Escape To The Country: Budget Planning And Financial Considerations

Table of Contents

Assessing Your Finances: Understanding Your Budget for a Country Escape

Before you start envisioning rolling hills and charming cottages, it's essential to realistically assess your current financial situation. A thorough understanding of your income, expenses, and debts will form the bedrock of your country escape plan.

Current Financial Situation: A Realistic Appraisal

Before you even start browsing properties, take a hard look at your finances. This involves more than just checking your bank balance.

- Calculate your net monthly income: After taxes, deductions, and other regular payments, how much money do you have left each month? This is your disposable income.

- List all current debts: Include mortgages, loans, credit card debts, and any other outstanding financial obligations. Knowing your total debt will help determine how much you can realistically borrow for your move.

- Track monthly expenses: For at least three months, meticulously track all your spending. Identify areas where you can cut back to free up more money for your country escape. Subscription services, dining out, and entertainment are common areas for potential savings.

- Determine a realistic savings goal: Based on your income and expenses, how much can you realistically save each month towards your countryside dream? Set a specific, achievable savings target and timeframe.

Property Costs: Navigating the Countryside Real Estate Market

Property prices vary dramatically depending on location, size, and condition. Understanding the costs involved in purchasing a property in your chosen area is paramount.

- Research average property prices: Use online property portals and local estate agents to research the average cost of properties in your desired area. Consider factors like proximity to schools, shops, and public transport (even if limited).

- Factor in additional costs: Beyond the purchase price, remember to factor in significant additional costs such as stamp duty (property transfer tax), legal fees (solicitors or conveyancers), surveyor fees (for a building survey), and land registry fees.

- Explore different property types: The countryside offers a range of properties, from quaint cottages to sprawling farmhouses and even plots of land requiring new builds. Choose a property type that fits your budget and lifestyle.

- Consider renovation costs: Older properties in the countryside often require renovations. Factor in potential costs for repairs, upgrades, and modernization. A thorough survey is essential to avoid unexpected expenses.

Beyond the Purchase Price: Hidden Costs of Country Living

While the property purchase price is a significant expense, many hidden costs associated with country living can quickly add up. Failing to account for these can derail your idyllic escape.

Increased Utility Bills: The Rural Energy Premium

Rural properties often present higher utility bills than urban equivalents. Older properties may lack insulation and have less energy-efficient appliances.

- Research average utility costs: Contact local utility providers to get an estimate of average electricity, gas, heating oil (common in rural areas), and water bills in your target area.

- Consider energy-efficient upgrades: Investing in insulation, double-glazing, and energy-efficient appliances can significantly reduce your long-term energy costs.

- Explore renewable energy options: Solar panels, wind turbines, and other renewable energy sources can lessen your reliance on traditional energy suppliers and potentially lower your bills.

Transportation Costs: The Price of Rural Isolation

The lack of public transport in many rural areas often necessitates car ownership. This increases your transportation costs considerably.

- Calculate annual car ownership costs: Include fuel, insurance, maintenance, repairs, and potentially the cost of parking.

- Consider alternative transportation: Where possible, explore cycling, walking, or carpooling to reduce reliance on a car and associated costs.

Maintenance and Repairs: Budgeting for the Unexpected

Older properties in the countryside frequently require more maintenance and repairs than newer urban properties. Unexpected problems can quickly drain your finances.

- Set aside a contingency fund: Establish a dedicated savings account for unexpected repairs and maintenance. Aim for a fund covering at least a few months of potential expenses.

- Obtain comprehensive home insurance: Protect yourself against significant unforeseen events with a suitable home insurance policy that covers structural damage, plumbing issues, and other potential problems.

Securing Funding for Your Country Escape: Mortgages, Loans, and Savings

Securing the necessary funding for your country escape will likely involve a combination of savings, mortgages, and potentially personal loans.

Mortgage Options: Finding the Right Loan

Mortgages are a common way to finance a property purchase. Careful research and comparison are crucial.

- Speak to multiple mortgage brokers: Brokers can access a wider range of mortgage options and help you find the best deal for your circumstances.

- Understand mortgage types: Compare fixed-rate mortgages (offering predictable repayments) with variable-rate mortgages (offering potentially lower initial rates but with fluctuating repayments).

Personal Loans and Savings: Supplementing Your Mortgage

If your savings don't cover the entire cost, you may need a personal loan to supplement your mortgage. Maximize your savings contributions to accelerate your move.

- Compare personal loan interest rates: Shop around for the most competitive interest rates and repayment terms.

- Create a detailed savings plan: Set realistic savings goals and milestones to track your progress and ensure you are on track to achieve your countryside dream.

Conclusion: Plan Your Escape to the Country with Confidence

Planning your escape to the country requires meticulous financial planning. From assessing your current financial situation to accounting for hidden costs and securing funding, a comprehensive budget is crucial. By understanding and addressing these key financial considerations, you can significantly increase your chances of a successful and enjoyable move to your dream countryside home. Don't let financial worries derail your plans; start planning your escape to the country today with a robust budget in place. Begin your financial planning now and make your countryside dream a reality.

Featured Posts

-

Tathyr Atfaq Altjart Alsyny Alamryky Ela Mwshr Daks Wswlh Ila 24 Alf Nqtt

May 24, 2025

Tathyr Atfaq Altjart Alsyny Alamryky Ela Mwshr Daks Wswlh Ila 24 Alf Nqtt

May 24, 2025 -

South Florida Hosts The Prestigious Ferrari Challenge Racing Days

May 24, 2025

South Florida Hosts The Prestigious Ferrari Challenge Racing Days

May 24, 2025 -

Ot Evroviziya Do Dnes Promyanata V Zhivota Na Konchita Vurst

May 24, 2025

Ot Evroviziya Do Dnes Promyanata V Zhivota Na Konchita Vurst

May 24, 2025 -

Kyle Walker Night Out In Milan Following Wifes Uk Departure

May 24, 2025

Kyle Walker Night Out In Milan Following Wifes Uk Departure

May 24, 2025 -

Veterans Memorial Elementary Welcomes Lego Master Manny Garcia Photos From The Visit

May 24, 2025

Veterans Memorial Elementary Welcomes Lego Master Manny Garcia Photos From The Visit

May 24, 2025

Latest Posts

-

France To Increase Penalties For Young Offenders A Closer Look At Proposed Legislation

May 24, 2025

France To Increase Penalties For Young Offenders A Closer Look At Proposed Legislation

May 24, 2025 -

Macrons Party Proposes Hijab Ban For Under 15s In Public Spaces

May 24, 2025

Macrons Party Proposes Hijab Ban For Under 15s In Public Spaces

May 24, 2025 -

France Considers Tougher Sentences For Young Criminals

May 24, 2025

France Considers Tougher Sentences For Young Criminals

May 24, 2025 -

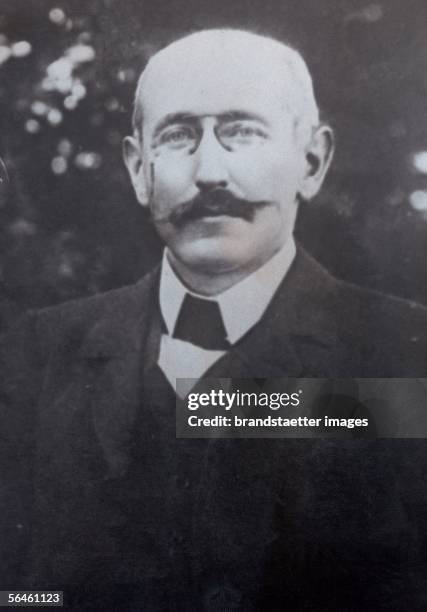

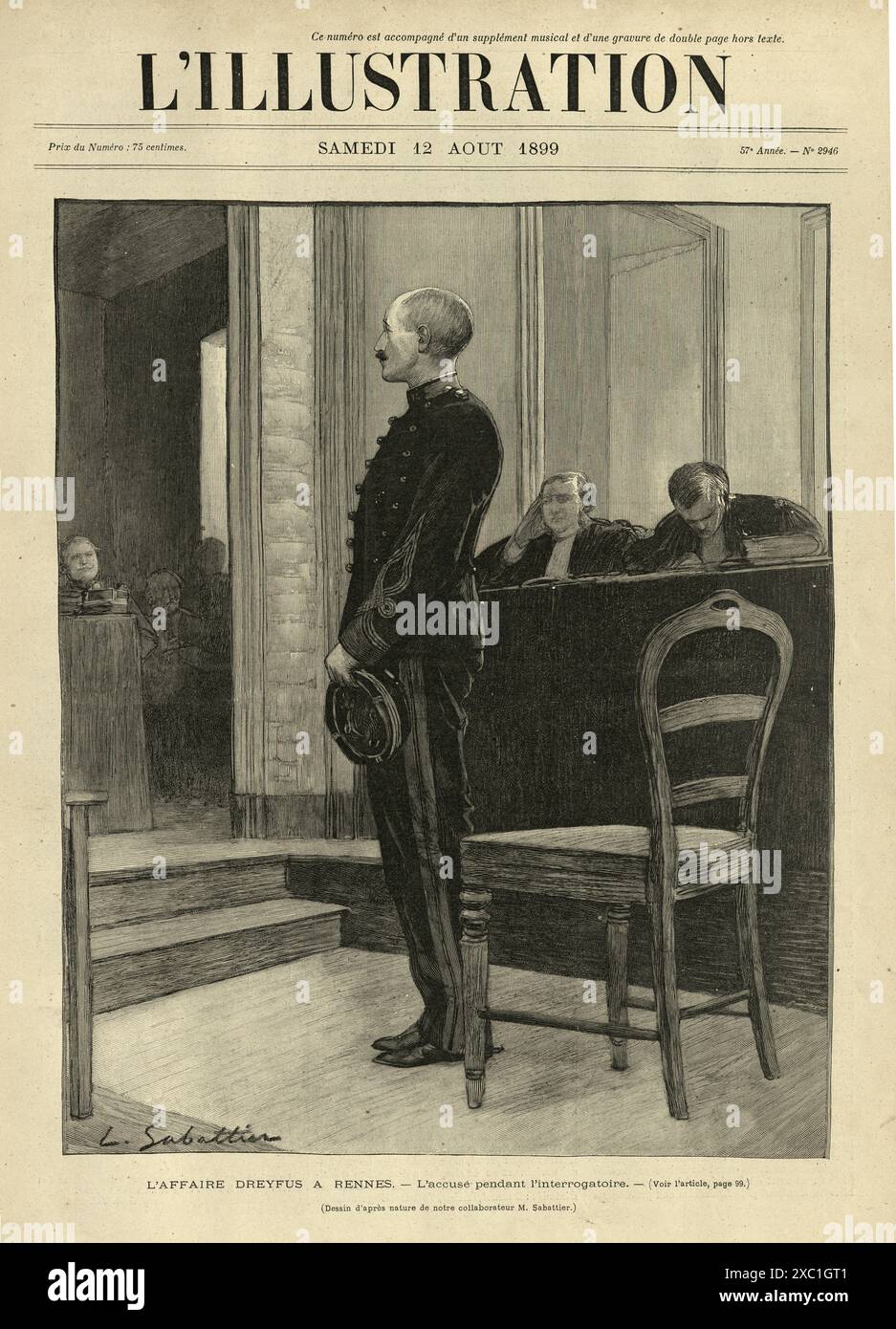

Alfred Dreyfus French Lawmakers Seek To Right A Historical Wrong

May 24, 2025

Alfred Dreyfus French Lawmakers Seek To Right A Historical Wrong

May 24, 2025 -

Dreyfus Affair Lawmakers Propose Posthumous Military Promotion

May 24, 2025

Dreyfus Affair Lawmakers Propose Posthumous Military Promotion

May 24, 2025