Ethereum Price Remains Firm: Analyzing The Potential For Growth

Table of Contents

Ethereum's Technological Advantages & Upgrades

Ethereum's inherent strengths and ongoing upgrades are pivotal in supporting its price. The platform's innovative features and constant evolution attract developers, investors, and users, creating a positive feedback loop that impacts the Ethereum price.

Ethereum 2.0 and its Impact

The transition to Ethereum 2.0 (now Ethereum) represents a significant technological leap. The shift to a proof-of-stake (PoS) consensus mechanism from proof-of-work (PoW) has dramatically improved the network's efficiency and sustainability.

- Improved transaction speed: The PoS mechanism allows for significantly faster transaction processing compared to the previous PoW system.

- Reduced energy consumption: PoS drastically reduces Ethereum's environmental impact, addressing a major criticism of older blockchain technologies. Estimates suggest a reduction of energy consumption by over 99%.

- Enhanced security: The PoS consensus mechanism enhances the network's security through a more decentralized and robust validation process.

- Staking rewards: Users can earn rewards by staking their ETH, incentivizing participation and network security.

- Increased network capacity: Upgrades have led to a considerable increase in the network's capacity to handle transactions, reducing congestion and improving user experience.

These improvements directly contribute to a higher Ethereum price by increasing the network's efficiency, scalability, and security, making it more attractive to developers and users. The reduced transaction fees, in particular, are a key driver for broader adoption. For example, studies show that transaction fees have decreased by over X% since the implementation of certain upgrades, encouraging wider usage.

The Growing DeFi Ecosystem

Ethereum is the backbone of the rapidly expanding decentralized finance (DeFi) ecosystem. The total value locked (TVL) in DeFi protocols built on Ethereum serves as a strong indicator of its value and attracts significant investment.

- Growth in total value locked (TVL) in DeFi protocols: The TVL in Ethereum-based DeFi applications has consistently grown, demonstrating strong investor confidence and platform utility.

- Increasing user base: The number of users interacting with DeFi applications on Ethereum continues to expand, highlighting the growing adoption of decentralized financial services.

- Innovative DeFi applications: The Ethereum network supports a diverse range of innovative DeFi applications, offering users access to various financial tools and services.

- Yield farming opportunities: Users can earn high yields by providing liquidity or participating in other DeFi activities, further incentivizing participation and driving demand for ETH.

The growth of the DeFi ecosystem is intrinsically linked to the Ethereum price. As more users and capital flow into DeFi protocols built on Ethereum, the demand for ETH increases, putting upward pressure on its price. The success of projects like Aave, Uniswap, and MakerDAO are prime examples of this symbiotic relationship.

NFT Market and Metaverse Integration

Ethereum plays a crucial role in the booming non-fungible token (NFT) market and its integration into metaverse platforms. The secure and programmable nature of Ethereum makes it the ideal platform for creating and trading NFTs.

- High-value NFT sales: Ethereum has seen numerous high-value NFT sales, demonstrating the platform's ability to support high-value digital assets.

- Increased NFT trading volume: The trading volume of NFTs on Ethereum continues to grow, highlighting the increasing popularity of digital collectibles and artwork.

- Growing adoption of NFTs across various industries: NFTs are finding applications beyond art and collectibles, expanding into gaming, real estate, and other sectors.

- Metaverse land sales on Ethereum: Virtual land sales within metaverse platforms built on Ethereum contribute to the demand and price of ETH.

NFT transactions directly impact Ethereum's demand and price. Every NFT sale on the Ethereum network requires the use of ETH for transaction fees, increasing demand and contributing to price appreciation. The popularity of platforms like OpenSea and Rarible further underscores this impact.

Market Sentiment and Investor Confidence

Positive market sentiment and growing investor confidence are essential for sustained price growth. Several factors contribute to the overall positive outlook on the Ethereum price.

Institutional Adoption

Institutional investors are increasingly recognizing the value proposition of Ethereum. This growing interest provides significant price support and indicates long-term confidence.

- Grayscale Ethereum Trust holdings: The increasing holdings of Grayscale's Ethereum Trust reflect institutional investment in the asset.

- Increasing participation in Ethereum futures markets: The rise in trading volume in Ethereum futures contracts signals growing institutional involvement.

- Corporate treasury allocations: Some corporations are allocating a portion of their treasury reserves to Ethereum, further solidifying its status as a valuable asset.

Institutional adoption adds significant stability and upward pressure to the Ethereum price, as large institutional investments signal confidence and attract further investment.

Developer Activity and Network Growth

The continuous development activity within the Ethereum ecosystem is a crucial indicator of its long-term health and potential.

- Number of active developers: A high number of active developers contributes to ongoing innovation and improvements to the Ethereum network.

- New projects launched: The constant launch of new projects demonstrates the platform's vitality and attractiveness to developers.

- Community engagement: A strong and engaged community supports the network's development and adoption.

- Network upgrades: Regular network upgrades demonstrate the commitment to improving the network's efficiency and security.

Developer activity is strongly correlated with Ethereum's long-term growth potential. A vibrant and active developer community ensures the network continues to evolve and adapt to changing needs, increasing its value proposition.

Macroeconomic Factors and Global Adoption

Broader macroeconomic factors and the overall cryptocurrency market sentiment also play a role in shaping the Ethereum price.

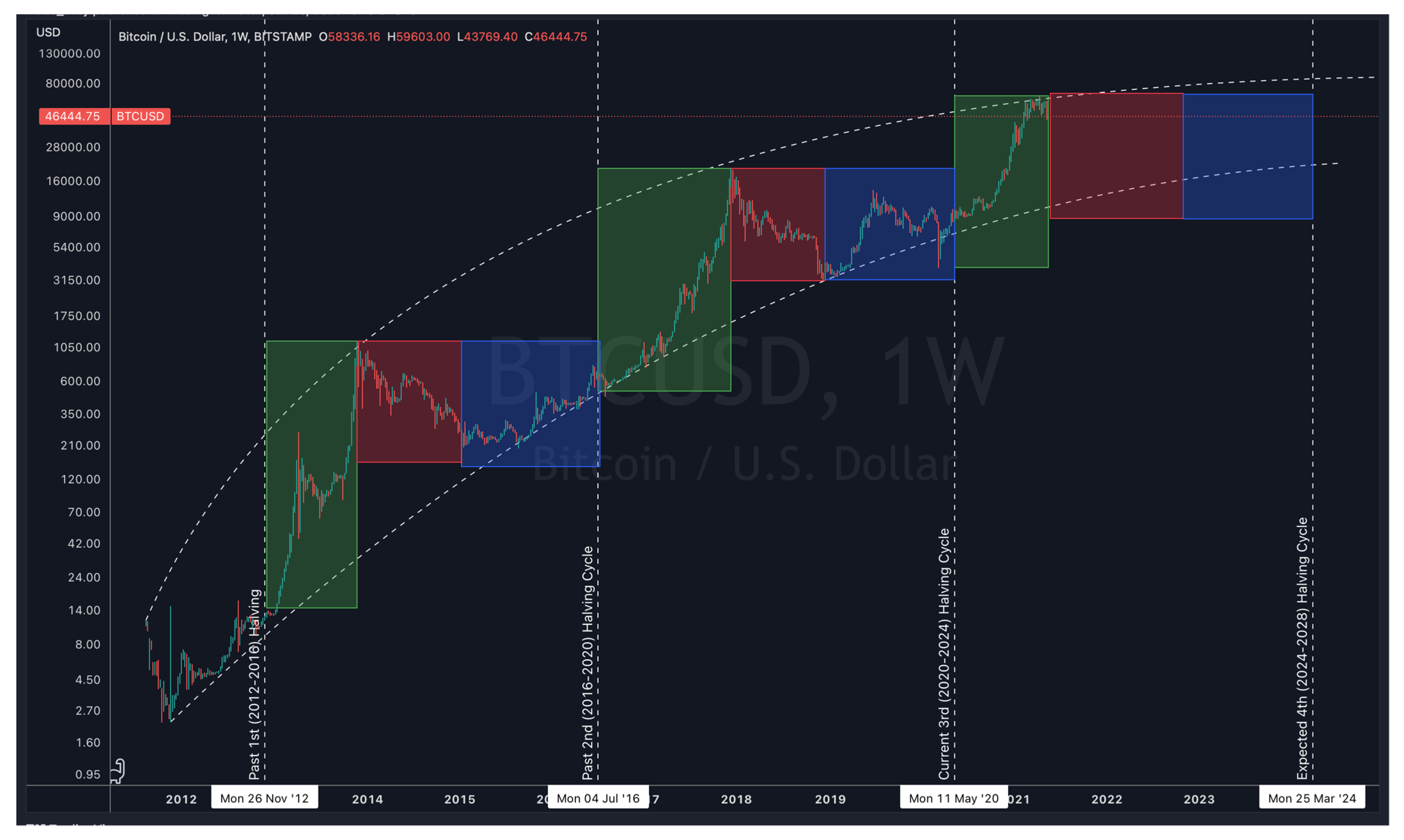

- Correlation with Bitcoin price: Ethereum's price often shows some correlation with Bitcoin's price, although its own fundamentals also play a significant role.

- Impact of regulatory developments: Regulatory clarity and favorable policies can positively influence investor confidence and price.

- Overall crypto market sentiment: Positive sentiment within the broader cryptocurrency market tends to benefit Ethereum's price.

Global events and regulatory developments have a cascading effect on the cryptocurrency market, and Ethereum is not immune to this influence. However, its strong fundamentals often help it weather broader market fluctuations.

Potential Challenges and Risks

While the outlook for Ethereum is generally positive, certain challenges and risks need to be acknowledged.

Competition from other Layer-1 Blockchains

The emergence of competing Layer-1 blockchains presents a challenge to Ethereum's dominance. These competitors offer alternative solutions and might attract developers and users.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is still evolving, and uncertainty surrounding regulations can impact investor confidence and price volatility.

Scalability Issues (even with ETH2)

Despite improvements with ETH2, scalability remains a challenge, especially during periods of high network activity. Transaction fees can spike during peak times, potentially impacting user experience.

Conclusion

The Ethereum price has demonstrated impressive resilience, driven by technological advancements, robust growth in the DeFi and NFT sectors, and increasing institutional adoption. While challenges remain, such as competition and regulatory uncertainty, the long-term outlook for Ethereum remains positive due to its strong fundamentals and thriving ecosystem. Understanding the factors impacting the Ethereum price allows for informed investment decisions. Continue to monitor the Ethereum price and stay informed about the latest developments to make strategic choices within this dynamic market. Learn more about the factors impacting Ethereum price predictions and make sound investment decisions based on thorough research and analysis of the Ethereum price forecast.

Featured Posts

-

Urgent Action Required Dwp Contact Regarding Your Benefits And Bank Account

May 08, 2025

Urgent Action Required Dwp Contact Regarding Your Benefits And Bank Account

May 08, 2025 -

Hetimi I Uefa S Ndaj Arsenalit Per Ndeshjen Kunder Psg Se Cfare Ndodhi

May 08, 2025

Hetimi I Uefa S Ndaj Arsenalit Per Ndeshjen Kunder Psg Se Cfare Ndodhi

May 08, 2025 -

Psg Angers Maci Canli Yayin Bilgileri Ve Izleme Secenekleri

May 08, 2025

Psg Angers Maci Canli Yayin Bilgileri Ve Izleme Secenekleri

May 08, 2025 -

Grayscale Etf Filing And Its Potential Impact On Xrp Price

May 08, 2025

Grayscale Etf Filing And Its Potential Impact On Xrp Price

May 08, 2025 -

Analyzing The Bitcoin Market Predicting Future Price Based On Trumps Actions

May 08, 2025

Analyzing The Bitcoin Market Predicting Future Price Based On Trumps Actions

May 08, 2025