Facing Government Action For Delinquent Student Loans? Know Your Options

Table of Contents

Understanding the Severity of Delinquent Student Loans

Delinquency on student loans isn't something to take lightly. It progresses through stages, each with increasingly serious consequences. Understanding these stages is crucial to preventing further damage to your financial well-being.

- Late Payments: Missing payments, even by a few days, can negatively impact your credit score and lead to late fees. This is the earliest stage of delinquency and the easiest to address.

- Default: This is the most serious stage of delinquency. It occurs after you've missed a certain number of payments (usually 9 months), and the consequences can be severe. Student loan default has significant repercussions.

The consequences of defaulting on student loans include:

- Damaged Credit Score: A default significantly lowers your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. This impacts your "credit score impact" negatively.

- Wage Garnishment: The government can garnish your wages, taking a portion of your paycheck to repay the debt. This can severely impact your ability to meet your daily living expenses.

- Tax Refund Offset: Your federal and state tax refunds can be seized to repay your student loans. This means you won't receive any of your refund.

- Bank Levy: The government can seize funds directly from your bank account. This can leave you with insufficient funds for essential needs.

- Difficulty Obtaining Future Loans or Credit Cards: A defaulted student loan makes it extremely challenging to secure future loans or credit cards, further hindering your financial prospects.

The key takeaway? Addressing your student loan debt before it reaches the default stage is paramount. Understanding the potential "financial consequences" of ignoring the problem is the first step to a solution.

Exploring Your Options for Resolving Delinquent Student Loans

Fortunately, several options exist to help you resolve your delinquent student loans. It's crucial to explore these possibilities to find the best fit for your individual circumstances.

Repayment Plans

Income-driven repayment (IDR) plans can significantly lower your monthly payments, making them more manageable. Several options exist, each with its own eligibility requirements and terms:

- IBR (Income-Based Repayment): Payments are calculated based on your income and family size.

- PAYE (Pay As You Earn): Similar to IBR, but generally offers lower monthly payments.

- REPAYE (Revised Pay As You Earn): Another income-driven plan with potentially lower payments than IBR or PAYE.

- ICR (Income Contingent Repayment): Payments are based on your income and loan amount.

Each plan has benefits and drawbacks. Carefully reviewing the details of each "income-driven repayment" plan is essential to determining which one best suits your financial situation.

Loan Consolidation

Consolidating multiple student loans into a single loan can simplify repayment and potentially lower your monthly payments. "Student loan consolidation" can streamline your debt management.

- Simplified Repayment: Instead of managing multiple loans and due dates, you'll only have one loan to track.

- Potential for Lower Monthly Payments: Depending on the consolidation terms, you might achieve a lower monthly payment, though the total amount repaid might be higher.

- Potential Drawbacks: A longer repayment period may result in paying more interest overall. "Loan refinancing" is a related option that can potentially offer better interest rates.

Deferment and Forbearance

These options offer temporary relief from making payments, but they don't eliminate the debt.

- Deferment: Usually granted due to specific circumstances like unemployment or enrollment in school.

- Forbearance: Granted due to temporary financial hardship.

Remember, "student loan deferment" and "student loan forbearance" are temporary solutions. You'll eventually need to resume payments, and interest may continue to accrue during these periods. These should be seen as a short-term strategy, not a long-term solution.

Loan Forgiveness Programs

Some programs offer the possibility of loan forgiveness, but they often have strict eligibility requirements.

- Public Service Loan Forgiveness (PSLF): Forgives the remaining balance on federal student loans after 120 qualifying monthly payments while working full-time for a qualifying government or non-profit organization.

- Teacher Loan Forgiveness: Forgives a portion of federal student loans for teachers who meet certain requirements.

"Public Service Loan Forgiveness" and "teacher loan forgiveness" are valuable programs, but qualifying can be challenging. Carefully investigate the eligibility requirements before relying on these programs as your primary solution.

Seeking Professional Help with Delinquent Student Loans

Navigating the complexities of the student loan system can be overwhelming. Seeking professional help is often the best course of action.

- Student Loan Counselors: These professionals can provide personalized guidance, helping you understand your options and develop a repayment plan that fits your budget.

- Student Loan Attorneys: Attorneys can represent you in legal matters related to your student loans, such as negotiating with lenders or defending against wage garnishment.

Finding a reputable "student loan counselor" or "student loan attorney" is essential. Look for professionals with experience in student loan debt management and positive client reviews. They can provide "debt consolidation help" and other necessary support. Their expertise in navigating the complexities of the student loan system can be invaluable.

Conclusion

Delinquent student loans pose a serious threat to your financial well-being. However, understanding the severity of the situation and exploring the available options is crucial. Remember the key takeaways: addressing your debt before it reaches default is crucial; several options exist, including various repayment plans, consolidation, deferment, forbearance, and forgiveness programs; and seeking professional help can provide invaluable support. Don't let delinquent student loans overwhelm you. Explore your options today and take control of your financial future. Learn more about managing your delinquent student loans and finding the right solution for you.

Featured Posts

-

How To Watch Andor Season 1 Episodes 1 3 Hulu And You Tube Guide

May 17, 2025

How To Watch Andor Season 1 Episodes 1 3 Hulu And You Tube Guide

May 17, 2025 -

Is Jalen Brunson Injured The Latest Update For Knicks Fans

May 17, 2025

Is Jalen Brunson Injured The Latest Update For Knicks Fans

May 17, 2025 -

Trottinette Electrique Moins De 200 E Profitez De L Offre Cdiscount

May 17, 2025

Trottinette Electrique Moins De 200 E Profitez De L Offre Cdiscount

May 17, 2025 -

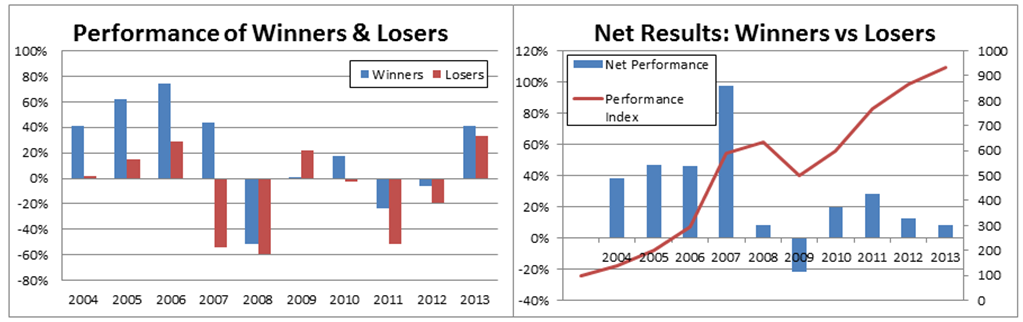

Stock Market Winners Rockwell Automation And Others Soaring Today

May 17, 2025

Stock Market Winners Rockwell Automation And Others Soaring Today

May 17, 2025 -

Cassie Announces Gender Of Third Baby With Alex Fine

May 17, 2025

Cassie Announces Gender Of Third Baby With Alex Fine

May 17, 2025