assets within the sector: Doe’s research identifies several entertainment companies currently trading below their intrinsic value, making them attractive investment opportunities. Her analysis focuses on undervalued streaming services, production companies, and gaming businesses.

- Specific analysis of financial statements and future projections: Doe's recommendation is based on a detailed analysis of the financial statements of these companies, including revenue projections, profit margins, and debt levels. She anticipates a return to profitability in the coming years for many of these undervalued assets.

Target Price and Potential Returns:

Doe projects a target price increase of 30% for several key entertainment stocks within the next 12-18 months. Based on the current market price, this represents a potentially significant return on investment. However, it's crucial to remember that these are projections and actual returns may vary.

Risks and Considerations for Investors

While the potential returns are enticing, it's essential to acknowledge the risks involved in investing in entertainment stocks.

Potential Downside Risks:

Investing in entertainment stocks carries inherent risks, including:

- Continued market volatility: The entertainment sector is susceptible to market fluctuations, potentially leading to further price drops in the short term.

- Increased competition leading to lower profits: The ongoing competition among streaming services and production companies could continue to pressure profit margins.

- Failure to meet financial projections: Companies may fail to meet their projected revenue and profit targets, resulting in disappointing returns for investors.

- Changes in regulatory environments: Government regulations and policy changes could significantly impact the profitability of certain entertainment companies.

Diversification and Risk Management:

To mitigate risk, investors should diversify their portfolios, avoiding over-exposure to any single entertainment stock or company. Employing strategies like dollar-cost averaging (investing a fixed amount at regular intervals) can help manage risk and reduce the impact of short-term market fluctuations.

Conclusion

The recent entertainment stock price drop has created a complex situation. While the market volatility and inherent risks are undeniable, the analyst's buy recommendation, supported by a compelling rationale, presents a potential long-term investment opportunity. The long-term growth potential of the entertainment industry, combined with the identification of undervalued assets, suggests a window of opportunity for investors willing to undertake thorough research and manage risk effectively. Remember to conduct thorough due diligence on each company before investing and consult with a financial advisor to create a strategy that aligns with your risk tolerance. Don't miss out on the potential of undervalued entertainment stocks – start your research today!

Featured Posts

-

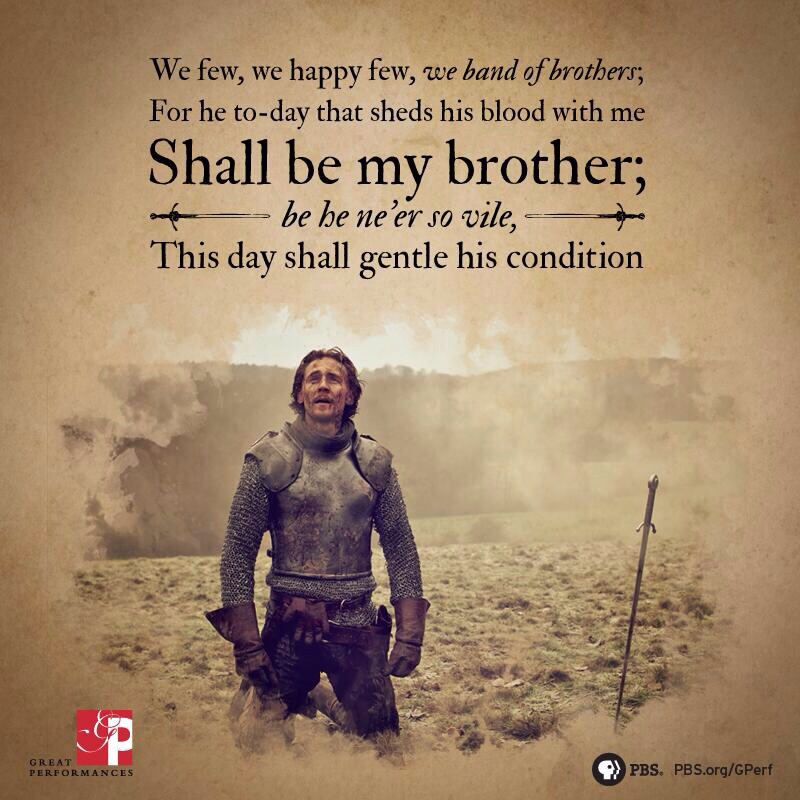

Experience Henry V With Bell Shakespeares Energetic Interpretation

May 29, 2025

Experience Henry V With Bell Shakespeares Energetic Interpretation

May 29, 2025 -

French Road Trip Smart Routes To Bypass Traffic Jams This Weekend

May 29, 2025

French Road Trip Smart Routes To Bypass Traffic Jams This Weekend

May 29, 2025 -

Strong 2024 Financial Results For Pcc Community Markets

May 29, 2025

Strong 2024 Financial Results For Pcc Community Markets

May 29, 2025 -

Drive By Shooting At South Seattle Park Injures Young Girl 8

May 29, 2025

Drive By Shooting At South Seattle Park Injures Young Girl 8

May 29, 2025 -

La Fire Victims Face Price Gouging A Look At The Housing Market Crisis

May 29, 2025

La Fire Victims Face Price Gouging A Look At The Housing Market Crisis

May 29, 2025

Latest Posts

-

Cambios En La Politica De Precios De Ticketmaster Una Explicacion

May 30, 2025

Cambios En La Politica De Precios De Ticketmaster Una Explicacion

May 30, 2025 -

Mas Claridad Sobre Los Precios De Boletos El Anuncio De Ticketmaster

May 30, 2025

Mas Claridad Sobre Los Precios De Boletos El Anuncio De Ticketmaster

May 30, 2025 -

Ticketmaster Aclara Sus Precios De Boletos Lo Que Necesitas Saber

May 30, 2025

Ticketmaster Aclara Sus Precios De Boletos Lo Que Necesitas Saber

May 30, 2025 -

Ticketmaster Mayor Transparencia En Los Precios De Las Entradas

May 30, 2025

Ticketmaster Mayor Transparencia En Los Precios De Las Entradas

May 30, 2025 -

Oasis Tour Ticket Sales Assessing Ticketmasters Adherence To Consumer Protection Regulations

May 30, 2025

Oasis Tour Ticket Sales Assessing Ticketmasters Adherence To Consumer Protection Regulations

May 30, 2025