Escape To The Country: Budgeting For Your Rural Lifestyle

Table of Contents

Understanding the Higher Costs of Rural Living

While the charm of rural living is undeniable, it's crucial to acknowledge that certain costs can be significantly higher than in urban areas. Let's explore some key areas:

Property Prices and Taxes

Rural properties, while often boasting larger plots and more space, frequently command higher prices per square foot than their urban counterparts. This is due to factors like land scarcity, desirable views, and a generally lower supply of homes. Property taxes also vary greatly depending on location and local government assessments.

- Consider factors like: land size, property age, condition, proximity to amenities, and school districts when comparing prices.

- Research thoroughly: Check local property tax rates and assess potential future increases. Many county websites provide this information.

- Factor in renovation costs: Older rural properties may require significant repairs or renovations, adding substantial costs to your initial investment. Budget for these contingencies.

Increased Transportation Costs

Longer commutes are a common reality of rural living. This translates to higher fuel costs, increased vehicle wear and tear, and potentially the need for a more reliable vehicle.

- Calculate transportation costs: Estimate your daily commute distance and factor in fuel prices, vehicle maintenance, and potential repairs.

- Explore alternatives: Research public transportation options, even if limited, to reduce reliance on a personal vehicle. Carpooling with neighbors could also help.

- Plan for vehicle upkeep: Factor in the cost of regular maintenance, repairs, and potential vehicle replacements into your budget.

Utilities and Services

Access to essential services can differ significantly in rural areas. High-speed internet, for example, might be limited or expensive, requiring satellite internet or other more costly alternatives. Water and heating costs can also vary considerably.

- Research utility costs: Contact local providers to determine the cost of water, electricity, gas, and internet services in your target area.

- Internet access: Investigate internet availability and compare prices from different providers. Satellite internet is often more expensive than cable or fiber.

- Well and septic maintenance: If your property has a well and septic system, budget for regular maintenance and potential repairs. These systems require professional service.

Essential Budget Categories for Rural Living

Beyond the increased costs discussed above, several other budget categories require careful consideration when planning your escape to the country.

Food Costs

Grocery shopping in rural areas can be more challenging and costly. Limited local options, longer distances to supermarkets, and reliance on delivery services can all inflate your food bill.

- Calculate grocery costs: Estimate your weekly or monthly grocery expenses based on your dietary needs and the prices in nearby stores.

- Embrace local sourcing: Consider growing your own food, visiting farmers' markets, or joining a community-supported agriculture (CSA) program to reduce costs and enjoy fresh, local produce.

- Preserve your harvest: If you plan to grow your own food, budget for preserving and storing your harvest to ensure you have food throughout the year.

Home Maintenance and Repairs

Rural properties often require more extensive maintenance and repairs due to factors like exposure to the elements and potentially older infrastructure.

- Budget for maintenance: Allocate a specific amount in your budget for routine maintenance tasks such as lawn care, snow removal, and minor repairs.

- Plan for emergencies: Set aside funds for unexpected repairs, such as plumbing issues, roof damage, or heating system malfunctions.

- Find local contractors: Research and establish relationships with reliable local contractors to ensure efficient and cost-effective repairs when needed.

Unexpected Expenses

Rural living often brings unexpected challenges, from severe weather to wildlife encounters. Flexibility is crucial in your budgeting process.

- Emergency fund: Create a substantial emergency fund to cover unforeseen costs. This fund can act as a safety net for unexpected expenses.

- Insurance coverage: Consider insurance options that specifically address risks associated with rural living, such as damage from severe weather or wildlife infestations.

- Adapt and adjust: Be prepared to adjust your budget as unexpected situations arise, demonstrating flexibility and responsiveness to unforeseen circumstances.

Strategies for Successful Budgeting for Your Rural Escape

Planning a successful escape to the country requires a proactive and adaptable approach to budgeting.

Detailed Financial Planning

Develop a thorough budget that incorporates all aspects of rural living, both fixed and variable expenses.

- Use budgeting tools: Employ budgeting apps, spreadsheets, or financial software to track income and expenses effectively.

- Regular review: Regularly review and adjust your budget to reflect changing circumstances and seasonal variations in costs.

- Set realistic goals: Establish clear financial goals and milestones to help you stay on track and achieve your rural living dream.

Seeking Local Advice

Connect with existing rural residents to gain valuable insights into the realities of living in your chosen area.

- Network: Attend local community events, meetings, or farmers' markets to interact with residents.

- Talk to neighbors: Speak to neighbors or local business owners to understand the local costs of living and any hidden expenses.

- Join online forums: Engage in online forums or social media groups focused on your target rural community to gather information and advice from experienced residents.

Embrace a Sustainable Lifestyle

Adopting a sustainable lifestyle not only benefits the environment but can also translate to significant cost savings.

- Energy efficiency: Invest in energy-efficient appliances and adopt energy-saving practices to reduce utility bills.

- Renewable energy: Explore the possibility of incorporating renewable energy sources, such as solar panels, to decrease reliance on conventional energy.

- Homegrown food: Growing your own food significantly reduces grocery costs and promotes a healthier lifestyle.

Conclusion

Successfully planning your escape to the country requires a thorough understanding of the unique financial considerations involved. By carefully analyzing the higher costs associated with property, transportation, utilities, and home maintenance, and by creating a detailed and flexible budget, you can ensure a smooth and financially secure transition. Remember to thoroughly research your chosen area, seek local advice, and embrace a sustainable lifestyle. Start planning your escape to the country today and embrace the tranquil life you deserve!

Featured Posts

-

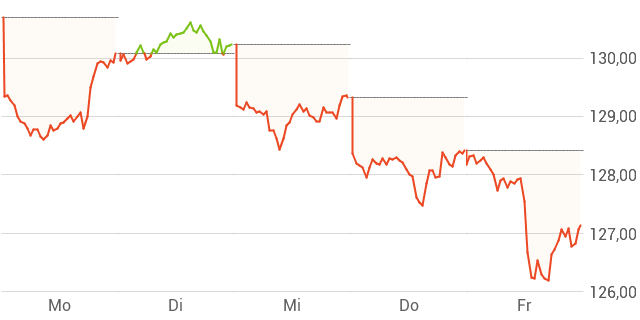

Amundi Msci All Country World Ucits Etf Usd Acc Understanding Net Asset Value Nav

May 24, 2025

Amundi Msci All Country World Ucits Etf Usd Acc Understanding Net Asset Value Nav

May 24, 2025 -

Lauryn Goodman And Kyle Walker Unpacking The Italian Relocation

May 24, 2025

Lauryn Goodman And Kyle Walker Unpacking The Italian Relocation

May 24, 2025 -

Daxs Rise A Wall Street Recoverys Potential Impact

May 24, 2025

Daxs Rise A Wall Street Recoverys Potential Impact

May 24, 2025 -

Live Pedestrian Vs Vehicle Accident On Princess Road Ongoing Updates

May 24, 2025

Live Pedestrian Vs Vehicle Accident On Princess Road Ongoing Updates

May 24, 2025 -

Important Notice

May 24, 2025

Important Notice

May 24, 2025

Latest Posts

-

European Shares Rise On Trump Tariff Relief Hints Lvmh Slumps

May 24, 2025

European Shares Rise On Trump Tariff Relief Hints Lvmh Slumps

May 24, 2025 -

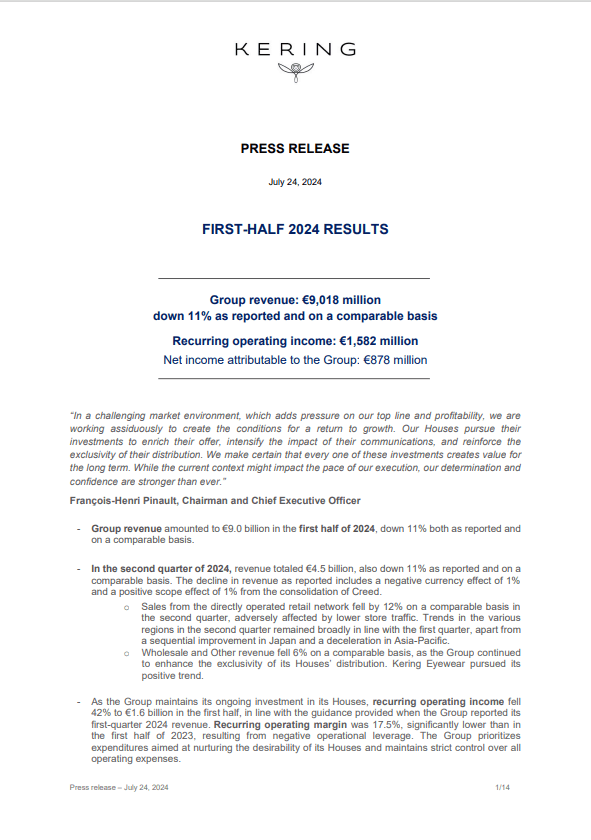

Kering Q1 Results 6 Share Price Drop Highlights Challenges

May 24, 2025

Kering Q1 Results 6 Share Price Drop Highlights Challenges

May 24, 2025 -

Is Jordan Bardella The Future Of French Politics

May 24, 2025

Is Jordan Bardella The Future Of French Politics

May 24, 2025 -

6 Kering Share Slump Q1 Results Fall Short Of Expectations

May 24, 2025

6 Kering Share Slump Q1 Results Fall Short Of Expectations

May 24, 2025 -

French Election 2027 Jordan Bardellas Path To Power

May 24, 2025

French Election 2027 Jordan Bardellas Path To Power

May 24, 2025