Ethereum Transaction Volume Spikes: Analysis Of Recent Network Activity

Table of Contents

Main Points: Deciphering the Surge

Several factors contributed to this remarkable increase in Ethereum transaction volume. Let's examine the key players:

2.1. Decentralized Finance (DeFi) Boom as a Key Driver

Decentralized finance (DeFi) applications have played a pivotal role in escalating Ethereum transaction volume. The explosive growth of DeFi protocols like Uniswap, Aave, and Compound has fueled a surge in on-chain activity. These platforms offer decentralized alternatives to traditional financial services, attracting users with their innovative features and high yields. The increasing popularity of DeFi lending, borrowing, and yield farming strategies directly translates into a higher number of transactions on the Ethereum blockchain.

- Rising popularity of yield farming strategies: Users actively seek high returns by lending and borrowing crypto assets across various DeFi platforms, generating numerous transactions.

- Increased usage of decentralized exchanges (DEXs): The decentralized nature and lower fees of DEXs like Uniswap have driven substantial trading volumes, contributing significantly to the Ethereum transaction volume spikes.

- Growth of DeFi lending and borrowing platforms: Platforms such as Aave and Compound facilitate the lending and borrowing of cryptocurrencies, generating a substantial number of transactions. Data from DeFi Pulse shows a dramatic increase in Total Value Locked (TVL) in DeFi protocols, directly correlating with higher Ethereum network activity.

2.2. Non-Fungible Tokens (NFTs) and Market Activity

The flourishing NFT market has also significantly impacted Ethereum's transaction volume. The minting and trading of NFTs, particularly through popular marketplaces like OpenSea, have resulted in a substantial increase in network activity. Hype cycles surrounding specific NFT collections and high-profile sales further amplify these spikes.

- Increased NFT trading volume: The buying and selling of unique digital assets generate a significant number of transactions on the Ethereum blockchain.

- Growth of NFT marketplaces: Platforms like OpenSea have become central hubs for NFT trading, facilitating countless transactions and driving network congestion.

- Impact of high-profile NFT sales: High-value NFT sales generate substantial media attention, attracting new users and increasing overall transaction volume. The record-breaking sales of certain NFT collections are often followed by noticeable spikes in Ethereum network activity.

2.3. Ethereum Improvement Proposals (EIPs) and Network Upgrades

Ethereum's continuous evolution through Ethereum Improvement Proposals (EIPs) and network upgrades can influence transaction volume, though not always directly. For instance, EIP-1559, which introduced a base fee mechanism for transaction fees, has undoubtedly affected the cost of transactions, but its impact on the overall volume is complex. While it might have discouraged some low-value transactions, it arguably improved network efficiency for higher-value ones.

- Impact of EIP-1559 on transaction fees: EIP-1559 introduced a predictable base fee, potentially influencing user behavior and transaction frequency.

- Effects of network upgrades on scalability: Network upgrades aim to enhance scalability and reduce congestion, potentially affecting the overall number of transactions processed.

- Influence on user adoption: Successful upgrades can enhance the user experience, potentially leading to increased adoption and higher transaction volumes.

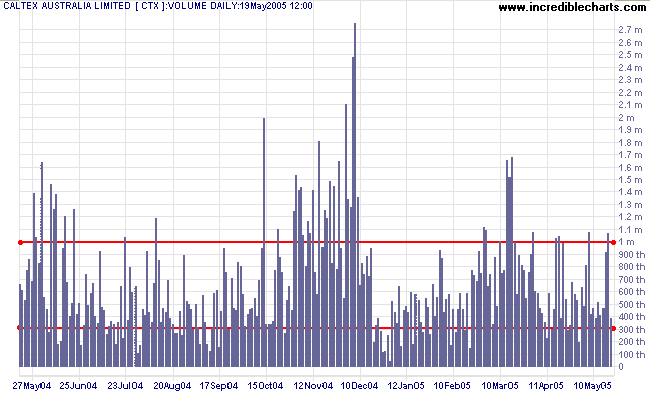

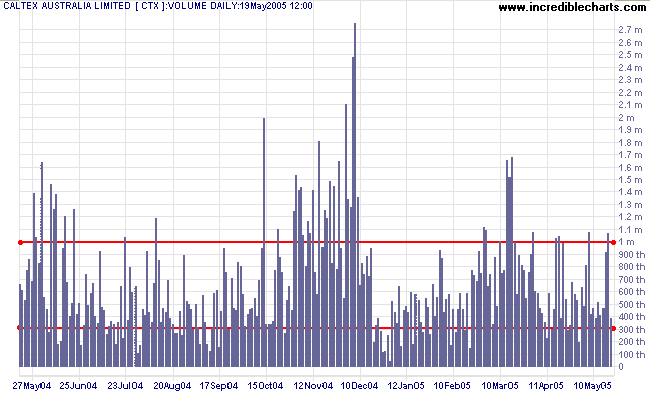

2.4. Impact of Increased Transaction Volume on Gas Fees and Network Congestion

The surge in Ethereum transaction volume has led to a direct correlation with increased gas fees – the cost of processing transactions on the Ethereum network. High transaction volumes cause network congestion, leading to significantly higher gas fees and longer transaction confirmation times. This impacts both users and developers, making it challenging to use the network efficiently. The need for scalability solutions is evident, with layer-2 solutions gaining traction as a potential mitigation strategy.

- Gas fee fluctuations: Gas fees fluctuate dramatically depending on network congestion, often making transactions prohibitively expensive during peak periods.

- Network congestion issues: High transaction volumes lead to delays and increased processing times, impacting user experience and potentially hindering the network's functionality.

- Potential solutions for scalability: Layer-2 scaling solutions, such as rollups and sidechains, aim to alleviate network congestion by processing transactions off-chain before settling them on the main Ethereum blockchain.

2.5. Future Predictions and Trends in Ethereum Transaction Volume

Predicting future trends in Ethereum transaction volume requires considering various factors. The continued growth of DeFi and NFTs, coupled with ongoing technological advancements and regulatory developments, will likely influence future network activity. While challenges remain, such as improving network scalability and managing gas fees, the long-term outlook for Ethereum transaction volume appears positive.

- Potential future growth areas: Continued growth in DeFi, NFTs, and metaverse applications will likely drive further increases in transaction volume.

- Challenges and opportunities: Addressing scalability challenges and managing gas fees will be crucial for sustaining the network's growth and attracting new users.

- Long-term outlook for Ethereum transaction volume: The overall trajectory points towards continued growth, although the rate of growth might vary based on market conditions and technological advancements.

Conclusion: Understanding and Navigating Ethereum Transaction Volume Spikes

The recent surge in Ethereum transaction volume is a result of the confluence of several key factors: the booming DeFi ecosystem, the thriving NFT market, and ongoing network upgrades. These Ethereum transaction volume spikes have resulted in significant gas fee increases and network congestion, highlighting the need for improved scalability. To navigate these trends and effectively participate in the Ethereum ecosystem, it's vital to stay informed. Monitor Ethereum transaction activity closely, understand the implications of network congestion, and explore solutions like layer-2 scaling technologies. Subscribe to our newsletter and follow us on social media to stay updated on the latest developments and understand Ethereum network activity.

Featured Posts

-

Bitcoin Price Prediction Will Trumps 100 Day Speech Push Btc Past 100 000

May 08, 2025

Bitcoin Price Prediction Will Trumps 100 Day Speech Push Btc Past 100 000

May 08, 2025 -

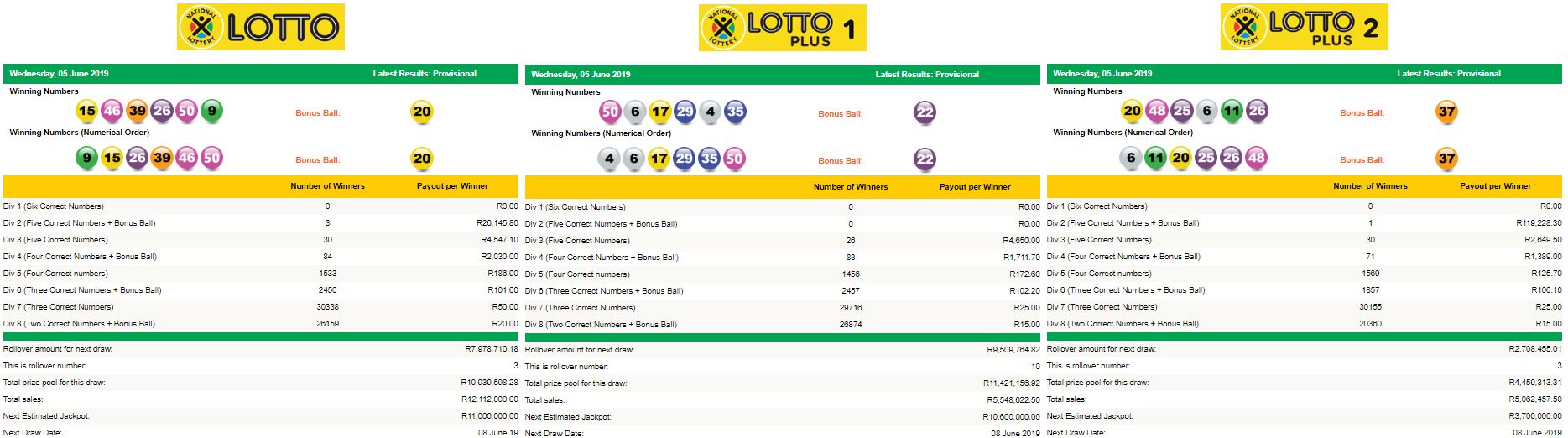

Lotto Lotto Plus 1 And 2 Official Draw Results And Numbers

May 08, 2025

Lotto Lotto Plus 1 And 2 Official Draw Results And Numbers

May 08, 2025 -

Ethereum Price Action Analysis And 2 000 Price Prediction

May 08, 2025

Ethereum Price Action Analysis And 2 000 Price Prediction

May 08, 2025 -

Liga De Quito Vs Flamengo Pronostico Y Previa Copa Libertadores Grupo C Fecha 3

May 08, 2025

Liga De Quito Vs Flamengo Pronostico Y Previa Copa Libertadores Grupo C Fecha 3

May 08, 2025 -

Xrp Ripple Investment A Comprehensive Guide To Potential Returns

May 08, 2025

Xrp Ripple Investment A Comprehensive Guide To Potential Returns

May 08, 2025