Ethereum Price At Crucial Support: Is A Drop To $1,500 Likely?

Table of Contents

Technical Analysis: Chart Patterns and Indicators Suggesting Potential Decline

Technical analysis provides valuable insights into potential price movements. Examining key indicators and chart patterns can help determine the likelihood of an Ethereum price drop to $1,500.

- RSI (Relative Strength Index): While the RSI might currently indicate oversold conditions, suggesting a potential bounce, it hasn't decisively broken above the oversold threshold, leaving room for further decline in the Ethereum price. A sustained low RSI reading could signal continued bearish pressure.

- MACD (Moving Average Convergence Divergence): A bearish MACD crossover, coupled with a downward trending signal line, points towards bearish momentum and potentially further downward pressure on the Ethereum price. This indicator is crucial in assessing short-term trends.

- Moving Averages: The convergence or divergence of short-term and long-term moving averages (e.g., 50-day and 200-day) can reveal the overall trend. A bearish crossover, where the short-term average falls below the long-term average, is a bearish signal for the Ethereum price.

- Support and Resistance Levels: Identifying key support and resistance levels is crucial. A break below a significant support level, such as $1,700, could trigger a cascade effect, pushing the Ethereum price towards $1,500. Conversely, a strong bounce off this support could signal a temporary reprieve.

- Chart Patterns: Bearish chart patterns like head and shoulders or double tops could suggest a potential decline in the Ethereum price. The formation of such patterns, confirmed by other indicators, strengthens the case for a drop towards $1,500.

[Insert relevant chart showing RSI, MACD, moving averages, support/resistance levels, and any identified chart patterns.]

Market Sentiment and News Affecting Ethereum Price

Market sentiment and news events significantly influence the Ethereum price. Negative news can trigger sell-offs, while positive developments can lead to price increases.

- Regulatory Updates: Stringent regulatory announcements impacting the cryptocurrency market can negatively affect investor confidence, potentially driving down the Ethereum price. Uncertainty surrounding regulations creates volatility.

- Developer Activity: Increased developer activity, such as new project launches on the Ethereum network or significant upgrades, generally boosts investor confidence and can positively impact the Ethereum price.

- Market Trends: The overall cryptocurrency market trend heavily influences the Ethereum price. A broader market downturn often drags down even strong assets like Ethereum.

- Social Media Sentiment: Analyzing social media sentiment towards Ethereum can provide insights into market psychology. Negative sentiment can fuel sell-offs, pushing the Ethereum price down.

- Upcoming Events: Major events like network upgrades (e.g., Shanghai upgrade) or significant partnerships can create volatility. Anticipation of positive developments can push the Ethereum price up, while negative surprises could have the opposite effect.

The Role of Institutional Investors and Whale Activity

Large institutional investors and "whales" (individuals holding significant amounts of Ethereum) can heavily influence the Ethereum price.

- Large Transactions: Tracking large Ethereum transactions can reveal potential sell-offs by whales, which can trigger price drops. Large sell orders can overwhelm the market's buying pressure.

- Institutional Holdings: Information about institutional holdings of Ethereum provides insights into potential liquidation events, which could cause significant price drops. Liquidations are often forced sell-offs, contributing to downward pressure.

Alternative Scenarios: Factors That Could Prevent a Drop to $1,500

While a drop to $1,500 is possible, several factors could prevent it.

- Bullish Reversal: A strong bounce off key support levels, confirmed by technical indicators like a bullish MACD crossover or a positive RSI divergence, could signal a bullish reversal, halting the decline in the Ethereum price.

- Positive News and Developments: Positive news, like significant partnerships, successful network upgrades, or increased adoption, can boost investor sentiment and push the Ethereum price upwards.

- Sustained Growth Despite Volatility: Even with short-term volatility, the underlying fundamentals of Ethereum, such as its strong developer community and growing ecosystem, could support sustained growth and prevent a sharp decline to $1,500.

Conclusion: Ethereum Price Outlook and Next Steps

Based on the analysis of technical indicators, market sentiment, and potential events, a drop to $1,500 for the Ethereum price is a possibility, but not a certainty. Several factors could prevent this, including a bullish reversal or positive news. It's crucial to monitor the Ethereum price closely and stay updated on Ethereum news. This analysis offers insights, but it's not financial advice. Conduct your own thorough research, track the Ethereum market, analyze the Ethereum price trends, and understand your risk tolerance before making any investment decisions. Remember, investing in cryptocurrencies carries significant risk, and price fluctuations are common. Always exercise caution and make informed decisions when dealing with the Ethereum price or any other volatile asset.

Featured Posts

-

Senator Fetterman Addresses Fitness Concerns Reaffirms Senate Bid

May 08, 2025

Senator Fetterman Addresses Fitness Concerns Reaffirms Senate Bid

May 08, 2025 -

De Andre Hopkins Joins Ravens Contract Terms And Impact

May 08, 2025

De Andre Hopkins Joins Ravens Contract Terms And Impact

May 08, 2025 -

April 16 2025 Daily Lotto Winning Numbers

May 08, 2025

April 16 2025 Daily Lotto Winning Numbers

May 08, 2025 -

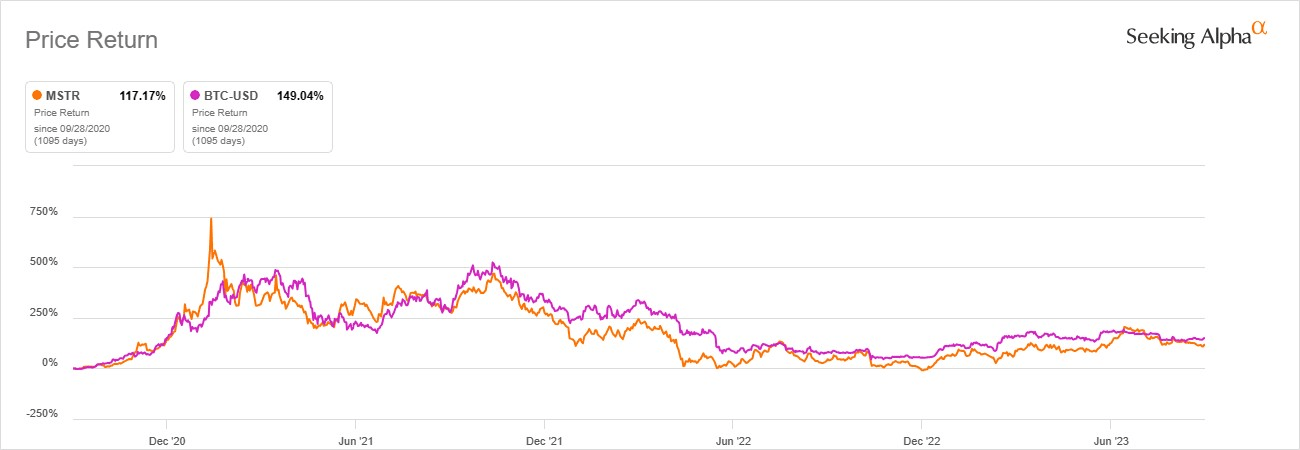

Micro Strategy Vs Bitcoin In 2025 Which Is The Better Investment

May 08, 2025

Micro Strategy Vs Bitcoin In 2025 Which Is The Better Investment

May 08, 2025 -

Ousmane Dembele Injury Update Arsenal Face Major Setback

May 08, 2025

Ousmane Dembele Injury Update Arsenal Face Major Setback

May 08, 2025