Ethereum's Bullish Run: Price Analysis And Future Predictions

Table of Contents

Recent Price Performance and Trends

Ethereum's price has demonstrated considerable volatility in recent months, exhibiting both impressive rallies and periods of correction. Analyzing this price action is key to understanding the current Ethereum bullish run. Let's examine the key trends:

-

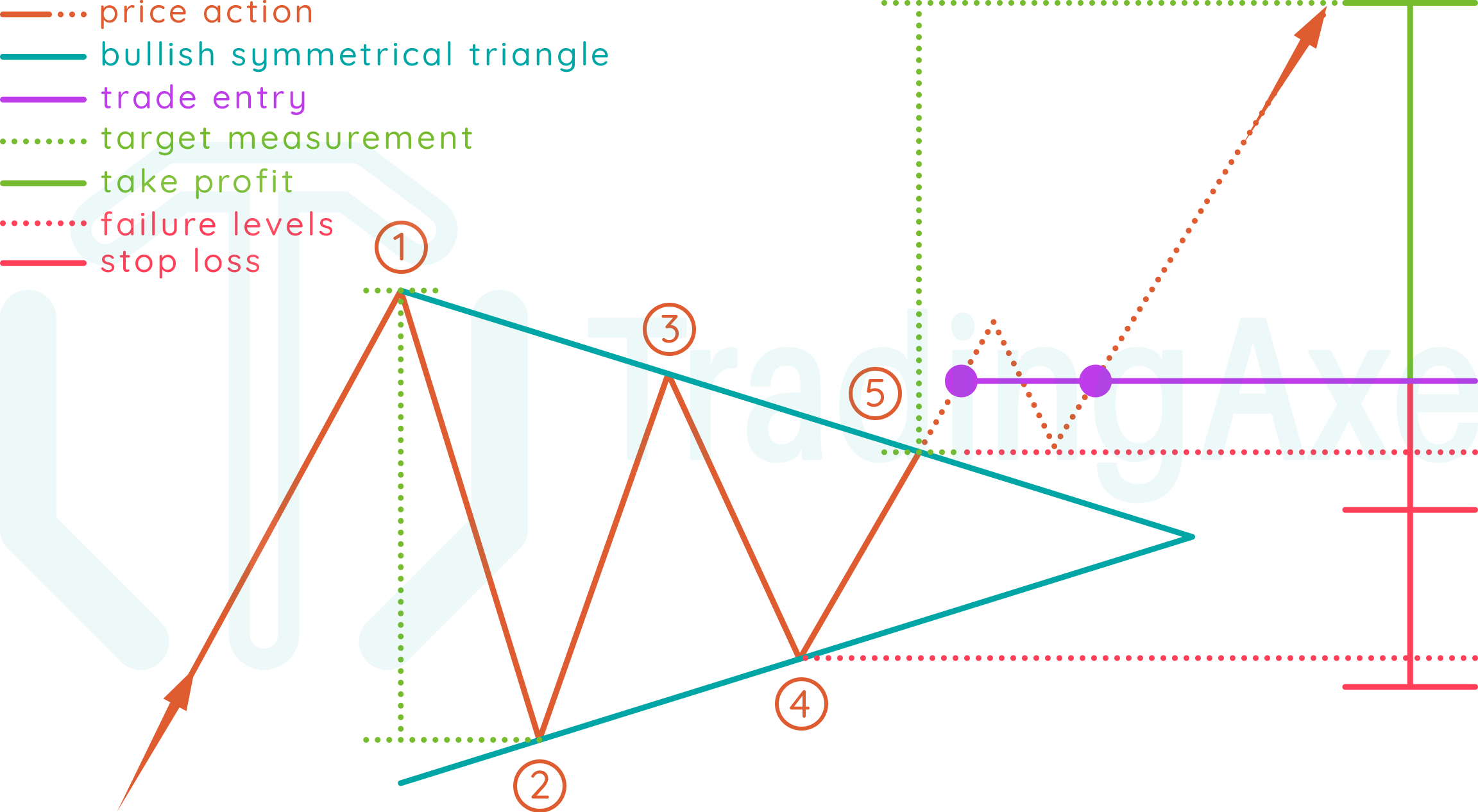

[Insert Chart/Graph showing Ethereum price over the last 6-12 months] This chart visually represents the price fluctuations, highlighting significant highs and lows. Observe the periods of rapid growth interspersed with consolidation phases.

-

Market Sentiment and News: Positive news, such as successful upgrades to the Ethereum network or increased adoption by institutions, often correlates with price increases. Conversely, negative news or regulatory uncertainty can trigger price drops. For example, [cite a specific news event and its impact on the Ethereum price].

-

Key Price Points and Support/Resistance:

- Between [Date] and [Date], Ethereum experienced a significant price surge from $[Price] to $[Price], encountering resistance around $[Price].

- The subsequent pullback found support around $[Price], suggesting a potential base for future growth.

- The volatility inherent in Ethereum's price necessitates a cautious approach to investing, requiring diligent risk management strategies.

Factors Influencing Ethereum's Bullish Momentum

Several factors contribute to the current bullish sentiment surrounding Ethereum. These can be categorized into technological advancements, ecosystem growth, and macroeconomic influences.

Technological Advancements

Ethereum 2.0, with its shift to a proof-of-stake consensus mechanism, is a major driver of the bullish narrative.

- Sharding and Proof-of-Stake: The transition to proof-of-stake significantly reduces energy consumption and transaction fees, while sharding enhances scalability, paving the way for mass adoption.

- Improved Efficiency: These upgrades promise a more efficient and sustainable blockchain, attracting both developers and investors.

- Further Developments: Ongoing development of Layer-2 scaling solutions further enhances the network's capabilities, tackling scalability issues and improving user experience.

Growing Adoption and Ecosystem Development

The expanding Ethereum ecosystem fuels further growth.

- DeFi and NFTs: The burgeoning Decentralized Finance (DeFi) sector and the explosive growth of Non-Fungible Tokens (NFTs) heavily rely on the Ethereum blockchain, boosting demand and network activity.

- dApp Growth: The increasing number of decentralized applications (dApps) built on Ethereum demonstrates the platform's versatility and its potential for widespread use across various industries.

- NFT Market Impact: The NFT market’s boom directly impacts Ethereum's price due to the high transaction volume and associated fees.

Macroeconomic Factors and Market Sentiment

External factors also influence Ethereum's price.

- Bitcoin Correlation: Ethereum's price often correlates with Bitcoin's price, meaning broader market trends in the cryptocurrency space significantly impact Ethereum.

- Institutional Investment: Increased institutional adoption, with major firms allocating funds to Ethereum, provides a solid foundation for sustained growth.

- Regulatory Landscape: The evolving regulatory landscape for cryptocurrencies can impact market sentiment and investment decisions, creating both opportunities and challenges.

Future Predictions and Potential Risks

Predicting cryptocurrency prices is inherently challenging, but based on the factors discussed above, several potential scenarios emerge.

-

Short-Term Predictions: In the short term (next 6-12 months), a continuation of the bullish trend is possible, with potential price targets ranging from $[Price] to $[Price], contingent upon continued adoption and positive market sentiment.

-

Long-Term Predictions: In the long term (next 3-5 years), Ethereum’s price could experience substantial growth, driven by its expanding ecosystem and technological advancements, potentially reaching $[Price] or higher.

-

Potential Risks: However, risks remain. Regulatory uncertainty, increased competition from other blockchain platforms, and periods of market correction could negatively impact Ethereum's price. Diversification and robust risk management strategies are crucial.

Conclusion

Ethereum's bullish run presents both exciting opportunities and inherent risks. Understanding the interplay of technological progress, ecosystem growth, and macroeconomic factors is key to navigating this dynamic market. While the potential for substantial gains exists, thorough research and careful risk management are essential for any investor considering exposure to Ethereum. Stay informed about the latest developments in the Ethereum market to effectively navigate the potential of this exciting Ethereum Bullish Run and make informed investment decisions. Continue your research on the Ethereum Bullish Run to stay ahead of the curve.

Featured Posts

-

Predicting Ethereums Future A Deep Dive Into Market Trends And Price Dynamics

May 08, 2025

Predicting Ethereums Future A Deep Dive Into Market Trends And Price Dynamics

May 08, 2025 -

Supermans Cinema Con Presentation A Deeper Dive Into Kryptos Role

May 08, 2025

Supermans Cinema Con Presentation A Deeper Dive Into Kryptos Role

May 08, 2025 -

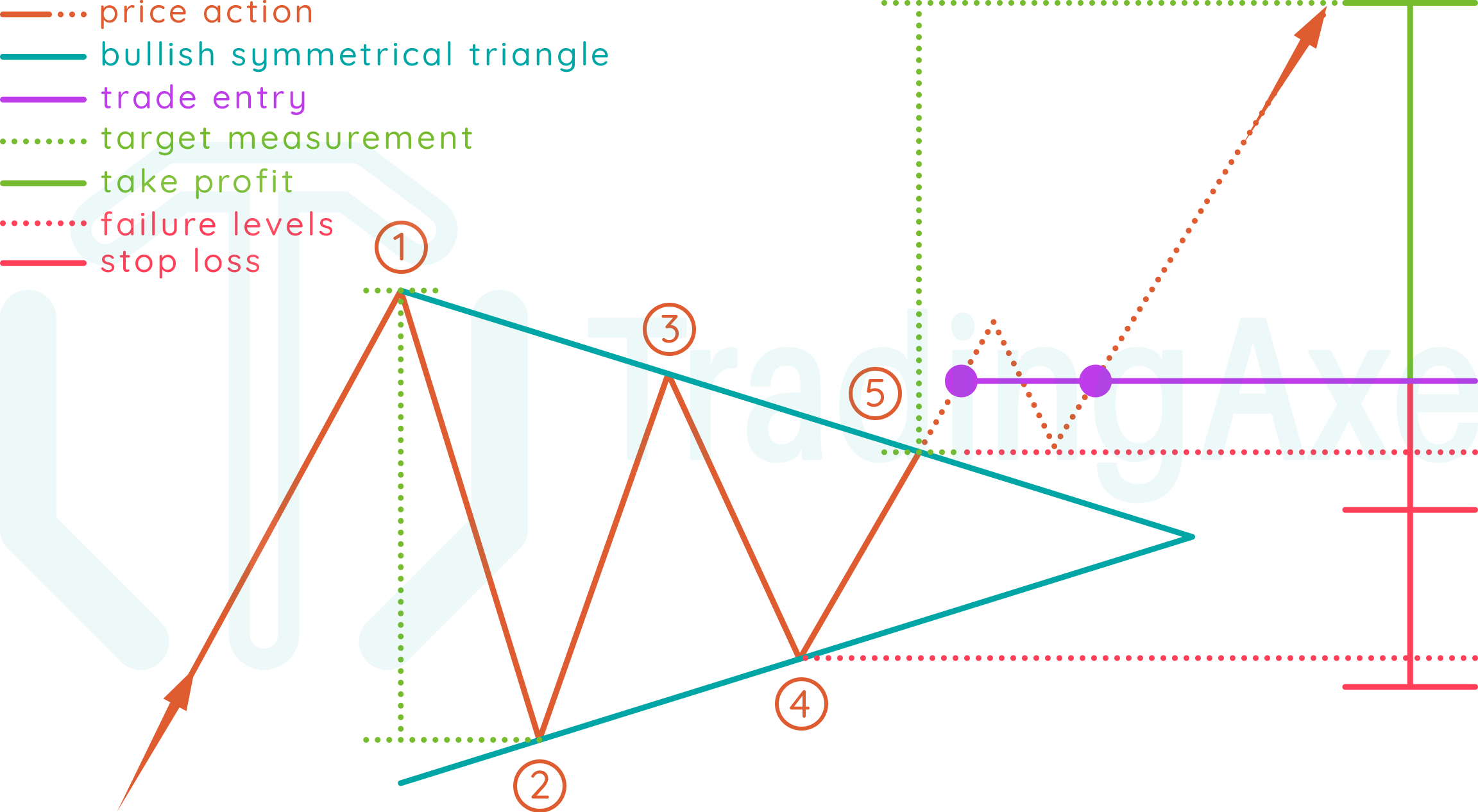

Uber Vs Door Dash A Legal Battle Over Food Delivery Dominance

May 08, 2025

Uber Vs Door Dash A Legal Battle Over Food Delivery Dominance

May 08, 2025 -

Xrp Price Jumps On News Of Pro Shares Etf Launch Non Spot

May 08, 2025

Xrp Price Jumps On News Of Pro Shares Etf Launch Non Spot

May 08, 2025 -

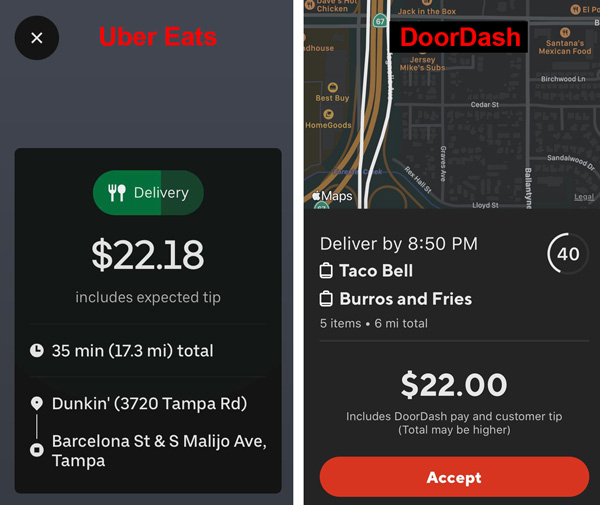

Canadas Trade Deficit A 506 Million Improvement With New Tariffs

May 08, 2025

Canadas Trade Deficit A 506 Million Improvement With New Tariffs

May 08, 2025