Extreme Price Hike: Broadcom's VMware Proposal Costs AT&T 1,050% More

Table of Contents

The Acquisition's Impact on VMware Pricing

Broadcom's acquisition of VMware represents a significant shift in the virtualization landscape. Broadcom, known for its semiconductor and infrastructure software businesses, operates under a different business model compared to VMware. This shift has directly influenced pricing strategies for VMware products, leading to concerns about market dominance and reduced competition. The drastic price increase for AT&T suggests a potential move towards maximizing profit margins, capitalizing on their newfound control over a dominant market player. Several factors contribute to this dramatic price hike:

- Increased licensing fees: Existing licensing agreements are being renegotiated with significantly higher fees.

- New pricing tiers: VMware has introduced new pricing tiers that are less favorable to large enterprise customers like AT&T.

- Removal of discounts: Previously available discounts and bundled offers have been eliminated, further increasing costs.

- Changes in contract terms: Contract terms are being revised to favor Broadcom, potentially locking customers into less favorable agreements. This lack of flexibility exacerbates the impact of the price hike.

AT&T's Financial Implications

The 1050% increase in VMware licensing costs presents a significant financial burden for AT&T. This substantial expense will undoubtedly strain their budget and may necessitate difficult choices regarding other investments and operations. The implications extend beyond simple budget cuts:

- Budgetary constraints: AT&T might need to reallocate resources, potentially delaying or canceling other crucial projects.

- Potential impact on investments: Planned investments in research and development, network infrastructure upgrades, or other strategic initiatives could be impacted.

- Impact on shareholders: The increased costs could negatively affect AT&T's profitability and ultimately impact shareholder returns.

- Potential legal ramifications: The magnitude of the price increase might warrant legal scrutiny, raising questions about fair business practices and potential antitrust violations.

Broader Implications for the Tech Industry

The AT&T case serves as a cautionary tale for other large corporations relying heavily on VMware products. This price hike signals a potential trend of increased costs across the industry following major acquisitions, forcing businesses to reassess their reliance on specific vendors. The implications are far-reaching:

- Increased costs for businesses: Companies dependent on VMware can expect increased operational expenditure, potentially impacting profitability and competitiveness.

- Shift towards open-source alternatives: The price hike may accelerate the adoption of open-source virtualization solutions as businesses seek cost-effective alternatives.

- Increased scrutiny of mergers and acquisitions: Regulatory bodies are likely to pay closer attention to the pricing practices of companies resulting from large-scale acquisitions.

- Potential antitrust concerns: The drastic price increase raises antitrust concerns, prompting investigations into whether Broadcom's acquisition has resulted in monopolistic practices.

Alternatives and Mitigation Strategies for Businesses

Businesses facing similar challenges need to explore alternative strategies to reduce their dependence on VMware and mitigate the impact of potential price hikes. Several options exist:

- Open-source virtualization solutions: Open-source platforms like Proxmox VE, oVirt, and Xen offer cost-effective alternatives to VMware.

- Cloud migration strategies: Migrating workloads to cloud platforms like AWS, Azure, or Google Cloud can diversify vendor dependence and potentially reduce costs.

- Negotiating favorable contract terms: Businesses with significant negotiating power can attempt to negotiate more favorable contract terms with VMware or seek alternative vendors.

- Seeking alternative vendors: Exploring other virtualization providers can help businesses reduce their reliance on a single vendor and improve their negotiating position.

Conclusion: Navigating the VMware Price Hike After Broadcom's Acquisition

Broadcom's acquisition of VMware has resulted in a dramatic price hike for AT&T, demonstrating the potential consequences of major tech mergers. The 1050% increase in licensing costs highlights the significant financial burden on businesses reliant on VMware products and underscores the need for proactive planning and diversification. The implications extend beyond AT&T, impacting the broader tech industry and raising concerns about market dominance and fair business practices. Don't let a Broadcom-led VMware price hike cripple your budget. Analyze your licensing agreements and explore alternative solutions today! Understanding the potential risks associated with vendor lock-in and proactively exploring alternative VMware solutions, such as open-source options or cloud migration, is crucial for businesses to mitigate the impact of future price increases and maintain their financial stability.

Featured Posts

-

Clisson Un College Face A La Question Du Port De Signes Religieux

May 21, 2025

Clisson Un College Face A La Question Du Port De Signes Religieux

May 21, 2025 -

D Wave Quantum Qbts Stock Price Movement Examining The Recent Spike

May 21, 2025

D Wave Quantum Qbts Stock Price Movement Examining The Recent Spike

May 21, 2025 -

Mission Patrimoine 2025 Plouzane Et Clisson Des Projets De Restauration En Bretagne

May 21, 2025

Mission Patrimoine 2025 Plouzane Et Clisson Des Projets De Restauration En Bretagne

May 21, 2025 -

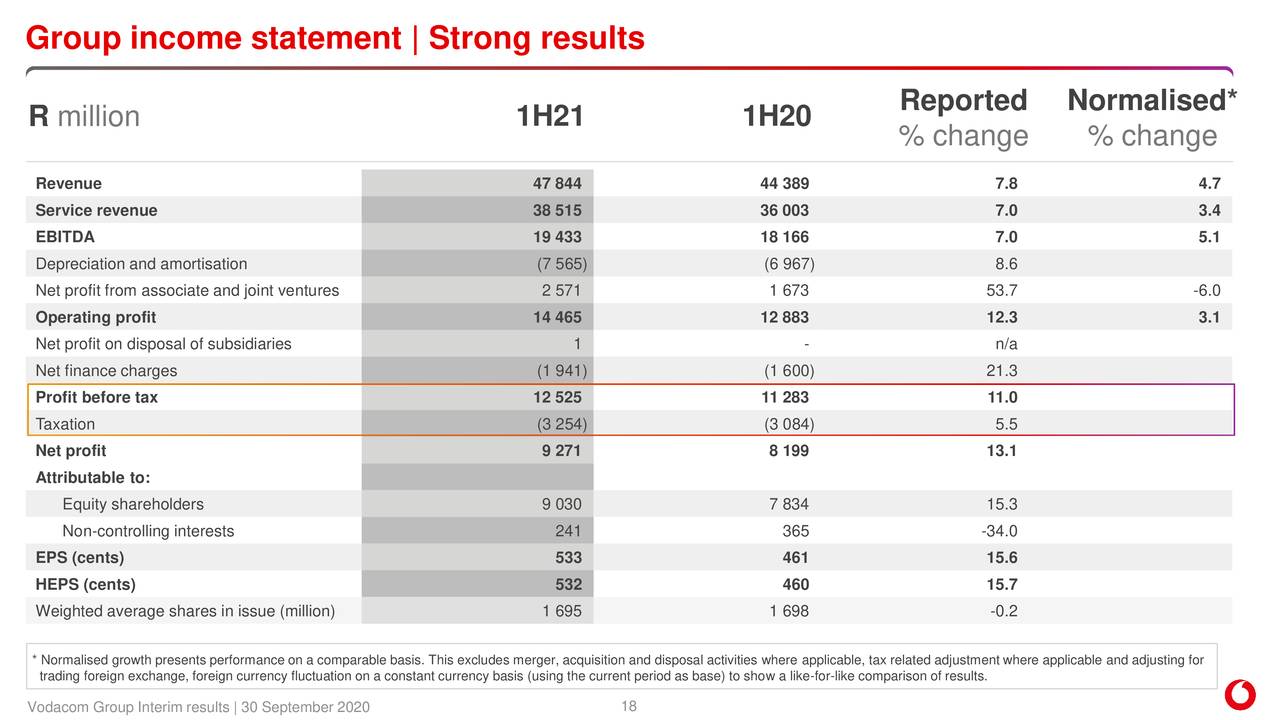

Vodacoms Vod Q Quarter Earnings Exceed Forecasts

May 21, 2025

Vodacoms Vod Q Quarter Earnings Exceed Forecasts

May 21, 2025 -

Vybz Kartel Announces Historic New York Concert Details Revealed

May 21, 2025

Vybz Kartel Announces Historic New York Concert Details Revealed

May 21, 2025

Latest Posts

-

I Diavrosi Tis Anthropinis Aksias To Paradeigma Giakoymaki

May 21, 2025

I Diavrosi Tis Anthropinis Aksias To Paradeigma Giakoymaki

May 21, 2025 -

Baggelis Giakoymakis Mia Analysi Tis Ithikis Katastrofis

May 21, 2025

Baggelis Giakoymakis Mia Analysi Tis Ithikis Katastrofis

May 21, 2025 -

I Katarrakosi Tis Aksias I Periptosi Baggeli Giakoymaki

May 21, 2025

I Katarrakosi Tis Aksias I Periptosi Baggeli Giakoymaki

May 21, 2025 -

Giakoymakis Kai I Kroyz Azoyl I Epityxia Poy Odigise Ston Teliko Toy Champions League

May 21, 2025

Giakoymakis Kai I Kroyz Azoyl I Epityxia Poy Odigise Ston Teliko Toy Champions League

May 21, 2025 -

I Prokrisi Tis Kroyz Azoyl I Syneisfora Toy Giakoymaki Ston Teliko Toy Champions League

May 21, 2025

I Prokrisi Tis Kroyz Azoyl I Syneisfora Toy Giakoymaki Ston Teliko Toy Champions League

May 21, 2025