European Midday Briefing: Stock Market Dip On PMI Data

Table of Contents

PMI Data Deep Dive: Unveiling the Weakness

The Purchasing Managers' Index (PMI) is a widely-followed economic indicator that tracks the activity levels of purchasing managers in the manufacturing and services sectors. A PMI reading above 50 generally signals expansion, while a reading below 50 indicates contraction. Today's release revealed significant weakness across several key areas, sending ripples through the European stock market.

-

Specific PMI Figures:

- Manufacturing PMI: Fell to 48.5, down from 49.2 the previous month and below analyst expectations of 49.8. This indicates a contraction in the manufacturing sector.

- Services PMI: Slipped to 51.2, a decrease from 52.1 and slightly below the predicted 51.5. While still technically in expansion territory, the slowdown is concerning.

- Composite PMI: The combined manufacturing and services PMI fell to 50.0, marking stagnation and highlighting the overall weakening economic activity across Europe.

-

Geographical Variations: While the overall picture is gloomy, there are geographical variations. Germany, a major European economy, experienced a particularly sharp decline in its manufacturing PMI. In contrast, France showed slightly better resilience, though still below the expansion threshold. This disparity underscores the heterogeneous nature of the European economic landscape and the challenges in generating a unified response.

-

Unexpected Surprises: The most significant surprise was the sharper-than-anticipated drop in the manufacturing PMI. This suggests deeper-rooted issues within the European industrial sector, possibly related to weakening global demand and persistent supply chain disruptions. The data deviated substantially from many analysts' predictions, highlighting the inherent uncertainty in economic forecasting.

Sector-Specific Impacts: Which Industries Felt the Pinch?

The negative PMI data had a disproportionate impact on various sectors of the European stock market. Market volatility was evident, with some experiencing significant share price drops while others exhibited relative resilience.

-

Heavily Impacted Sectors: The automotive and technology sectors were particularly hard hit, reflecting their sensitivity to global economic cycles and consumer sentiment. Companies heavily reliant on global supply chains also experienced significant setbacks.

-

Reasons for Vulnerability: The vulnerability of certain sectors stems from multiple factors. For example, consumer discretionary spending decreased in the face of rising inflation and interest rates. Sectors closely tied to this type of spending saw significant drops. Furthermore, the ongoing energy crisis continues to put pressure on production costs across many industries.

-

Resilient Sectors: Surprisingly, the healthcare sector showed some degree of resilience, benefiting from its relatively stable demand regardless of broader economic conditions. Utilities also demonstrated a degree of stability.

-

Market Capitalization Changes: The overall decline in the European stock market led to a substantial decrease in the combined market capitalization of many affected companies. This emphasizes the broad and significant impact of the weak PMI data.

Impact on Investor Sentiment and Trading Activity

The release of the weak PMI data had an immediate and measurable impact on investor sentiment and subsequent trading activity.

-

Increased Trading Volume: The initial reaction was a surge in trading volume as investors reacted swiftly to the negative news, triggering a market dip. This increased activity suggests a heightened level of uncertainty and potential risk aversion amongst investors.

-

Shift in Investor Sentiment: The prevailing sentiment swiftly shifted towards risk aversion, leading to a sell-off in many sectors. Investors are increasingly concerned about the potential for a more significant economic slowdown or even a recession.

-

Changes in Bond Yields and Currency Fluctuations: The weaker PMI data also led to some shifts in bond yields, with government bond yields falling slightly as investors sought safer havens. The Euro also experienced some modest downward pressure against other major currencies.

Looking Ahead: Potential Market Scenarios and Future Outlook

The current situation presents a challenging outlook for the European economy and the stock market. Several potential scenarios could unfold in the coming weeks and months.

-

Potential Recovery Scenarios: A rebound is possible if upcoming economic indicators show signs of stabilization or improvement. However, this would require a substantial shift in various factors, including easing inflation pressures, improved supply chain conditions, and renewed consumer confidence.

-

Potential Risks and Challenges: The ongoing energy crisis, persistently high inflation, and the potential for further interest rate hikes by the European Central Bank pose significant risks to the economic outlook. Geopolitical tensions could also exacerbate the situation, causing further market uncertainty.

-

Importance of Monitoring Economic Indicators: Investors should closely monitor upcoming economic releases, such as inflation data, employment figures, and consumer confidence indices. These indicators will provide valuable insights into the trajectory of the European economy.

-

Expert Opinions and Predictions: Many economic experts are expressing cautious optimism, suggesting that the current downturn may be temporary. However, the overall outlook remains uncertain, and further economic data is needed to clarify the situation.

Conclusion:

The release of weak PMI data has triggered a noticeable dip in the European stock market today. Understanding the nuances of this data, its sectoral impacts, and investor sentiment is crucial for navigating the current market volatility. By closely monitoring future PMI releases and other key economic indicators, investors can better position themselves for the evolving landscape. Stay informed with our regular European Midday Briefing for the latest updates and analysis on market trends and impactful PMI data. For continuous coverage of the European stock market and the latest PMI data analysis, subscribe to our newsletter.

Featured Posts

-

Bbc Lancashire Remembering Dj Andy Peebles With Andy Bayes

May 23, 2025

Bbc Lancashire Remembering Dj Andy Peebles With Andy Bayes

May 23, 2025 -

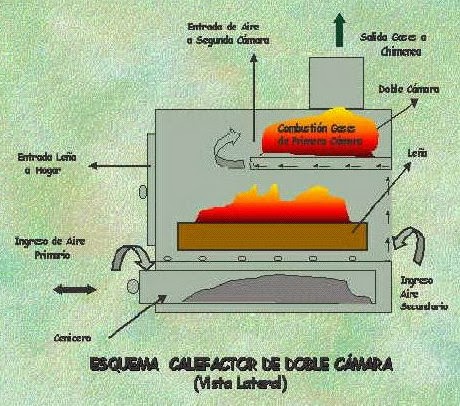

Motor De Agua Britanico Una Revolucion En La Tecnologia De Combustion

May 23, 2025

Motor De Agua Britanico Una Revolucion En La Tecnologia De Combustion

May 23, 2025 -

Last Wicket Stand By Crawley Prevents Gloucestershire Win

May 23, 2025

Last Wicket Stand By Crawley Prevents Gloucestershire Win

May 23, 2025 -

Tahar Rahim On Metamorphosis Exploring His Role In Julia Ducournaus Alpha

May 23, 2025

Tahar Rahim On Metamorphosis Exploring His Role In Julia Ducournaus Alpha

May 23, 2025 -

Clinton Vs Congress Examining The One Percent Budget Veto Standoff

May 23, 2025

Clinton Vs Congress Examining The One Percent Budget Veto Standoff

May 23, 2025

Latest Posts

-

Ing Groups 2024 Annual Report Form 20 F Released

May 23, 2025

Ing Groups 2024 Annual Report Form 20 F Released

May 23, 2025 -

Ingressos Atlantida Celebration Como Comprar E Nao Perder A Festa Em Santa Catarina

May 23, 2025

Ingressos Atlantida Celebration Como Comprar E Nao Perder A Festa Em Santa Catarina

May 23, 2025 -

Ing Provides Project Finance Facility To Freepoint Eco Systems

May 23, 2025

Ing Provides Project Finance Facility To Freepoint Eco Systems

May 23, 2025 -

Atlantida Celebration Sc Nando Reis Armandinho Di Ferrero E Atracoes Imperdiveis

May 23, 2025

Atlantida Celebration Sc Nando Reis Armandinho Di Ferrero E Atracoes Imperdiveis

May 23, 2025 -

Tov Z Odnim Uchasnikom Yak Pravilno Organizuvati Gospodarsku Diyalnist

May 23, 2025

Tov Z Odnim Uchasnikom Yak Pravilno Organizuvati Gospodarsku Diyalnist

May 23, 2025