Euro And US Futures: Swissquote Bank's Market Analysis

Table of Contents

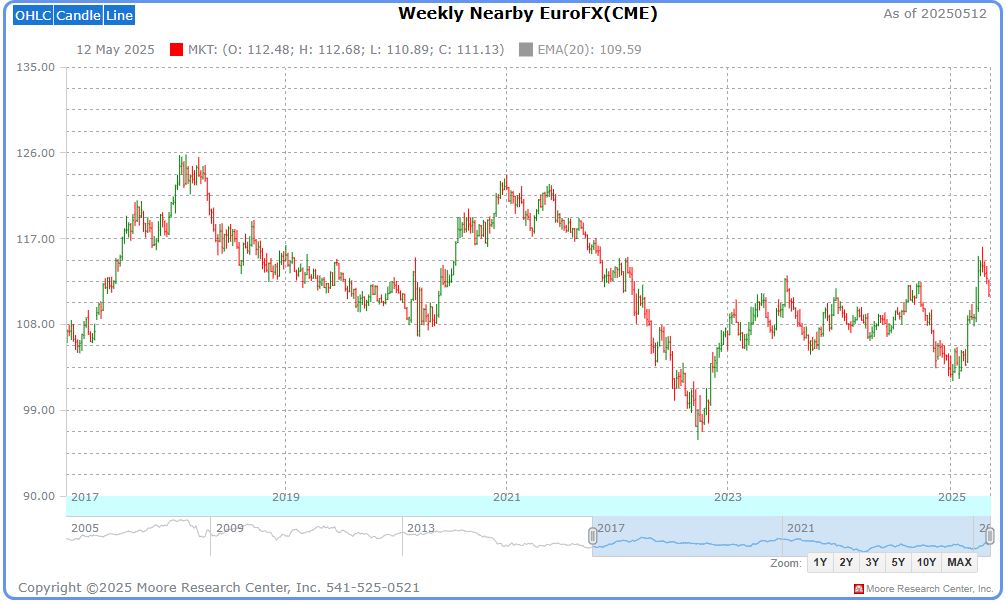

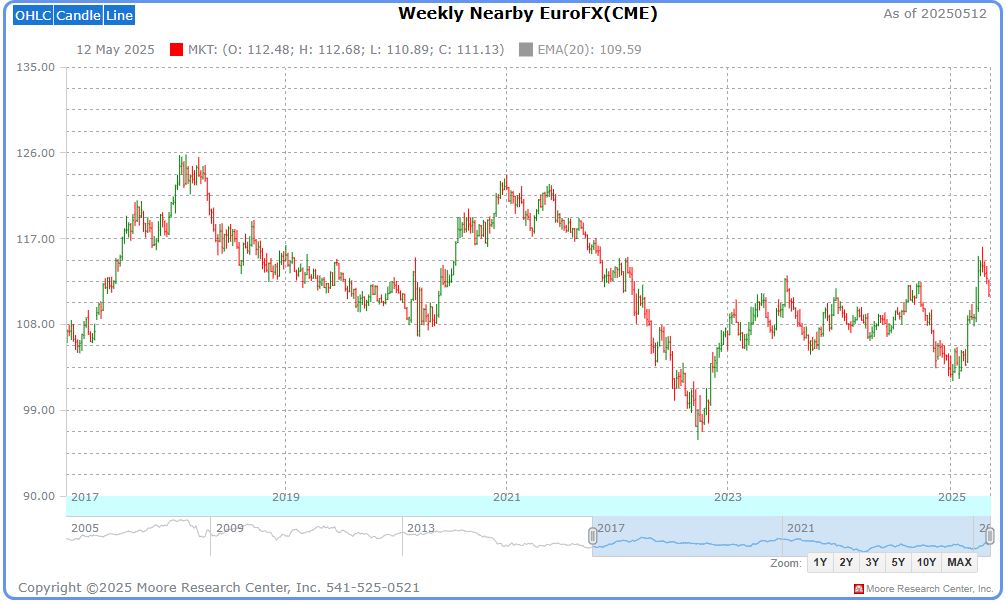

Understanding Euro Futures Contracts

Euro futures contracts, often represented as EUR/USD futures, are derivatives that track the value of the Euro against the US Dollar. Understanding their intricacies is fundamental for successful trading.

Contract Specifications

Euro FX futures contracts have specific parameters crucial for traders to understand:

- Contract Size: Typically, one contract represents a specific amount of Euros (e.g., 125,000 EUR).

- Trading Hours: These contracts are traded electronically on global exchanges, offering extended trading hours across different time zones.

- Expiry Dates: Euro futures contracts have defined expiry dates, after which they settle based on the prevailing exchange rate. Traders must understand these dates to manage their positions effectively. Understanding these

contract specificationsis vital for avoiding unexpected losses.

Factors Influencing Euro Futures Prices

Numerous macroeconomic factors significantly impact Euro futures prices. These include:

- European Central Bank (ECB) monetary policy decisions: Changes in interest rates, quantitative easing programs, and other ECB actions directly influence the Euro's value.

- Eurozone economic growth data (GDP, inflation): Strong economic data generally strengthens the Euro, while weak data can lead to declines. Tracking

Eurozone economic growthindicators is key. - Geopolitical events affecting the Eurozone: Political instability, crises, and international relations within the Eurozone can create volatility in Euro futures.

- US Dollar strength relative to the Euro: The US dollar's strength or weakness against other major currencies, including the Euro, directly affects the EUR/USD exchange rate and, consequently, Euro futures prices.

Trading Strategies for Euro Futures

Successful Euro futures trading relies on employing effective strategies:

- Hedging: Businesses can use Euro futures contracts to hedge against foreign exchange risk associated with Euro-denominated transactions.

- Speculation: Traders can speculate on the future direction of the EUR/USD exchange rate, attempting to profit from price movements.

- Arbitrage: Sophisticated traders may exploit price discrepancies between different markets to achieve arbitrage profits. Mastering

Euro futures trading strategiesis crucial for maximizing potential returns while mitigating risks.

Analyzing US Futures Contracts

US futures contracts encompass a wide range of underlying assets, providing diverse trading opportunities.

Types of US Futures Contracts

The US futures market offers several types of contracts, including:

- US equity futures: Contracts based on major US equity indices like the S&P 500 futures, offering exposure to the overall US stock market.

- US interest rate futures: Contracts based on US Treasury bonds or other interest rate instruments, allowing traders to speculate on interest rate movements. Understanding the differences between various

futures contractsis crucial for informed trading.

Key Indicators Affecting US Futures

Several key economic indicators drive US futures prices:

- US Federal Reserve (Fed) interest rate decisions: The Fed's monetary policy significantly impacts interest rates and, in turn, influences US equity and interest rate futures.

- US economic data (employment, inflation, consumer confidence): Strong US economic data generally supports higher futures prices, while weak data can lead to declines.

- Global economic growth and trade relations: Global economic conditions and international trade significantly impact US markets and futures prices.

- Geopolitical risks and uncertainties: Geopolitical events and uncertainties can cause volatility in US futures markets.

Risk Management in US Futures Trading

Effective risk management is essential for successful US futures trading:

- Stop-loss orders: These orders automatically limit potential losses by closing a position when the price reaches a predetermined level.

- Position sizing: Carefully determining the size of your trading positions is crucial for managing risk and capital.

- Diversification: Spreading your investments across different futures contracts can help reduce overall portfolio risk. Employing sound

risk managementpractices is paramount in minimizing potential losses.

Swissquote Bank's Market Analysis and Tools

Swissquote Bank provides traders with the necessary tools and resources for navigating the complexities of Euro and US Futures trading.

Access to Real-time Data

Swissquote Bank offers access to:

- Real-time market data: Up-to-the-minute price quotes and market information are critical for making informed trading decisions.

- Advanced charting tools: Sophisticated charting packages allow for detailed technical analysis. Access to

real-time market datais crucial for timely decision-making.

Expert Analysis and Insights

Swissquote Bank provides:

- Market analysis reports: Regularly published reports offer insightful analysis of market trends and potential opportunities.

- Expert commentaries: Experienced analysts provide insightful commentary on market events and their implications for futures traders. This

market analysisis invaluable for understanding market dynamics.

Educational Resources and Support

Swissquote Bank offers comprehensive support to its clients:

- Trading education: Educational resources, webinars, and tutorials help traders enhance their knowledge and skills.

- Dedicated customer support: Experienced support staff is available to answer questions and assist traders. Access to

educational resourcesandcustomer supportis vital for both novice and experienced traders.

Conclusion

Successfully trading Euro and US Futures requires a deep understanding of the underlying economic and geopolitical factors influencing price movements. By carefully considering contract specifications, macroeconomic indicators, and employing effective risk management techniques, traders can significantly improve their chances of success. Swissquote Bank provides the essential tools and expert insights necessary to navigate this complex market effectively. Stay ahead in the dynamic world of Euro and US Futures trading. Access Swissquote Bank's comprehensive market analysis and trading tools today! Mastering Euro and US futures trading requires the right tools and expertise.

Featured Posts

-

Jon Almaas Fra Tv Skjermen Til Bondegarden

May 19, 2025

Jon Almaas Fra Tv Skjermen Til Bondegarden

May 19, 2025 -

Post Roe America How Otc Birth Control Impacts Womens Health

May 19, 2025

Post Roe America How Otc Birth Control Impacts Womens Health

May 19, 2025 -

Fsu Shooting Victims Family History A Cia Operatives Legacy

May 19, 2025

Fsu Shooting Victims Family History A Cia Operatives Legacy

May 19, 2025 -

Wembley Woes Continue Haalands Fa Cup Final Goal Drought

May 19, 2025

Wembley Woes Continue Haalands Fa Cup Final Goal Drought

May 19, 2025 -

I Protomagia Stin Kastoria Istoria Kai Paradosi Stis Topikes Enories

May 19, 2025

I Protomagia Stin Kastoria Istoria Kai Paradosi Stis Topikes Enories

May 19, 2025