Ethereum Price Holds Above Key Support: Could $1,500 Be Next?

Table of Contents

Technical Analysis: Key Support Levels and Indicators

Identifying Key Support Levels

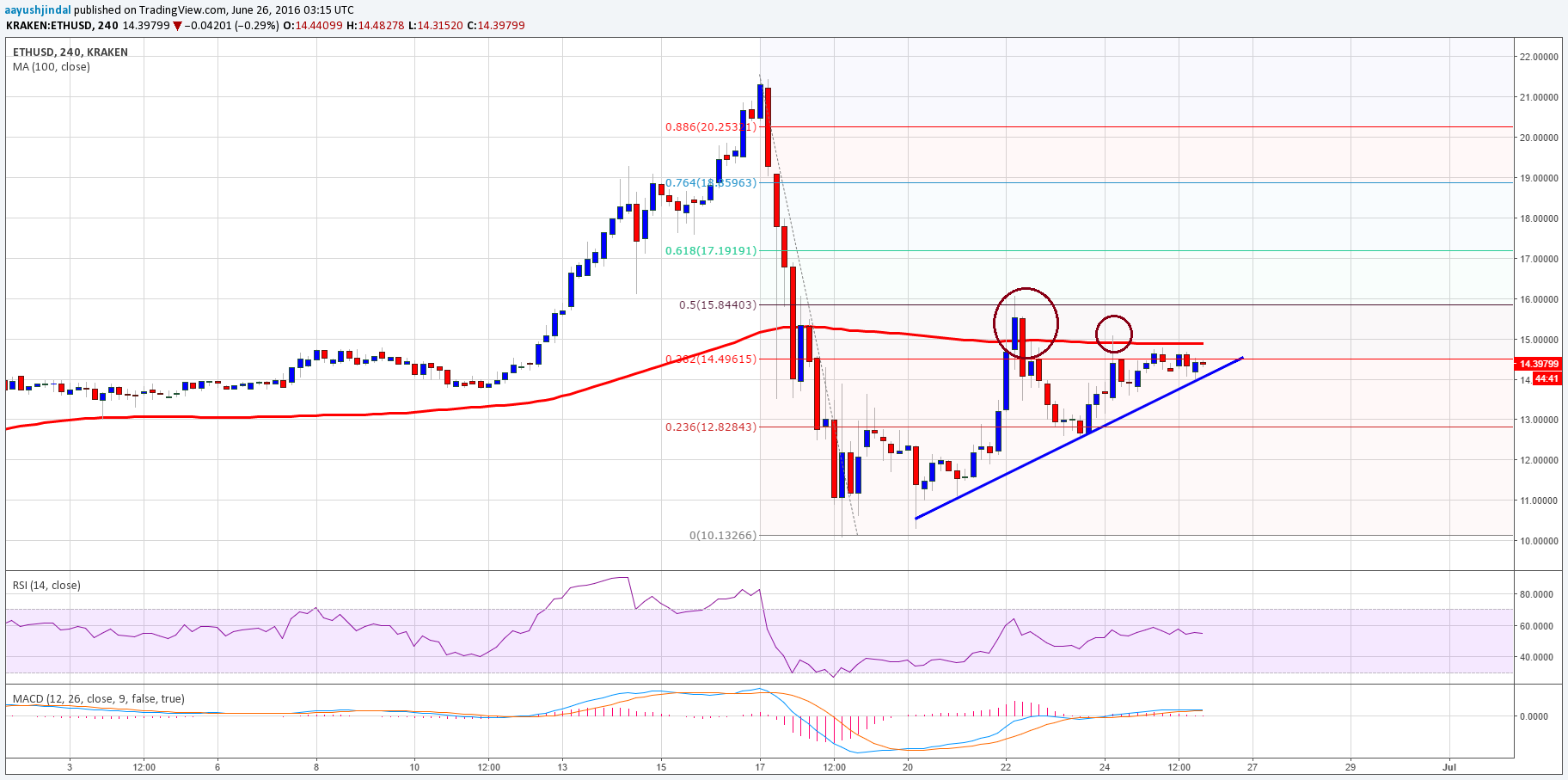

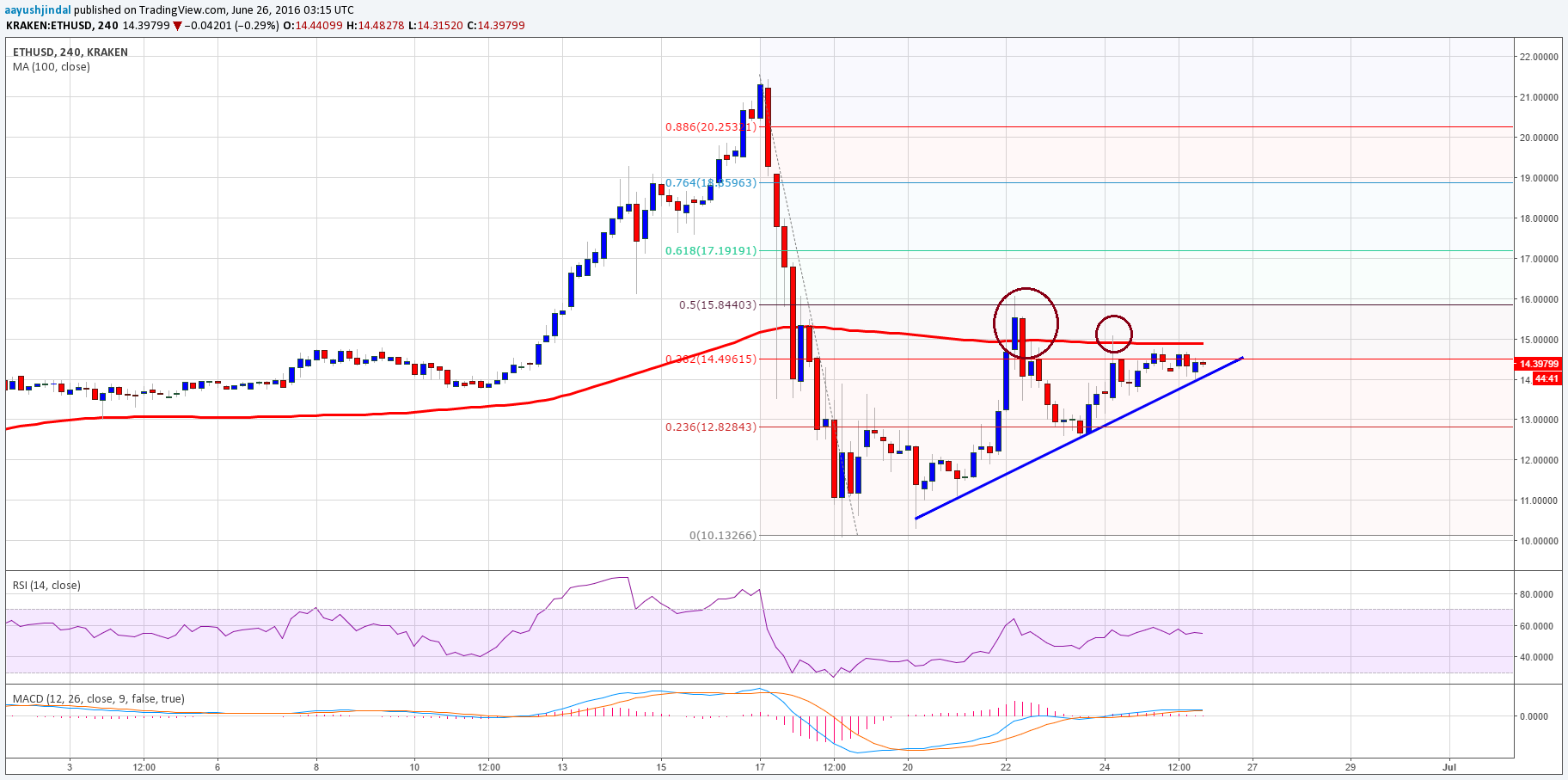

Understanding support levels is crucial for predicting Ethereum price movements. Support levels represent price points where buying pressure is strong enough to prevent further declines. For Ethereum, we've observed significant support around $1,600 and $1,700 in recent weeks. Breaking below these levels could signal a more significant downturn, while holding above them suggests underlying strength. [Insert chart showing ETH price with support levels clearly marked]. The significance of these levels stems from previous price action; these points have acted as "floors" in past price corrections, suggesting potential buying interest at those price points. Analyzing the behavior of the price around these support levels using Ethereum technical analysis is critical.

Analyzing Key Indicators

Several technical indicators provide further insight into potential Ethereum price movements. The Relative Strength Index (RSI) can gauge market momentum. A reading above 50 generally suggests bullish sentiment, while a reading below 30 might indicate oversold conditions. [Insert chart showing RSI for ETH]. The Moving Average Convergence Divergence (MACD) helps identify potential trend reversals. A bullish crossover (MACD line crossing above the signal line) could signal an upward trend. [Insert chart showing MACD for ETH]. Examining these Ethereum technical indicators in conjunction with support levels provides a more comprehensive picture.

Fundamental Factors Influencing Ethereum Price

Ethereum Network Upgrades and Development

Upcoming Ethereum upgrades are significant catalysts for price appreciation. The Shanghai upgrade, enabling staked ETH withdrawals, is a major milestone that could positively impact investor sentiment. Furthermore, continued development on scalability solutions like sharding is crucial for long-term growth. These factors directly affect the utility and adoption of Ethereum, contributing to its value proposition. Increased developer activity and a growing number of decentralized applications (dApps) built on the Ethereum network also bolster its fundamental strength. This ongoing development reinforces the network's health and longevity.

Macroeconomic Factors and Market Sentiment

Broader macroeconomic factors and overall market sentiment significantly influence cryptocurrency prices, including Ethereum's. The price of Bitcoin, the dominant cryptocurrency, often correlates with ETH's performance. Negative regulatory changes or a general downturn in the global stock market can impact the entire cryptocurrency market cap, including Ethereum. Investor confidence and sentiment are key; periods of fear and uncertainty can lead to sell-offs, while optimism fuels price increases. Therefore, monitoring market sentiment and broader economic conditions is crucial for accurate ETH price prediction.

Potential Scenarios and Price Predictions

Bullish Scenario: Reaching $1,500 and Beyond

A bullish scenario for Ethereum involves sustained holding above key support levels ($1,600 and $1,700), a positive reaction to the Shanghai upgrade, and continued positive news regarding network development and adoption. These factors, coupled with improving overall market sentiment, could drive Ethereum’s price towards $1,500 and potentially beyond. Strong positive momentum, confirmed by technical indicators, could catalyze a significant price increase.

Bearish Scenario: Potential Downturn and Support Levels

A bearish scenario involves a breakdown of key support levels, driven by negative market sentiment, regulatory headwinds, or a broader cryptocurrency market downturn. While this would likely trigger a price correction, the previously mentioned support levels around $1,600 and $1,700 could act as buffers, limiting the extent of any price decline. However, a failure to hold these levels could indicate a more substantial price drop.

Conclusion: Ethereum's Future and Investment Strategies

Ethereum's price currently exhibits resilience, holding above key support levels. While a move towards $1,500 is plausible under a bullish scenario, several factors – including technical indicators, network upgrades, and macroeconomic conditions – need to be considered. Both technical and fundamental analysis are crucial for informed investment decisions. Remember, this analysis is not financial advice; conducting your own thorough research and staying updated on Ethereum price movements is paramount for making sound investment decisions. Stay informed about Ethereum price movements and continue your research into ETH price predictions to make the best investment decisions.

Featured Posts

-

Mike Trouts Two Homeruns Cant Prevent Angels Loss To Giants

May 08, 2025

Mike Trouts Two Homeruns Cant Prevent Angels Loss To Giants

May 08, 2025 -

Angels Triumph Over Dodgers Impact Of Missing Shortstops

May 08, 2025

Angels Triumph Over Dodgers Impact Of Missing Shortstops

May 08, 2025 -

El Psg Vence Al Lyon En Francia

May 08, 2025

El Psg Vence Al Lyon En Francia

May 08, 2025 -

Boston Celtics Coach Provides Jayson Tatum Wrist Injury Update

May 08, 2025

Boston Celtics Coach Provides Jayson Tatum Wrist Injury Update

May 08, 2025 -

Before The Rookie Nathan Fillions Unforgettable Wwii Role

May 08, 2025

Before The Rookie Nathan Fillions Unforgettable Wwii Role

May 08, 2025