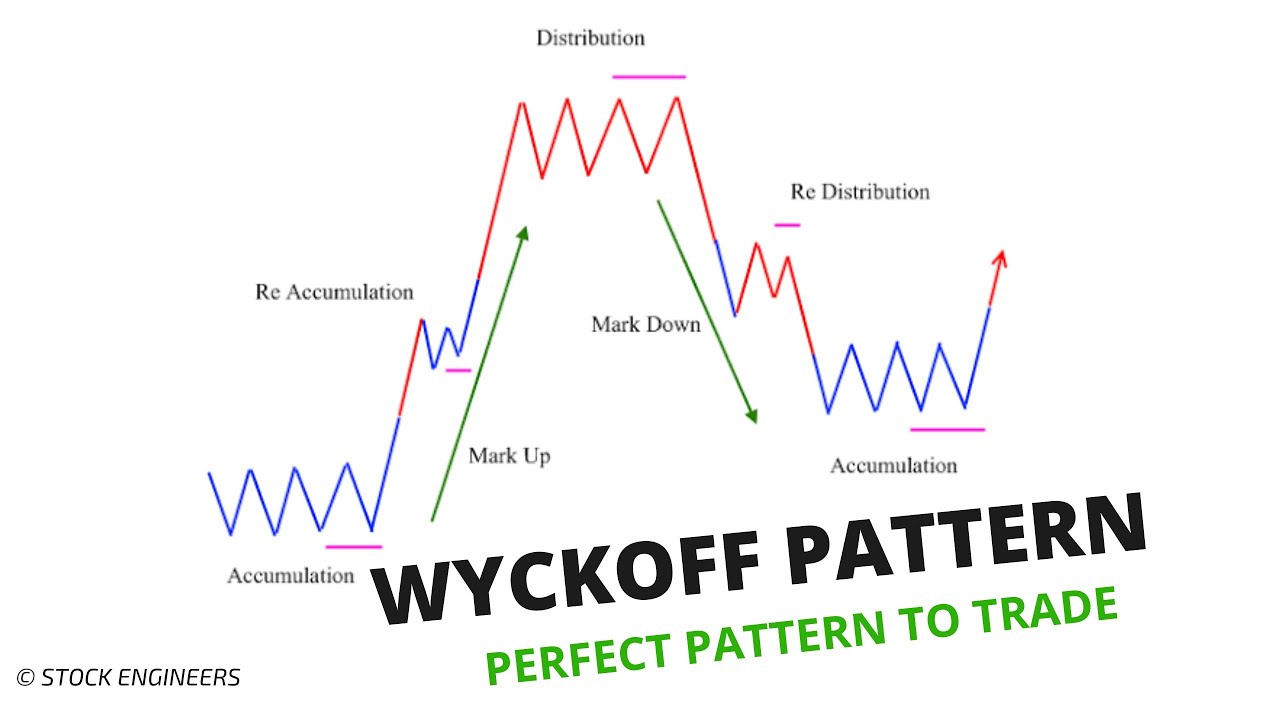

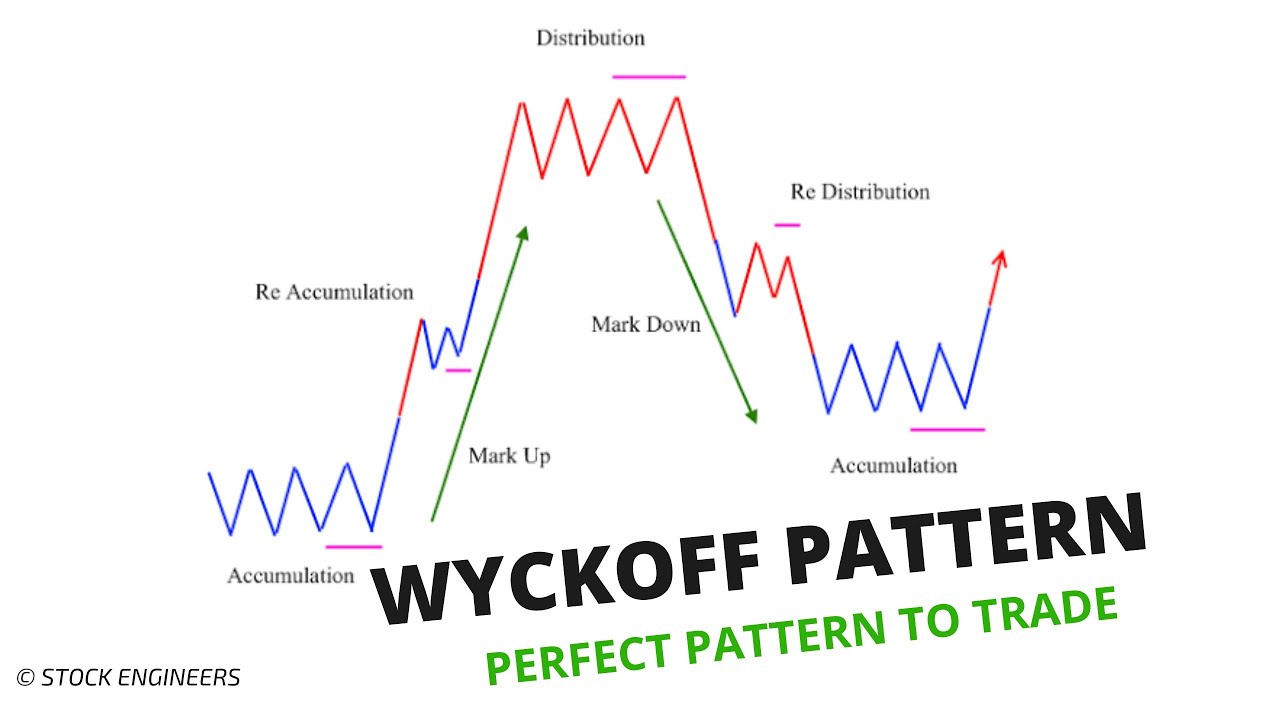

Ethereum's Path To $2,700: A Wyckoff Accumulation Perspective

Table of Contents

Understanding Wyckoff Accumulation:

Key Characteristics of a Wyckoff Accumulation:

The Wyckoff method is a sophisticated technical analysis technique used to identify accumulation and distribution phases in the market. A successful Wyckoff Accumulation shows several key characteristics:

- Smart Money Accumulation: Large institutional investors ("smart money") quietly accumulate ETH at relatively low prices, building a significant position before a price surge. This buying pressure is often hidden from casual observation.

- Testing Support Levels: Repeated testing of support levels helps gauge the market depth and identify potential buyers. These tests reveal how strong the support is.

- Low Volume During Accumulation: Generally, trading volume remains relatively low during the accumulation phase, indicating less public participation and a more controlled price movement.

- Springs and Tests: The pattern often includes "springs" (sudden downward movements) and "tests" (attempts to break above resistance) designed to shake out weak holders and attract buyers at lower prices.

- Increasing Buying Pressure: As the accumulation progresses, subtle signs of increased buying pressure become more evident, such as higher lows and increasing volume on upward movements.

- Upthrusts: False breakouts above resistance ("upthrusts") are designed to lure in more sellers, adding to the "smart money's" position at a higher price level. These are crucial to the Wyckoff Accumulation pattern.

- Sign of Weakness (SoW): A final test of support, often accompanied by relatively high volume, is a crucial signal, confirming the potential for a significant price increase. This "Sign of Weakness" is deceptively named, as it often precedes a strong upward trend.

Identifying Wyckoff Accumulation in the Ethereum Chart:

Applying the Wyckoff method to the Ethereum chart requires a careful examination of several factors:

- Chart Analysis: Analyzing the ETH/USD chart for classic Wyckoff Accumulation phases, paying close attention to price action, volume, and the relationship between them.

- Support and Resistance: Precisely pinpointing potential support and resistance levels is crucial. These levels often act as boundaries for price fluctuations during accumulation.

- Volume and Price Action: Correlating volume and price action is key to validating the pattern. Low volume during consolidation and increasing volume during breakouts confirms the pattern.

- Historical Comparisons: Comparing current ETH price action with historical examples of Wyckoff Accumulations in other assets or even previous ETH cycles provides context and improves pattern recognition.

- Indicator Confirmation: Utilizing indicators like the On-Balance Volume (OBV) and Relative Strength Index (RSI) to corroborate the analysis and add further confirmation to the potential accumulation.

Market Factors Influencing Ethereum's Price:

Ethereum's Network Development and Upgrades:

Several factors intrinsic to Ethereum's development influence its price:

- Ethereum 2.0: The ongoing development and eventual full rollout of Ethereum 2.0 is a major catalyst for price appreciation. The shift to a proof-of-stake consensus mechanism is expected to increase efficiency and scalability.

- DeFi Growth: The explosive growth of decentralized finance (DeFi) applications built on Ethereum continues to drive demand for ETH. As DeFi adoption expands, the need for ETH as gas (transaction fees) increases.

- NFTs and Metaverse: The popularity of non-fungible tokens (NFTs) and the growing metaverse further fuel demand for ETH, impacting price positively.

The Overall Cryptocurrency Market Sentiment:

External market forces also play a significant role:

- Bitcoin Correlation: Ethereum's price often correlates with Bitcoin's price. A bullish Bitcoin market usually leads to a bullish Ethereum market.

- Investor Sentiment: Overall investor sentiment towards cryptocurrencies significantly impacts ETH's price. Positive sentiment generally drives prices up, while negative sentiment can lead to declines.

- Regulatory News: Regulatory announcements and news from various jurisdictions can impact investor sentiment and thus the price of Ethereum.

Macroeconomic Conditions and Their Influence:

Broader economic factors also affect crypto prices:

- Inflation and Interest Rates: High inflation and rising interest rates can negatively impact risk assets like cryptocurrencies, potentially reducing investment in ETH.

- Geopolitical Events: Geopolitical instability and major global events can create volatility in the cryptocurrency market and affect ETH's price.

Potential Risks and Challenges:

The Limitations of Technical Analysis:

It's crucial to understand the limitations of technical analysis:

- No Guarantees: Wyckoff Accumulation, like any technical analysis tool, is not a guaranteed prediction of future price movements. It's a probabilistic tool, not a certainty.

- Alternative Scenarios: Other market scenarios are possible, and the price may not follow the predicted path.

Unforeseen Market Events:

Unexpected events can significantly impact the price of Ethereum:

- Black Swan Events: Unpredictable events ("black swan" events) can cause significant price volatility, potentially derailing any predicted price trajectory.

- Risk Management: Effective risk management is crucial when investing in cryptocurrencies, given their inherent volatility.

Competition from Other Cryptocurrencies:

The competitive landscape within the cryptocurrency market poses a challenge:

- Alternative Blockchains: The emergence of competing blockchains and alternative cryptocurrencies could impact Ethereum's dominance and market share.

Conclusion:

This analysis suggests that Ethereum's current price action may be indicative of a Wyckoff Accumulation pattern, potentially paving the way for a price increase towards $2700. However, it’s crucial to remember that technical analysis is not foolproof, and unforeseen events could impact the price. Careful consideration of the market's overall sentiment, Ethereum's technological advancements, and macroeconomic factors is essential. While the path to Ethereum reaching $2700 remains uncertain, understanding the potential for Wyckoff Accumulation and the various contributing factors can provide a more informed perspective. Further research into Ethereum's price action and the principles of Wyckoff Accumulation are highly recommended for any investor considering a position in ETH. Continuously monitoring the Ethereum price and related indicators will be crucial for evaluating the validity of this analysis and making informed trading decisions regarding Ethereum $2700.

Featured Posts

-

Wlyme Ky Khwshy Ghm Myn Bdly Gjranwalh Myn Dlha Jan Bhq

May 08, 2025

Wlyme Ky Khwshy Ghm Myn Bdly Gjranwalh Myn Dlha Jan Bhq

May 08, 2025 -

Azmt Jysws Wflamnghw Alshmrany Yubdy Rayh Fydyw

May 08, 2025

Azmt Jysws Wflamnghw Alshmrany Yubdy Rayh Fydyw

May 08, 2025 -

Cash Only Ubers Updated Auto Service Policy

May 08, 2025

Cash Only Ubers Updated Auto Service Policy

May 08, 2025 -

Andor Showrunner Tony Gilroy Reflects On Production

May 08, 2025

Andor Showrunner Tony Gilroy Reflects On Production

May 08, 2025 -

Chat Gpt And Open Ai Facing Ftc Investigation

May 08, 2025

Chat Gpt And Open Ai Facing Ftc Investigation

May 08, 2025