ETFs: The Safe Haven For Investors Amidst Market Instability

Table of Contents

Diversification: The Cornerstone of ETF Stability

Diversification is a fundamental principle of successful investing. By spreading your investments across different asset classes, you significantly reduce your exposure to the risks associated with any single investment. ETFs excel in this area, offering instant diversification that would be difficult and time-consuming to achieve by picking individual stocks.

- Sector ETFs: These ETFs allow you to gain exposure to specific sectors of the economy, such as technology (e.g., Technology Select Sector SPDR Fund (XLK)), healthcare (e.g., Health Care Select Sector SPDR Fund (XLV)), or energy (e.g., Energy Select Sector SPDR Fund (XLE)). This helps you tailor your portfolio to your beliefs about future economic growth.

- Geographic ETFs: Investing in ETFs focused on specific geographic regions or countries (e.g., iShares MSCI Emerging Markets ETF (EEM), Vanguard FTSE Developed Markets ETF (VEA)) diversifies your portfolio geographically, reducing your dependence on a single national economy. This is especially important in times of global uncertainty.

- Bond ETFs: ETFs invested in bonds (e.g., iShares Core U.S. Aggregate Bond ETF (AGG), Vanguard Total Bond Market ETF (BND)) provide a counterbalance to the volatility often seen in the stock market. They offer a more stable income stream and can help cushion your portfolio during market downturns.

This readily available diversification offered by ETFs contrasts sharply with the painstaking research and higher risk associated with individually picking stocks across various sectors and geographies.

Lower Costs and Enhanced Accessibility

One of the significant advantages of ETFs is their generally lower expense ratios compared to actively managed mutual funds. This means more of your investment returns work for you, not the fund manager. Furthermore, ETFs trade on major stock exchanges just like individual stocks, making them easy to buy and sell throughout the trading day.

- Lower management fees: ETFs typically have significantly lower annual fees than actively managed mutual funds.

- Transparent pricing: The price of an ETF is readily available throughout the trading day, promoting transparency.

- Reduced transaction costs: Buying and selling ETFs is generally cheaper than trading individual stocks in many cases, especially for smaller trades.

- Fractional shares: Many brokerages allow you to buy fractional shares of ETFs, making them accessible to investors with limited capital.

Transparency and Liquidity

ETFs offer a high degree of transparency. You can easily see the holdings of the ETF, allowing you to understand precisely what you're investing in. This contrasts with some investment vehicles where the underlying assets are less transparent. Additionally, the high liquidity of ETFs means they can be readily bought and sold, providing you with access to your money when you need it.

- Real-time pricing: ETF prices are updated throughout the trading day, giving you a clear picture of your investment's value.

- Easy to trade throughout the day: Unlike mutual funds, which are only priced at the end of the day, ETFs can be traded at any point during market hours.

- High trading volume: The high trading volume of many ETFs ensures that you can typically buy or sell them without significantly impacting the price.

Strategic Asset Allocation with ETFs

ETFs are invaluable tools for implementing a strategic asset allocation plan. By combining different ETFs – such as those focused on stocks, bonds, and real estate – you can tailor your portfolio to your specific risk tolerance and investment goals. Regular rebalancing, easily done with ETFs, ensures that your portfolio remains aligned with your target asset allocation.

- Tailored portfolio construction: Combine various ETFs to create a portfolio perfectly suited to your risk profile and financial aspirations.

- Easy rebalancing: Adjust your portfolio's allocation as needed to maintain your desired asset mix.

- Risk management tools: ETFs provide a versatile way to manage risk by diversifying across asset classes and adjusting allocations over time.

Conclusion

In conclusion, ETFs offer a compelling combination of diversification, low costs, transparency, and liquidity, making them a safe haven for investors navigating market instability. By strategically allocating assets across various ETFs, investors can mitigate risk and work toward their financial goals, even during periods of uncertainty. Don't let market uncertainty derail your financial goals. Start exploring the world of ETFs today and build a more resilient investment portfolio. Begin your journey towards a more secure financial future by researching different ETF options that suit your investment style and risk tolerance.

Featured Posts

-

Short Term Rental Contract Ban A Year Later Could It Be Scrapped

May 28, 2025

Short Term Rental Contract Ban A Year Later Could It Be Scrapped

May 28, 2025 -

Sinners Strong Start Top Half Draw At The French Open

May 28, 2025

Sinners Strong Start Top Half Draw At The French Open

May 28, 2025 -

Significant Padres Drop In Latest National Mlb Power Rankings

May 28, 2025

Significant Padres Drop In Latest National Mlb Power Rankings

May 28, 2025 -

Urgent Search Bryan County Sheriffs Office Looking For Missing Teen

May 28, 2025

Urgent Search Bryan County Sheriffs Office Looking For Missing Teen

May 28, 2025 -

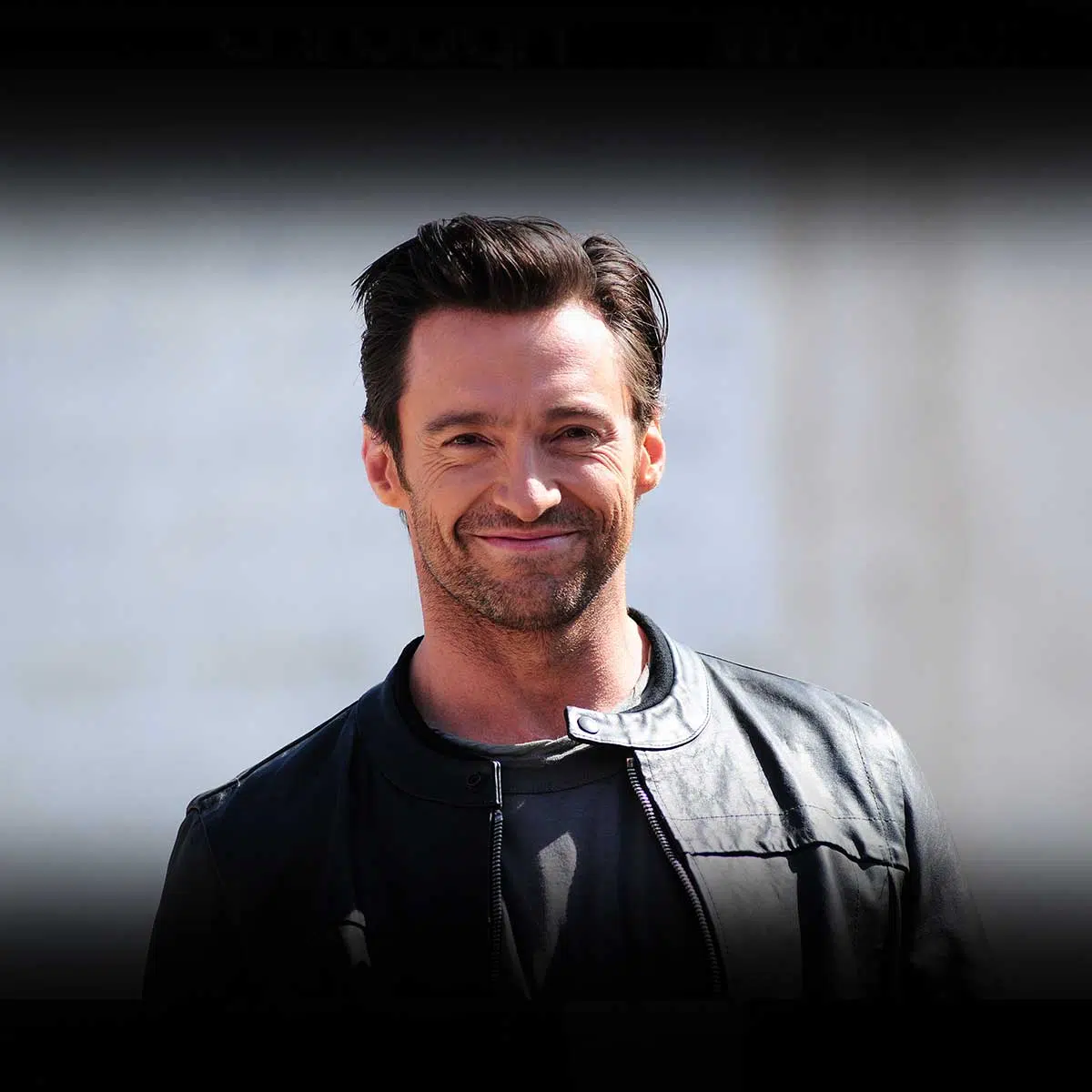

Hugh Jackmans Personal Life Age Difference And Career Considerations

May 28, 2025

Hugh Jackmans Personal Life Age Difference And Career Considerations

May 28, 2025

Latest Posts

-

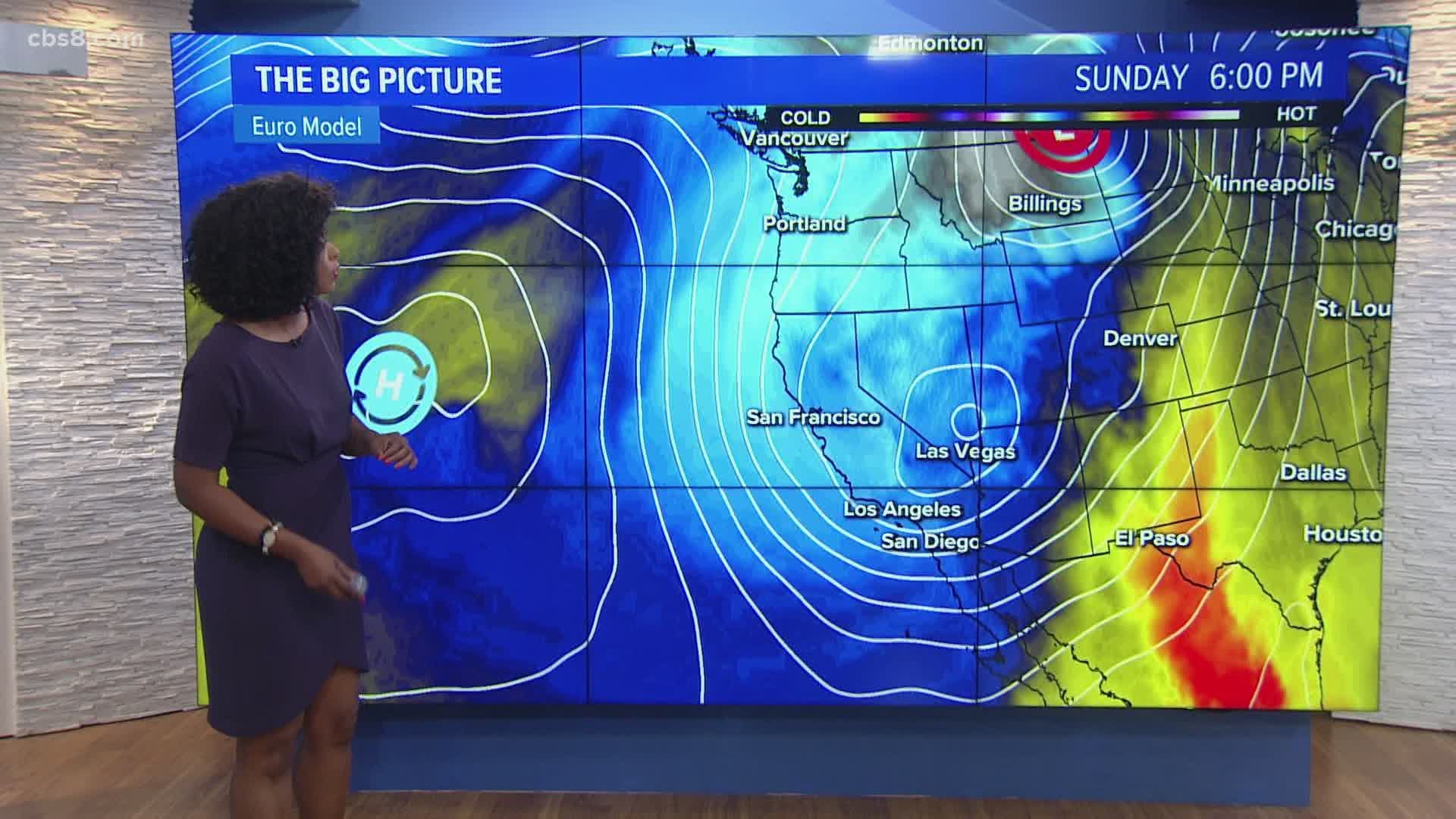

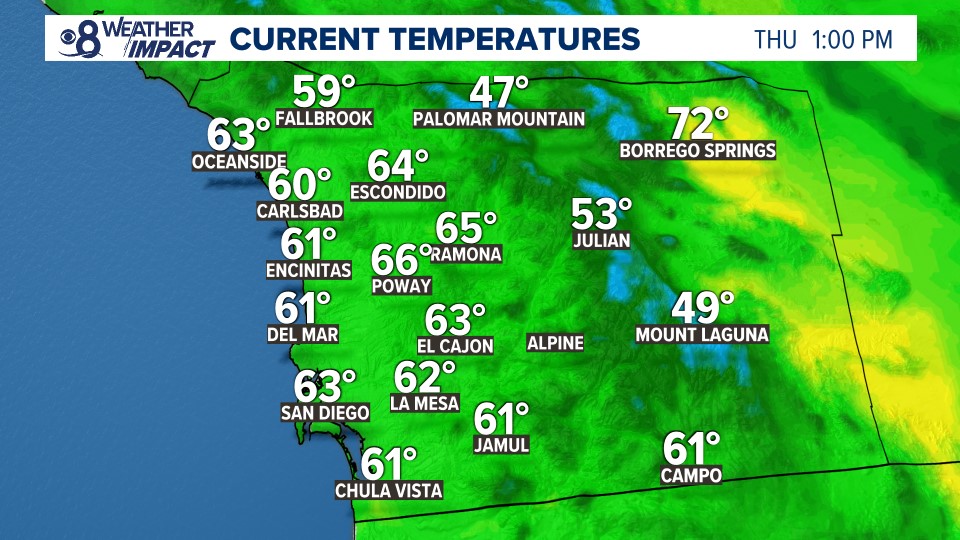

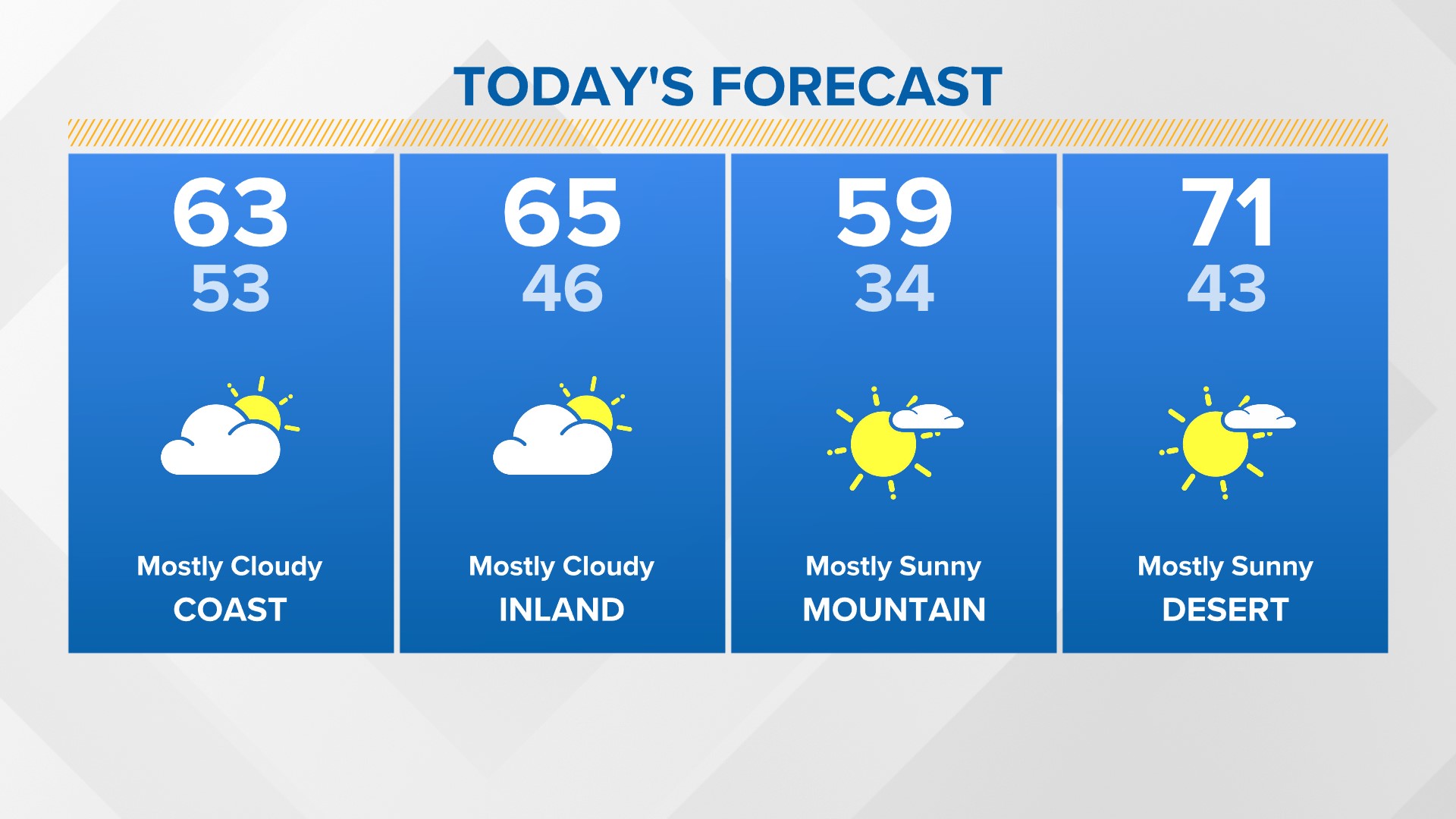

San Diego County Weather Fog Cooler Temperatures And Possible Light Showers

May 30, 2025

San Diego County Weather Fog Cooler Temperatures And Possible Light Showers

May 30, 2025 -

San Diego Weather 4 Day Forecast Of Warm Sunny Conditions

May 30, 2025

San Diego Weather 4 Day Forecast Of Warm Sunny Conditions

May 30, 2025 -

Four Days Of Sunshine San Diego County Weather Forecast

May 30, 2025

Four Days Of Sunshine San Diego County Weather Forecast

May 30, 2025 -

San Diego County Four Days Of Warm Sunny Weather Ahead

May 30, 2025

San Diego County Four Days Of Warm Sunny Weather Ahead

May 30, 2025 -

March Rainfall A Step Towards Relieving Water Shortages

May 30, 2025

March Rainfall A Step Towards Relieving Water Shortages

May 30, 2025