Evaluating Uber (UBER) As An Investment Opportunity

Table of Contents

Analyzing Uber's Financial Performance and Growth

Understanding Uber's financial health is crucial for any potential investor. Let's examine its revenue streams and profitability to gauge its growth trajectory.

Revenue Streams and Growth Trajectory

Uber generates revenue from multiple sources, creating diversification but also complexity in analysis. Its primary revenue streams include:

- Rides: This remains a significant revenue driver, though its growth rate has shown some variation depending on factors like global economic conditions and competition.

- Uber Eats: The food delivery segment has experienced considerable growth, especially during periods of increased demand and restrictions on dine-in services. This offers a compelling avenue for future growth.

- Uber Freight: This segment focuses on logistics and transportation for businesses, representing a potentially high-growth area in the long term.

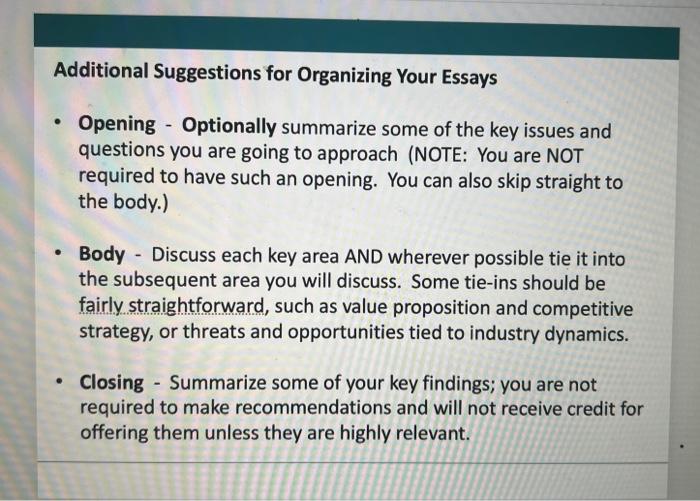

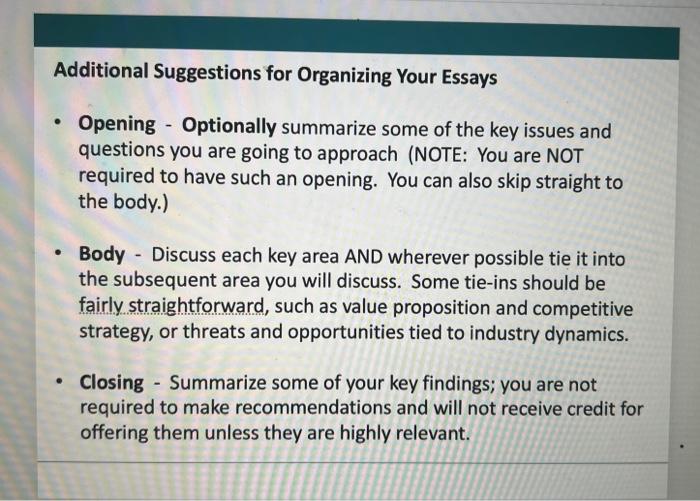

Analyzing Uber's historical revenue growth reveals periods of rapid expansion followed by periods of slower growth or even contraction. Understanding the underlying causes of these fluctuations – such as economic downturns, regulatory changes, or increased competition – is essential. Investors should consult financial statements and industry reports to accurately project Uber's future revenue growth potential. (Include a relevant chart or graph here visually representing revenue trends across different segments). Keywords such as "Uber revenue," "Uber Eats revenue," and "Uber Freight revenue" should be strategically placed within the chart's description.

Profitability and Margins

Uber's profitability has been a subject of ongoing debate. While the company has shown impressive revenue growth, achieving sustained profitability has proven challenging. Key factors affecting Uber's profitability include:

- Driver compensation: The cost of driver payments significantly impacts operating expenses.

- Operating costs: Expenses such as marketing, technology infrastructure, and administrative overhead are substantial.

- Competition: Intense competition from Lyft and other ride-sharing services puts pressure on pricing and margins.

Analyzing Uber's operating margins and net income over time is essential. Investors should scrutinize the company's efforts to improve profitability, such as implementing cost-cutting measures, optimizing pricing strategies, and expanding higher-margin services. Keywords like "Uber profitability," "Uber margins," and "Uber operating expenses" should be organically integrated within this analysis.

Competitive Landscape and Market Position

Uber operates in a dynamic and intensely competitive market. Understanding its competitive position and the potential for disruption is critical.

Key Competitors and Market Share

Uber's primary competitors include:

- Lyft: A major player in the US ride-sharing market, directly competing with Uber on pricing and services.

- Didi Chuxing: A dominant force in the Chinese market, showcasing the regional variations in competitive dynamics.

Analyzing Uber's market share in various geographic regions reveals areas of strength and vulnerability. The competitive intensity varies significantly across different markets. Monitoring market share trends and competitive actions is essential for assessing Uber's long-term growth prospects. The keywords "Uber competitors," "Lyft," "Didi Chuxing," and "ride-sharing market share" are crucial for SEO purposes.

Disruptive Technologies and Future Trends

The ride-sharing industry is subject to rapid technological advancements that could significantly impact Uber's future. Key areas to consider include:

- Autonomous Vehicles: The development and deployment of autonomous vehicles could revolutionize the transportation industry, potentially impacting both costs and revenue streams for Uber.

- Micromobility: Expansion into micromobility options like e-scooters and e-bikes presents opportunities for diversification and increased market reach.

Analyzing the impact of these disruptive technologies on Uber's business model is crucial. Understanding how Uber is adapting to these changes and investing in innovative technologies will provide valuable insights into its long-term prospects. The keywords "autonomous vehicles," "Uber technology," and "future of ride-sharing" should be incorporated naturally.

Risks and Challenges Facing Uber

While Uber presents opportunities, several risks and challenges could hinder its growth and profitability.

Regulatory Hurdles and Legal Battles

Uber operates under a complex and evolving regulatory environment globally. This creates several challenges:

- Licensing and permits: Securing necessary licenses and permits in different jurisdictions can be time-consuming and costly.

- Legal challenges: Uber faces ongoing legal battles related to driver classification, labor laws, and data privacy.

These regulatory hurdles and legal battles create uncertainty and potential financial liabilities. The keywords "Uber regulation," "Uber lawsuits," and "legal risks" are essential for SEO optimization in this section.

Driver Relations and Labor Costs

The relationship between Uber and its drivers is a key factor impacting its operations and costs:

- Driver compensation and benefits: The cost of driver compensation and any potential benefits significantly influence Uber's profitability.

- Labor disputes: The gig economy model has led to labor disputes and calls for improved driver rights and working conditions.

Understanding the dynamics of driver relations and their impact on labor costs is crucial for evaluating Uber's future performance. The keywords "Uber drivers," "gig economy," "driver compensation," and "labor costs" should be naturally integrated.

Conclusion

Evaluating Uber (UBER) as an investment opportunity requires a careful consideration of its financial performance, competitive landscape, and future prospects. While Uber has shown significant revenue growth and expansion into new markets, challenges remain in achieving consistent profitability and navigating regulatory hurdles and labor relations. The company's success hinges on its ability to effectively manage its costs, adapt to technological advancements, and maintain a competitive edge in a rapidly evolving market. Based on this analysis, investors should conduct thorough due diligence and carefully weigh the potential risks and rewards before investing in UBER stock. Learn more about evaluating Uber (UBER) stock and conduct your own due diligence before making any investment decisions.

Featured Posts

-

Zielinskis Calf Injury Inter Milan Midfielder Faces Weeks Out

May 08, 2025

Zielinskis Calf Injury Inter Milan Midfielder Faces Weeks Out

May 08, 2025 -

Dodgers Betts Out Illness Keeps Star Outfielder From Freeway Series

May 08, 2025

Dodgers Betts Out Illness Keeps Star Outfielder From Freeway Series

May 08, 2025 -

Tuerkiye De Kripto Para Duezenlemesi Spk Nin Son Aciklamalari Ve Etkileri

May 08, 2025

Tuerkiye De Kripto Para Duezenlemesi Spk Nin Son Aciklamalari Ve Etkileri

May 08, 2025 -

Ethereum Price Breaks Resistance 2 000 Target In Sight

May 08, 2025

Ethereum Price Breaks Resistance 2 000 Target In Sight

May 08, 2025 -

Ubers Big Shift Cash Only Auto Service

May 08, 2025

Ubers Big Shift Cash Only Auto Service

May 08, 2025