Ethereum Price: 1.11M ETH Accumulated - Bullish Market Outlook

Table of Contents

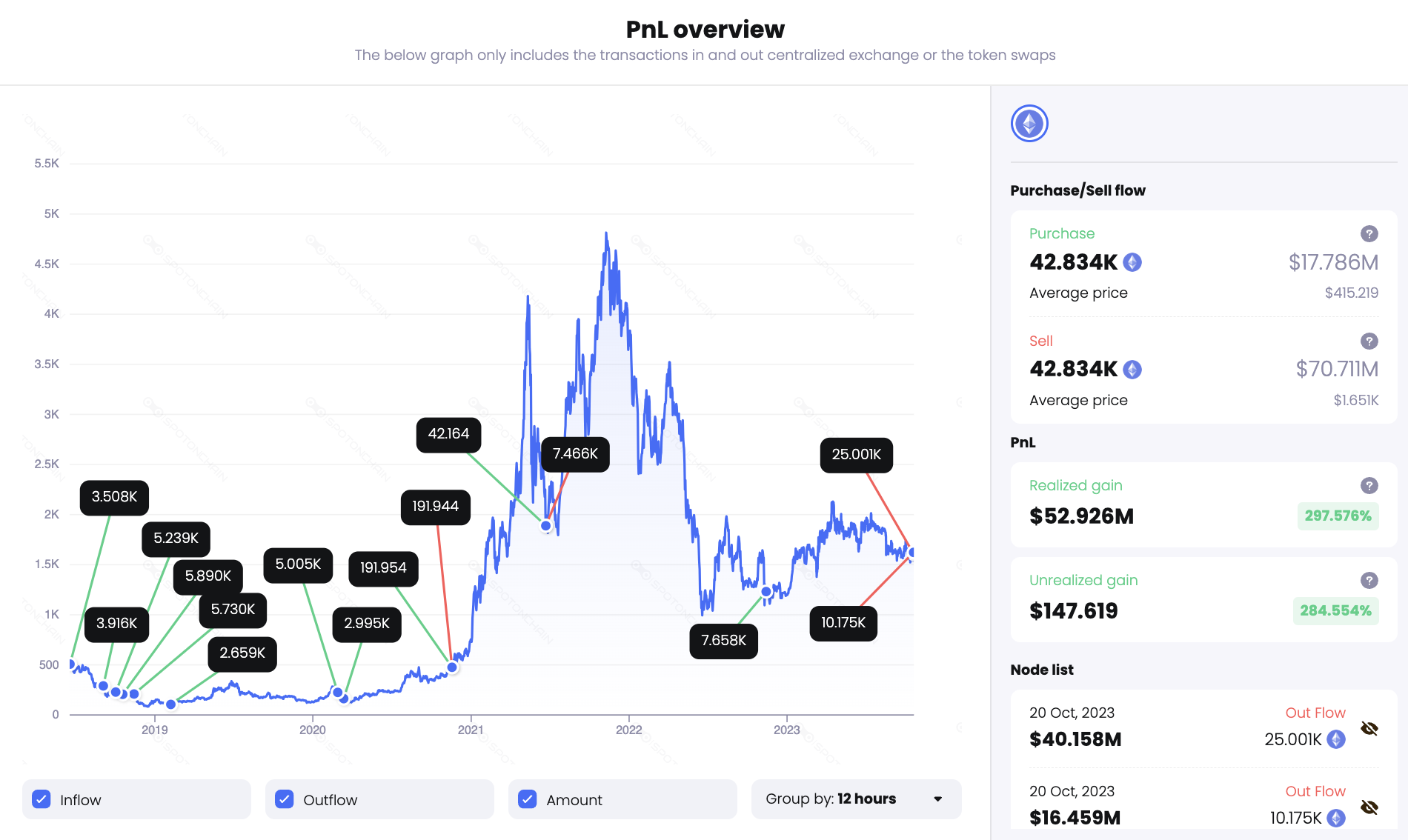

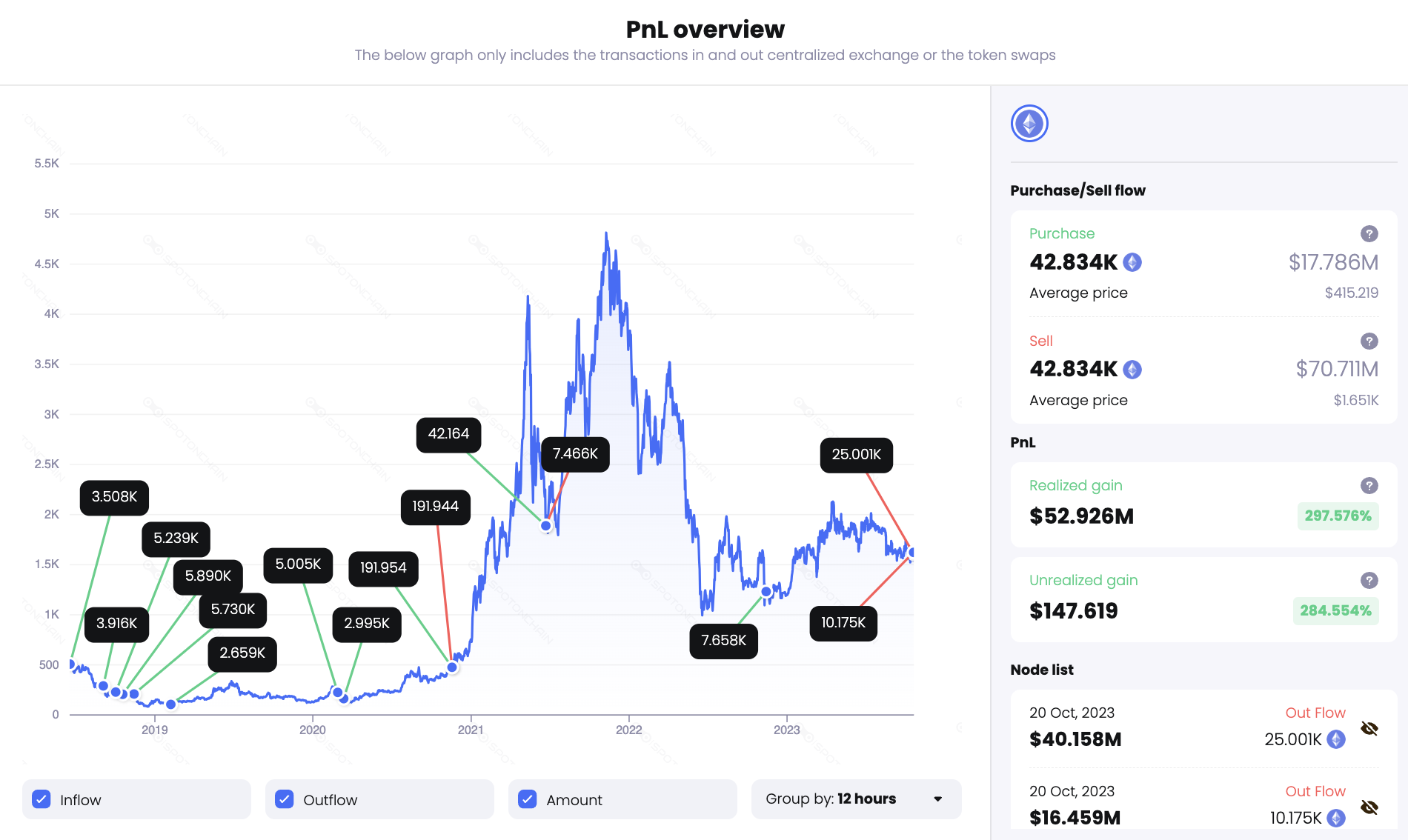

The Significance of 1.11M ETH Accumulation

The accumulation of 1.11 million ETH represents a substantial portion of the total ETH supply, potentially exerting significant buying pressure on the market. This volume of ETH, depending on the timeframe of accumulation, indicates substantial capital inflow into the Ethereum ecosystem. Understanding who is accumulating this ETH is crucial. While precise identification is challenging, potential actors include:

- Ethereum Whales: Large holders of ETH, often with significant influence on market movements. Their actions often serve as leading indicators of price trends. Increased Ethereum whale activity is a key factor to watch.

- Institutional Investors: The growing institutional adoption of cryptocurrencies, including Ethereum, suggests a shift towards mainstream acceptance and increased investment.

- Retail Investors: A growing number of retail investors are also showing interest in accumulating ETH, driven by factors like DeFi applications and the overall potential of the Ethereum network.

Impact of this accumulation:

- Impact on ETH Supply: This massive accumulation reduces the circulating supply of ETH, potentially leading to scarcity and price appreciation. Analyzing ETH supply dynamics is crucial for understanding long-term price trends.

- Potential Price Implications: The increased demand and reduced supply can lead to a surge in Ethereum's price, driving the bullish market sentiment. On-chain analysis supports this conclusion.

- Comparison to Previous Accumulation Periods: Comparing the current accumulation with past trends can help determine whether this is an exceptional event or part of a recurring pattern. Analyzing historical data provides crucial context.

[Insert relevant chart illustrating the ETH accumulation here]

Factors Contributing to the Bullish Ethereum Price Outlook

Several factors contribute to the optimistic Ethereum price outlook, supporting the bullish market predictions:

- Increased Institutional Adoption of Ethereum: Major financial institutions are increasingly investing in Ethereum, viewing it as a valuable asset and a key player in the blockchain space. Institutional investment in Ethereum is a significant driver of price appreciation.

- Growing DeFi Ecosystem and Applications: The booming decentralized finance (DeFi) ecosystem built on Ethereum continues to attract users and developers, fostering innovation and increasing demand for ETH. Ethereum DeFi applications are a major catalyst for growth.

- Development Updates and Network Upgrades: Significant developments like the Shanghai upgrade improve Ethereum's scalability, efficiency, and functionality, further bolstering its value proposition. Ethereum 2.0 development and upgrades are pivotal for long-term success.

- Positive Regulatory Developments (if any): While regulatory clarity remains a challenge, positive developments in certain jurisdictions could further enhance investor confidence and drive price appreciation. Analyzing Ethereum regulation and its implications is important.

Potential Risks and Challenges

Despite the bullish outlook, it's crucial to acknowledge potential risks and challenges:

- Macroeconomic Factors: Global macroeconomic conditions, including inflation and potential recession, can significantly impact investor sentiment and cryptocurrency markets. Ethereum market volatility is influenced by these external factors.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies remains uncertain in many parts of the world, posing potential risks to the market.

- Competition from Other Cryptocurrencies: Ethereum faces competition from other blockchain platforms, which could affect its market share and price.

- Potential for Market Corrections: Like any asset class, the cryptocurrency market is prone to corrections, and Ethereum's price could experience temporary dips. Understanding Ethereum price correction patterns is important.

Ethereum Price Prediction and Trading Strategies

Predicting the exact Ethereum price is impossible. However, based on the current accumulation and positive factors, a cautiously optimistic outlook seems reasonable. Remember, this is not financial advice. Any investment decision should be based on your own thorough research and risk tolerance.

Potential trading strategies:

- Technical Analysis: Use indicators like moving averages and RSI to identify potential entry and exit points, but always manage your risk. Ethereum technical analysis can assist with decision-making.

- Fundamental Analysis: Consider the underlying factors influencing Ethereum's value, such as adoption rates, network upgrades, and regulatory changes.

- Risk Management: Implement appropriate risk management techniques, including stop-loss orders and diversification, to protect your investment. Ethereum investment strategy requires robust risk management.

Conclusion: Navigating the Bullish Ethereum Market – Your Next Steps

The accumulation of 1.11 million ETH, coupled with positive market developments, suggests a bullish outlook for Ethereum's price. However, potential risks and market volatility must be acknowledged. This Ethereum price analysis highlights the need for thorough research and careful consideration before making any investment decisions. Conduct your own in-depth research, stay informed about Ethereum market trends, and make investment decisions based on your own risk tolerance. Understanding Ethereum price analysis and market dynamics is critical for successful investment in the space. Consider your Ethereum investment strategy carefully.

Featured Posts

-

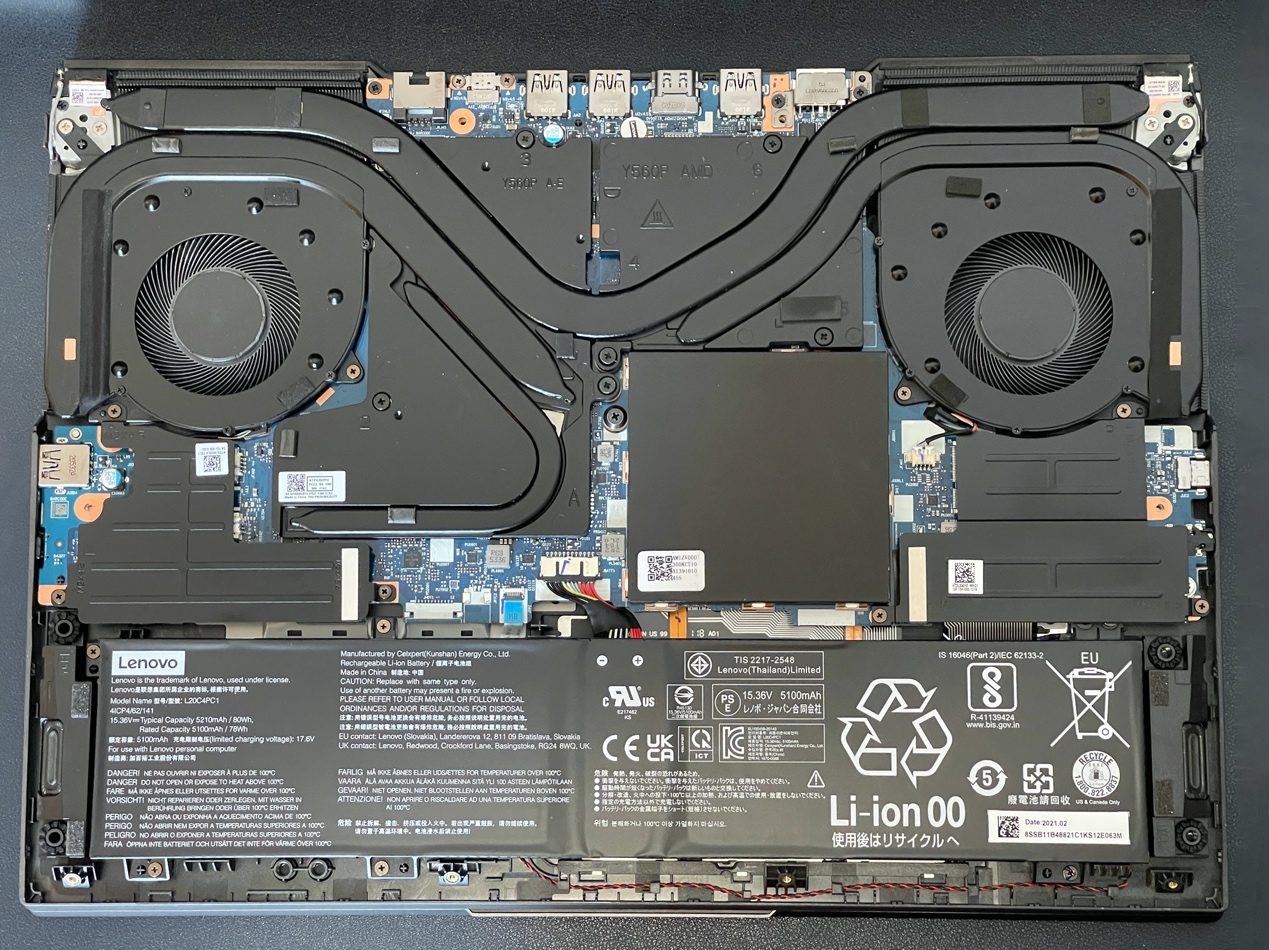

Ps 5 Pro Disassembly Inside The Liquid Metal Cooling

May 08, 2025

Ps 5 Pro Disassembly Inside The Liquid Metal Cooling

May 08, 2025 -

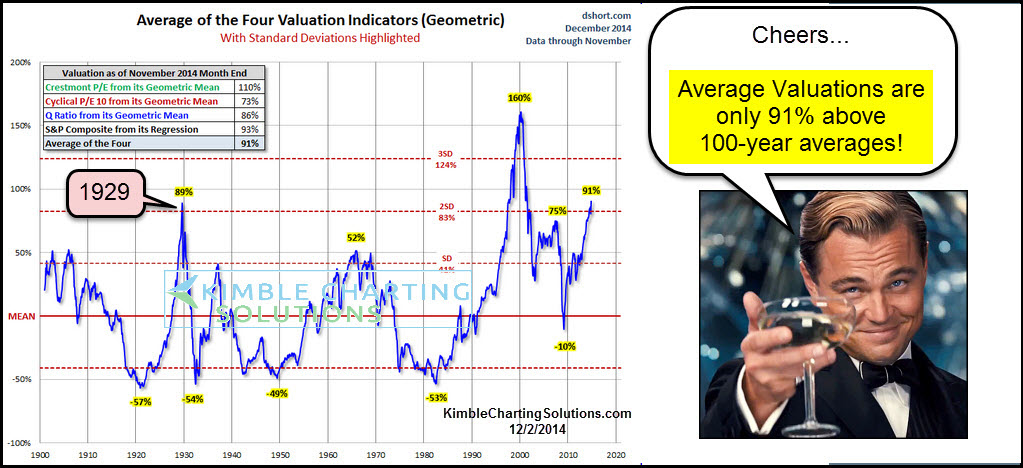

Addressing Investor Concerns Bof A On Elevated Stock Market Valuations

May 08, 2025

Addressing Investor Concerns Bof A On Elevated Stock Market Valuations

May 08, 2025 -

Calf Injury Could Sideline Inters Zielinski For Several Weeks

May 08, 2025

Calf Injury Could Sideline Inters Zielinski For Several Weeks

May 08, 2025 -

De Andre Hopkins Joins Ravens Contract Terms And Impact

May 08, 2025

De Andre Hopkins Joins Ravens Contract Terms And Impact

May 08, 2025 -

The Essence Of Success Jayson Tatums Journey From Grooming To Coaching

May 08, 2025

The Essence Of Success Jayson Tatums Journey From Grooming To Coaching

May 08, 2025