Ethereum Price Action: Analysis And $2,000 Price Prediction

Table of Contents

Current Market Conditions Affecting Ethereum Price

Several macroeconomic factors and regulatory developments significantly influence Ethereum's price action. Understanding these conditions is key to any accurate Ethereum price analysis.

Macroeconomic Factors

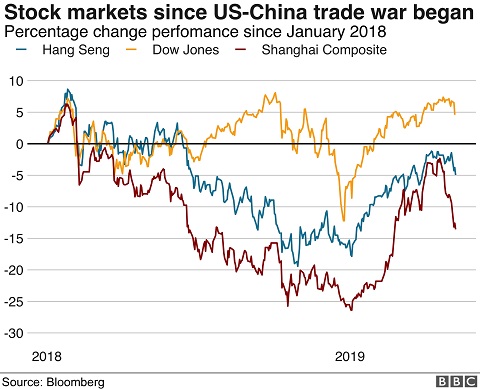

Global economic trends heavily impact cryptocurrency markets, and Ethereum is no exception.

- Impact of Inflation on Crypto Investment: High inflation often drives investors towards alternative assets like cryptocurrencies, potentially increasing demand for ETH. However, aggressive interest rate hikes to combat inflation can simultaneously decrease risk appetite, impacting ETH price negatively.

- Correlation Between Interest Rates and ETH Price: Rising interest rates generally lead to lower cryptocurrency prices as investors move towards higher-yielding, less risky assets. This inverse correlation has been observed historically with ETH.

- Investor Sentiment in Relation to Recessionary Predictions: Fears of a recession can lead to a flight to safety, causing investors to liquidate their holdings in riskier assets, including ETH, resulting in price drops.

Regulatory Landscape

The regulatory environment surrounding cryptocurrencies significantly affects investor confidence and, consequently, Ethereum's price.

- Specific Examples of Regulations Affecting Crypto: Recent SEC actions against cryptocurrency exchanges and the ongoing debate surrounding regulatory frameworks for digital assets create uncertainty and volatility.

- Potential Future Regulatory Impacts: Future regulatory clarity (or lack thereof) in various jurisdictions will play a crucial role in shaping the Ethereum price trajectory. Stringent regulations could stifle growth, while a favorable regulatory environment could boost investor confidence.

- Effect on Investor Confidence: Uncertainty around regulations can cause investors to hesitate, leading to lower trading volumes and price suppression.

Bitcoin's Influence on Ethereum

Bitcoin's price movements often correlate with Ethereum's, although the degree of correlation fluctuates.

- Historical Correlation Data: Historically, there's been a positive correlation between Bitcoin and Ethereum prices; when Bitcoin rises, Ethereum often follows suit, and vice versa.

- Analysis of How Bitcoin's Price Affects Investor Sentiment Towards ETH: Bitcoin's price often acts as a leading indicator for the broader crypto market, influencing overall investor sentiment and consequently affecting ETH price.

- Potential for Decoupling: While correlation exists, there's growing discussion about the potential for Ethereum to decouple from Bitcoin's price movements as its own ecosystem and utility grow.

On-Chain Metrics and Technical Analysis

Analyzing on-chain data and employing technical analysis provide valuable insights into Ethereum's price action.

Analyzing On-Chain Data

On-chain metrics offer a glimpse into the health and activity of the Ethereum network.

- Specific Examples of On-Chain Data and Their Interpretations: Active addresses, transaction volume, and gas fees provide indicators of network usage and potential future demand. High network activity often correlates with bullish price action.

- How These Metrics Can Predict Price Trends: Sustained increases in active addresses and transaction volume, for instance, can suggest growing adoption and potentially lead to price appreciation.

Technical Analysis of ETH Charts

Technical analysis of ETH charts helps identify potential price trends and predict future movements.

- Key Technical Indicators: Moving averages, Relative Strength Index (RSI), and candlestick patterns are commonly used to analyze price trends and identify potential support and resistance levels.

- Interpretation of Chart Patterns: Identifying chart patterns like head and shoulders or double tops/bottoms can provide signals about potential price reversals.

- Identification of Support and Resistance Levels: Support and resistance levels indicate price areas where buying or selling pressure is likely to be strong, offering potential price targets.

Ethereum's Development and Future Potential

Ethereum's ongoing development and its role in the DeFi ecosystem are critical factors shaping its long-term price potential.

Upcoming Upgrades and Developments

Significant upgrades are constantly enhancing Ethereum's capabilities.

- Specific Examples of Upgrades: Ethereum 2.0 (now in progress), scaling solutions like layer-2 protocols, and improvements to network efficiency are all positive factors for long-term price growth.

- Their Expected Impact on Network Efficiency: These upgrades aim to increase transaction speeds and reduce costs, making Ethereum more attractive to developers and users.

- How These Improvements Might Attract More Investors: Improved efficiency and scalability can attract more institutional and individual investors, driving up demand and potentially the price.

Ethereum's Role in the DeFi Ecosystem

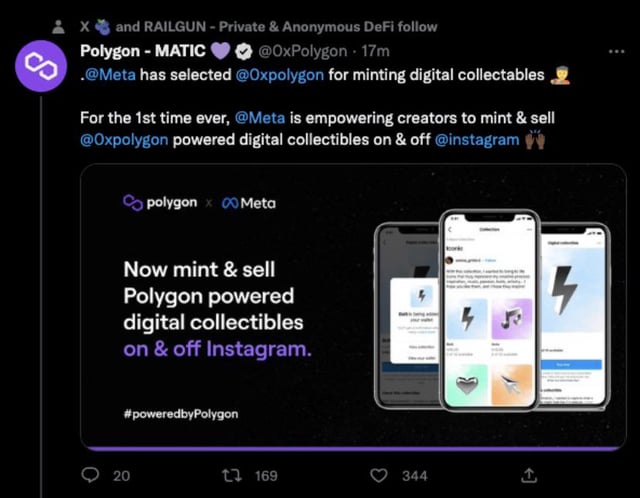

Ethereum is the leading platform for decentralized finance (DeFi) applications.

- Growth of DeFi Applications on Ethereum: The explosive growth of DeFi applications on Ethereum indicates a thriving ecosystem and strong potential for future expansion.

- The Connection Between DeFi Growth and ETH Price: As DeFi adoption increases, demand for ETH (used for transactions and governance) is likely to rise, positively impacting its price.

- Future Potential of DeFi on the Ethereum Network: The continued innovation and growth in the DeFi space are bullish signals for ETH's long-term price outlook.

Institutional Adoption and Investment

Growing institutional adoption of Ethereum signifies increasing mainstream acceptance.

- Examples of Institutional Investors Adopting ETH: Large investment firms and hedge funds are increasingly adding ETH to their portfolios, showing growing confidence in the asset.

- The Effect of Institutional Investment on Price Stability: Institutional investments can contribute to greater price stability and reduce volatility.

- Potential for Future Institutional Inflows: Further institutional adoption could drive significant demand and price appreciation.

$2,000 Ethereum Price Prediction: A Realistic Scenario?

Considering the factors discussed above, reaching $2,000 ETH is a complex question. While the ongoing development, growing DeFi ecosystem, and increasing institutional adoption are bullish indicators, macroeconomic conditions and regulatory uncertainty pose significant challenges. A price surge to $2,000 could occur if positive developments outweigh negative factors, potentially within 12-24 months under a strongly bullish market scenario. However, a more conservative prediction might see the price reaching this level later or not at all if the bear market extends.

Conclusion: Ethereum Price Action and the Road to $2,000

Analyzing Ethereum price action requires considering a complex interplay of macroeconomic conditions, regulatory developments, network activity, and technological advancements. While the potential for ETH to reach $2,000 exists, the timeframe and likelihood depend on the balance of bullish and bearish forces. Staying informed about Ethereum price action, on-chain data, and regulatory updates is crucial for informed investment decisions. Stay tuned for more insightful analyses on Ethereum price action and continue your own research to make informed investment decisions. Learn more about Ethereum price prediction and stay updated on the latest market trends.

Featured Posts

-

Us Bond Etf Investments A Taiwanese Retreat

May 08, 2025

Us Bond Etf Investments A Taiwanese Retreat

May 08, 2025 -

Analyzing The Impact Of Liberation Day Tariffs On Stock Performance

May 08, 2025

Analyzing The Impact Of Liberation Day Tariffs On Stock Performance

May 08, 2025 -

Analysis The Unexpected Rise In Bitcoin Mining This Week

May 08, 2025

Analysis The Unexpected Rise In Bitcoin Mining This Week

May 08, 2025 -

Analysis Broadcoms Proposed V Mware Price Hike An Extreme Jump

May 08, 2025

Analysis Broadcoms Proposed V Mware Price Hike An Extreme Jump

May 08, 2025 -

Lahwr Myn Py Ays Ayl Trafy Shayqyn Ka Jwsh W Khrwsh

May 08, 2025

Lahwr Myn Py Ays Ayl Trafy Shayqyn Ka Jwsh W Khrwsh

May 08, 2025