Epiroc's ADR Programs: Deutsche Bank Named Depositary Bank

Table of Contents

What are American Depositary Receipts (ADRs)?

American Depositary Receipts (ADRs) represent ownership in a foreign company's stock, allowing it to be traded on US stock exchanges. This is a crucial mechanism for international investing, facilitating easier access to global markets. Understanding ADRs is key to navigating this aspect of international finance.

- Sponsored vs. Unsponsored ADRs: Sponsored ADRs are issued with the cooperation of the foreign company, offering greater transparency and often more information. Unsponsored ADRs, conversely, are created without the direct involvement of the foreign company, potentially limiting the available information.

- Benefits of ADRs: Investing in ADRs offers several key advantages for international investors:

- Trading in US dollars (USD) eliminates currency conversion complexities.

- Access to a wider range of investment options, including companies not directly listed on US exchanges.

- Simplified trading processes through familiar brokerage accounts.

- Keywords: ADR definition, sponsored ADR, unsponsored ADR, global investing, international stocks.

Epiroc's Global Reach and the Need for ADRs

Epiroc boasts a considerable global presence, providing cutting-edge equipment and services to mining and infrastructure projects worldwide. Its strong international market position necessitates straightforward access for global investors. Listing on the Stockholm Stock Exchange, while advantageous, doesn't provide the same accessibility as a US-based trading mechanism for many international investors.

- Epiroc's Market Position: Epiroc is a major player in the mining and infrastructure equipment market, operating globally.

- Overcoming Barriers to Entry: ADRs lower barriers to entry for US and international investors who might otherwise find it challenging or costly to invest directly on the Stockholm Stock Exchange.

- Expanded Investor Base: This initiative allows Epiroc to attract a broader investor base, fostering further growth and development.

- Keywords: Epiroc stock, Stockholm Stock Exchange, global expansion, international market access, Swedish stocks.

Deutsche Bank's Role as Depositary Bank

Deutsche Bank's appointment as the depositary bank for Epiroc's ADR program is a significant development. The depositary bank plays a crucial role in facilitating trading and ensuring the smooth functioning of the ADR program.

- Responsibilities: Deutsche Bank is responsible for:

- Holding the underlying Epiroc shares.

- Issuing and cancelling ADRs.

- Facilitating the transfer of ADRs between investors.

- Ensuring the accurate settlement of transactions.

- Benefits for Epiroc and Investors: This partnership offers several benefits:

- Enhanced trust and credibility for Epiroc in international markets.

- Simplified processes and improved efficiency for investors trading Epiroc ADRs.

- Leveraging Deutsche Bank's extensive experience in managing ADR programs for global companies.

- Keywords: depositary bank responsibilities, Deutsche Bank ADR services, financial institution, trust and custody, ADR program management.

Investing in Epiroc ADRs: A Practical Guide

Investing in Epiroc ADRs is a relatively straightforward process for those familiar with trading stocks through brokerage accounts. However, it's important to remember that international investing always carries inherent risks.

- How to Invest (High-Level Overview): Investors can typically purchase Epiroc ADRs through their brokerage accounts, just as they would with any other publicly traded stock. (This is not financial advice).

- Brokerage Accounts: Most reputable online brokerage accounts facilitate the trading of ADRs.

- Risks of International Investing: Potential risks include currency fluctuations, political instability in the country where the underlying company operates, and varying levels of regulatory oversight. Thorough due diligence is crucial.

- Keywords: buy Epiroc ADR, Epiroc ADR trading, brokerage account, international investment risks, global investment strategies.

Conclusion: Investing in Epiroc through its ADR Program

Epiroc's ADR program, with Deutsche Bank acting as depositary bank, presents a valuable opportunity for international investors seeking exposure to a leading global company in the mining and infrastructure sectors. The ease of access through established brokerage accounts, coupled with the expertise of a reputable financial institution like Deutsche Bank, makes this an attractive investment avenue. Remember to always consult with a qualified financial advisor before making any investment decisions. Learn more about investing in Epiroc ADRs and explore the global investment opportunities they offer. Start your research on Epiroc ADR investment today!

Featured Posts

-

Ruben Amorims Concerns A Manchester United Players Future In Doubt

May 30, 2025

Ruben Amorims Concerns A Manchester United Players Future In Doubt

May 30, 2025 -

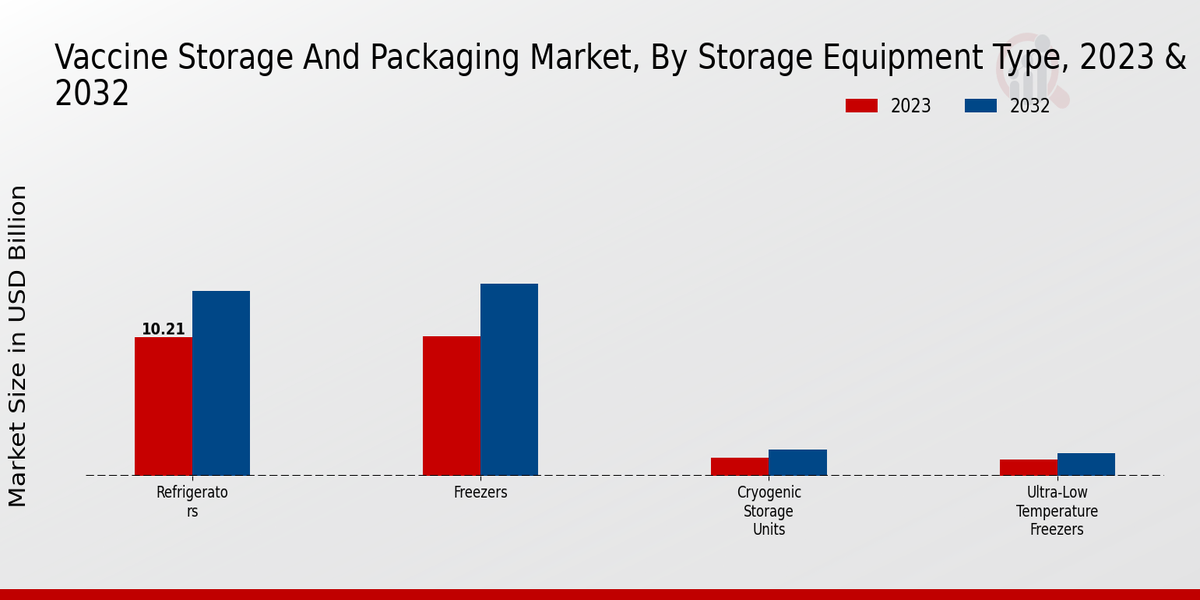

Understanding The Booming Vaccine Packaging Market

May 30, 2025

Understanding The Booming Vaccine Packaging Market

May 30, 2025 -

Conciertos Con Ticketmaster Y Setlist Fm Todo Lo Que Necesitas Saber

May 30, 2025

Conciertos Con Ticketmaster Y Setlist Fm Todo Lo Que Necesitas Saber

May 30, 2025 -

Bts Members V And Jungkooks Impressive Fitness Post Military Service

May 30, 2025

Bts Members V And Jungkooks Impressive Fitness Post Military Service

May 30, 2025 -

The Enduring Appeal Of Dara O Briains Voice Of Reason

May 30, 2025

The Enduring Appeal Of Dara O Briains Voice Of Reason

May 30, 2025