ETF Sales Pressure: Taiwan's Financial Regulator Launches Investigation

Table of Contents

The Trigger for the Investigation: Unusually High ETF Sales Volume

The catalyst for the FSC's investigation is an unusually sharp increase in ETF sales volume over the past [insert timeframe, e.g., two weeks]. This surge wasn't evenly distributed across all ETFs; specific instruments experienced disproportionately high sell-offs, leading to significant price fluctuations and raising red flags among market analysts and investors. These unusual trading patterns have fueled speculation about potential manipulation within the market.

- Specific ETFs affected: [Insert names of specific ETFs experiencing high sales volume. e.g., 0050 (Taiwan 50 ETF), 006208 (FTSE Taiwan Mid Cap ETF)]

- Dates of significant sales activity: [Insert specific dates of unusual trading activity]

- Percentage changes in trading volume and prices: [Insert data showing percentage increases in trading volume and corresponding price drops for affected ETFs. e.g., "Trading volume in 0050 increased by 300% on [date], with the price dropping by 5%."]

The concerns stem not only from the sheer volume but also the seemingly coordinated nature of the sales. Many market analysts are expressing apprehension about the possibility of concerted efforts to depress ETF prices, potentially for illicit gains. This situation underscores the critical need for robust regulatory oversight in maintaining a fair and transparent trading environment.

The FSC's Response: Scope and Objectives of the Investigation

The FSC has officially announced a comprehensive investigation into the matter, stating its commitment to ensuring market integrity and protecting investors. The investigation's scope extends to several potential violations, including:

- Market manipulation: The FSC is scrutinizing trading activities to identify any evidence of artificial price suppression or other actions designed to mislead the market.

- Insider trading: Investigators will explore whether any individuals or entities possessed material non-public information before engaging in large-scale ETF sales.

- Unlawful short-selling: The investigation will assess whether short-selling activities played a role in the recent price declines and if any regulations were violated.

The investigative process will likely involve:

- Review of trading records: Analyzing detailed trading data to identify suspicious patterns and unusual transactions.

- Interviews with key individuals: Gathering information from market participants, brokers, and potentially implicated individuals.

- Examination of corporate records: Reviewing documents from companies involved in the trading of the affected ETFs.

The potential penalties for those found guilty of market manipulation or other violations are severe, ranging from substantial fines to criminal prosecution.

- Key individuals and institutions under investigation: [If known, list the individuals and institutions involved in the investigation]

- Specific regulations being examined: [List specific regulations under scrutiny by the FSC]

- Potential penalties for violations: [Detail potential punishments for violating market regulations, such as fines or jail time]

Impact on the Taiwanese Stock Market and Investor Confidence

The investigation into the ETF sales pressure is already having a noticeable impact on the Taiwanese stock market. Investor confidence has been shaken, leading to increased market volatility. While the immediate effect has been negative, the long-term consequences remain uncertain.

- Changes in market indices: [Mention specific changes in key market indices, e.g., the TAIEX]

- Investor reactions and market outlooks: [Describe how investors are reacting and what the future outlook may be]

- Potential effects on foreign investment: [Discuss the potential impact on foreign investments into Taiwan's stock market]

The FSC's decisive action, while potentially disruptive in the short term, is crucial for restoring confidence in the market’s integrity. A transparent and thorough investigation is vital to reassuring both domestic and international investors that the Taiwanese market is a safe and reliable place to invest.

Related Keywords: Market Manipulation, Insider Trading, Regulatory Scrutiny in Taiwan

The investigation highlights the crucial role of strong regulatory frameworks in combating market manipulation and insider trading. The FSC's active response demonstrates the increasing regulatory scrutiny in Taiwan, emphasizing its commitment to maintaining a level playing field for all investors. The situation underscores the interconnectedness of global markets and the need for consistent oversight to prevent illicit activities from undermining investor trust and market stability.

Conclusion: ETF Sales Pressure and the Future of Taiwan's Market

The recent surge in ETF sales pressure in Taiwan has triggered a significant investigation by the FSC, highlighting concerns about potential market manipulation and other irregularities. The investigation's outcome will have far-reaching consequences for the Taiwanese stock market, affecting investor confidence, foreign investment flows, and the future of ETF trading in the country. The FSC's commitment to a thorough investigation is a crucial step in maintaining a fair and transparent market environment.

It is vital for investors to stay informed about further developments in this ongoing investigation into ETF sales pressure. Following reputable financial news sources for updates is critical to understanding the situation and its effects on the market. Further research on Taiwanese ETF regulations and market manipulation in Asia can provide a more comprehensive understanding of this complex issue. Stay informed and stay invested wisely.

Featured Posts

-

At And T Challenges Broadcoms V Mware Price Hike A 1 050 Jump

May 15, 2025

At And T Challenges Broadcoms V Mware Price Hike A 1 050 Jump

May 15, 2025 -

Ovechkin Noviy Rekord V Pley Off N Kh L

May 15, 2025

Ovechkin Noviy Rekord V Pley Off N Kh L

May 15, 2025 -

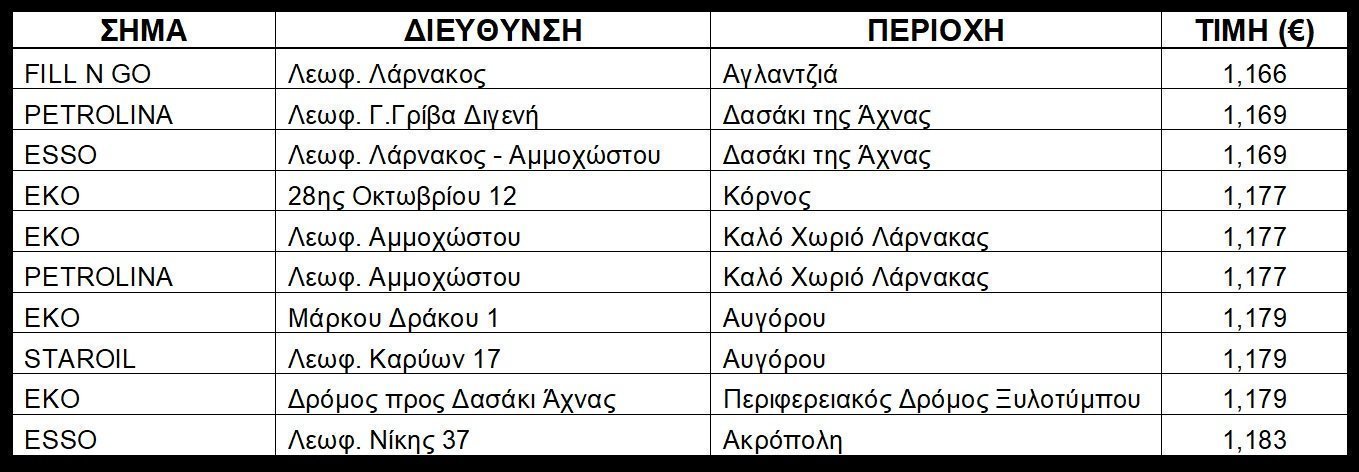

Times Kaysimon Kypros Breite Ta Fthinotera Pratiria

May 15, 2025

Times Kaysimon Kypros Breite Ta Fthinotera Pratiria

May 15, 2025 -

Nhl Fans Outraged By Unclear Draft Lottery Procedures

May 15, 2025

Nhl Fans Outraged By Unclear Draft Lottery Procedures

May 15, 2025 -

Selling Sunset Star Highlights Post Fire Rent Hikes In Los Angeles

May 15, 2025

Selling Sunset Star Highlights Post Fire Rent Hikes In Los Angeles

May 15, 2025

Latest Posts

-

Avalanche Vs Maple Leafs Prediction Game Preview And Picks For March 19th

May 15, 2025

Avalanche Vs Maple Leafs Prediction Game Preview And Picks For March 19th

May 15, 2025 -

Round 1 Game 2 Live Stream Senators Vs Maple Leafs Nhl Playoffs

May 15, 2025

Round 1 Game 2 Live Stream Senators Vs Maple Leafs Nhl Playoffs

May 15, 2025 -

Maple Leafs Secure 2 1 Win Against Avalanche In Tense Matchup

May 15, 2025

Maple Leafs Secure 2 1 Win Against Avalanche In Tense Matchup

May 15, 2025 -

Hard Fought 2 1 Victory For Maple Leafs Over Avalanche

May 15, 2025

Hard Fought 2 1 Victory For Maple Leafs Over Avalanche

May 15, 2025 -

Nhl Playoffs Senators Vs Maple Leafs Live Stream April 22nd 25th Game 2

May 15, 2025

Nhl Playoffs Senators Vs Maple Leafs Live Stream April 22nd 25th Game 2

May 15, 2025